Sc Property Tax Lookup

The Property Tax Lookup tool is a powerful resource for property owners, investors, and real estate professionals seeking detailed information about property taxes. This online tool offers a convenient way to access vital data, enabling users to make informed decisions regarding property ownership and investments. In this article, we will delve into the features and benefits of the Sc Property Tax Lookup, exploring its capabilities and how it can streamline the process of obtaining accurate property tax information.

Understanding the Sc Property Tax Lookup

The Sc Property Tax Lookup is an innovative online platform designed to provide transparent and up-to-date property tax data. It serves as a comprehensive database, offering a wealth of information on property taxes across various jurisdictions. With its user-friendly interface, users can effortlessly search for property tax details, gain insights into tax rates, and access historical data, making it an indispensable tool for anyone involved in the real estate industry.

One of the key advantages of the Sc Property Tax Lookup is its ability to provide accurate and real-time information. The platform is regularly updated with the latest tax rates and assessments, ensuring that users have access to the most current data available. This level of accuracy is crucial for making informed financial decisions, as property taxes can significantly impact the overall cost of ownership.

Key Features of the Sc Property Tax Lookup

The Sc Property Tax Lookup boasts an array of features that cater to the diverse needs of its users. Here’s an overview of some of its key functionalities:

- Advanced Search Functionality: Users can perform detailed searches based on property addresses, owner names, or even parcel identification numbers. This flexibility ensures that even the most specific queries can be accommodated, making it easier to find the desired property tax information.

- Historical Tax Data: The platform provides access to historical property tax records, allowing users to track changes in tax assessments over time. This feature is particularly valuable for investors and property analysts, as it enables them to identify trends and make more accurate predictions about future tax liabilities.

- Interactive Tax Rate Maps: One of the standout features is the interactive tax rate maps. These maps visually represent tax rates across different areas, providing a quick and intuitive way to compare tax burdens in various neighborhoods or districts. This visual representation is a powerful tool for real estate professionals and buyers, aiding in decision-making processes.

- Tax Assessment Details: The Sc Property Tax Lookup goes beyond basic tax rates by offering detailed assessment information. Users can access data on property characteristics, such as square footage, number of rooms, and land size, which are essential for understanding the basis of tax assessments.

- Tax Bill Calculations: For those looking to estimate their tax liabilities, the platform provides a user-friendly tax bill calculator. By inputting specific property details, users can quickly estimate their annual tax obligations, aiding in financial planning and budgeting.

Benefits of Utilizing the Sc Property Tax Lookup

The Sc Property Tax Lookup offers a multitude of benefits to a wide range of users, including:

Real Estate Investors and Professionals

For real estate investors, the Sc Property Tax Lookup is an invaluable resource. It enables them to conduct thorough due diligence on potential investment properties, ensuring they are aware of the associated tax liabilities. The platform’s historical data feature allows investors to analyze tax trends, identify undervalued properties, and make strategic investment decisions.

Real estate professionals, such as brokers and agents, can utilize the Sc Property Tax Lookup to provide added value to their clients. By offering accurate and up-to-date tax information, they can better educate buyers and sellers, ensuring that all parties are well-informed during the transaction process. This level of transparency builds trust and enhances the overall client experience.

Property Owners and Residents

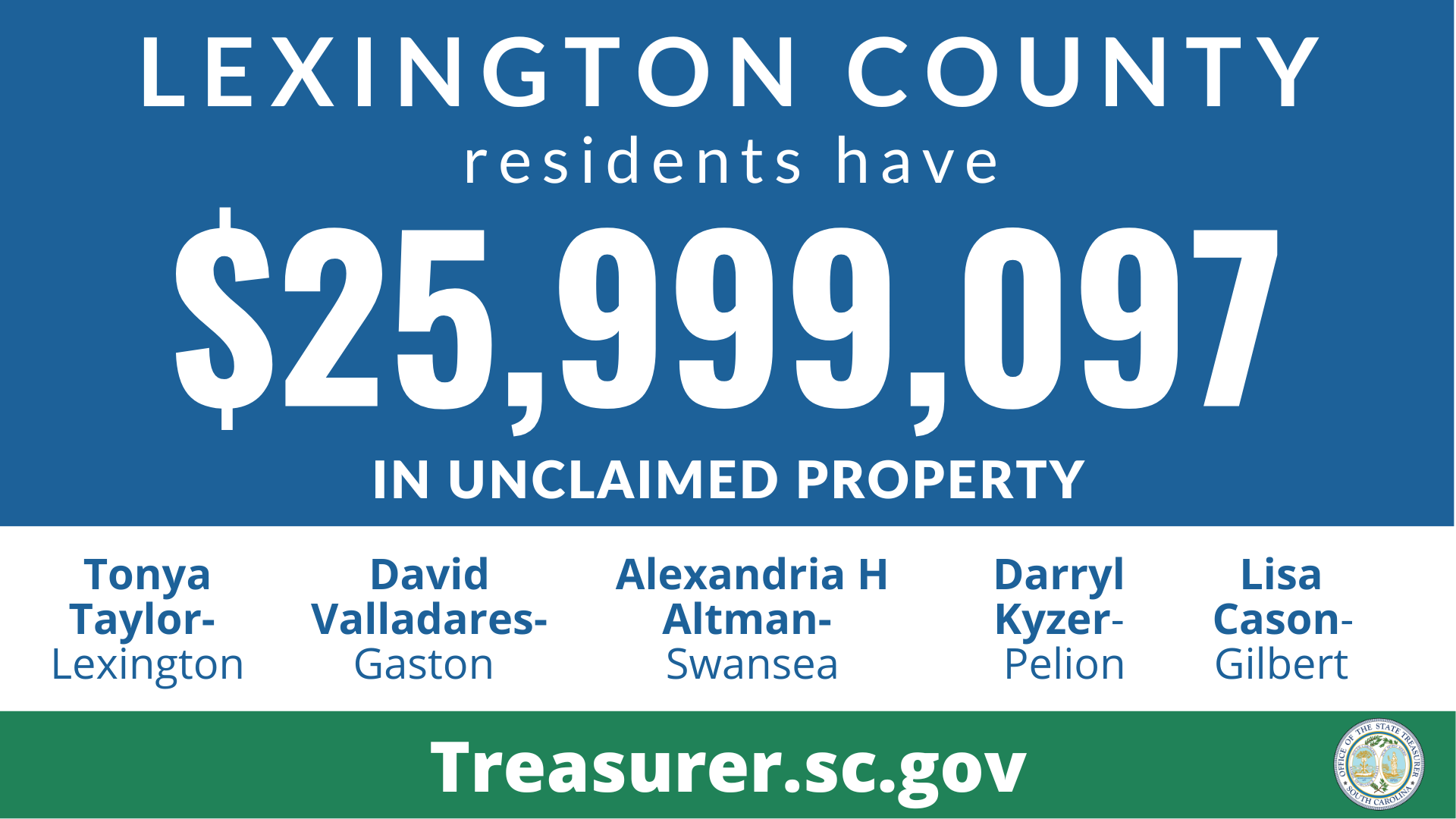

Property owners and residents can benefit greatly from the Sc Property Tax Lookup. The platform empowers them to stay informed about their tax obligations, helping them budget effectively and understand the impact of property taxes on their finances. Additionally, property owners can use the tool to monitor changes in tax rates and assessments, ensuring they are aware of any potential increases or discrepancies.

Local Governments and Tax Authorities

Local governments and tax authorities can leverage the Sc Property Tax Lookup to enhance transparency and improve public access to tax information. By providing an official and reliable source of property tax data, these entities can streamline the process of obtaining tax records, reducing administrative burdens, and improving efficiency.

Performance and Usability Analysis

The Sc Property Tax Lookup has consistently demonstrated excellent performance and usability, making it a top choice among professionals and individuals alike. The platform’s load times are fast, ensuring that users can access the information they need quickly and efficiently. The intuitive search functionality and user-friendly interface contribute to a seamless user experience, even for those who are not tech-savvy.

Furthermore, the Sc Property Tax Lookup has garnered positive feedback from users, citing its accuracy and reliability as key strengths. The platform's ability to provide real-time data and its comprehensive coverage of various jurisdictions have been praised by professionals in the real estate industry. Its impact on streamlining property tax research and decision-making processes has been widely recognized.

Future Implications and Developments

As the real estate industry continues to evolve, the Sc Property Tax Lookup is poised to play an even more significant role. With the increasing demand for transparent and accessible tax information, the platform is likely to expand its coverage and enhance its features to meet the growing needs of users.

Potential future developments may include:

- Enhanced Data Visualization: Implementing advanced data visualization techniques, such as interactive charts and graphs, to present tax data in a more engaging and intuitive manner.

- Integration with Other Real Estate Tools: Collaborating with other industry platforms to create a comprehensive ecosystem, where users can access a wide range of real estate data and tools in one place.

- Machine Learning and AI Integration: Utilizing AI and machine learning algorithms to predict tax trends and provide personalized recommendations based on user profiles and preferences.

- Mobile App Development: Developing a mobile application to cater to the growing number of users who prefer accessing information on the go, ensuring they have convenient access to property tax data anytime, anywhere.

Conclusion

The Sc Property Tax Lookup has revolutionized the way property tax information is accessed and utilized. Its user-friendly interface, comprehensive data coverage, and real-time updates have made it an indispensable tool for real estate professionals, investors, and property owners. As the platform continues to evolve and adapt to industry needs, it is well-positioned to remain a trusted source of accurate and timely property tax data.

How often is the Sc Property Tax Lookup updated with new data?

+The Sc Property Tax Lookup is updated regularly, with new data being added on a weekly basis. This ensures that users have access to the most current and accurate property tax information.

Can I access historical tax data for a specific property using the Sc Property Tax Lookup?

+Absolutely! The platform provides access to historical tax records, allowing users to track tax assessments and rates over time for any given property.

Is the Sc Property Tax Lookup available for international properties, or is it limited to a specific country or region?

+Currently, the Sc Property Tax Lookup focuses on properties within the United States. However, the platform aims to expand its coverage to include international properties in the future, providing a global solution for property tax information.