Peoria County Property Tax

Property taxes in Peoria County, Illinois, are an essential aspect of the local government's revenue stream, contributing significantly to the funding of various public services and infrastructure projects. The assessment and collection of property taxes in Peoria County involve a comprehensive process that ensures fair and equitable taxation for all property owners. This article aims to provide an in-depth analysis of Peoria County's property tax system, exploring its workings, impact, and potential implications for residents and businesses.

Understanding Peoria County’s Property Tax Landscape

Peoria County, nestled in the heart of Central Illinois, is home to a diverse range of properties, from residential homes and commercial establishments to agricultural lands and industrial facilities. The property tax system in Peoria County operates under a framework designed to assess the value of these properties and determine the corresponding tax liability for each owner.

The Assessment Process

The assessment process is a critical component of Peoria County’s property tax system. It involves the evaluation of each property’s worth, taking into account various factors such as location, size, improvements, and market conditions. The Peoria County Assessor’s Office is responsible for conducting these assessments annually, ensuring that property values are accurately reflected in the tax rolls.

To ensure fairness and accuracy, the Assessor’s Office employs a combination of physical inspections, market research, and statistical analysis. They consider recent sales data, construction costs, and other relevant information to determine the fair market value of each property. This value forms the basis for calculating the property tax liability.

| Assessment Year | Average Property Value Increase |

|---|---|

| 2022 | 3.5% |

| 2021 | 4.2% |

| 2020 | 2.8% |

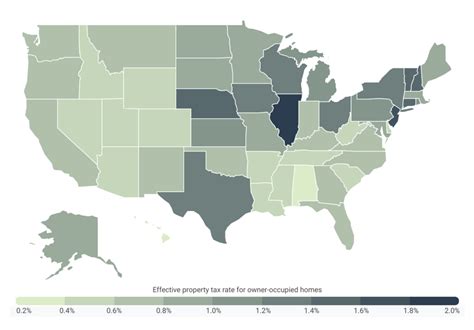

Tax Rate Structure

Once the assessed value of a property is determined, the applicable tax rate is applied to calculate the property tax liability. In Peoria County, the tax rate is set by various taxing districts, including the county, municipalities, school districts, and special purpose districts.

The tax rate is expressed as a percentage and varies depending on the type of property and the specific taxing district. For instance, residential properties may have different tax rates than commercial properties, and school districts often have higher rates to fund education.

| Taxing District | Tax Rate (per $100 of Assessed Value) |

|---|---|

| Peoria County | 2.5% |

| City of Peoria | 3.7% |

| Peoria Public Schools | 5.2% |

Property Tax Exemptions and Incentives

Peoria County offers several property tax exemptions and incentives to eligible property owners, aiming to encourage specific activities or provide relief to certain groups.

- Homestead Exemption: Eligible homeowners can receive a reduction in their property taxes through the homestead exemption program. This exemption helps stabilize property taxes for long-term residents.

- Senior Citizen Exemption: Peoria County provides tax relief to senior citizens by offering a reduction in property taxes based on income and property value.

- Agricultural Property Tax Incentives: Agricultural lands are assessed at a lower rate, encouraging farming and preserving open spaces.

- Renewable Energy Incentives: Properties with renewable energy installations may qualify for tax incentives, promoting sustainable practices.

The Impact of Property Taxes on Peoria County Residents

Property taxes in Peoria County have a direct and significant impact on the lives of residents and businesses. These taxes contribute to the funding of essential services, infrastructure development, and community projects.

Funding Public Services

A substantial portion of the revenue generated from property taxes goes towards funding vital public services. This includes maintaining and improving local roads, bridges, and other infrastructure. Property taxes also support the operations of fire and police departments, ensuring the safety and well-being of the community.

Additionally, property taxes play a crucial role in funding education. Peoria County’s school districts rely on property tax revenue to provide quality education, maintain schools, and support educational programs.

Economic Development and Business Growth

Peoria County’s property tax system also plays a role in encouraging economic development and business growth. The availability of incentives and exemptions can make the county an attractive location for businesses, fostering job creation and economic prosperity.

For instance, the agricultural tax incentives mentioned earlier can promote the growth of farming and agribusiness, contributing to the local economy. Similarly, renewable energy incentives can encourage the adoption of sustainable practices, attracting environmentally conscious businesses.

Community Development and Quality of Life

Property taxes in Peoria County are not solely focused on revenue generation. They also serve as a means to enhance the quality of life for residents and build thriving communities.

The tax revenue is utilized to develop and maintain parks, recreational facilities, and cultural venues. This investment in community spaces promotes a healthy and active lifestyle, fostering social connections and a sense of belonging.

Furthermore, property taxes contribute to the funding of social services, such as healthcare, senior care, and support for vulnerable populations. These services ensure that Peoria County remains a supportive and inclusive community for all its residents.

Analysis and Future Implications

Peoria County’s property tax system is a well-established and vital component of the local economy and community. The careful assessment process, coupled with a fair tax rate structure, ensures that property owners contribute their fair share towards the funding of essential services.

Assessing the Tax Burden

While Peoria County’s property tax system aims for fairness and equity, it is essential to analyze the tax burden on different segments of the population. This includes evaluating the impact of tax rates on homeowners, renters, and businesses, especially in the context of changing market conditions.

For instance, rising property values can lead to increased tax liabilities for homeowners, potentially affecting their financial stability. Similarly, businesses may face challenges if tax rates become uncompetitive, impacting their ability to operate and expand.

Exploring Alternative Revenue Streams

As Peoria County continues to evolve and adapt to changing economic and social landscapes, it may be beneficial to explore alternative revenue streams alongside property taxes. This could involve diversifying the tax base or implementing new strategies to fund specific initiatives.

One potential avenue is the exploration of impact fees or development charges, particularly in areas experiencing rapid growth. These fees can be used to fund infrastructure projects directly related to new development, reducing the burden on existing property taxpayers.

Promoting Tax Transparency and Education

Ensuring transparency and educating property owners about the tax system is crucial for maintaining trust and understanding. Peoria County can further enhance its property tax system by providing clear and accessible information about assessment processes, tax rates, and the allocation of tax revenue.

Educational initiatives can empower property owners to make informed decisions, understand their rights, and actively participate in the community’s fiscal governance.

Conclusion

Peoria County’s property tax system is a complex yet essential mechanism that drives the funding of public services, infrastructure, and community development. By understanding the assessment process, tax rate structure, and the impact of property taxes, residents and businesses can actively engage in shaping their community’s future.

As Peoria County continues to evolve, a proactive approach to tax policy, community engagement, and economic development will be key to ensuring a vibrant and prosperous future for all its residents.

How often are property values assessed in Peoria County?

+Property values in Peoria County are assessed annually to ensure accurate tax assessments. The assessment process takes into account various factors, including market trends and property improvements.

Are there any appeals processes for property tax assessments in Peoria County?

+Yes, property owners in Peoria County have the right to appeal their property tax assessments if they believe the assessed value is inaccurate. The appeals process is managed by the Peoria County Board of Review, and specific guidelines and timelines apply.

How can I estimate my property tax liability in Peoria County?

+To estimate your property tax liability, you can use the Peoria County Assessor’s online property tax estimator. This tool provides an estimated tax amount based on your property’s assessed value and the applicable tax rates.