Florida Sales Tax Filing

For businesses operating in the Sunshine State, understanding the intricacies of Florida sales tax filing is crucial for compliance and avoiding potential penalties. This comprehensive guide aims to provide an in-depth analysis of the Florida sales tax filing process, offering expert insights and practical advice for businesses of all sizes.

The Basics of Florida Sales Tax

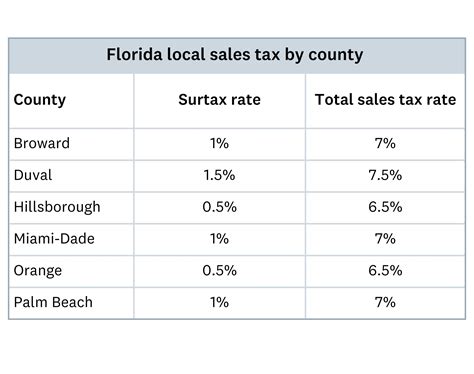

Florida’s sales and use tax is a consumption tax levied on the sale, rental, lease, or consumption of goods and some services within the state. It is a crucial revenue source for the state, with rates varying based on location. As of January 2023, the statewide sales tax rate is set at 6%, with local governments permitted to levy additional taxes, known as discretionary sales surtaxes, up to 1.5%. These local surtaxes are implemented to support specific projects or initiatives, resulting in a combined sales tax rate that can range from 6% to 7.5% across the state.

It's important to note that certain counties in Florida, such as Miami-Dade, levy an additional 1% surtax on sales of certain goods and services, bringing the total sales tax rate to 8.5% in those areas. Additionally, specific types of goods and services may be subject to additional taxes or exemptions, further complicating the sales tax landscape for businesses operating in Florida.

Registration and Permits

To legally collect and remit sales tax in Florida, businesses must first obtain a Florida Sales and Use Tax Permit from the Florida Department of Revenue (DOR). This permit is required for all entities selling tangible personal property, providing certain services, or leasing or renting tangible personal property in Florida. The DOR provides an online application process, which typically takes around 10 business days to process, with some applications requiring additional time for review.

Upon receiving the sales tax permit, businesses are provided with a Florida Department of Revenue Identification Number (DOR ID), which is used for all future filings and correspondence with the DOR. This ID is unique to each business and is essential for accurate record-keeping and compliance.

| Registration Process | Timeline |

|---|---|

| Online Application | Approximately 10 business days |

| Permit Review | Varies, depending on application complexity |

Sales Tax Filing Requirements

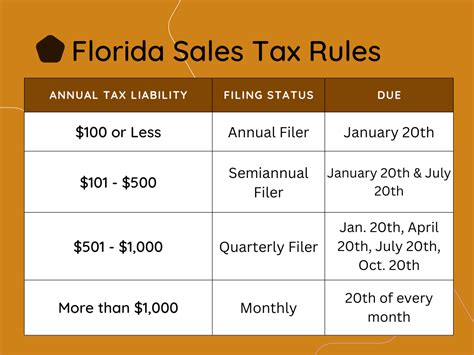

Florida’s sales tax filing requirements are determined by a business’s annual taxable sales and its registration date. The state operates on a calendar year basis for sales tax purposes, with the filing frequency determined by the business’s annual taxable sales as follows:

- Annual Taxable Sales Below $150,000: Quarterly filing is required, with due dates falling on the 20th day of the month following the end of each quarter (i.e., January, April, July, and October)

- Annual Taxable Sales of $150,000 or More: Monthly filing is required, with due dates on the 20th day of the following month (i.e., February, March, and so on)

It's important to note that the due date for the fourth quarter is slightly different, falling on the 30th day of January, with an extension option until the 20th day of February. This extension is granted automatically and does not require a formal request.

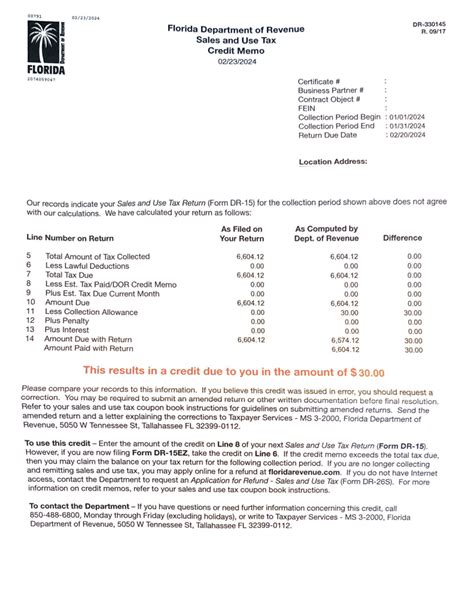

Sales Tax Returns

Businesses are required to file a Florida Sales and Use Tax Return (Form DR-15) for each filing period. This form is available for download from the DOR website and must be completed and submitted electronically through the DOR’s online portal. The return must include the total taxable sales for the period, the applicable sales tax rate, and any applicable exemptions or credits.

In addition to the sales tax return, businesses may also be required to submit supporting documentation, such as sales invoices, purchase orders, or other records that substantiate the reported sales and tax calculations. It is crucial to maintain accurate records to ensure compliance and facilitate any potential audits.

| Filing Frequency | Due Dates |

|---|---|

| Quarterly | January, April, July, and October (20th day of the month) |

| Monthly | 20th day of the following month (February, March, etc.) |

| Fourth Quarter Extension | 30th day of January (with automatic extension until 20th day of February) |

Remitting Sales Tax

Along with the sales tax return, businesses are required to remit the calculated sales tax to the Florida DOR. This can be done through various payment methods, including electronic funds transfer (EFT), credit card, or paper check. The DOR provides a secure online payment portal, allowing businesses to make payments quickly and securely.

It's important to note that late payments may incur penalties and interest. The DOR assesses a 5% penalty on the unpaid tax amount if the payment is not received by the due date. Additionally, interest is calculated daily on the unpaid tax amount at a rate of 0.5% per month or a portion thereof. These penalties can accumulate quickly, so timely payment is crucial for maintaining compliance and avoiding additional costs.

Payment Options

The Florida DOR offers a range of payment options to accommodate different business needs. These include:

- Electronic Funds Transfer (EFT): This is the preferred method of payment, offering a secure and efficient way to remit sales tax. Businesses can set up EFT payments through the DOR's online portal, providing banking details and authorizing the DOR to withdraw the required amount on the due date.

- Credit Card: Sales tax payments can be made using a credit card through the DOR's online payment portal. A convenience fee, typically 2.35% of the payment amount, is charged for this service.

- Paper Check: Businesses can also remit sales tax by mailing a paper check to the DOR. The check should be made payable to the "Florida Department of Revenue" and include the business's DOR ID on the memo line. It's important to allow sufficient time for the check to reach the DOR by the due date to avoid late payment penalties.

Sales Tax Audits and Compliance

The Florida DOR conducts sales tax audits to ensure businesses are accurately reporting and remitting sales tax. Audits can be triggered by various factors, including random selection, suspected non-compliance, or changes in business operations. The audit process typically involves the following steps:

- Notice of Audit: The DOR sends a formal notice to the business, outlining the scope and timeline of the audit. The notice will specify the period under review and any specific documents or records required.

- Information Gathering: The business is required to provide the requested documents and cooperate with the auditor during the review process. This may involve on-site visits or remote access to financial records.

- Audit Report: Once the audit is complete, the DOR will issue an audit report detailing any findings, including any additional tax liabilities, penalties, or interest due.

- Appeal Process: If the business disagrees with the audit findings, it has the right to appeal. The appeal process typically involves a formal written response and may lead to a hearing or further review.

It's crucial for businesses to maintain accurate records and comply with sales tax regulations to minimize the risk of audits and penalties. Regular internal reviews and professional advice can help ensure compliance and facilitate a smoother audit process if one is triggered.

Sales Tax Exemptions and Credits

Florida offers various sales tax exemptions and credits to eligible businesses and consumers. These exemptions can significantly reduce the tax burden and should be carefully considered during the sales tax filing process. Some common exemptions and credits include:

- Resale Exemption: Businesses that purchase goods for resale are exempt from sales tax on the purchase. This exemption applies to retailers, wholesalers, and other businesses that sell goods to the final consumer.

- Manufacturing Exemption: Manufacturers are exempt from sales tax on the purchase of certain machinery, equipment, and supplies used directly in the manufacturing process.

- Agricultural Exemption: Agricultural producers and businesses involved in agricultural activities may be eligible for sales tax exemptions on certain purchases.

- Tax Credits: Florida offers various tax credits, such as the Sales Tax Holiday Credit, which provides a temporary reduction in sales tax for specific items during designated holiday periods.

It's important for businesses to stay informed about the latest sales tax exemptions and credits and to consult with tax professionals to ensure they are maximizing their eligibility and accurately applying these benefits during the filing process.

Conclusion: Navigating Florida Sales Tax with Confidence

Understanding and complying with Florida’s sales tax regulations is essential for businesses operating in the state. By familiarizing themselves with the registration process, filing requirements, remittance options, and compliance best practices, businesses can navigate the sales tax landscape with confidence. Regular internal reviews, professional advice, and timely payments can help ensure compliance and minimize the risk of audits and penalties.

As the Florida sales tax landscape continues to evolve, staying informed and adapting to changes is crucial. The Florida DOR provides resources and guidance to help businesses stay compliant, and seeking professional assistance can provide additional support and peace of mind. With careful planning and attention to detail, businesses can successfully manage their sales tax obligations and contribute to the vibrant economy of the Sunshine State.

How often do sales tax rates change in Florida, and how can businesses stay updated on these changes?

+

Sales tax rates in Florida can change periodically, often as a result of local government decisions to implement or adjust discretionary sales surtaxes. To stay updated on these changes, businesses can monitor local news and government announcements, as well as subscribe to updates from the Florida Department of Revenue. Additionally, using sales tax automation software can help businesses automatically apply the correct rates based on the most recent information.

What are the penalties for late sales tax filings or payments in Florida, and how can businesses avoid them?

+

Late sales tax filings or payments in Florida can result in penalties and interest charges. The penalty for late payment is typically 5% of the unpaid tax amount, and interest is calculated daily at a rate of 0.5% per month. To avoid these penalties, businesses should set up reminders for filing and payment due dates, consider automatic payment options through EFT, and maintain accurate financial records to facilitate timely payments.

Are there any specific sales tax requirements for online businesses operating in Florida, particularly those with out-of-state customers?

+

Online businesses operating in Florida must comply with the state’s sales tax laws, including collecting and remitting sales tax on transactions with in-state customers. For out-of-state customers, the sales tax requirements may depend on the nexus rules established by the state where the customer resides. It’s crucial for online businesses to understand their nexus obligations and consult with tax professionals to ensure compliance with both Florida and other states’ sales tax laws.