Colorado Estimated Tax Payments

For residents of the Centennial State, understanding the ins and outs of Colorado estimated tax payments is crucial. This guide will delve into the specifics of this process, offering a comprehensive understanding of the requirements, timelines, and strategies for ensuring compliance with Colorado's tax obligations.

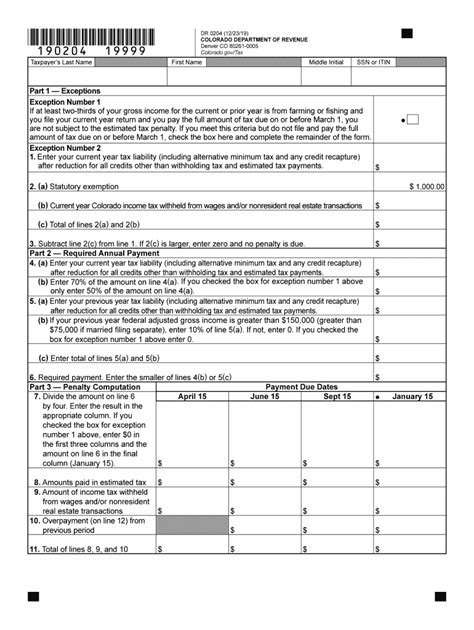

Navigating Colorado’s Estimated Tax System

Colorado’s estimated tax system is designed to ensure that taxpayers remit their taxes throughout the year, rather than facing a large tax bill at the end of the fiscal period. This system is particularly relevant for individuals with variable income streams, such as business owners, freelancers, and investors.

Understanding Estimated Tax Payments

Estimated tax payments in Colorado are quarterly payments made by individuals and businesses to cover their anticipated tax liabilities. These payments are typically required if the taxpayer expects to owe $500 or more in taxes for the year. The purpose of these payments is to ensure a steady revenue stream for the state and to help taxpayers manage their financial obligations.

Who Needs to Make Estimated Tax Payments?

Colorado residents who meet any of the following criteria are generally required to make estimated tax payments:

- Individuals with income from self-employment, freelance work, or other business activities.

- Those who receive income from rents, royalties, or other passive activities.

- Individuals who have a significant amount of interest or dividend income.

- Anyone who expects their withholding tax to be less than their total estimated tax liability for the year.

It's important to note that even if you are not required to make estimated tax payments, doing so voluntarily can help you avoid penalties for underpayment of taxes at the end of the year.

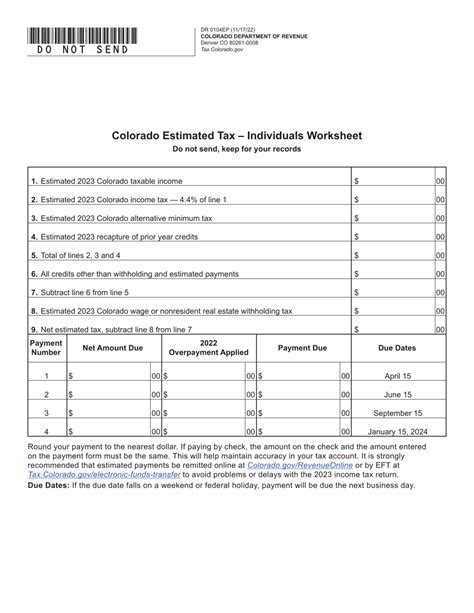

Calculation of Estimated Taxes

The calculation of estimated taxes involves a few key steps. First, you need to estimate your income for the year, including all sources of income such as wages, self-employment income, interest, dividends, and capital gains. Then, you subtract any deductions and credits you expect to claim. The result is your estimated taxable income.

Next, you apply the appropriate tax rates to your estimated taxable income to determine your estimated tax liability. Colorado's tax rates vary depending on income brackets and can be found on the Colorado Department of Revenue's website. You can use their tax calculator or consult a tax professional to ensure accuracy.

Finally, you divide your estimated tax liability by four to determine the amount of each quarterly payment. These payments are due on specific dates, as outlined below.

Payment Deadlines and Due Dates

Colorado’s estimated tax payment deadlines are as follows:

- First Quarter: April 15th

- Second Quarter: June 15th

- Third Quarter: September 15th

- Fourth Quarter: January 15th of the following year

These dates are crucial, and late payments may result in penalties and interest. It's advisable to set reminders or utilize tax software that can help manage these deadlines.

Safe Harbor Rules

Colorado’s Safe Harbor rules provide some flexibility for taxpayers. Under these rules, if your estimated tax payments are at least 100% of your prior year’s tax liability, or 90% of your current year’s liability, you are considered in compliance and will not be penalized for underpayment.

Electronic Payment Options

Colorado offers several electronic payment options for estimated taxes, including online payment portals and mobile apps. These options provide convenience and ensure timely payments, which is crucial for avoiding penalties.

Strategies for Managing Estimated Taxes

Here are some strategies to consider when managing your estimated tax payments:

- Regularly Review Your Income and Tax Obligations: Stay updated on your income streams and tax obligations throughout the year. This will help you make more accurate estimates and adjust your payments accordingly.

- Utilize Tax Software or a Professional: Tax software or a qualified tax professional can assist in calculating your estimated taxes accurately and efficiently.

- Set Aside Funds for Taxes: Consider setting aside a portion of your income specifically for tax payments. This can help ensure you have sufficient funds available when it’s time to make your estimated tax payments.

Remember, while estimated tax payments can seem complex, they are a crucial part of managing your financial obligations as a Colorado resident. Staying informed and organized can help streamline the process and ensure compliance with state tax laws.

Frequently Asked Questions

Can I pay my estimated taxes in a lump sum instead of quarterly payments?

+While Colorado’s estimated tax system is designed for quarterly payments, you can make a lump sum payment if it aligns with your financial strategy. However, it’s important to ensure that you are not underpaying for the year, as this could result in penalties.

What happens if I miss an estimated tax payment deadline?

+Missing an estimated tax payment deadline may result in penalties and interest. It’s advisable to make the payment as soon as possible to minimize these additional charges. If you are unable to make the full payment, consider paying what you can and contacting the Colorado Department of Revenue to discuss your options.

Are there any exceptions to the estimated tax payment requirements?

+Yes, there are certain exceptions and exemptions for estimated tax payments. For instance, if you had no tax liability in the previous year and expect the same for the current year, you may be exempt from making estimated tax payments. It’s best to consult with a tax professional to determine if you qualify for any exceptions.

Can I deduct my estimated tax payments from my federal tax return?

+Yes, estimated tax payments made to Colorado can be deducted on your federal tax return as a state and local tax deduction. This can help reduce your overall federal tax liability, providing a potential benefit for those who itemize their deductions.

What happens if I overpay my estimated taxes?

+If you overpay your estimated taxes, you will receive a refund when you file your annual tax return. Alternatively, you can choose to apply the overpayment to your next year’s estimated tax payments to simplify your tax management.