St Louis County Real Estate Taxes

Welcome to a comprehensive exploration of real estate taxes in St. Louis County, a critical aspect of property ownership in this vibrant region. As an expert in local real estate and tax matters, I'll guide you through the intricacies of this topic, providing valuable insights and a deep understanding of the processes involved.

Understanding Real Estate Taxes in St. Louis County

Real estate taxes are an essential part of property ownership, and in St. Louis County, they play a significant role in the overall cost of owning a home or commercial property. These taxes are a primary source of revenue for the county, helping to fund vital services and infrastructure. Understanding how these taxes work and what they entail is crucial for both homeowners and investors.

The real estate tax system in St. Louis County is a complex but well-defined process. It involves a series of steps, from property valuation to tax calculation and collection. Each step is governed by specific laws and regulations, ensuring fairness and transparency. This article aims to demystify these processes, offering a clear and detailed guide to real estate taxes in the county.

Property Valuation: The Foundation of Real Estate Taxes

The journey towards understanding real estate taxes begins with property valuation. In St. Louis County, the process of valuing properties is handled by the St. Louis County Assessor’s Office. This office is responsible for assessing the value of all taxable properties within the county, including residential, commercial, and industrial properties.

The valuation process typically occurs every odd-numbered year. During this time, the Assessor's Office conducts thorough evaluations of properties, considering factors such as location, size, age, condition, and recent sales data. This information is then used to determine the assessed value of each property, which serves as the basis for tax calculations.

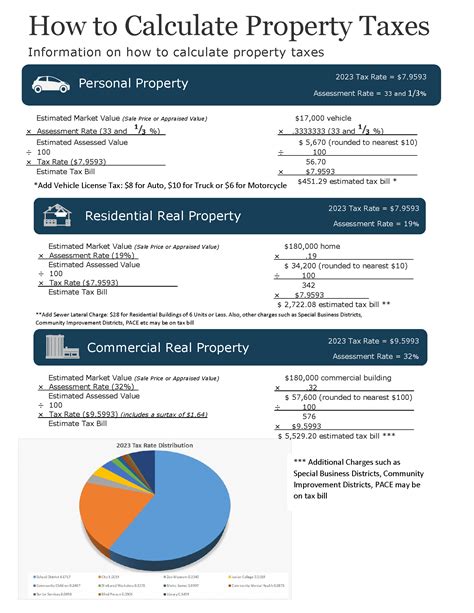

Once the assessed value is determined, it is multiplied by the tax rate, which is set by the local government. This rate can vary depending on the type of property and its location within the county. The resulting amount is the taxable value, which is the basis for the real estate tax bill.

| Property Type | Assessed Value | Tax Rate | Taxable Value |

|---|---|---|---|

| Residential Property | $250,000 | 1.15% | $2,875 |

| Commercial Property | $500,000 | 1.3% | $6,500 |

Tax Calculation and Billing

Once the taxable value of a property is determined, the real estate tax calculation process begins. The formula for calculating real estate taxes is relatively straightforward: Taxable Value x Tax Rate = Real Estate Tax.

For instance, if a residential property has a taxable value of $250,000 and the tax rate is 1.15%, the real estate tax for that property would be calculated as follows: $250,000 x 0.0115 = $2,875. This amount is what the property owner would be required to pay in real estate taxes for the year.

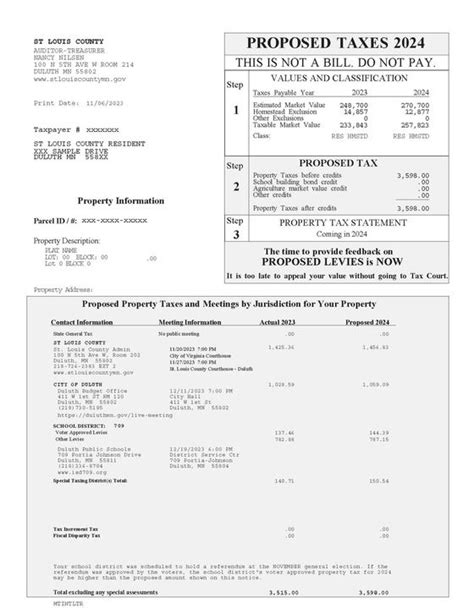

In St. Louis County, real estate taxes are billed semi-annually, with payments due in June and December. Property owners receive a tax bill from the St. Louis County Collector's Office, which provides the total amount due and the payment deadline. It's crucial for property owners to pay their taxes on time to avoid late fees and potential penalties.

Tax Relief Programs and Exemptions

St. Louis County recognizes that real estate taxes can be a significant financial burden for some property owners. To address this, the county offers various tax relief programs and exemptions aimed at easing the tax burden for eligible homeowners.

One such program is the Homestead Exemption, which provides a reduction in the assessed value of a property for homeowners who use it as their primary residence. This exemption can result in a significant decrease in real estate taxes, making homeownership more affordable for many residents.

Additionally, the county offers Senior Citizen Tax Relief, which provides a reduction in real estate taxes for homeowners aged 65 and above. This program aims to support senior citizens who may be on fixed incomes and face financial challenges associated with property ownership.

Other exemptions and relief programs are available for veterans, disabled individuals, and certain nonprofit organizations. These initiatives demonstrate the county's commitment to ensuring that real estate taxes remain fair and manageable for all property owners.

The Impact of Real Estate Taxes on the Local Economy

Real estate taxes play a pivotal role in the economic health of St. Louis County. The revenue generated from these taxes is a significant contributor to the county’s budget, funding essential services such as education, public safety, infrastructure development, and social services.

By investing in these areas, the county can enhance the quality of life for its residents and create a more attractive environment for businesses. This, in turn, can lead to economic growth, job creation, and increased property values, benefiting both homeowners and the community as a whole.

Challenges and Future Considerations

While real estate taxes are essential for funding vital services, they can also present challenges for property owners, especially during economic downturns or when property values fluctuate. In such situations, the county may need to carefully balance the need for revenue with the financial well-being of its residents.

Looking ahead, St. Louis County is committed to maintaining a fair and sustainable real estate tax system. This includes regular reviews of tax rates and assessment processes to ensure they remain equitable and aligned with the county's economic realities. Additionally, the county is exploring ways to enhance tax relief programs and make them more accessible to those in need.

Conclusion: Navigating Real Estate Taxes in St. Louis County

Understanding real estate taxes in St. Louis County is a crucial step towards responsible property ownership. By demystifying the process, this article aims to empower homeowners and investors with the knowledge they need to navigate the tax landscape effectively.

From property valuation to tax calculation and relief programs, each aspect of the real estate tax system in St. Louis County is designed to ensure fairness and transparency. As the county continues to grow and evolve, staying informed about these processes will remain essential for all property owners.

How often are real estate taxes assessed in St. Louis County?

+Real estate taxes in St. Louis County are typically assessed every odd-numbered year. This means properties are evaluated and valued for tax purposes every two years.

Can property owners appeal their assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The process involves submitting an appeal to the St. Louis County Board of Equalization, which reviews such cases and makes final decisions.

What happens if I miss the tax payment deadline?

+Missing the tax payment deadline can result in late fees and potential penalties. It’s important to keep track of payment deadlines and make timely payments to avoid these additional charges.

Are there any tax relief programs for low-income homeowners?

+Yes, St. Louis County offers tax relief programs specifically designed for low-income homeowners. These programs provide reductions in real estate taxes, making homeownership more affordable. It’s advisable to check with the St. Louis County Assessor’s Office for more information on eligibility and application processes.