Polk Taxes Property Taxes

Welcome to our comprehensive guide on Polk County property taxes. As a trusted source of information, we aim to provide you with all the insights and details you need to navigate the world of property taxes in this region. Whether you're a homeowner, a prospective buyer, or simply curious about the tax landscape, this article will offer a deep dive into the subject.

Unraveling the Complexity of Polk County Property Taxes

Property taxes are an essential aspect of homeownership, and in Polk County, they play a significant role in the local economy. With a diverse range of properties and varying assessment methods, understanding the intricacies of these taxes is crucial. Let's explore the key aspects, rates, and factors that influence property tax obligations in this vibrant community.

The Fundamentals of Polk County Property Taxes

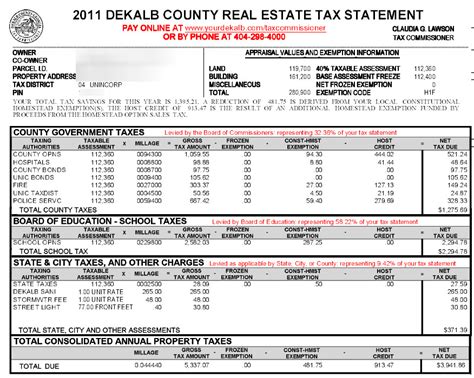

In Polk County, property taxes are levied based on the assessed value of a property. This value is determined by the Polk County Property Appraiser's Office, which conducts regular assessments to ensure fairness and accuracy. The process involves evaluating factors such as location, size, improvements, and market trends.

The assessed value is then multiplied by the millage rate, which is set by the local government and can vary depending on the type of property and its usage. Millage rates are expressed in mills, with one mill equating to $1 of tax for every $1,000 of assessed value. For instance, a millage rate of 10 mills would mean $10 in taxes for every $1,000 of assessed value.

| Property Type | 2023 Millage Rate |

|---|---|

| Homestead Properties | 9.3383 mills |

| Non-Homestead Properties | 10.2468 mills |

Understanding Assessment and Tax Calculations

The process of assessing a property's value involves a detailed examination by the county's appraisers. They consider various factors, including:

- Recent sales of similar properties in the area (known as comparable sales or comps).

- The property's improvement value, which includes any additions, renovations, or upgrades.

- Income potential for commercial properties, based on rental rates and occupancy.

- Land value, taking into account the property's size, location, and any unique features.

Once the assessed value is determined, it is multiplied by the applicable millage rate to calculate the property tax. For instance, a homestead property with an assessed value of $200,000 and a millage rate of 9.3383 mills would have a tax obligation of $1,867.66 (200,000 x 0.0093383). This calculation provides a clear understanding of the tax liability for property owners.

Homestead Exemptions: A Significant Tax Relief

One of the most notable features of Polk County's property tax system is the homestead exemption. This exemption is available to homeowners who make Polk County their permanent residence. By filing for the exemption, homeowners can significantly reduce the taxable value of their property, leading to lower tax obligations.

The homestead exemption is a crucial benefit for long-term residents, as it helps them manage their financial responsibilities. It is automatically renewed each year, providing stability and predictability in property tax assessments. This exemption is a key incentive for homeowners, encouraging them to establish roots and contribute to the local community.

| Homestead Exemption Details | Value |

|---|---|

| Maximum Exemption | $50,000 |

| Additional Senior Exemption | $25,000 for homeowners aged 65 and older |

Tax Relief Programs and Special Assessments

In addition to the homestead exemption, Polk County offers various tax relief programs to support specific groups of homeowners. These programs aim to provide assistance to those who may face financial challenges or have unique circumstances.

- Senior Citizen Exemption: As mentioned earlier, homeowners aged 65 and older are eligible for an additional $25,000 exemption on their homestead property.

- Disabled Veteran Exemption: Veterans with service-connected disabilities may qualify for a total exemption from property taxes on their homestead property.

- Low-Income Senior Exemption: Seniors with limited income may be eligible for a partial exemption, reducing their taxable value and, consequently, their tax obligations.

It's important to note that these exemptions and relief programs have specific eligibility criteria and may require additional documentation. Homeowners should consult the Polk County Property Appraiser's Office or their tax advisor to determine their eligibility and understand the application process.

Property Tax Payment Options and Deadlines

Polk County provides several convenient options for homeowners to pay their property taxes. The primary method is through the Polk County Tax Collector's Office, which accepts payments online, by mail, or in person. Homeowners can choose the method that suits their preferences and schedule.

The tax year in Polk County runs from January 1st to December 31st, and taxes are typically due in two installments. The first installment is due by March 31st, and the second installment is due by September 30th. Failure to pay by the due dates may result in penalties and interest, so it's crucial for homeowners to stay informed and plan their payments accordingly.

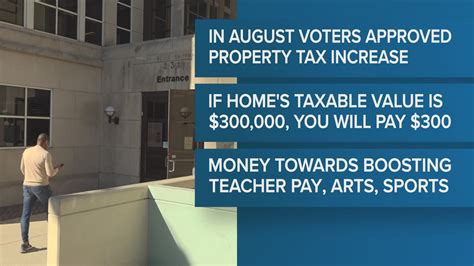

The Impact of Property Taxes on the Local Economy

Property taxes play a vital role in funding essential services and infrastructure in Polk County. The revenue generated from these taxes supports various sectors, including education, public safety, transportation, and healthcare. It ensures that the community receives the necessary resources to thrive and develop.

The tax system in Polk County is designed to be fair and equitable, with rates and assessments based on objective criteria. This approach promotes transparency and ensures that the burden of taxation is distributed fairly among property owners. It also encourages responsible property ownership and investment, benefiting the local economy in the long run.

Navigating the Property Tax Appeal Process

In some cases, homeowners may feel that their property's assessed value is inaccurate or unfair. Polk County provides a formal appeal process to address such concerns. Homeowners can file an appeal with the Value Adjustment Board (VAB), which is an independent body responsible for reviewing and making decisions on property tax disputes.

The appeal process involves submitting evidence and arguments to support the claim that the assessed value is incorrect. This may include comparable sales data, appraisals, or other relevant information. The VAB will carefully consider the evidence and make a decision, which can result in a reduction in the assessed value and, consequently, the property taxes owed.

Conclusion: A Comprehensive Understanding for Homeowners

Understanding the intricacies of Polk County property taxes is essential for homeowners and prospective buyers. By comprehending the assessment process, tax calculations, and available exemptions, individuals can make informed decisions and effectively manage their financial obligations.

This guide has provided a comprehensive overview of the property tax landscape in Polk County, offering valuable insights and practical information. We hope it empowers homeowners to navigate the system with confidence and make the most of the benefits and resources available to them.

How often are property assessments conducted in Polk County?

+Property assessments are conducted annually by the Polk County Property Appraiser’s Office. They aim to ensure that property values are up-to-date and reflect the current market conditions.

What happens if I miss the tax payment deadline?

+Missing the tax payment deadline can result in penalties and interest charges. It’s important to stay informed about the payment schedule and plan your finances accordingly to avoid additional costs.

Are there any online resources available for property tax information in Polk County?

+Yes, the Polk County Property Appraiser’s Office and the Tax Collector’s Office both have official websites with valuable resources and tools. These websites provide property search features, tax payment options, and detailed information about exemptions and relief programs.