When Is Property Tax Due

Property tax is a crucial aspect of homeownership, and understanding when it is due is essential for every homeowner. The due dates for property taxes can vary significantly depending on the location and jurisdiction. In this comprehensive guide, we will delve into the world of property taxes, exploring the factors that influence their due dates and providing you with the knowledge to stay on top of your financial obligations.

Understanding Property Tax Due Dates

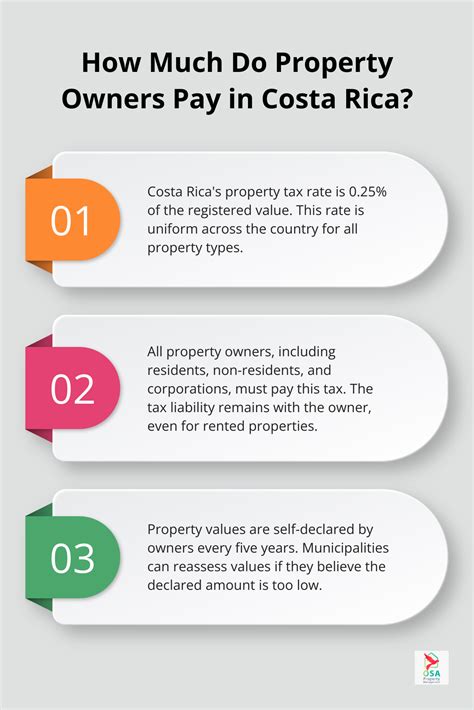

Property tax, also known as real estate tax, is a levy imposed on the value of real property, including land and improvements such as buildings and structures. It is a significant source of revenue for local governments and is used to fund various public services and infrastructure projects. The due dates for property taxes are typically determined by local authorities, which can include municipalities, counties, or states.

The specific due dates can vary widely, and it is crucial for homeowners to be aware of the deadlines applicable to their specific location. These due dates are often set by legislative bodies or tax authorities within a jurisdiction, and they can differ not only across states but also within counties or even cities.

Factors Influencing Property Tax Due Dates

Several factors come into play when determining the due dates for property taxes. Understanding these factors can help homeowners anticipate and plan for their tax obligations.

- Jurisdictional Regulations: Each jurisdiction has its own set of rules and regulations regarding property taxes. These regulations outline the assessment process, valuation methods, and, most importantly, the due dates for tax payments.

- Assessment Periods: Property taxes are often assessed on an annual basis, but the assessment period can vary. Some jurisdictions assess properties on a calendar year basis, while others may have fiscal years that deviate from the standard January to December cycle.

- Bill Issuance: Property tax bills are typically sent out by the local tax authority. The timing of bill issuance can impact the due date, as homeowners are generally given a grace period to make their payments.

- Payment Installments: In some cases, property taxes can be paid in installments. Jurisdictions may offer options to split the tax liability into multiple payments, each with its own due date. This provides flexibility for homeowners but requires careful planning to avoid penalties.

- Appeal Processes: Homeowners have the right to appeal their property tax assessments if they believe the valuation is incorrect. The appeal process can impact the due date, as some jurisdictions may allow for deferred payments until the appeal is resolved.

Navigating Property Tax Due Dates Across Jurisdictions

Given the vast differences in property tax systems and due dates across jurisdictions, it is essential for homeowners to be well-informed about the specific rules and regulations in their area.

State-Level Variations

At the state level, property tax due dates can vary significantly. For instance, in the state of California, property taxes are due on December 10th, with a grace period until December 31st before penalties are incurred. In contrast, the state of Texas has a due date of February 1st, allowing homeowners a later payment window.

| State | Due Date |

|---|---|

| California | December 10th |

| Texas | February 1st |

County and Municipal Differences

Within states, counties and municipalities often have their own property tax systems and due dates. These variations can be even more nuanced, with some counties offering semi-annual or quarterly payment options. For example, in Los Angeles County, property taxes are due in two installments: the first by November 1st and the second by December 10th.

| County/Municipality | Due Date |

|---|---|

| Los Angeles County, CA | November 1st and December 10th (two installments) |

| Houston, TX | January 31st |

Staying Informed and Managing Property Tax Obligations

To ensure compliance and avoid penalties, it is crucial for homeowners to stay informed about their property tax due dates. Here are some practical tips and strategies to manage your property tax obligations effectively:

- Research Local Regulations: Familiarize yourself with the property tax regulations and due dates specific to your jurisdiction. Local government websites often provide detailed information about tax assessments, due dates, and payment options.

- Set Reminders: Create reminders for yourself leading up to the due dates. Mark your calendar or set up notifications to ensure you don't miss any payment deadlines.

- Explore Payment Options: Investigate the various payment options available. Some jurisdictions offer online payment portals, while others may accept payments through mail or in-person visits. Choose the option that suits your preferences and ensures timely payment.

- Consider Payment Plans: If you anticipate financial challenges in meeting the due dates, explore payment plan options. Many jurisdictions offer installment plans or deferred payment programs to assist homeowners facing temporary financial difficulties.

- Stay Updated on Assessments: Regularly review your property tax assessments to ensure accuracy. If you believe your property's value has been incorrectly assessed, consider appealing the assessment. A successful appeal can result in a reduced tax liability.

The Impact of Late Payments and Penalties

Failing to pay property taxes by the due date can result in significant penalties and consequences. Local governments typically impose late payment fees, which can accrue over time if the taxes remain unpaid. In some cases, non-payment of property taxes can lead to tax liens being placed on the property, affecting its marketability and potentially leading to foreclosure.

It is essential to prioritize property tax payments to avoid these penalties and maintain a positive relationship with your local tax authorities. By staying informed and planning ahead, homeowners can ensure a smooth and stress-free process when it comes to fulfilling their property tax obligations.

Future Trends and Developments

The world of property taxes is constantly evolving, and several trends and developments are shaping the landscape. As technology advances, many jurisdictions are adopting digital solutions to streamline the tax assessment and payment processes. Online portals and mobile apps are becoming more prevalent, offering homeowners convenient and efficient ways to manage their property tax obligations.

Additionally, there is a growing focus on tax equity and fairness. Some jurisdictions are exploring ways to ensure that property taxes are distributed equitably among homeowners, taking into account factors such as income levels and property values. These initiatives aim to create a more balanced and sustainable tax system.

As the real estate market continues to evolve, so too will the strategies and approaches to property tax assessments and due dates. Staying informed about these developments is crucial for homeowners to navigate the changing landscape and make informed decisions regarding their financial obligations.

Can I pay my property taxes early?

+Yes, many jurisdictions allow early payment of property taxes. Paying early can be beneficial as it ensures you don’t forget the due date and helps you budget your finances accordingly.

What happens if I miss the property tax due date?

+Missing the property tax due date can result in late fees and penalties. In some cases, prolonged non-payment may lead to tax liens or foreclosure proceedings. It’s crucial to stay informed and make timely payments.

Are there any tax benefits for paying property taxes on time?

+Some jurisdictions offer tax incentives or rebates for homeowners who pay their property taxes on time or early. These incentives can vary, so it’s worth checking with your local tax authority to explore any potential benefits.