Maryland Homeowners Tax Credit

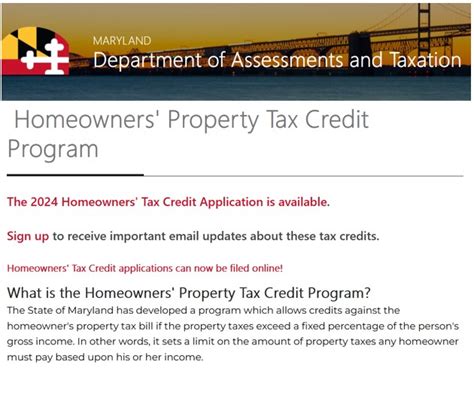

The Maryland Homeowners Tax Credit is a vital program designed to provide financial relief to homeowners across the state. It is an essential component of Maryland's efforts to support its residents and encourage homeownership. In this comprehensive guide, we will delve into the intricacies of this tax credit, exploring its benefits, eligibility criteria, application process, and the positive impact it can have on homeowners' financial well-being.

Understanding the Maryland Homeowners Tax Credit

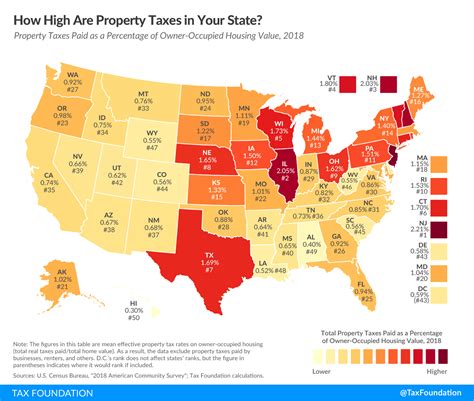

The Maryland Homeowners Tax Credit is a state-level initiative aimed at reducing the tax burden for homeowners. It serves as a powerful tool to make homeownership more affordable and accessible to a wider range of residents. This credit is particularly beneficial for those who may face challenges in paying their property taxes, offering them much-needed financial support.

The credit is calculated based on the assessed value of the property and the income of the homeowner. It is designed to provide a credit against the state's income tax, offering a direct reduction in the amount of tax owed. This credit can be a significant benefit, especially for those with lower to moderate incomes, as it can substantially lower their overall tax liability.

Benefits of the Homeowners Tax Credit

The advantages of the Maryland Homeowners Tax Credit are multifaceted. Firstly, it provides immediate financial relief to homeowners, reducing the annual cost of homeownership. This can make a substantial difference in a homeowner’s budget, allowing them to allocate funds to other essential areas such as maintenance, upgrades, or even savings.

Secondly, the credit encourages long-term homeownership. By reducing the financial strain associated with property taxes, it creates a more stable and sustainable environment for homeowners. This stability can lead to increased investment in the property, community involvement, and overall satisfaction with homeownership.

Lastly, the credit can have a positive impact on the local economy. When homeowners have more disposable income, they are more likely to spend locally, boosting business activity and potentially creating new job opportunities. This ripple effect can contribute to the overall growth and prosperity of Maryland's communities.

Eligibility Criteria

To be eligible for the Maryland Homeowners Tax Credit, homeowners must meet specific criteria. The credit is primarily designed for homeowners with limited incomes, ensuring that those who need it the most can access this financial benefit.

The income threshold for eligibility varies depending on the county or municipality. Generally, homeowners must have an annual income that falls below a certain limit, which is adjusted annually to account for inflation and cost of living increases. This income limit is set by the Maryland Department of Assessments and Taxation and is based on household size and location.

Additionally, the homeowner must occupy the property as their primary residence. Rental properties or second homes are typically not eligible for this credit. The property must also be located in Maryland and be subject to property taxes.

| County | Income Limit (Single Filers) | Income Limit (Married Filers) |

|---|---|---|

| Baltimore City | $45,000 | $60,000 |

| Montgomery County | $120,000 | $150,000 |

| Howard County | $80,000 | $100,000 |

| Anne Arundel County | $75,000 | $100,000 |

| Frederick County | $70,000 | $90,000 |

Application Process

Applying for the Maryland Homeowners Tax Credit is a straightforward process, designed to be accessible to all eligible homeowners. The application typically opens during the tax filing season and remains open for a specified period.

Step-by-Step Guide

- Obtain the Application: Homeowners can access the application form online through the Maryland Department of Assessments and Taxation’s website. The form is usually available in both electronic and printable formats, allowing for flexibility in the application process.

- Gather Required Documents: To complete the application, homeowners will need to provide documentation supporting their income and residency status. This may include recent tax returns, pay stubs, or other income verification documents. Additionally, a copy of the property tax bill and proof of residency may be required.

- Complete the Application: The application form will require homeowners to provide their personal and property details, including the assessed value of the property, household income, and any applicable deductions or credits. It is essential to ensure accuracy and completeness in filling out the form.

- Submit the Application: Once the application is completed, homeowners can submit it electronically or by mail, depending on their preference. It is advisable to keep a copy of the submitted application for future reference.

- Await Processing: After submitting the application, homeowners will need to allow sufficient time for processing. The Maryland Department of Assessments and Taxation will review the application and determine eligibility. Homeowners can typically expect a response within a few weeks to a couple of months, depending on the volume of applications.

- Receive Notification: If the application is approved, homeowners will receive a notification letter or email confirming their eligibility and the amount of the tax credit. This credit can then be applied against their state income tax liability, reducing the amount they owe.

Tips for a Successful Application

- Stay organized: Keep all relevant documents and information readily available to streamline the application process.

- Read the instructions carefully: Pay close attention to the application guidelines and ensure you understand the requirements before starting the application.

- Provide accurate information: Inaccurate or incomplete information can lead to delays or even disqualification. Double-check your application for errors before submitting.

- Seek assistance if needed: If you have any questions or concerns during the application process, don’t hesitate to reach out to the Maryland Department of Assessments and Taxation for clarification or support.

Impact and Future Outlook

The Maryland Homeowners Tax Credit has had a significant impact on the lives of thousands of homeowners across the state. By reducing the financial burden of property taxes, it has enabled homeowners to maintain their properties, invest in their communities, and plan for the future with greater financial stability.

Looking ahead, the future of the Homeowners Tax Credit appears promising. With the continued support of the Maryland government and the positive impact it has on residents' lives, it is likely that this credit will remain a crucial component of the state's tax system. As the program evolves, it may see further enhancements and adjustments to better meet the needs of Maryland's diverse homeowner population.

Additionally, the success of the Homeowners Tax Credit may inspire other states to implement similar initiatives, creating a broader network of support for homeowners nationwide. This could lead to a more widespread recognition of the importance of tax relief in promoting stable and prosperous communities.

Potential Enhancements

While the Maryland Homeowners Tax Credit is already a valuable program, there are opportunities for improvement and expansion. Here are some potential enhancements that could further strengthen the program:

- Adjusting Income Limits: Regularly reviewing and adjusting income limits based on economic conditions and cost of living can ensure that the credit remains accessible to those who need it the most. This adjustment could be done annually or biennially to keep pace with changing financial landscapes.

- Expanding Eligibility Criteria: Considering additional factors such as property value, age of the homeowner, or special circumstances could broaden the reach of the credit. For example, offering higher credits for older homeowners or those with disabilities could provide targeted support to vulnerable populations.

- Enhancing Outreach and Education: Increasing awareness about the Homeowners Tax Credit through targeted marketing and educational campaigns can ensure that eligible homeowners are aware of the program and understand the application process. This could include partnerships with local community organizations, financial institutions, and real estate professionals.

- Streamlining the Application Process: Simplifying the application form and providing clear instructions can make it more accessible to homeowners, especially those who may have limited digital literacy or language barriers. Offering multiple language versions of the application and providing support hotlines can further enhance accessibility.

- Integrating with Other Assistance Programs: Collaborating with other state and local initiatives, such as first-time homebuyer programs or energy efficiency incentives, could create a comprehensive package of benefits for homeowners. This integration could provide additional financial support and encourage homeowners to take advantage of multiple programs.

Conclusion

The Maryland Homeowners Tax Credit is a powerful initiative that demonstrates the state’s commitment to its residents. By providing financial relief to homeowners, it not only reduces the burden of property taxes but also encourages long-term homeownership and contributes to the overall well-being of communities. With its wide-ranging benefits and accessible application process, this credit is a valuable asset for homeowners across Maryland.

Frequently Asked Questions

What is the maximum amount of credit I can receive through the Maryland Homeowners Tax Credit program?

+The maximum credit amount varies based on factors such as county, income level, and property value. Generally, the credit is a percentage of the property’s assessed value, with caps in place to ensure fairness. It’s recommended to consult the official guidelines or contact the Maryland Department of Assessments and Taxation for precise information regarding your specific circumstances.

Can I apply for the Homeowners Tax Credit if I’ve already filed my state income tax return for the year?

+Yes, you can still apply for the Homeowners Tax Credit even if you’ve already filed your state income tax return. The credit is typically applied as an adjustment to your tax liability, so you can claim it during the current tax year or carry it forward to future years, depending on the specific circumstances.

Are there any penalties for not meeting the eligibility requirements for the Homeowners Tax Credit?

+No, there are no penalties for not meeting the eligibility requirements. The Homeowners Tax Credit is a voluntary program, and homeowners are not penalized for not applying or not meeting the criteria. However, it’s important to note that only eligible homeowners can receive the credit, so it’s beneficial to review the guidelines to understand your eligibility status.

Can I receive the Homeowners Tax Credit if I rent out a portion of my property?

+The eligibility for the Homeowners Tax Credit is typically based on the primary residency status of the homeowner. If a portion of the property is rented out, it may impact the eligibility for the credit. It’s advisable to consult the official guidelines or seek professional advice to determine the specific impact on your eligibility.

How often can I apply for the Maryland Homeowners Tax Credit?

+The Maryland Homeowners Tax Credit is an annual program, meaning you can apply for it every year as long as you meet the eligibility criteria. It’s important to note that the application period is typically time-bound, so be sure to apply within the designated timeframe to avoid missing out on the credit for the current tax year.