Sales Tax In South Carolina On Cars

When purchasing a vehicle in South Carolina, it's essential to understand the sales tax implications. The sales tax on cars is a significant aspect of the transaction and can vary depending on various factors. This comprehensive guide will delve into the specifics of sales tax for car purchases in South Carolina, providing you with all the necessary information to navigate this process smoothly.

Understanding Sales Tax on Cars in South Carolina

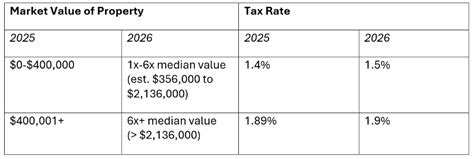

South Carolina imposes a state sales tax on the purchase of vehicles, and this tax is collected by the Department of Revenue (DOR). The tax is calculated as a percentage of the purchase price of the vehicle, and it is an important consideration for both buyers and sellers.

The state sales tax in South Carolina is currently set at 6% for most vehicle purchases. However, it's crucial to note that this tax rate can be influenced by several factors, which we will explore in detail.

Taxable Vehicle Types

The sales tax applies to various types of vehicles, including:

- New and used cars

- Trucks

- SUVs

- Motorcycles

- Recreational vehicles (RVs)

- Boat trailers

However, there are certain exceptions and exemptions, which we will discuss later in this article.

Tax Calculation

The sales tax is calculated based on the purchase price of the vehicle. This price includes not only the vehicle’s base cost but also any additional fees and charges, such as:

- Dealer preparation fees

- Destination charges

- Sales tax itself (in case of a vehicle being transferred from one state to another)

- Extended warranties

- Insurance premiums

It’s important to note that the sales tax is calculated on the total amount, including these additional fees.

Example Calculation

Let’s consider an example to illustrate how the sales tax is calculated. Suppose you are purchasing a used car with a total purchase price of $25,000, including all additional fees. The sales tax would be calculated as follows:

| Purchase Price | $25,000 |

|---|---|

| Sales Tax Rate | 6% |

| Sales Tax Amount | $1,500 |

Sales Tax Exemptions and Exceptions

While the 6% sales tax rate is standard for most vehicle purchases in South Carolina, there are certain situations where exemptions or reduced tax rates apply. Understanding these exemptions is crucial to ensure you pay the correct amount of sales tax.

Vehicle Types Exempt from Sales Tax

Certain types of vehicles are exempt from sales tax in South Carolina. These include:

- Vehicles for hire: Taxis, limousines, and other vehicles used for transportation services are exempt from sales tax.

- Certain farm vehicles: Agricultural equipment and vehicles used exclusively for farming purposes are exempt.

- Government-owned vehicles: Vehicles owned and operated by government agencies are not subject to sales tax.

- Diplomatic vehicles: Vehicles owned by foreign embassies or consulates are exempt.

Sales Tax Exemptions for Specific Buyers

In addition to vehicle type exemptions, certain buyers may also be exempt from paying sales tax on their vehicle purchases. These include:

- Disabled veterans: Veterans with a service-connected disability may be eligible for a sales tax exemption.

- Active-duty military personnel: Military members stationed in South Carolina may be exempt from sales tax on certain vehicle purchases.

- Charitable organizations: Non-profit organizations registered as charities may be exempt from sales tax on vehicle purchases.

Sales Tax on Out-of-State Purchases

If you purchase a vehicle out of state and bring it into South Carolina, you will likely be subject to a use tax, which is similar to sales tax. The use tax is calculated based on the purchase price of the vehicle and is due within a certain timeframe after the purchase.

Sales Tax Forms and Payment

When purchasing a vehicle in South Carolina, you will need to complete specific forms to pay the sales tax. These forms are typically provided by the dealer or seller and must be submitted to the Department of Revenue.

Form ST-3

Form ST-3 is the standard sales tax form used for vehicle purchases. It requires you to provide information about the vehicle, including the purchase price, make, model, and VIN (Vehicle Identification Number). You will also need to declare any applicable exemptions or deductions.

Form ST-3L

Form ST-3L is specifically for leased vehicles. If you are leasing a vehicle, you will need to complete this form to calculate and pay the sales tax on the lease.

Form ST-3R

Form ST-3R is for vehicles purchased out of state and brought into South Carolina. This form is used to calculate and pay the use tax on these vehicles.

Sales Tax Payment Options

You can pay the sales tax on your vehicle purchase using various methods, including:

- Credit card

- Check or money order

- Electronic funds transfer (EFT)

- Cash (in-person payments only)

Frequently Asked Questions (FAQ)

What happens if I don’t pay the sales tax on my vehicle purchase in South Carolina?

+Failure to pay the sales tax on your vehicle purchase can result in penalties and interest. The Department of Revenue may also place a hold on your vehicle registration until the tax is paid.

Can I deduct the sales tax on my vehicle purchase from my taxes?

+In some cases, you may be able to deduct the sales tax on your vehicle purchase as a business expense. Consult with a tax professional to determine if you are eligible for this deduction.

Are there any ways to reduce the sales tax I pay on my vehicle purchase in South Carolina?

+There are a few ways to potentially reduce your sales tax burden. These include taking advantage of any applicable exemptions, such as those for disabled veterans or active-duty military personnel. Additionally, some dealers may offer promotional discounts or incentives that can lower the purchase price and, consequently, the sales tax.

Conclusion

Understanding the sales tax on cars in South Carolina is crucial for any vehicle buyer or seller. By familiarizing yourself with the tax rates, exemptions, and payment processes, you can ensure a smooth and compliant transaction. Remember to consult with professionals, such as tax advisors or dealership staff, for specific guidance tailored to your situation.