Montana Property Taxes

Welcome to our comprehensive guide on Montana Property Taxes. In this expert-driven article, we will delve into the intricacies of property taxation in the Treasure State, providing you with a deep understanding of the system, its unique features, and how it impacts homeowners and investors alike. Whether you're a resident looking to manage your tax obligations effectively or an investor exploring the real estate market, this guide will equip you with the knowledge to navigate Montana's property tax landscape with confidence.

Understanding Montana's Property Tax System

Montana's property tax system is designed to generate revenue for local governments, primarily used to fund essential services such as education, public safety, and infrastructure development. This system is governed by state laws and regulations, ensuring a fair and consistent approach across the state. Let's break down the key components of Montana's property tax structure.

Assessment and Valuation Process

Property taxes in Montana are based on the assessed value of your property. The assessment process involves evaluating the property's market value, which is then used to calculate the tax liability. This assessment is carried out by county assessors, who employ various methods to determine the value, including recent sales data, income potential, and replacement cost.

It's important to note that Montana utilizes a market value assessment approach, ensuring that property taxes are based on the property's actual worth in the current market. This approach provides transparency and fairness, as properties are taxed based on their true value rather than arbitrary assessments.

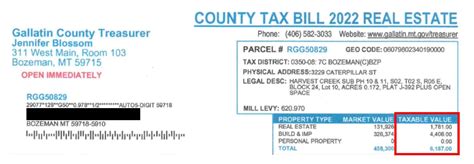

Tax Rates and Mill Levies

The tax rate, also known as the mill levy, is a crucial factor in determining your property tax bill. In Montana, tax rates are set by local taxing authorities, including counties, cities, and school districts. These entities decide on the mill levy, which is expressed in mills (one mill is equal to one-tenth of a cent or $0.001) and applied to the assessed value of your property.

For instance, if your property has an assessed value of $200,000 and the mill levy is set at 70 mills, your property tax liability would be calculated as follows: $200,000 x 0.070 = $14,000. This means you would owe $14,000 in property taxes for that year.

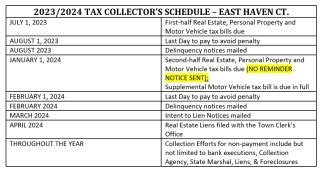

Tax Districts and Assessments

Montana is divided into tax districts, each with its own assessment and tax collection processes. These districts can include counties, cities, towns, and special assessment districts. Understanding which tax districts your property falls under is essential, as it determines the specific mill levies and assessment procedures applicable to your property.

For example, if your property is located in a city, you may be subject to additional taxes levied by the city government to fund local projects and services. Similarly, if your property is within a special assessment district, you may incur extra charges for specific improvements or infrastructure projects.

| Tax District | Assessment Method |

|---|---|

| County | Annual valuation based on market value |

| City/Town | Variable assessment methods, including market value or cost-based approaches |

| Special Assessment District | Assessments for specific projects or improvements |

Property Tax Rates and Trends in Montana

Montana's property tax rates can vary significantly across the state due to the localized nature of tax assessments and mill levies. Understanding the average tax rates and trends in your specific area is crucial for budgeting and financial planning.

Average Property Tax Rates

According to recent data, the average effective property tax rate in Montana is approximately 0.84% of the property's assessed value. However, it's important to note that this rate can fluctuate based on various factors, including the property's location, type, and recent market trends.

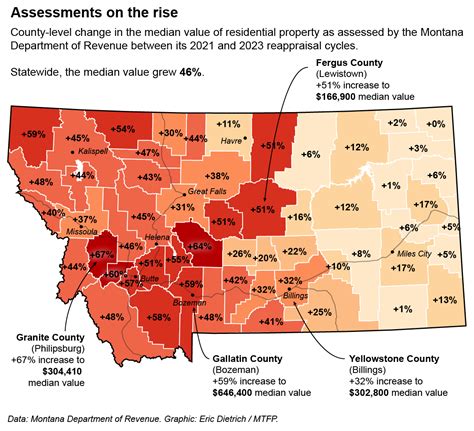

Property Tax Rate Trends

Montana has experienced relatively stable property tax rates over the past decade. While there have been slight fluctuations, the overall trend indicates a consistent approach to taxation, providing homeowners and investors with a predictable financial environment.

However, it's essential to monitor local tax rate changes, as certain areas may experience adjustments due to budgetary needs or infrastructure development projects. Staying informed about these changes can help you budget effectively and plan for any potential increases.

Property Tax Relief and Incentives

Montana offers several property tax relief programs and incentives aimed at supporting homeowners and certain property types. These initiatives provide financial assistance and reduce the tax burden for eligible individuals and properties.

Homestead Tax Exemption

The Homestead Tax Exemption is a valuable program that provides a partial exemption from property taxes for eligible homeowners. To qualify, homeowners must meet certain residency and income requirements. This exemption can significantly reduce the tax liability for primary residences, making homeownership more affordable.

Veterans and Senior Citizen Benefits

Montana extends special property tax benefits to veterans and senior citizens. Veterans' property tax exemption provides a reduction in taxes for those who have served in the military, while the Senior Citizen Exemption offers relief to homeowners aged 62 or older. These exemptions can make a substantial difference in the overall tax burden for these deserving individuals.

Agricultural and Timber Land Incentives

Montana recognizes the importance of agriculture and timber industries to the state's economy. As such, it offers special assessment programs for agricultural and timber land, which provide lower tax rates and assessments based on the land's productive value rather than its market value. This incentive supports the state's agricultural and forestry sectors, promoting economic growth and sustainability.

Appealing Property Assessments and Taxes

If you believe your property assessment or tax bill is inaccurate or unfair, Montana provides a process for appealing these decisions. Understanding the appeal process and your rights is crucial for ensuring a fair and equitable tax assessment.

The Appeal Process

The first step in appealing your property assessment is to contact your county assessor's office. They can provide guidance on the appeal process and help identify potential errors or discrepancies in your assessment. It's important to gather relevant evidence, such as recent sales data or professional appraisals, to support your case.

If you're unable to resolve the issue with the county assessor, you can escalate the appeal to the Montana Department of Revenue, which oversees property tax assessments and appeals. This department provides a formal review process, allowing you to present your case and seek a fair resolution.

Common Reasons for Appeals

Property owners may appeal assessments for various reasons, including:

- Overvaluation: If you believe your property's assessed value is higher than its true market value, you can provide evidence to support a lower valuation.

- Unequal Assessment: If your property is assessed at a higher rate than similar properties in your area, you can argue for an adjustment to align with local market trends.

- Improper Classification: Ensure your property is classified correctly based on its use and characteristics. Incorrect classification can lead to higher tax rates.

The Impact of Property Taxes on Real Estate Investments

Property taxes play a significant role in real estate investments, influencing both the profitability and long-term sustainability of these ventures. Understanding how property taxes affect your investment is crucial for making informed decisions.

Cash Flow Considerations

Property taxes are a significant expense for real estate investors. When calculating the potential cash flow from an investment property, it's essential to factor in the property taxes. Higher tax rates can reduce the net operating income (NOI) and impact the overall return on investment (ROI).

For example, if you're considering a commercial property investment with a potential NOI of $50,000 per year, and the property taxes amount to $10,000 annually, your effective NOI would be $40,000. This reduction in NOI directly affects the investment's profitability.

Cap Rate and Property Tax Impact

The capitalization rate (cap rate), a key metric in real estate investing, is influenced by property taxes. A higher tax rate can lead to a lower cap rate, making the investment less attractive to potential buyers. Conversely, a lower tax rate can increase the cap rate, making the property more desirable and potentially increasing its value.

Long-Term Investment Strategies

When planning long-term real estate investments, it's crucial to consider the potential for property tax increases. While Montana's stable tax rates provide a predictable environment, it's essential to monitor local trends and budget accordingly. Implementing strategies to mitigate tax increases, such as seeking tax incentives or appealing assessments, can help protect your investment's value over time.

Navigating Montana's Property Tax Landscape: Key Takeaways

Montana's property tax system, while comprehensive and fair, requires careful understanding and management. Here are some key takeaways to remember as you navigate this landscape:

- Montana utilizes a market value assessment approach, ensuring transparency and fairness in property tax assessments.

- Tax rates can vary significantly across the state, so stay informed about local mill levies and assessment procedures.

- Explore property tax relief programs, such as the Homestead Tax Exemption and veteran/senior citizen benefits, to reduce your tax burden.

- If you disagree with your property assessment or tax bill, follow the appeal process to seek a fair resolution.

- Property taxes significantly impact real estate investments, affecting cash flow, cap rates, and long-term profitability.

FAQs: Property Taxes in Montana

How often are property taxes assessed in Montana?

+

Property taxes in Montana are assessed annually. The assessment process involves evaluating the property’s market value, which is then used to calculate the tax liability for the upcoming year.

Can I receive a discount on my property taxes if I pay in full?

+

Yes, Montana offers a discount for property owners who pay their taxes in full by a certain deadline. The discount rate varies by county but typically ranges from 1% to 3% of the total tax bill.

What happens if I don’t pay my property taxes on time?

+

Failure to pay property taxes on time can result in penalties and interest charges. If the taxes remain unpaid, the county may place a tax lien on the property, which could lead to foreclosure if the debt is not resolved.

Are there any property tax deferment programs for seniors in Montana?

+

Yes, Montana offers a Senior Citizen Property Tax Deferral Program. This program allows eligible seniors to defer a portion of their property taxes until the property is sold, transferred, or upon the death of the homeowner. However, there are specific eligibility criteria and limitations to this program.

How can I estimate my property taxes before purchasing a home in Montana?

+

To estimate your property taxes, you can use the Montana Property Tax Estimator provided by the Department of Revenue. This online tool allows you to input the property’s assessed value and view the estimated tax liability based on the current mill levies.