Ri Tax Return

The Rhode Island tax return process is an essential aspect of financial management for individuals and businesses residing in the Ocean State. Understanding the nuances of state tax laws and regulations is crucial for ensuring compliance and maximizing potential benefits. This comprehensive guide aims to provide an in-depth analysis of the RI tax return process, offering valuable insights and practical tips to navigate the system efficiently.

Unraveling the RI Tax Landscape

Rhode Island’s tax system, like many other states, comprises a range of taxes, including income tax, sales tax, property tax, and various other levies. The complexity of this system necessitates a careful examination of the different tax forms, deadlines, and applicable regulations.

Income Tax: The Foundation of RI Tax Returns

At the heart of the RI tax return process is the income tax. Rhode Island follows a progressive income tax system, with rates varying based on an individual’s or entity’s taxable income. The state’s tax brackets and rates are updated annually to account for inflation and other economic factors. For the 2023 tax year, the income tax rates range from 3.75% to 5.99% for individuals, and a flat rate of 7.0% for corporations.

| Tax Bracket | Tax Rate |

|---|---|

| Up to $25,000 | 3.75% |

| $25,001 to $40,000 | 4.75% |

| $40,001 and above | 5.99% |

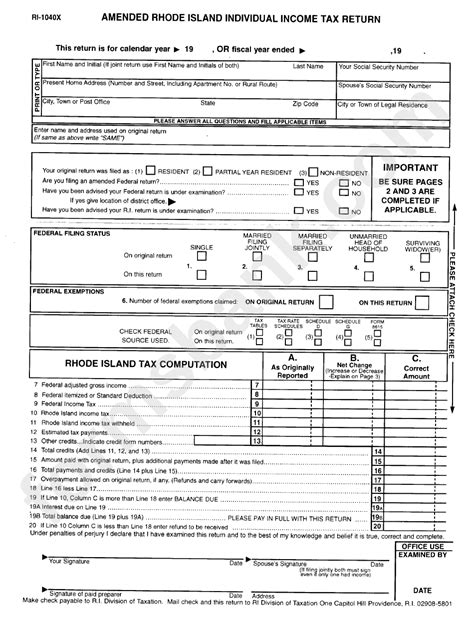

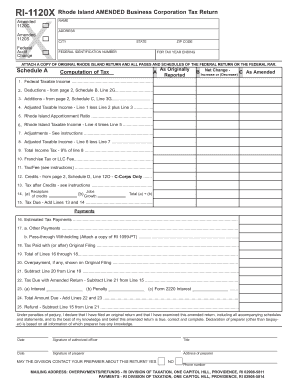

The state's Form RI-1040 is used to report income and calculate the applicable tax. This form requires individuals to provide details about their sources of income, deductions, and credits. Businesses, on the other hand, use Form RI-1120 for corporations and Form RI-1065 for partnerships.

Sales and Use Tax: A Significant Revenue Source

Rhode Island’s sales and use tax is another crucial component of the state’s revenue stream. The sales tax rate is currently set at 7.0%, with additional local taxes varying by municipality. The state also imposes a use tax on goods purchased out of state but used or consumed within Rhode Island. This tax ensures fairness and generates revenue from online purchases, which are often subject to sales tax in the purchaser’s state.

Businesses collecting sales tax must register with the Rhode Island Division of Taxation and obtain a sales tax permit. They are then required to file periodic sales tax returns and remit the collected taxes to the state. Failure to comply with sales tax regulations can result in penalties and interest charges.

Property Tax: A Local Responsibility

Property tax is a significant source of revenue for local governments in Rhode Island. Each municipality sets its own property tax rates, which can vary widely across the state. Property owners receive tax bills directly from their local assessor’s office, and payments are typically due in two installments, with the specific dates determined by the municipality.

Appealing a property tax assessment is a right of property owners in Rhode Island. The process involves filing an appeal with the local assessor's office, followed by a hearing before the local tax board. If the appeal is unsuccessful, the property owner can further pursue the matter through the state's tax appeal court system.

Navigating the RI Tax Return Process

Filing a RI tax return can be a complex process, but with the right guidance and preparation, it can be managed efficiently. Here are some key steps to consider:

Gathering Necessary Documents

Before starting the tax return process, it’s essential to collect all relevant documents. This includes W-2 forms from employers, 1099 forms for miscellaneous income, and any other documentation related to income, deductions, and credits. For businesses, this may also include financial statements, receipts, and records of expenses.

Understanding Tax Credits and Deductions

Rhode Island offers a range of tax credits and deductions that can reduce the amount of tax owed. These include credits for low- and moderate-income individuals, property tax relief for certain homeowners, and deductions for business expenses. Understanding these incentives and ensuring eligibility is crucial for minimizing tax liability.

Online Filing vs. Traditional Methods

Rhode Island offers both online and traditional filing methods. Online filing is generally faster and more convenient, with the added benefit of instant confirmation of receipt. The state’s official website provides a user-friendly platform for electronic filing. However, for those who prefer traditional methods, paper forms can be downloaded and mailed to the appropriate address.

Seeking Professional Assistance

For individuals and businesses with complex tax situations, seeking professional assistance from a tax preparer or accountant can be beneficial. These professionals can provide expert advice, ensure compliance with state regulations, and identify opportunities for tax savings. Engaging a professional can also reduce the risk of errors and potential audits.

Conclusion: A Comprehensive Approach to RI Tax Returns

The RI tax return process is a multifaceted journey that requires careful consideration and planning. By understanding the state’s tax landscape, including income tax, sales tax, and property tax, individuals and businesses can navigate the system effectively. Gathering necessary documents, claiming applicable credits and deductions, and choosing the right filing method are crucial steps in the process.

For those with complex tax situations, seeking professional guidance can provide peace of mind and ensure optimal tax outcomes. Whether filing online or through traditional methods, staying informed about tax laws and regulations is key to successful compliance. With a comprehensive approach, Rhode Island taxpayers can fulfill their obligations while maximizing potential benefits.

When is the RI tax filing deadline for individuals and businesses?

+

The tax filing deadline for individuals and businesses in Rhode Island is typically April 15th of each year. However, it’s important to note that this deadline may be adjusted in certain circumstances, such as during tax law changes or natural disasters. It’s always recommended to check the official state website or consult a tax professional for the most up-to-date information.

What are the penalties for late filing or non-compliance in RI?

+

Late filing or non-compliance with RI tax laws can result in penalties and interest charges. The state imposes a penalty of 5% of the unpaid tax for each month (or part of a month) the return is late, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax balance at a rate of 12% per year. It’s crucial to file on time and maintain compliance to avoid these penalties.

Are there any tax incentives or programs for specific industries in RI?

+

Yes, Rhode Island offers various tax incentives and programs to support specific industries and promote economic growth. These include tax credits for research and development, film and digital media production, renewable energy, and certain manufacturing activities. It’s beneficial for businesses to explore these opportunities and consult with tax professionals to understand their eligibility and potential benefits.