Notice Of Federal Tax Lien

In the intricate world of tax law and financial management, understanding the nuances of tax liens is crucial for both individuals and businesses. This comprehensive guide aims to delve into the specifics of a Notice of Federal Tax Lien, shedding light on its implications, processes, and strategies to navigate this complex legal territory.

The Essence of a Notice of Federal Tax Lien

A Notice of Federal Tax Lien is a powerful legal instrument employed by the Internal Revenue Service (IRS) to secure payment of delinquent taxes from taxpayers. It acts as a public notice, indicating that the IRS has a legal claim on the taxpayer’s property as security for the outstanding tax debt.

This notice is a formal step taken by the IRS when other collection methods, such as tax levies or installment agreements, have been unsuccessful or unfeasible. It serves as a last resort, a strong-arm tactic to ensure the government recoups its due taxes.

The implications of a Notice of Federal Tax Lien are far-reaching and can significantly impact an individual's or business's financial stability and reputation. Here's a deeper dive into the specifics.

Impact on Creditworthiness

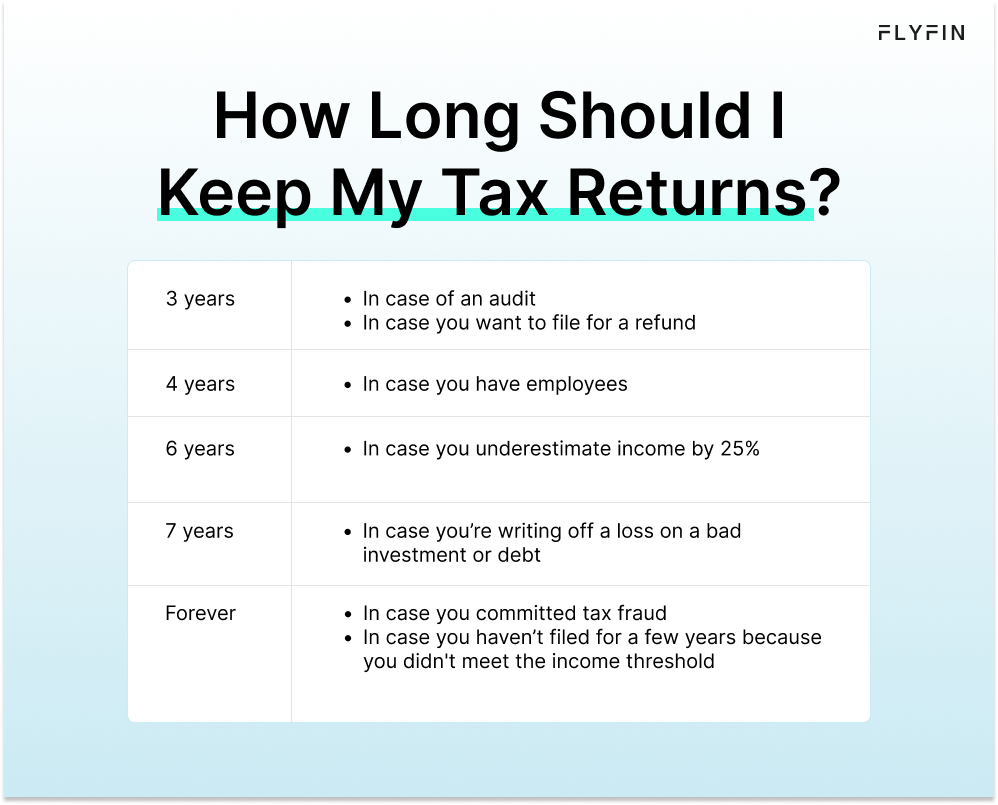

One of the most immediate consequences of a Notice of Federal Tax Lien is its effect on the taxpayer’s credit score and overall creditworthiness. A federal tax lien can remain on a credit report for up to 7 years from the date it’s filed, impacting the taxpayer’s ability to secure loans, mortgages, or even credit cards.

Financial institutions view a federal tax lien as a serious negative mark, often refusing to offer credit to those with such liens. This can severely limit a taxpayer's financial flexibility and ability to conduct business or make personal purchases.

| Consequence | Impact |

|---|---|

| Lower Credit Score | Difficulties in obtaining new loans or favorable interest rates. |

| Limited Financial Options | Reduced access to credit, impacting business and personal finances. |

| Increased Interest Rates | Higher borrowing costs due to perceived higher risk. |

Asset Seizure and Property Rights

A Notice of Federal Tax Lien grants the IRS the legal right to seize and sell the taxpayer’s property to recover the outstanding tax debt. This can include real estate, vehicles, business assets, and even personal belongings.

The IRS has the authority to sell these seized assets at public auction, often resulting in the taxpayer receiving less than the market value for their property. This can leave the taxpayer in a precarious financial position, especially if the proceeds from the sale are insufficient to cover the tax debt.

Legal and Administrative Costs

Dealing with a Notice of Federal Tax Lien can incur significant legal and administrative costs. Taxpayers may need to engage legal counsel to navigate the complex tax laws and negotiate with the IRS. Additionally, there are administrative fees associated with filing and releasing a federal tax lien.

| Cost Category | Estimated Expenses |

|---|---|

| Legal Fees | $2000 - $5000 (or more, depending on the complexity of the case) |

| IRS Lien Release Fees | $165 per lien |

| Other Administrative Costs | Varies based on specific circumstances and actions taken. |

Reputation and Business Impact

For businesses, a Notice of Federal Tax Lien can have severe consequences on their reputation and day-to-day operations. It can lead to loss of contracts, difficulty in securing new business, and even the loss of business licenses or permits.

In some cases, a federal tax lien can be a significant hurdle for a business to overcome, potentially leading to bankruptcy or dissolution. The stigma associated with a tax lien can be difficult to shake off, affecting the business's ability to attract investors, partners, or even employees.

Navigating the Notice of Federal Tax Lien

While a Notice of Federal Tax Lien can be daunting, there are strategies and options available to taxpayers to navigate this challenging situation. Here are some potential paths forward.

Paying the Debt in Full

The most straightforward approach is to pay the outstanding tax debt in full. This can be done through a lump-sum payment or by negotiating a payment plan with the IRS. While this option may not be feasible for all taxpayers, it is the most effective way to resolve the issue and remove the lien.

The IRS offers various payment plans, including short-term and long-term agreements, to help taxpayers manage their debt. These plans can provide much-needed financial relief and allow taxpayers to regain control of their financial situation.

Lien Withdrawal

In certain circumstances, the IRS may agree to withdraw the Notice of Federal Tax Lien. This is typically done when the taxpayer has entered into a direct debit installment agreement with the IRS, demonstrating their commitment to resolving the debt.

To be eligible for lien withdrawal, taxpayers must generally meet specific criteria, such as being current with estimated tax payments, not having a prior withdrawn lien, and demonstrating a willingness to resolve the tax debt.

Subordination

Subordination is an option where the IRS agrees to make its lien secondary to another debt. This is often pursued when the taxpayer is seeking a loan or refinancing and needs to clear their credit report of the tax lien.

However, subordination is not a guarantee and is typically granted on a case-by-case basis. The IRS will consider various factors, including the taxpayer's financial situation, the likelihood of full payment, and the impact on other creditors.

Offer in Compromise

An Offer in Compromise (OIC) is a settlement agreement where the taxpayer offers a lump-sum amount to resolve the outstanding tax debt. This option is typically reserved for taxpayers who cannot pay their full tax liability and do not qualify for other resolution methods.

An OIC can be a complex process and is not guaranteed to be accepted by the IRS. Taxpayers must demonstrate financial hardship and an inability to pay the full amount. The IRS will thoroughly review the offer, considering factors like the taxpayer's income, assets, and ability to pay.

Statute of Limitations

The statute of limitations is a crucial aspect of tax law, dictating the timeframe within which the IRS can collect outstanding taxes. Once this timeframe expires, the IRS can no longer enforce collection, and the tax debt is considered satisfied.

Understanding the statute of limitations can be a powerful tool for taxpayers. However, it's important to note that this period can be extended if the taxpayer takes specific actions, such as filing an offer in compromise or entering into a payment plan.

Conclusion: Strategies and Expert Advice

Navigating a Notice of Federal Tax Lien requires a strategic and knowledgeable approach. Taxpayers should seek expert advice from tax professionals or legal counsel who specialize in tax law and can guide them through the complex legal and financial landscape.

While a Notice of Federal Tax Lien can be a challenging hurdle, it's important to remember that it is not the end of the road. With the right strategies and guidance, taxpayers can resolve their tax debt, regain financial stability, and move forward with their lives and businesses.

What happens if I ignore a Notice of Federal Tax Lien?

+Ignoring a Notice of Federal Tax Lien can lead to severe consequences. The IRS may take additional collection actions, including levying your wages, bank accounts, or social security benefits. It’s crucial to respond to the notice and take action to resolve the debt.

Can I still conduct business with a Notice of Federal Tax Lien on my record?

+A Notice of Federal Tax Lien can significantly impact your business operations. It may lead to difficulties in securing new contracts, obtaining business loans, or maintaining your business licenses. It’s essential to address the lien promptly to minimize these impacts.

How long does a federal tax lien stay on my credit report?

+A federal tax lien can remain on your credit report for up to 7 years from the date it’s filed. However, if the lien is released or withdrawn, it will be removed from your credit report within 30 days of the release or withdrawal.

Are there any tax relief programs that can help with a federal tax lien?

+Yes, the IRS offers various tax relief programs, such as installment agreements, offers in compromise, and penalty abatement. These programs can provide financial relief and help resolve the tax debt. Consult with a tax professional to determine your eligibility and the best course of action.