Dekalb County Property Taxes

DeKalb County, located in the heart of Georgia, is a vibrant community known for its diverse neighborhoods, thriving businesses, and rich cultural heritage. One aspect that significantly impacts the lives of residents and property owners in this county is the property tax system. Understanding how DeKalb County property taxes work, including their calculation, assessment, and payment, is essential for homeowners and investors alike.

The DeKalb County Property Tax System

DeKalb County's property tax system is a vital revenue source for the local government, funding various essential services such as education, public safety, infrastructure development, and community programs. The tax revenue collected plays a crucial role in maintaining the county's infrastructure, supporting its schools, and ensuring the overall well-being of its residents.

The property tax system in DeKalb County operates under a comprehensive framework, considering several factors to determine the tax liability for each property owner. These factors include the assessed value of the property, the applicable tax rate, and any exemptions or deductions that may apply. Let's delve deeper into each of these components to gain a clearer understanding.

Property Assessment in DeKalb County

The process of property assessment is a fundamental step in determining the tax liability for a property. In DeKalb County, the DeKalb County Board of Tax Assessors is responsible for assessing the value of all taxable properties within the county. This assessment takes into account various factors, including the property's location, size, age, condition, and recent sales data of comparable properties.

The Board of Tax Assessors aims to ensure that property assessments are fair and accurate. They conduct regular evaluations, considering market trends and changes in property values to maintain a consistent and equitable tax system. Property owners have the right to review their assessment notices and can appeal if they believe the assessed value is inaccurate.

Once the property assessment is complete, the Board of Tax Assessors provides property owners with a notice of assessment, which includes the estimated fair market value of the property and any applicable exemptions or deductions.

| Assessment Category | Description |

|---|---|

| Fair Market Value | The estimated value of a property based on market conditions and comparable sales. |

| Homestead Exemption | A deduction granted to primary homeowners to reduce their taxable property value. |

| Senior Citizen Exemption | A deduction available to senior citizens who meet certain age and income criteria. |

| Veteran Exemption | Certain properties owned by veterans may qualify for a partial or full exemption. |

It's important to note that the assessed value of a property may differ from its appraised value or the price it could fetch on the open market. The assessment is specifically for tax purposes and may not reflect the property's full market value.

Tax Rate Determination

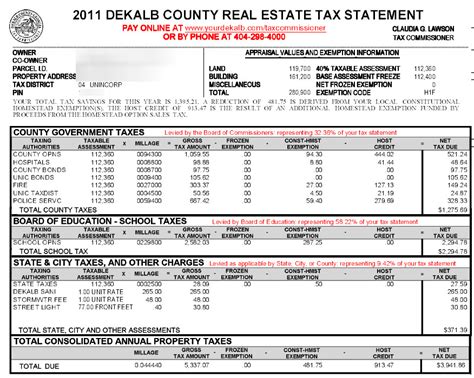

After the property assessment is finalized, the next step is to determine the applicable tax rate. In DeKalb County, the tax rate is set by the DeKalb County Board of Commissioners, who consider the county's budgetary needs, revenue requirements, and the impact on taxpayers. The tax rate is expressed as "mills," with one mill representing $1 of tax for every $1,000 of assessed property value.

The tax rate can vary across different areas within DeKalb County due to factors such as local school districts, municipalities, and special taxing districts. These entities have the authority to set their own tax rates, which are then added to the county's base tax rate to determine the total tax liability for a property.

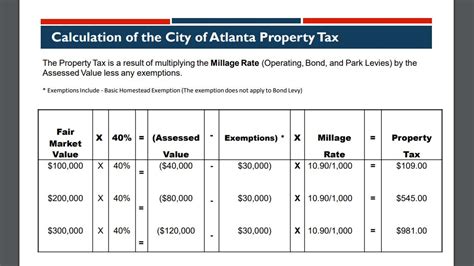

Calculating Property Taxes

The calculation of DeKalb County property taxes involves multiplying the assessed value of the property by the applicable tax rate. Here's a simplified formula to understand the process:

Property Taxes = (Assessed Value of Property) x (Tax Rate)

For example, if a property has an assessed value of $200,000 and the applicable tax rate is 10 mills, the property taxes would be calculated as follows:

Property Taxes = $200,000 x 0.01 (10 mills) = $2,000

It's worth mentioning that DeKalb County offers a variety of payment options for property taxes, including online payment portals, mail-in payments, and in-person payments at designated locations. Property owners should refer to the official DeKalb County tax website or contact the DeKalb County Tax Commissioner's Office for detailed information on payment methods and deadlines.

Exemptions and Deductions

DeKalb County offers several exemptions and deductions to eligible property owners, which can help reduce their tax liability. Some of the common exemptions and deductions available include:

- Homestead Exemption: This exemption is available to primary homeowners and reduces the taxable value of their property. The exemption amount varies based on the homeowner's age and income.

- Senior Citizen Exemption: Senior citizens who are at least 65 years old and meet certain income requirements may qualify for a partial or full exemption on their property taxes.

- Veteran Exemption: Properties owned by honorably discharged veterans may be eligible for a partial or full exemption, depending on the veteran's disability status and other criteria.

- Disabled Veteran Exemption: Certain disabled veterans may qualify for a full exemption on their property taxes.

- Conservation Use Exemption: Property owners who use their land for agricultural or conservation purposes may be eligible for a reduced tax assessment.

It's essential to note that exemptions and deductions have specific eligibility criteria, and property owners should carefully review the requirements to determine their eligibility. Additionally, it's advisable to consult with a tax professional or contact the DeKalb County Tax Commissioner's Office for guidance on applying for these benefits.

Appealing Property Assessments

If a property owner believes that their property assessment is inaccurate or unfair, they have the right to appeal the decision. The appeal process in DeKalb County involves several steps, including submitting an appeal application, providing supporting documentation, and potentially attending a hearing before the DeKalb County Board of Equalization.

The Board of Equalization is an independent body responsible for reviewing and making decisions on property assessment appeals. Property owners should carefully follow the appeal process guidelines and provide evidence to support their case. It's recommended to seek professional advice or representation during the appeal process to increase the chances of a successful outcome.

Property Tax Abatements and Incentives

DeKalb County offers various property tax abatements and incentives to encourage economic development, attract businesses, and stimulate investment. These abatements and incentives are typically granted on a case-by-case basis and may vary depending on the specific project and its impact on the community.

Some common types of property tax abatements and incentives include:

- Industrial Property Tax Abatement: Certain industrial properties may be eligible for a reduced tax assessment or a partial tax exemption to promote economic growth and job creation.

- Brownfield Tax Incentives: Properties with environmental contamination issues may qualify for tax incentives to encourage their redevelopment and revitalization.

- Historic Preservation Tax Credits: Owners of historic properties may be eligible for tax credits to support the preservation and restoration of these significant buildings.

- Enterprise Zone Tax Abatements: Designated enterprise zones within DeKalb County may offer tax abatements to businesses operating within these zones, encouraging economic activity and job opportunities.

Property owners and businesses interested in exploring these abatements and incentives should consult with the DeKalb County Development Authority or the DeKalb County Tax Commissioner's Office to understand the eligibility criteria and application process.

Property Tax Delinquency and Penalties

Property owners who fail to pay their taxes by the due date may face delinquency penalties and interest charges. DeKalb County has a strict policy regarding delinquent taxes, and property owners should take their tax obligations seriously to avoid financial penalties and potential legal consequences.

If a property owner fails to pay their taxes, the county may initiate collection actions, including the imposition of late fees, interest charges, and, in severe cases, the sale of the property at a tax sale. It's crucial for property owners to stay informed about their tax obligations and make timely payments to avoid these penalties.

Future Outlook and Developments

DeKalb County's property tax system is subject to ongoing evaluation and potential reforms to ensure fairness, efficiency, and transparency. The county's leadership and tax authorities continuously monitor market trends, assess property values, and adjust tax rates to maintain a sustainable revenue stream while supporting the community's needs.

In recent years, there have been discussions and initiatives aimed at improving the property tax system's equity and transparency. These efforts include proposals to streamline the assessment process, enhance communication with property owners, and explore alternatives to the current tax structure. The county's leadership is committed to finding solutions that benefit both taxpayers and the community as a whole.

As DeKalb County continues to grow and evolve, its property tax system will likely undergo further adjustments to adapt to changing economic conditions, demographic shifts, and community expectations. Staying informed about these developments and engaging with local government officials can help property owners understand the future implications of property taxes in the county.

Frequently Asked Questions

How can I estimate my DeKalb County property taxes before receiving the official assessment notice?

+You can estimate your DeKalb County property taxes by multiplying the assessed value of your property by the applicable tax rate. You can find the assessed value on your most recent tax assessment notice, and the tax rate is typically published by the DeKalb County Board of Commissioners. This estimation provides a rough idea of your tax liability before the official assessment is finalized.

What happens if I disagree with my property assessment in DeKalb County?

+If you believe your property assessment is inaccurate, you have the right to appeal. The appeal process involves submitting an appeal application to the DeKalb County Board of Equalization, providing supporting documentation, and potentially attending a hearing. It's advisable to consult with a tax professional or seek legal advice to increase the chances of a successful appeal.

Are there any property tax exemptions or deductions available in DeKalb County, and how do I apply for them?

+Yes, DeKalb County offers various exemptions and deductions, including the Homestead Exemption, Senior Citizen Exemption, Veteran Exemption, and more. To apply for these benefits, you typically need to complete an application form and provide supporting documentation. The DeKalb County Tax Commissioner's Office can provide guidance on the specific requirements and application process for each exemption or deduction.

How can I pay my DeKalb County property taxes, and what are the available payment options?

+DeKalb County offers several payment options for property taxes, including online payment portals, mail-in payments, and in-person payments at designated locations. The official DeKalb County tax website provides detailed information on each payment method, including instructions and deadlines. It's important to ensure timely payment to avoid penalties and interest charges.

What happens if I fail to pay my DeKalb County property taxes by the due date?

+Failure to pay your DeKalb County property taxes by the due date can result in delinquency penalties, interest charges, and potential legal consequences. The county may initiate collection actions, including the sale of your property at a tax sale. It's crucial to stay informed about your tax obligations and make timely payments to avoid these penalties.

Understanding the DeKalb County property tax system is crucial for property owners and investors to navigate their tax obligations effectively. By staying informed about assessment processes, tax rates, exemptions, and payment options, individuals can make informed decisions regarding their property taxes. Additionally, staying engaged with local government initiatives and proposed reforms can help residents actively participate in shaping the future of DeKalb County’s property tax system.