City Of Boston Excise Tax

The City of Boston, known for its rich history and vibrant culture, has implemented an excise tax as a means to generate revenue and support various city services. This excise tax, which is applied to specific goods and services, has become a crucial component of Boston's fiscal framework. In this article, we delve into the intricacies of the City of Boston Excise Tax, exploring its history, structure, impact on businesses and residents, and its role in shaping the city's financial landscape.

A Historical Perspective on Excise Taxation in Boston

The origins of excise taxation in Boston can be traced back to the early 20th century when the city faced significant financial challenges. To address these issues and provide much-needed revenue for essential services, the city introduced an excise tax in the form of a personal property tax. This tax was initially levied on tangible personal property owned by individuals and businesses within the city limits.

Over the years, the excise tax in Boston has evolved to adapt to changing economic landscapes and the city's evolving needs. In its modern form, the excise tax encompasses a range of goods and services, including:

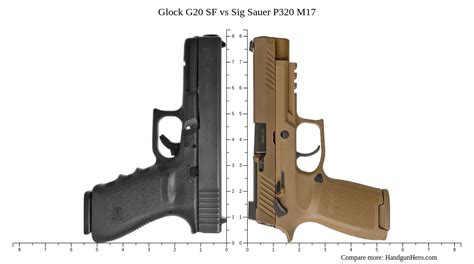

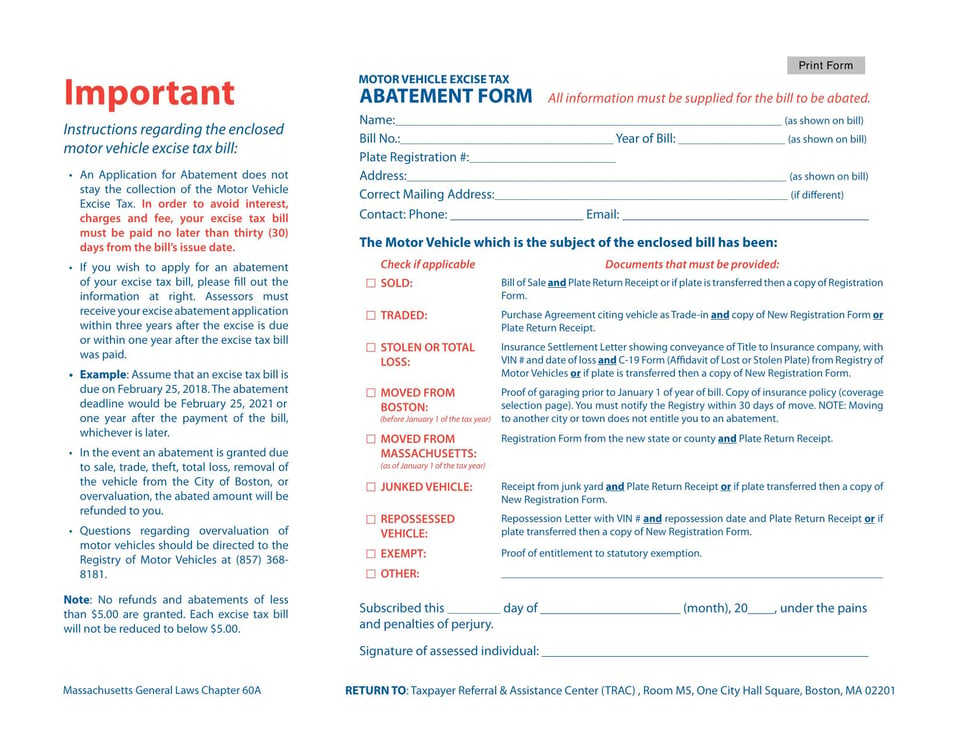

- Motor Vehicle Excise Tax: This tax is imposed on registered vehicles within the city, with rates varying based on the type of vehicle and its value.

- Meals and Entertainment Excise Tax: Restaurants, caterers, and other food establishments are subject to this tax, which is typically passed on to consumers as a percentage of the bill.

- Hotel and Lodging Excise Tax: A tax is applied to the rent or charges for accommodations provided by hotels, motels, and similar establishments.

- Personal Property Tax: While the focus has shifted, personal property tax still exists, targeting specific categories of tangible personal property.

The city's excise tax structure is designed to ensure a fair distribution of the tax burden among residents and businesses. It aims to strike a balance between generating sufficient revenue and maintaining a competitive business environment.

The Impact of Excise Taxation on Businesses and Residents

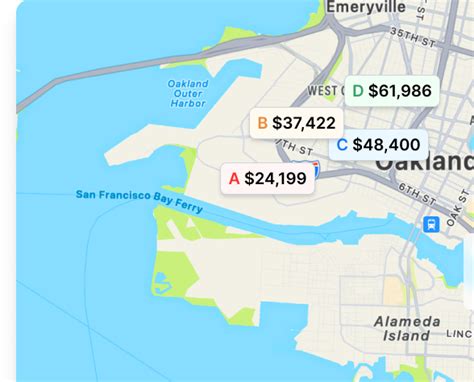

The City of Boston’s excise tax has a significant impact on both businesses and residents, influencing their financial decisions and daily lives. For businesses, the excise tax can be a substantial cost, particularly for those operating in industries subject to higher tax rates. This includes restaurants, hotels, and vehicle-related businesses.

To illustrate, consider the case of Smith's Restaurant, a popular eatery in downtown Boston. The excise tax on meals and entertainment adds a 7% surcharge to the total bill, which is then passed on to customers. While this tax contributes to the city's revenue, it also affects customer spending habits and may influence the restaurant's pricing strategies.

Residents, too, feel the impact of excise taxation. The motor vehicle excise tax, for instance, adds to the cost of owning and operating a vehicle in Boston. This tax, coupled with other vehicle-related expenses, can be a significant burden for commuters and car owners.

However, it is essential to recognize that excise taxes play a vital role in funding essential city services. These taxes contribute to the maintenance of roads, the provision of public transportation, and the support of social programs that benefit residents directly.

Excise Tax Administration and Compliance

The administration and compliance of the City of Boston’s excise tax are overseen by the Boston Tax Office, a dedicated department within the city government. This office is responsible for collecting and managing excise tax revenues, ensuring compliance with tax regulations, and providing support to taxpayers.

Businesses and individuals subject to excise taxation are required to register with the Boston Tax Office and obtain the necessary licenses and permits. Regular tax returns must be filed, and payments must be made by the designated due dates to avoid penalties and interest charges.

The Boston Tax Office offers resources and guidance to help taxpayers understand their excise tax obligations. This includes online portals for registration, tax payment, and accessing tax forms and publications. The office also provides assistance through dedicated customer service lines and in-person appointments at their offices located throughout the city.

To ensure compliance, the Boston Tax Office conducts audits and investigations to verify the accuracy of tax returns and identify potential instances of tax evasion. These efforts help maintain the integrity of the tax system and ensure that all taxpayers contribute their fair share to the city's revenue stream.

Excise Tax Exemptions and Incentives

Recognizing the potential impact of excise taxation on certain sectors and individuals, the City of Boston has implemented various exemptions and incentives to promote economic growth and support specific communities.

For instance, the city offers exemptions for certain types of organizations, such as non-profit entities and charitable organizations. These exemptions aim to encourage and support community initiatives and social programs that benefit Boston's residents.

Additionally, the city provides incentives for businesses operating in targeted industries or located in specific areas. These incentives may take the form of tax abatements, tax credits, or reduced tax rates to encourage economic development and job creation.

| Industry/Sector | Excise Tax Incentive |

|---|---|

| Green Technology | Reduced Tax Rates for Green Energy Businesses |

| Small Businesses | Tax Abatement Program for New Start-ups |

| Creative Industries | Tax Credits for Film and Media Productions |

These exemptions and incentives demonstrate the city's commitment to fostering a business-friendly environment while also promoting social and economic development.

Future Outlook and Implications

As Boston continues to evolve and adapt to changing economic conditions, the role of excise taxation is likely to remain a critical component of the city’s financial strategy. The city’s excise tax structure will need to strike a delicate balance between generating revenue and supporting economic growth, especially in the post-pandemic era.

Looking ahead, the city may explore innovative approaches to excise taxation, such as implementing a tourism tax to fund cultural initiatives or leveraging technology to streamline tax administration and compliance processes. Additionally, ongoing efforts to promote economic equality and support underserved communities may influence the design and implementation of future excise tax policies.

Conclusion

The City of Boston’s excise tax is a complex yet crucial aspect of the city’s fiscal framework. From its historical origins to its modern-day applications, the excise tax has evolved to meet the changing needs of the city and its residents. While it presents challenges for businesses and individuals, it also plays a vital role in funding essential services and contributing to Boston’s economic vitality.

As Boston continues to thrive and adapt, the excise tax will remain a key element in shaping the city's future, ensuring its financial sustainability, and supporting the diverse needs of its vibrant community.

FAQ

How often do businesses need to file excise tax returns in Boston?

+Businesses in Boston are typically required to file excise tax returns on a quarterly basis. However, the specific filing frequency may vary depending on the type of business and the excise taxes they are subject to. It is essential for businesses to consult the Boston Tax Office’s guidelines and resources to ensure compliance with the appropriate filing requirements.

Are there any tax incentives for renewable energy projects in Boston?

+Yes, Boston recognizes the importance of promoting renewable energy and offers tax incentives to support such initiatives. Businesses engaged in green energy projects may be eligible for reduced tax rates or tax credits. The city’s Office of Environment, Energy, and Open Space provides information on these incentives and can guide businesses through the application process.

How can residents stay informed about changes to excise taxation in Boston?

+Residents can stay updated on excise tax changes and developments by regularly visiting the Boston Tax Office’s website. The office provides important tax-related announcements, updates on new tax laws and regulations, and information on any upcoming changes that may impact residents’ tax obligations. Additionally, residents can subscribe to the city’s official newsletters and follow relevant social media accounts to receive timely updates.