Claim Your ct state tax refund Today

Securing a state tax refund is often viewed solely as a matter of filing forms correctly and waiting patiently, but beneath this routine process lies a complex web of legal, financial, and administrative nuances. Many taxpayers operate under misconceptions that simplify or skew their understanding of how claims are filed, processed, and ultimately awarded or denied. By dissecting these misconceptions through evidence-based analysis, this article aims to debunk common myths surrounding the process of claiming your Connecticut (CT) state tax refund, guiding taxpayers towards a more strategic and informed approach to maximizing their entitlements and avoiding common pitfalls.

Understanding the Foundations of Connecticut State Tax Refunds

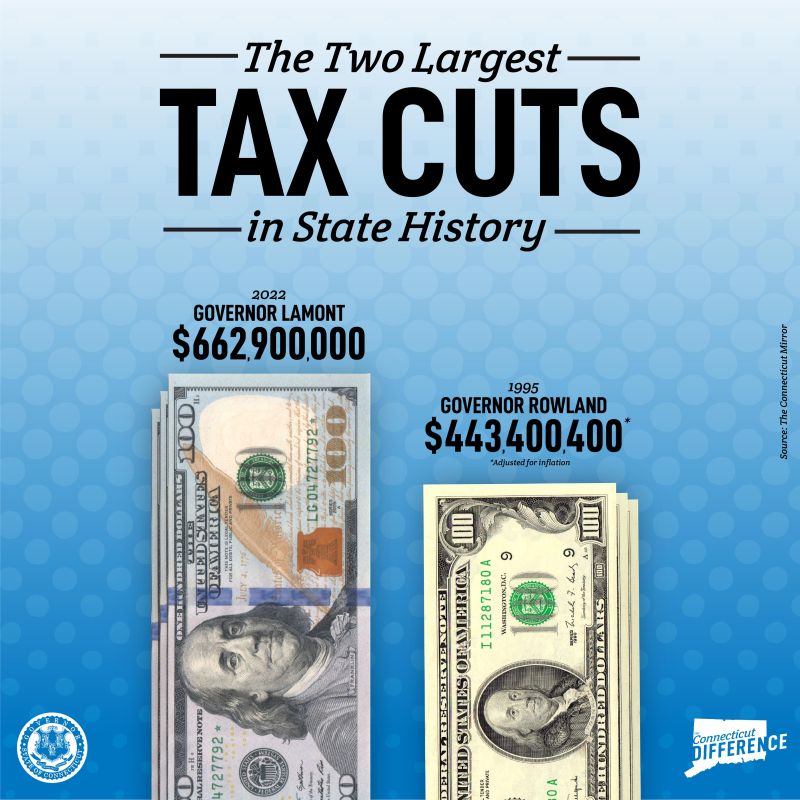

To truly grasp the intricacies involved in claiming a CT state tax refund, one must first understand the fundamental structure of Connecticut’s tax system, including its fiscal policies, legislative changes, and administrative procedures. CT imposes a progressive income tax system, with rates ranging from 3% to 6.99% as of the latest fiscal year, based on taxable income brackets. The state’s revenue collection mechanisms, refund eligibility criteria, and audit practices are shaped by ongoing policy reforms aimed at balancing state budgeting needs with taxpayer fairness.

Debunking the Myth: Refunds Are Automatic After Filing

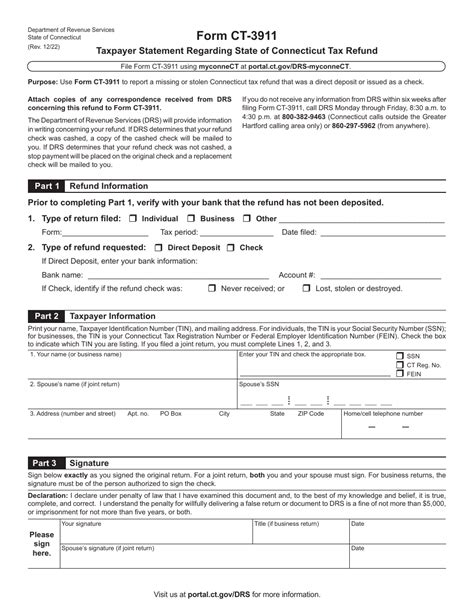

A pervasive misconception is that once a taxpayer files their Connecticut state tax return, the refund will automatically be issued without further action. While electronic filing platforms and direct deposit options have streamlined the process, the reality involves multiple stages that can introduce delays or denials. After submission, the Connecticut Department of Revenue Services (DRS) conducts an eligibility review, checks for errors, discrepancies, or potential fraud indicators. This review may require additional documentation, especially if irregularities are flagged. The assumption that refunds are automatically guaranteed overlooks these compliance checks and administrative timelines.

| Relevant Category | Substantive Data |

|---|---|

| Average Processing Time | Approximately 4-6 weeks for electronic returns under normal circumstances |

| Common Causes for Delay | Mismatched Social Security numbers, incomplete documentation, or errors in reported income |

Myth: You Can Only Claim Your Refund During Standard Filing Seasons

Many believe that the window for claiming a Connecticut state tax refund is strictly confined to the regular filing window—typically from January 1 to April 15 every year. This misconception ignores the existence of amended returns, late filings, and extended deadlines granted under specific circumstances. For example, if a taxpayer discovers an error or omitted credit after the initial filing deadline, they can submit an amended return (Form CT-1040X) up to three years after the original due date or the date the return was filed—that is, generally until April 15 of the third year following the tax year in question.

Complexity of the Amended Return Process

While filing an amended return can rescue a missed refund or correct previous inaccuracies, taxpayers should be aware of procedural differences. Amended returns require separate forms and supporting documentation, and may trigger additional reviews, extending the refund timeline. Moreover, the IRS’s policy aligns with federal statutes, but Connecticut-specific nuances—such as state-specific credits or deductions—must also be considered carefully during amendments.

| Relevant Category | Substantive Data |

|---|---|

| Amended Return Deadline | Typically within 3 years from original filing or 2 years from the date tax was paid |

| Processing Time for Amendments | Typically 6-8 weeks upon receipt by DRS, though delays are common |

Myth: High Income Disqualifies You from Refunds

A significant misconception persists that only low-income taxpayers qualify for refunds, or that earning above certain thresholds disqualifies one from claiming refunds. In truth, Connecticut’s tax credits and refund entitlements are often targeted towards specific income brackets but are not solely limited to the low-income demographic. For example, the Connecticut Earned Income Tax Credit (EITC) is available to qualified filers with income up to approximately $56,000 for the 2023 tax year, which is designed to benefit working-class families.

Income Thresholds and Refund Eligibility

Understanding the precise limits and eligibility criteria for various credits is critical. Connecticut offers a range of credits including the property tax credit, child and dependent care credit, and the earned income tax credit—all of which enhance the likelihood of a refund, even for higher earners if they qualify. Moreover, refunds are not limited to credits alone; overpayment of withholding taxes, estimated payments, or refundable portions of deductions can generate genuine refunds across the income spectrum.

| Relevant Category | Substantive Data |

|---|---|

| Income Limit for EITC | Up to $56,000 for single filers in 2023 |

| Average Refund Increase from Credits | $600 to $2,500, depending on credits claimed |

Myth: Overpayment Is Always Mistaken or Unintentional

Another widespread misconception is that any overpayment leading to a refund is merely an error or accident, whereas in reality, deliberate overpayment strategies—such as contributing to retirement plans via payroll deductions, tax equalization methods, or advancing Estimated Tax Payments—are legitimate and often advantageous financial practices. These actions inflate withholding amounts or prepay liabilities, resulting in refunds that reflect proactive tax planning rather than mistake.

Strategic Overpayment and Tax Planning

Tax professionals often recommend overpaying temporarily during high-income years or when anticipating additional tax liabilities. The resulting refunds act as interest-free loans to the government, which can be managed through careful financial planning. Recognizing this shifts the narrative from overpayment as error towards overpayment as a strategic tool, with the key being accurate record-keeping and timely adjustments in future tax periods to avoid excessive overpayment.

| Relevant Category | Substantive Data |

|---|---|

| Average Overpayment in CT | Approximately 7-10% of annual withholding, equating to $4,000-$9,000 for high-income earners |

| Refund Timing Post-Overpayment | Typically 4-6 weeks post-filing, contingent on processing accuracy |

Conclusion: Taking Control of Your CT Tax Refunds

Debunking these misconceptions reveals that claiming a Connecticut state tax refund involves a nuanced interplay of legal rights, procedural steps, and strategic planning. Rather than assuming automaticity or limited eligibility, informed taxpayers actively engage with their filings—amending returns when necessary, leveraging credits appropriate for their income level, and employing strategic overpayment techniques responsibly. By understanding these core aspects and the processes involved, taxpayers can transform what might seem like a bureaucratic obligation into a proactive financial strategy that ensures fair recognition of their paid taxes and rightful refunds.

What is the typical processing time for a Connecticut state tax refund?

+Most refunds are processed within 4-6 weeks for electronically filed returns, though delays can occur due to errors or additional reviews.

Can I claim a refund if I realized I missed credits or made errors after the deadline?

+Yes, through filing an amended return (Form CT-1040X) within three years of the original filing or payment date, you can correct mistakes and claim owed refunds.

Are refunds available for higher-income taxpayers in Connecticut?

+Absolutely. Refunds depend on eligibility for specific credits such as the Connecticut EITC or property tax credits, which are accessible to qualifying higher-income filers.