Income Tax Monopoly

Income Tax is a well-known and often-feared term, especially during tax season. But what if we told you that there's a board game that not only incorporates the concept of income tax but also makes it an engaging and strategic part of the gameplay? Welcome to the world of Income Tax Monopoly, a unique twist on the classic board game that adds a layer of financial complexity and realism.

The Evolution of Monopoly: Embracing Income Tax

Monopoly, a game that needs no introduction, has been a staple in households and game nights for generations. Its simple yet addictive gameplay has captured the hearts of players worldwide. However, the traditional version of Monopoly often lacks the depth and realism of the real-world financial landscape. That’s where Income Tax Monopoly steps in, aiming to revolutionize the way we play and learn about financial strategies.

Income Tax Monopoly is an innovative variant of the classic game, designed to educate and entertain players by introducing the concept of income tax and its implications in a fun and interactive manner. By integrating income tax rules and calculations, this version of Monopoly adds a layer of complexity that mirrors the challenges and decisions faced in the real world of finance.

Unraveling the Rules of Income Tax Monopoly

So, how does Income Tax Monopoly differ from the original game? Let’s delve into the rules and mechanics that make this version a captivating and educational experience.

Income Tax Rate and Calculation

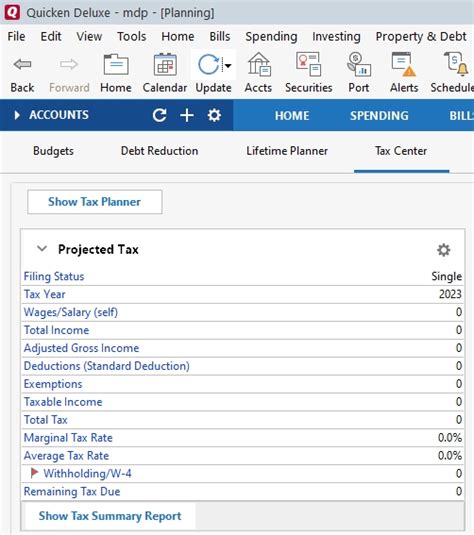

In traditional Monopoly, players are simply required to pay a flat rate when landing on the Income Tax square. However, Income Tax Monopoly takes a more realistic approach. Here’s how it works:

- Upon landing on the Income Tax square, players must calculate their income tax liability based on their current financial situation.

- The game provides a detailed income tax table, specifying different tax rates for various income brackets. Players refer to this table to determine their tax rate.

- Once the tax rate is known, players calculate their income tax by multiplying their total income (from rents, bonuses, and other sources) by the applicable tax rate.

- The calculated amount is then paid to the bank, simulating the process of paying income tax in the real world.

Financial Strategies and Decision-Making

Income Tax Monopoly encourages players to adopt strategic financial planning. Here’s how it influences gameplay:

- Investment Decisions: Players must consider their investment strategies carefully. Investing in properties with high rents might lead to higher income, but it also results in a higher tax liability. Balancing income generation and tax efficiency becomes crucial.

- Risk Management: The game teaches players to manage risk effectively. Landing on the Income Tax square can be costly, so players learn to assess their financial health and make informed decisions to minimize tax liabilities.

- Budgeting and Savings: Players are incentivized to budget their funds wisely. Saving up for future investments or emergencies becomes a strategic move, as it helps mitigate the impact of income tax payments.

Example Scenario: A Realistic Game Experience

Imagine a player named Sarah, who has accumulated a substantial income from renting out her properties. She lands on the Income Tax square and follows these steps:

- Referring to the income tax table, Sarah identifies her income bracket and the corresponding tax rate.

- She calculates her total income, including rents and bonuses, for the current game turn.

- Using the tax rate and her total income, Sarah computes her income tax liability.

- Finally, she pays the calculated amount to the bank, feeling the impact of income tax on her finances.

This process not only adds a layer of realism to the game but also educates players about the implications of income tax and the importance of financial planning.

Income Tax Monopoly: A Tool for Financial Education

Income Tax Monopoly goes beyond being just a board game. It serves as an excellent educational tool, offering valuable lessons in financial literacy and tax awareness.

Benefits of Income Tax Monopoly for Players

- Financial Awareness: Players gain a deeper understanding of income tax, its calculation, and its impact on personal finances. This awareness can be invaluable in real-life financial planning.

- Strategic Thinking: The game fosters strategic decision-making skills. Players learn to analyze their financial situation, make informed choices, and adapt their strategies based on changing circumstances.

- Risk Assessment: Income Tax Monopoly teaches players to evaluate risks and make calculated decisions. This skill can be applied to various aspects of personal finance, from investment choices to managing debt.

- Tax Efficiency: By playing the game, individuals learn to optimize their financial strategies to minimize tax liabilities. This knowledge can lead to better financial management and potentially significant savings in the long run.

Incorporating Income Tax Monopoly in Educational Settings

Income Tax Monopoly has the potential to revolutionize financial education in schools and universities. Here’s how it can be effectively utilized:

- Classroom Integration: Teachers can introduce Income Tax Monopoly as a fun and engaging way to teach financial concepts. It can be used to explain income tax, investment strategies, and the importance of financial planning in a practical and interactive manner.

- Hands-on Learning: Students can actively participate in the game, applying theoretical knowledge to real-world scenarios. This experiential learning approach enhances their understanding and retention of financial concepts.

- Group Discussions: Income Tax Monopoly can spark meaningful discussions about financial literacy and tax awareness. Students can share their experiences, strategies, and insights, fostering a collaborative learning environment.

- Customized Learning: The game can be tailored to different educational levels, ensuring that students of all ages and backgrounds can benefit from its educational value.

The Impact of Income Tax Monopoly: A Revolutionary Gaming Experience

Income Tax Monopoly has garnered attention and acclaim from both gamers and financial educators alike. Its unique blend of entertainment and education has made it a standout variant of the classic Monopoly game.

Player Testimonials

Players who have experienced Income Tax Monopoly often praise its ability to make financial concepts accessible and engaging. Here are some testimonials:

“Income Tax Monopoly took our game night to a whole new level. It was exciting to see how our financial decisions impacted our game strategy. I learned so much about managing my virtual finances that I started applying those principles to my real-life budget.”

“As an educator, I’ve found Income Tax Monopoly to be an incredible teaching tool. It captures the attention of students and makes learning about income tax and financial planning an enjoyable experience. The game’s realism and strategic elements make it a valuable addition to our curriculum.”

Educational Impact

The educational impact of Income Tax Monopoly extends beyond the game board. Its integration into educational settings has shown promising results:

- Increased Engagement: Students actively participate and show a higher level of interest in financial literacy topics when Income Tax Monopoly is introduced.

- Improved Understanding: The game’s interactive nature enhances students’ comprehension of complex financial concepts, making it easier for them to grasp and apply these concepts in real-life scenarios.

- Long-Term Benefits: The skills and knowledge gained from playing Income Tax Monopoly can have a lasting impact. Students often report improved financial literacy and a more proactive approach to managing their personal finances.

Conclusion: A Game That Pays Off

Income Tax Monopoly is not just a board game; it’s an innovative educational tool that combines entertainment and learning. By incorporating income tax rules and financial strategies, this variant of Monopoly offers a unique and engaging experience. Whether it’s for entertainment or educational purposes, Income Tax Monopoly has the potential to leave a lasting impression on players, empowering them with financial literacy skills that can benefit their real-world financial journeys.

Can Income Tax Monopoly be played by all ages?

+Absolutely! Income Tax Monopoly can be tailored to different age groups and skill levels. The game’s complexity can be adjusted to suit the understanding of players, making it an inclusive and enjoyable experience for all.

How does Income Tax Monopoly compare to other financial board games?

+Income Tax Monopoly stands out for its focus on income tax and financial planning. While other financial board games may touch on similar concepts, this variant offers a more comprehensive and realistic portrayal of the impact of income tax on personal finances.

Is Income Tax Monopoly available for purchase?

+Yes, Income Tax Monopoly is available for purchase online and in select retail stores. It makes for an excellent gift for game enthusiasts and those interested in learning about personal finance in a fun way.