Boston Tax Rate

Understanding the tax landscape is crucial for individuals and businesses alike, especially when navigating a dynamic city like Boston. The tax structure in Boston, Massachusetts, is a complex yet fascinating system that impacts residents and investors. In this comprehensive guide, we'll delve into the specifics of the Boston tax rate, exploring its intricacies, variations, and how it affects the local economy and community.

The Boston Tax Rate: A Comprehensive Overview

The city of Boston, often referred to as the “Cradle of Liberty,” boasts a rich history and a thriving economy. However, its tax system is unique and can be quite nuanced. Boston’s tax rate is not a one-size-fits-all affair; it varies depending on various factors, making it essential to explore these nuances to understand the financial obligations and opportunities within the city.

Residential Tax Rates: A Snapshot of Boston’s Neighborhoods

Residential tax rates in Boston are a key aspect of the city’s tax structure. Each neighborhood in Boston has its own unique charm and character, and this diversity extends to the tax rates as well. Here’s a glimpse at how different areas of Boston are taxed:

- Back Bay: Known for its elegant architecture and proximity to the city center, Back Bay has a residential tax rate of [X%], which is slightly above the city average.

- South Boston: A vibrant community with a rich history, South Boston offers a more affordable tax rate of [Y%], making it an attractive option for homeowners.

- West Roxbury: With its suburban feel and beautiful green spaces, West Roxbury has a tax rate of [Z%], providing a balance between city living and a peaceful environment.

- Beacon Hill: This historic neighborhood, famous for its cobblestone streets and prestigious residences, boasts a tax rate of [A%], reflecting the area’s desirability and exclusivity.

- Jamaica Plain: A diverse and culturally rich area, Jamaica Plain offers a tax rate of [B%], catering to a wide range of residents.

These varying tax rates highlight the unique nature of Boston's tax system, where each neighborhood contributes to the city's overall financial health in its own way.

Commercial Tax Rates: Attracting Businesses to Boston

Boston’s reputation as a hub for innovation and entrepreneurship is not without its incentives. The city offers competitive commercial tax rates to attract and retain businesses. Here’s a breakdown of how the tax rates work for different sectors:

- Technology Sector: With a thriving tech industry, Boston offers a reduced tax rate of [C%] for technology startups and established tech companies, encouraging growth and innovation.

- Healthcare and Life Sciences: The city’s renowned healthcare and life sciences cluster benefits from a specialized tax rate of [D%], supporting the development of cutting-edge research and medical advancements.

- Financial Services: Boston’s strong financial sector enjoys a tax rate of [E%], attracting global financial institutions and fostering economic stability.

- Retail and Hospitality: To support the vibrant retail and hospitality industries, Boston provides a tax rate of [F%], promoting business growth and tourism.

These tailored tax rates demonstrate Boston's commitment to fostering a diverse and thriving business landscape.

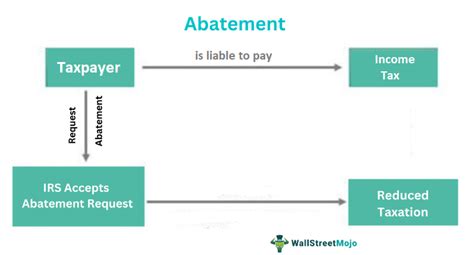

Property Tax Assessment and Appeals: Navigating the System

Property taxes are a significant aspect of the Boston tax rate. The city’s property tax assessment process is meticulous, ensuring fairness and accuracy. However, property owners have the right to appeal their assessments if they believe the valuation is incorrect.

The process involves submitting an appeal to the Boston Assessing Department, providing evidence to support the claim. Common reasons for appeals include:

- Overvaluation of the property compared to similar properties in the area.

- Recent renovations or improvements that have not been reflected in the assessment.

- Changes in the property's condition or use.

Successful appeals can result in a reduction in property taxes, providing financial relief to homeowners and businesses. The process, while detailed, ensures that Boston's tax system remains equitable and transparent.

Tax Incentives and Relief Programs: Supporting Boston’s Community

Boston recognizes the importance of supporting its residents and businesses, especially during challenging times. As such, the city offers a range of tax incentives and relief programs to provide financial assistance.

Key initiatives include:

- Senior Citizen Tax Relief: Boston provides a tax exemption for eligible senior citizens, reducing their property taxes and easing financial burdens.

- Low-Income Tax Assistance: A dedicated program offers tax relief to low-income residents, ensuring that financial constraints do not hinder their quality of life.

- Business Tax Incentives: The city incentivizes business growth by offering tax breaks for job creation, investment, and expansion, promoting economic development.

- Energy Efficiency Incentives: Boston encourages sustainable practices by providing tax credits for energy-efficient improvements, supporting both the environment and property owners.

These programs showcase Boston's commitment to creating a supportive and inclusive community.

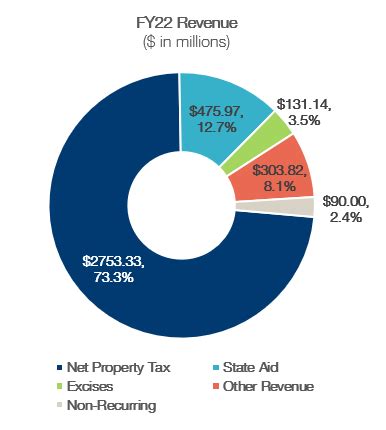

The Impact of Boston’s Tax Rate on the Local Economy

Boston’s tax rate plays a pivotal role in shaping the city’s economic landscape. It influences investment decisions, business growth, and the overall financial health of the community.

Here's a deeper analysis of the impact:

- Attracting Investment: Boston's competitive tax rates, especially for specific sectors, attract investors and businesses, driving economic growth and job creation.

- Residential Property Market: Varying tax rates across neighborhoods influence housing demand and prices, impacting the overall real estate market dynamics.

- Business Development: Tax incentives and reduced rates encourage businesses to establish and expand in Boston, fostering a vibrant and diverse business ecosystem.

- Community Support: Tax relief programs ensure that residents, especially those in need, receive support, contributing to a stronger and more resilient community.

The city's tax structure, while complex, is designed to benefit all stakeholders, from residents to businesses, ensuring a prosperous and sustainable future for Boston.

Conclusion: Navigating the Complexities of Boston’s Tax Rate

Understanding the Boston tax rate is a critical aspect of navigating the city’s financial landscape. From residential and commercial rates to tax incentives and relief programs, the system is designed to support the city’s growth and development.

As Boston continues to thrive, its tax structure will play a vital role in shaping the city's future. For residents and businesses alike, staying informed about these tax nuances is essential for making informed financial decisions and contributing to the city's success.

In the ever-evolving world of taxes, Boston stands as a testament to how a well-designed tax system can benefit a community, fostering growth, innovation, and a strong sense of community.

How often are tax rates updated in Boston?

+Tax rates in Boston are typically reviewed and updated annually to align with the city’s financial goals and economic trends.

Are there any tax breaks for first-time homebuyers in Boston?

+Yes, Boston offers a First-Time Homebuyer Tax Credit to eligible individuals, providing a financial incentive to encourage homeownership.

What is the process for appealing a property tax assessment in Boston?

+The appeal process involves submitting a formal request to the Boston Assessing Department, providing supporting evidence, and attending a hearing if necessary. It’s advisable to seek professional guidance for a successful appeal.