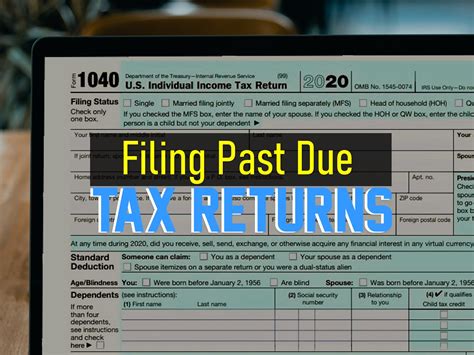

How Do I File Back Taxes

Filing back taxes, or tax returns from previous years, is a necessary process for individuals who have missed the initial deadline or need to amend their tax filings. It's important to understand the steps and considerations involved to ensure compliance with tax regulations and avoid potential penalties. This comprehensive guide will walk you through the process, providing insights and tips to make the experience as smooth as possible.

Understanding the Importance of Filing Back Taxes

Filing back taxes is crucial for maintaining a compliant financial record and ensuring you meet your tax obligations. Whether you've missed a deadline due to unforeseen circumstances, made a mistake in your initial filing, or simply need to adjust your tax return based on new information, taking the necessary steps to file back taxes is essential. It not only helps you avoid potential penalties and interest but also ensures you receive any refunds or credits you're entitled to.

Common Reasons for Filing Back Taxes

- Missed Deadline: Life happens, and sometimes we miss important deadlines. Filing back taxes allows you to catch up and avoid late fees.

- Unreported Income: If you've earned income that wasn't reported, such as from a side gig or a new job, you'll need to file back taxes to include this income.

- Change in Marital Status: A change in marital status can significantly impact your tax liability. Filing back taxes allows you to adjust your filing status accordingly.

- Dependency Changes: If your dependent status has changed, you might be eligible for additional tax benefits. Filing back taxes can help you claim these benefits.

- Error Correction: If you've made a mistake in your previous tax return, such as miscalculating deductions or claiming incorrect credits, filing back taxes allows you to correct these errors.

Step-by-Step Guide to Filing Back Taxes

Filing back taxes doesn't have to be a daunting task. By following these steps, you can navigate the process with confidence and accuracy.

Step 1: Gather Necessary Documentation

Before you begin, ensure you have all the required documents and information. This includes:

- W-2 forms from all employers for the tax year in question.

- 1099 forms for any self-employment or contract work income.

- Records of any other income, such as interest, dividends, or capital gains.

- Records of expenses and deductions, including medical expenses, charitable donations, and business expenses.

- Any relevant tax documents, such as previous year's tax returns or notices from the IRS.

Step 2: Determine the Tax Year(s) to File

Identify the specific tax year(s) for which you need to file back taxes. This is typically based on the deadline you missed or the year in which you need to make adjustments.

| Tax Year | Filing Deadline |

|---|---|

| 2023 | April 18, 2024 |

| 2022 | April 18, 2023 |

| 2021 | April 15, 2022 |

Step 3: Choose Your Filing Method

You have a few options for filing back taxes:

- Online Filing: The IRS offers online filing options, such as Free File, which is a secure and convenient way to file your tax return. This method is ideal for simple tax situations.

- Paper Filing: If you prefer a traditional approach or have a more complex tax situation, you can download and complete the necessary tax forms and mail them to the IRS. You can find these forms on the IRS website.

- Tax Software: Tax software like TurboTax or H&R Block can guide you through the filing process, ensuring you don't miss any deductions or credits. These tools are especially useful for more complex tax scenarios.

- Professional Assistance: For complex tax situations or if you're unsure about the process, consider hiring a tax professional or CPA. They can provide expert guidance and ensure your back taxes are filed accurately.

Step 4: Complete and Submit Your Tax Return

Follow the instructions for your chosen filing method to complete and submit your tax return. Make sure to double-check all the information for accuracy before submitting.

Step 5: Pay Any Outstanding Taxes

If you owe taxes for the year(s) you're filing, you'll need to pay the outstanding amount. The IRS offers various payment options, including direct debit, credit card, and electronic funds withdrawal. You can also set up a payment plan if you can't afford to pay the full amount at once.

Step 6: Keep Records and Documentation

Once you've filed your back taxes, keep all your records and documentation in a safe place. This includes your completed tax return, payment receipts, and any correspondence with the IRS. These records can be useful for future reference and may be required if you need to amend your return or respond to an IRS inquiry.

Tips and Considerations for a Smooth Filing Process

To ensure a stress-free experience when filing back taxes, consider these additional tips and considerations:

- Stay Organized: Keep all your tax-related documents in one place. This will make the filing process much easier and help you avoid missing any important information.

- Review Your Return Before Submitting: Take the time to review your completed tax return thoroughly. Check for errors, ensure all calculations are accurate, and double-check your personal information.

- Consider Professional Help: If you're unsure about any aspect of the filing process or have a complex tax situation, consulting a tax professional can be a wise decision. They can provide tailored advice and ensure your back taxes are filed correctly.

- Keep Track of Deadlines: Mark important deadlines on your calendar to ensure you don't miss any filing or payment deadlines. This includes both the initial filing deadline and any extended deadlines if you're filing late.

- Amend Returns if Needed: If you discover an error or need to make changes to your back taxes after filing, you can amend your return using Form 1040-X. This form is used to correct previously filed tax returns.

Frequently Asked Questions (FAQ)

What happens if I don't file my back taxes?

+If you fail to file your back taxes, you may face penalties and interest charges. The IRS can also take legal action, including imposing fines or even criminal charges in severe cases. It's best to file your back taxes as soon as possible to avoid these consequences.

Can I file back taxes if I don't have all the necessary documents?

+While it's ideal to have all the necessary documents, you can still file your back taxes even if you're missing some information. The IRS may request additional documentation, but you can start the process with what you have and provide any missing information later.

How long do I have to file back taxes?

+The statute of limitations for filing back taxes is generally 3 years from the original due date of the return. However, if you owe taxes and haven't filed, the IRS can pursue collection indefinitely. It's best to file your back taxes as soon as possible to avoid penalties and interest.

What if I'm due a refund for my back taxes?

+If you're due a refund for your back taxes, the IRS will typically process and issue your refund within 6-8 weeks of receiving your return. However, if you're filing multiple years or have a complex tax situation, it may take longer.

Can I file back taxes electronically (e-file)?

+Yes, you can file back taxes electronically using the IRS's e-file system. However, there may be restrictions on the number of years you can file electronically, and you'll need to meet certain requirements. Check the IRS website for more information on e-filing back taxes.

Filing back taxes is a responsible step towards maintaining financial compliance and ensuring you receive any refunds or credits you’re entitled to. By following the steps outlined above and staying organized, you can navigate the process efficiently and accurately. Remember, if you have any doubts or complex tax situations, seeking professional advice can provide valuable peace of mind.