Sales Tax In Va For Cars

When purchasing a car in the state of Virginia, understanding the sales tax implications is crucial for both buyers and sellers. Sales tax is an essential component of the transaction, impacting the overall cost of the vehicle and the financial obligations of all parties involved. In this comprehensive guide, we will delve into the intricacies of sales tax in Virginia for car purchases, providing you with a detailed understanding of the process and the key considerations.

Understanding Sales Tax in Virginia

Sales tax in Virginia is a consumption tax imposed on the purchase of goods and services within the state. It is a critical revenue source for the state government, funding various public services and infrastructure projects. The sales tax rate in Virginia is not uniform across the state; instead, it consists of a state-level sales tax and a local tax, which can vary from one jurisdiction to another.

For car purchases, the sales tax is applied to the total purchase price of the vehicle, including any additional fees and charges. This means that the sales tax amount can vary significantly depending on the price of the car and the specific tax rates in the buyer's jurisdiction.

State Sales Tax Rate

The state-level sales tax rate in Virginia is set at 4.3%. This rate is applicable statewide and remains constant regardless of the location of the purchase. However, it is important to note that this is only the base rate, and additional local taxes can significantly increase the overall sales tax burden.

Local Sales Tax Rates

Virginia’s local sales tax rates can vary widely, ranging from 0% to 4.75%. These local taxes are imposed by cities, counties, and other local governing bodies, and they are added to the state sales tax to determine the total sales tax rate for a specific location.

For instance, in the city of Norfolk, the local sales tax rate is 2.25%, resulting in a combined sales tax rate of 6.55% when added to the state tax. On the other hand, in Fairfax County, the local sales tax rate is 4.75%, leading to a combined rate of 9.05%—one of the highest in the state.

These local variations can have a significant impact on the overall cost of a car purchase, especially for higher-priced vehicles. It is crucial for buyers to be aware of the sales tax rates in their specific jurisdiction to accurately estimate the total cost of their vehicle acquisition.

| Jurisdiction | Local Sales Tax Rate | Combined Sales Tax Rate |

|---|---|---|

| Norfolk | 2.25% | 6.55% |

| Fairfax County | 4.75% | 9.05% |

| Charlottesville | 1.0% | 5.3% |

| Lynchburg | 3.5% | 7.8% |

| Roanoke | 3.0% | 7.3% |

Calculating Sales Tax for Car Purchases

Calculating the sales tax for a car purchase in Virginia involves a straightforward process. You can use the following formula to determine the sales tax amount:

Sales Tax = Purchase Price x Combined Sales Tax Rate

Let's consider an example. If you are purchasing a car in Fairfax County, where the combined sales tax rate is 9.05%, and the purchase price of the vehicle is $30,000, the sales tax calculation would be as follows:

Sales Tax = $30,000 x 0.0905 = $2,715

This means that in addition to the purchase price, you would need to pay an additional $2,715 in sales tax, bringing the total cost of the vehicle to $32,715.

Exemptions and Special Cases

While sales tax is generally applicable to car purchases, there are certain exemptions and special cases to be aware of. These can vary based on the specific circumstances of the transaction and the individual involved.

Vehicle Trade-Ins: When trading in a vehicle as part of a new car purchase, the sales tax calculation can be more complex. The trade-in value is typically subtracted from the purchase price of the new vehicle, and the sales tax is applied to the net amount. This can result in a lower sales tax burden for buyers who are trading in their old cars.

Leased Vehicles: For leased vehicles, the sales tax is typically included in the monthly lease payments. The dealership calculates the sales tax based on the capitalized cost of the lease, which includes the vehicle's purchase price, any additional fees, and the residual value.

Military Personnel: Active-duty military personnel stationed in Virginia may be eligible for certain tax exemptions or reductions. It is advisable for military members to consult with their finance or legal offices to understand their specific tax obligations.

Sales Tax Payment and Documentation

When purchasing a car in Virginia, the sales tax is typically due at the time of the transaction. The dealership or seller will collect the sales tax and remit it to the appropriate tax authority. It is essential to ensure that the sales tax is accurately calculated and paid to avoid any legal or financial complications.

After paying the sales tax, the buyer will receive a sales tax receipt or documentation confirming the payment. This document is crucial for various purposes, including vehicle registration and title transfer. It serves as proof of compliance with Virginia's sales tax laws and is a requirement for completing the vehicle ownership transfer process.

Online or Out-of-State Purchases

If you purchase a car online or from a private party outside of Virginia, you are still required to pay sales tax on the vehicle. In such cases, you will need to calculate the sales tax based on the jurisdiction where the vehicle will primarily be used or registered. This ensures that you fulfill your tax obligations and avoid any potential penalties.

Conclusion

Understanding the sales tax implications for car purchases in Virginia is crucial for making informed financial decisions. The varying sales tax rates across the state highlight the importance of being aware of the local tax landscape. By accurately calculating the sales tax and ensuring timely payment, buyers can navigate the car-buying process with confidence and clarity.

Frequently Asked Questions

Are there any exceptions to the sales tax for car purchases in Virginia?

+

Yes, there are certain exceptions and exemptions to the sales tax for car purchases in Virginia. These include vehicles purchased for resale, certain government entities, and charitable organizations. Additionally, military personnel stationed in Virginia may be eligible for tax exemptions or reductions.

How can I estimate the sales tax for a car purchase in advance?

+

You can estimate the sales tax for a car purchase in advance by multiplying the purchase price of the vehicle by the combined sales tax rate for your specific jurisdiction. This will give you an approximate sales tax amount, which can help you budget for the overall cost of the purchase.

What happens if I fail to pay the sales tax on my car purchase?

+

Failing to pay the sales tax on your car purchase can result in legal and financial consequences. You may face penalties, interest charges, and even have your vehicle registration or title transfer delayed or denied. It is crucial to ensure that the sales tax is paid accurately and on time to avoid these issues.

Can I negotiate the sales tax amount with the dealership or seller?

+

No, the sales tax amount is a legally mandated fee and cannot be negotiated with the dealership or seller. The sales tax is calculated based on the purchase price and the applicable tax rates, and both parties are obligated to comply with the law. However, you can still negotiate the purchase price of the vehicle itself.

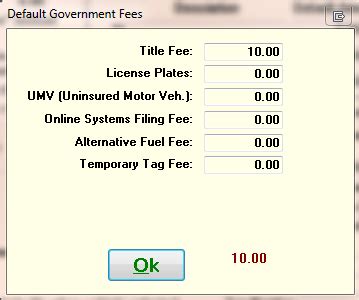

Are there any additional fees or charges I should be aware of when purchasing a car in Virginia?

+

Yes, in addition to sales tax, there are other fees and charges associated with car purchases in Virginia. These can include title fees, registration fees, and other administrative costs. It’s important to factor these additional expenses into your budget to ensure a smooth and complete vehicle acquisition process.