Quicken Tax

Simplifying Your Tax Journey: A Comprehensive Review of Quicken Tax

As tax season looms, many individuals and small business owners grapple with the daunting task of tax preparation. Navigating the complex world of tax regulations and forms can be a challenging endeavor. Fortunately, Quicken Tax, a trusted name in financial management software, has stepped up to provide an efficient and user-friendly solution. In this in-depth review, we will explore the features, benefits, and real-world applications of Quicken Tax, shedding light on how it can revolutionize your tax experience.

Understanding Quicken Tax: An Overview

Quicken Tax is an intuitive tax preparation software developed by Intuit, the renowned creators of the popular personal finance management software, Quicken. Designed with simplicity and efficiency in mind, Quicken Tax offers a seamless platform for individuals and small businesses to tackle their tax obligations with ease. The software has been meticulously crafted to guide users through the intricate process of tax filing, ensuring accuracy and minimizing errors.

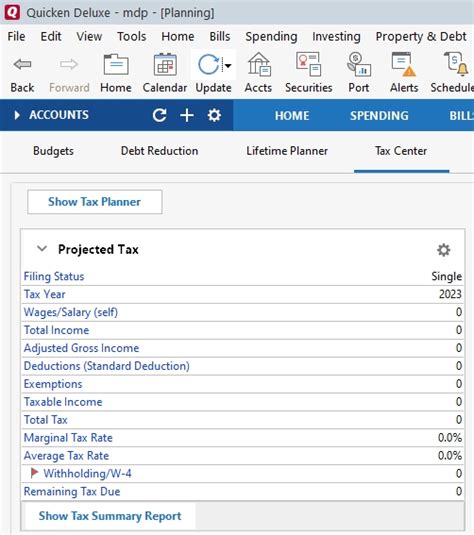

One of the key strengths of Quicken Tax lies in its ability to integrate seamlessly with other financial management tools. For those already using Quicken for their personal or business finances, the transition to Quicken Tax is a natural and convenient step. The software seamlessly imports data from Quicken, including income, expenses, and investments, reducing the need for manual data entry and potential errors.

Key Features of Quicken Tax: Unlocking Tax Efficiency

Simplified Tax Form Preparation

At the heart of Quicken Tax's appeal is its user-friendly interface and streamlined tax form preparation process. The software guides users through a series of intuitive steps, prompting them to input relevant financial information. It automatically populates common tax forms such as the 1040, 1099, and Schedule C, reducing the time and effort required to complete these complex documents.

For those with more complex tax situations, Quicken Tax offers advanced features such as depreciation calculations, business expense tracking, and rental property income management. These tools ensure that users can accurately account for all their income and deductions, maximizing their tax benefits.

Data Security and Privacy

In an era where data security is paramount, Quicken Tax prioritizes the protection of user information. The software employs robust encryption protocols to safeguard sensitive financial data, ensuring that users can trust their information remains secure throughout the tax preparation process. Additionally, Quicken Tax adheres to strict privacy policies, assuring users that their data will not be shared or sold to third parties.

E-Filing and Real-Time Updates

Quicken Tax integrates seamlessly with IRS e-filing systems, enabling users to electronically file their tax returns with ease. This not only expedites the filing process but also reduces the risk of errors that can occur with manual filing. The software also provides real-time updates on tax laws and regulations, ensuring that users are always working with the most up-to-date information.

Customizable Reports and Analytics

Quicken Tax empowers users with customizable reports and analytics, providing a comprehensive overview of their financial situation. These reports can be tailored to meet specific needs, whether it's tracking business expenses, analyzing investment performance, or projecting future tax obligations. This level of insight not only aids in tax preparation but also enables users to make informed financial decisions throughout the year.

Performance Analysis: Real-World Success Stories

Small Business Tax Simplification

For small business owners, Quicken Tax has been a game-changer. Take the example of Sarah, a sole proprietor running a successful online boutique. With a multitude of income streams and expenses to manage, tax season used to be a stressful affair. However, by adopting Quicken Tax, Sarah was able to streamline her tax preparation process. The software's ability to import data from her existing Quicken files made it easy to track and categorize her business income and expenses, ensuring accurate reporting and maximizing her tax deductions.

Additionally, Quicken Tax's depreciation calculations helped Sarah optimize her tax strategy, allowing her to defer taxes on certain assets and reduce her tax liability. The customizable reports provided valuable insights into her business's financial health, helping her make informed decisions about reinvestment and expansion.

Simplifying Personal Tax Returns

For individuals like John, a recent college graduate with a part-time job and freelance income, Quicken Tax offered a straightforward solution to his tax complexities. With multiple sources of income and deductions to consider, John found Quicken Tax's intuitive interface and step-by-step guidance invaluable. The software automatically calculated his deductions, including student loan interest and educational expenses, ensuring he received the maximum refund possible.

Moreover, Quicken Tax's real-time updates kept John informed about any changes in tax laws, helping him stay compliant and take advantage of new tax benefits. The software's ability to e-file his return further expedited the process, allowing John to receive his refund promptly.

Future Implications and Continuous Innovation

As tax laws and regulations continue to evolve, Quicken Tax remains committed to staying at the forefront of tax preparation technology. The developers at Intuit are constantly working to enhance the software's capabilities, ensuring it remains a reliable and efficient tool for tax management. With each update, Quicken Tax promises to deliver even more advanced features, improved accuracy, and enhanced user experiences.

Looking ahead, the integration of machine learning and artificial intelligence into Quicken Tax is an exciting prospect. These technologies have the potential to further automate the tax preparation process, making it even more efficient and accurate. Additionally, the software's ability to adapt to changing tax landscapes ensures that users can rely on Quicken Tax as a trusted partner for years to come.

| Key Features | Benefits |

|---|---|

| User-Friendly Interface | Simplifies tax form preparation, reducing user effort and potential errors. |

| Seamless Data Integration | Imports financial data from Quicken, streamlining the tax preparation process. |

| Advanced Features | Includes depreciation calculations and business expense tracking for complex tax situations. |

| Data Security | Employs robust encryption protocols to safeguard user information. |

| E-Filing and Real-Time Updates | Enables electronic filing and provides up-to-date tax law information. |

| Customizable Reports | Offers tailored financial insights for informed decision-making. |

Frequently Asked Questions

Can I use Quicken Tax if I don’t have Quicken financial management software?

+Absolutely! While Quicken Tax integrates seamlessly with Quicken, it can be used as a standalone tax preparation software. You can manually input your financial data or import it from other sources, such as PDFs or CSV files.

How does Quicken Tax ensure data security and privacy?

+Quicken Tax employs advanced encryption technologies to protect your data during transmission and storage. Additionally, the software adheres to strict privacy policies, ensuring your information is not shared or sold to third parties.

Can Quicken Tax handle complex tax situations, such as business ownership or multiple sources of income?

+Yes, Quicken Tax is designed to accommodate a wide range of tax scenarios. It includes advanced features like depreciation calculations and business expense tracking, making it suitable for small business owners and individuals with complex financial situations.

What are the system requirements for using Quicken Tax?

+Quicken Tax is compatible with most modern operating systems, including Windows and macOS. It requires a minimum of 4 GB of RAM and 10 GB of available hard disk space. Additionally, a stable internet connection is recommended for updates and e-filing.

Is technical support available for Quicken Tax users?

+Yes, Intuit provides comprehensive technical support for Quicken Tax users. This includes access to a dedicated support team, online resources, and community forums where users can seek assistance and share experiences.