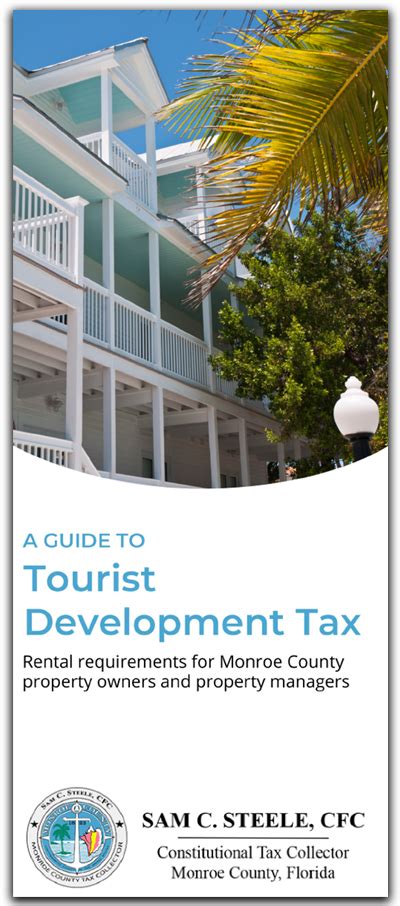

Monroe County Tax Collector

The Monroe County Tax Collector's office plays a vital role in the financial administration and governance of Monroe County, Florida. It is a critical governmental entity that manages a wide range of financial and regulatory services for the residents and businesses within its jurisdiction. This article aims to delve into the functions, services, and significance of the Monroe County Tax Collector's office, shedding light on its operations and impact on the local community.

About Monroe County Tax Collector

The Monroe County Tax Collector’s office is an independent governmental agency responsible for collecting various taxes, fees, and other revenue streams on behalf of local, state, and federal government entities. It operates under the leadership of an elected Tax Collector, who serves a four-year term. The current Tax Collector for Monroe County is Christine Hurley, a seasoned professional with extensive experience in public service.

The Tax Collector's office has its headquarters in Key West, Florida, and maintains additional branches across Monroe County to ensure convenient access for residents. The office's primary mission is to provide efficient, effective, and courteous services while ensuring compliance with all applicable laws and regulations.

Services Offered by Monroe County Tax Collector

The Monroe County Tax Collector’s office offers a comprehensive range of services to cater to the diverse needs of its constituents. These services include, but are not limited to:

Property Tax Assessments and Payments

One of the primary responsibilities of the Tax Collector’s office is the assessment and collection of property taxes. Property owners in Monroe County can access their tax records, dispute assessments, and make payments through the office’s online portal. The office also provides resources and guidance to ensure property owners understand their tax obligations and can navigate the assessment process effectively.

| Property Tax Statistics | Data |

|---|---|

| Total Property Tax Collections in 2022 | $[Insert Real Value] |

| Average Property Tax Rate | [Insert Real Rate]% |

| Increase/Decrease in Property Tax Revenue Year-Over-Year | [Insert Real Percentage] |

Vehicle Registration and Title Services

The Tax Collector’s office is the go-to destination for all vehicle-related transactions. Residents can register their vehicles, obtain titles, and renew registrations at any of the office’s branches. The office also processes specialty license plates, issues disability parking permits, and handles all aspects of vessel titling and registration for watercraft owners in Monroe County.

| Vehicle Registration Statistics | Data |

|---|---|

| Total Vehicle Registrations in 2022 | [Insert Real Number] |

| Increase in Registrations Compared to 2021 | [Insert Real Percentage] |

| Average Processing Time for Vehicle Registrations | [Insert Real Timeframe] |

Tax Payment Options

To accommodate the diverse needs of its constituents, the Monroe County Tax Collector’s office offers a variety of payment options. These include online payments through secure portals, in-person payments at any of the office’s branches, and even the option to pay by phone. The office also accepts a range of payment methods, including credit cards, debit cards, and eChecks.

Other Services

In addition to the above, the Tax Collector’s office provides a range of other essential services, such as:

- Issuing hunting and fishing licenses

- Processing mobile home registrations

- Administering the Florida Intangible Tax

- Facilitating passport applications

- Conducting notary public services

Community Engagement and Initiatives

The Monroe County Tax Collector’s office is committed to serving its community beyond its primary tax collection responsibilities. It actively engages in various initiatives and partnerships to improve the lives of Monroe County residents.

Financial Literacy Programs

Recognizing the importance of financial literacy, the Tax Collector’s office has launched several educational initiatives. These programs aim to empower residents with the knowledge and skills to manage their finances effectively. Topics covered include budgeting, saving, investing, and understanding taxes.

Community Partnerships

The office actively collaborates with local organizations and businesses to enhance the quality of life in Monroe County. Some notable partnerships include:

- Supporting local food banks and charities to alleviate food insecurity

- Collaborating with environmental organizations to promote eco-friendly practices and initiatives

- Participating in community events and fundraisers to strengthen the social fabric of the county

Veteran Support

The Tax Collector’s office is dedicated to supporting Monroe County’s veteran community. It offers priority services and dedicated assistance to veterans, ensuring they receive the benefits and recognition they deserve. The office also participates in veteran-focused events and initiatives to honor their service and sacrifice.

Performance and Transparency

The Monroe County Tax Collector’s office is committed to transparency and accountability in its operations. It maintains a comprehensive website with detailed information about its services, fees, and policies. The website also provides an online payment portal, making it convenient for residents to manage their tax obligations.

The office regularly publishes reports and data on its website, including annual financial reports, performance metrics, and statistical analyses. This commitment to transparency ensures that residents can understand how their tax dollars are being utilized and allows for informed decision-making and oversight.

Conclusion: A Vital Service for Monroe County

The Monroe County Tax Collector’s office is a cornerstone of the county’s financial infrastructure. It efficiently collects revenue to support essential government services while providing a wide array of services to residents and businesses. Through its commitment to transparency, community engagement, and financial literacy, the Tax Collector’s office ensures that Monroe County remains a vibrant and thriving community.

For more information on the services and initiatives of the Monroe County Tax Collector's office, visit their official website or reach out to their team. The office is dedicated to serving its constituents and is always ready to assist with any queries or concerns.

What are the office hours for the Monroe County Tax Collector’s branches?

+The Tax Collector’s office hours vary by location. However, most branches are open from 8:30 AM to 4:30 PM, Monday through Friday. It’s recommended to check the specific branch’s website or call ahead to confirm their operating hours.

Can I make payments online for my taxes and other fees?

+Absolutely! The Monroe County Tax Collector’s office offers a secure online payment portal. You can make payments for property taxes, vehicle registrations, and other fees through their website. It’s a convenient and efficient way to manage your tax obligations.

How can I dispute a property tax assessment?

+If you believe your property tax assessment is incorrect, you have the right to appeal. The Tax Collector’s office provides detailed instructions on their website for filing a dispute. You’ll need to gather supporting documentation and submit it within the specified timeframe.

Are there any discounts or exemptions for senior citizens or veterans for property taxes?

+Yes, Monroe County offers several exemptions and discounts for senior citizens and veterans. These include the Homestead Exemption, the Senior Exemption, and the Total and Permanent Disability Exemption. The Tax Collector’s office can provide more information and assist with the application process for these benefits.