How To Get Tax Return Transcript

Understanding your tax history and financial records is crucial for various reasons, whether you're planning your finances, applying for a loan, or simply keeping an eye on your tax records. One of the key documents that can provide valuable insights is the tax return transcript, which offers a detailed summary of your tax return as filed with the Internal Revenue Service (IRS). In this comprehensive guide, we'll delve into the process of obtaining your tax return transcript, covering everything from the different types of transcripts available to the various methods of retrieval and the importance of having access to this information.

The Importance of Tax Return Transcripts

Tax return transcripts are official records that summarize the key information from your tax return. They serve as a valuable resource for various purposes, including:

- Loan Applications: When applying for a mortgage or other loans, lenders often require proof of income and tax history. Tax return transcripts provide an accurate and official record of your tax filings, which can expedite the loan approval process.

- Financial Planning: Having access to your tax return transcripts allows you to review your financial history, identify trends, and make informed decisions about your future financial goals. It's an essential tool for budgeting and long-term financial planning.

- Tax Record Verification: If you need to verify your tax records with government agencies, educational institutions, or other organizations, tax return transcripts serve as an official source of information.

- Amending Returns: In case you need to make changes to a previously filed tax return, having the transcript can streamline the process, as it provides a detailed overview of the original filing.

Types of Tax Return Transcripts

The IRS offers several types of tax return transcripts, each serving a specific purpose. Understanding the differences between these transcripts is crucial to ensure you obtain the right information for your needs.

1. Tax Return Transcript

The Tax Return Transcript is the most comprehensive type, providing a line-by-line breakdown of your original tax return as filed. It includes all the information from your tax forms, such as Form 1040, schedules, and attachments. This transcript is especially useful for verifying your tax records and understanding the specific details of your tax filing.

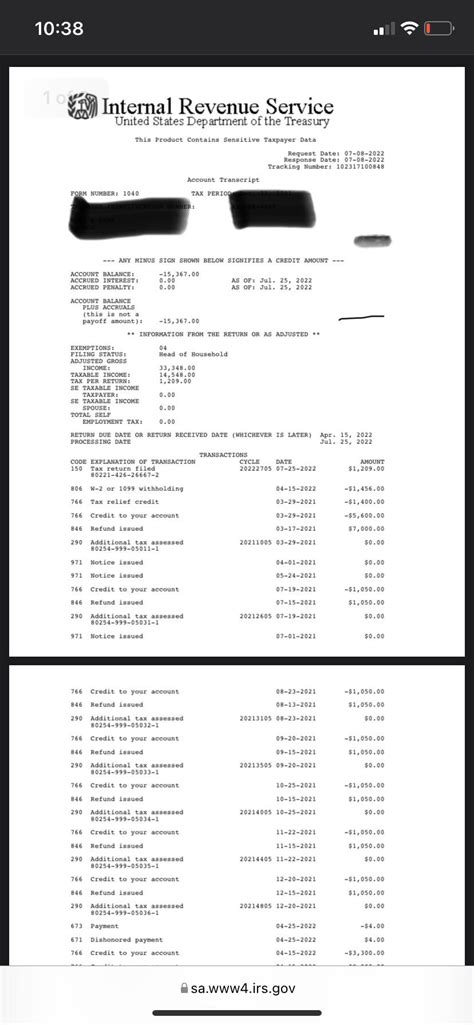

2. Tax Account Transcript

The Tax Account Transcript offers a broader overview of your tax account with the IRS. It includes information on tax returns filed, assessments, payments, and any applicable penalties or interest. This transcript is often used by lenders and other financial institutions to assess your overall tax compliance and financial stability.

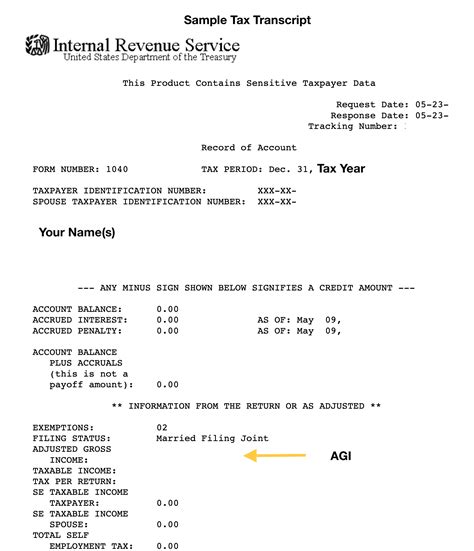

3. Record of Account Transcript

The Record of Account Transcript provides a detailed history of your tax account, including all transactions and adjustments made by the IRS. It’s particularly useful for understanding any changes made to your tax return after filing, such as refunds, adjustments, or tax payments.

4. Wage and Income Transcript

The Wage and Income Transcript focuses on the income information reported to the IRS by your employers and other payers. It includes Forms W-2, 1099, and other income-related documents. This transcript is often requested when verifying income for loan applications or other financial purposes.

| Transcript Type | Purpose |

|---|---|

| Tax Return Transcript | Verifying tax records, understanding tax filing details |

| Tax Account Transcript | Assessing tax compliance and financial stability |

| Record of Account Transcript | Reviewing tax account history and adjustments |

| Wage and Income Transcript | Verifying income for financial purposes |

Methods to Obtain Tax Return Transcripts

The IRS provides multiple methods to obtain your tax return transcripts, catering to different preferences and circumstances. Here’s a breakdown of the available options:

1. Online Retrieval through IRS.gov

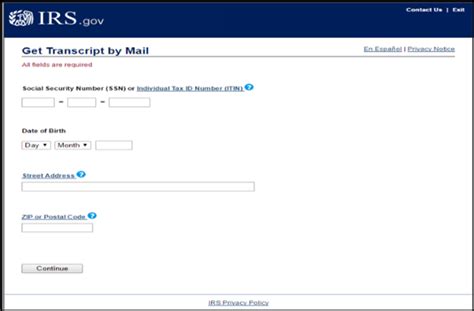

The most convenient and efficient way to obtain your tax return transcripts is through the official IRS website, IRS.gov. The IRS offers two online services for transcript retrieval:

- Get Transcript Online: This service allows you to access your tax return and record transcripts securely online. To use this service, you'll need to create an IRS Online Account, which involves a multi-step verification process to ensure the security of your information.

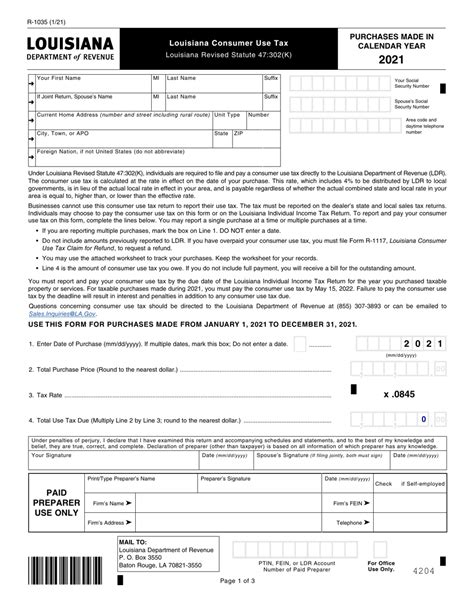

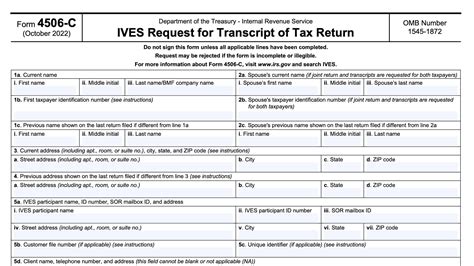

- Get Transcript by Mail: If you prefer not to create an online account, you can request your transcripts to be mailed to you. This service requires you to complete and submit Form 4506-T, "Request for Transcript of Tax Return", to the IRS. The form is available on the IRS website and can be submitted by mail or fax.

2. Phone Request

If you’re unable to access the online services or prefer a more traditional approach, you can request your tax return transcripts by phone. Call the IRS at 1-800-908-9946 and follow the prompts to speak with a representative. The IRS will verify your identity and then mail the transcripts to the address on file.

3. In-Person Request at a Local IRS Office

For those who prefer a face-to-face interaction, the IRS offers the option to request tax return transcripts in person at a local Taxpayer Assistance Center (TAC). You can find the nearest TAC using the IRS TAC locator. Bring a valid photo ID and any necessary documentation to verify your identity.

Understanding Your Transcript

Once you’ve obtained your tax return transcript, it’s important to understand how to read and interpret the information it contains. The format and content of the transcript may vary depending on the type you’ve requested, but here are some key components to look out for:

- Tax Form Information: The transcript will list the tax forms you filed, such as Form 1040, along with the corresponding schedules and attachments.

- Income and Deductions: It will include a breakdown of your income, deductions, and credits, similar to the information you provided on your original tax return.

- Tax Calculations: The transcript will show the calculations used to determine your tax liability, including any tax credits or adjustments.

- Payments and Refunds: You'll find a record of any tax payments you made and any refunds you received, along with the dates and amounts.

Future Implications and Planning

Having access to your tax return transcripts is not only beneficial for the present but also plays a significant role in future financial planning and decision-making. Here’s how your transcripts can impact your future:

1. Financial Planning and Budgeting

By reviewing your tax return transcripts, you can gain insights into your historical tax obligations and financial performance. This information can help you make informed decisions about your future financial goals, such as saving for retirement, investing, or planning for major expenses.

2. Tax Strategy and Compliance

Tax return transcripts provide a historical perspective on your tax filings. By analyzing past returns, you can identify trends, assess the effectiveness of your tax strategies, and make adjustments to optimize your tax liability in the future. Additionally, having accurate transcripts ensures you remain compliant with tax regulations.

3. Loan and Credit Applications

When applying for loans or credit, lenders often request tax return transcripts to verify your income and tax history. Having easy access to your transcripts can streamline the loan application process and increase your chances of approval. It demonstrates your financial responsibility and provides a clear picture of your financial standing.

FAQs

Can I request tax return transcripts for previous years?

+Yes, you can request tax return transcripts for previous tax years. The IRS typically retains tax records for a period of 10 years, so you can obtain transcripts for any year within this timeframe. However, it’s important to note that older transcripts may not be as detailed as more recent ones.

How long does it take to receive my tax return transcripts through the online or phone request methods?

+The processing time for online and phone requests can vary, but generally, you can expect to receive your tax return transcripts within 10 to 20 business days. However, during peak tax seasons, the processing time may be longer.

Are tax return transcripts free of charge?

+Yes, tax return transcripts are provided free of charge by the IRS. Whether you request them online, by phone, or in person, there is no cost associated with obtaining your transcripts.

Can I request tax return transcripts for someone else, such as a dependent or deceased family member?

+Requesting tax return transcripts for someone else requires specific authorization. If you’re requesting transcripts for a dependent, you’ll need to complete Form 8821, “Tax Information Authorization”, and provide the necessary documentation. For deceased individuals, you’ll need to provide a copy of the death certificate and other relevant information.

What if I encounter errors or discrepancies in my tax return transcript?

+If you notice errors or discrepancies in your tax return transcript, it’s important to address them promptly. Contact the IRS by phone or mail to report the issue. They will guide you through the process of correcting any errors and may require additional documentation to support your claim.

In conclusion, tax return transcripts are valuable tools for managing your finances, planning for the future, and demonstrating your tax compliance. Understanding the different types of transcripts, the methods to obtain them, and how to interpret their content is essential for anyone looking to take control of their financial well-being. By utilizing the resources provided by the IRS, you can access your tax return transcripts efficiently and securely, empowering you to make informed financial decisions.