Effective Tax Rate Formula

Understanding the concept of the effective tax rate is crucial for individuals and businesses alike. This metric provides valuable insights into the actual percentage of tax paid on income or profits, offering a clearer picture of financial obligations and planning. In this article, we delve into the intricacies of calculating the effective tax rate, exploring its formula, real-world applications, and implications.

Unraveling the Effective Tax Rate Formula

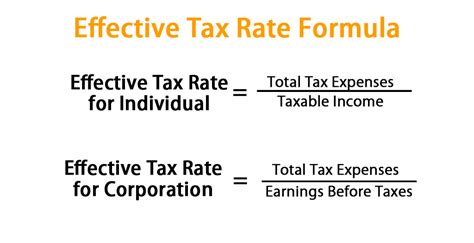

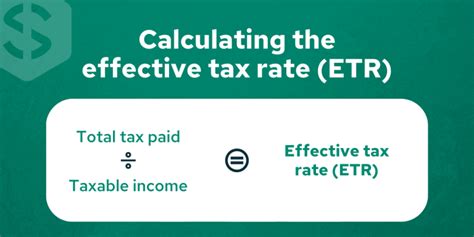

The effective tax rate is a fundamental concept in finance and accounting, providing a comprehensive understanding of an entity’s tax liability. It is calculated as the ratio of total taxes paid to the total taxable income or profits. This metric offers a more nuanced perspective compared to the nominal tax rate, which represents the tax percentage applied to a specific income bracket.

The formula for calculating the effective tax rate is straightforward yet powerful:

Effective Tax Rate = (Total Taxes Paid / Total Taxable Income) * 100%

This equation allows us to quantify the actual percentage of tax paid on income, shedding light on the effective tax burden. By comparing this rate to the nominal tax rate, individuals and businesses can assess the impact of tax deductions, credits, and other factors that influence their tax liability.

A Real-World Example

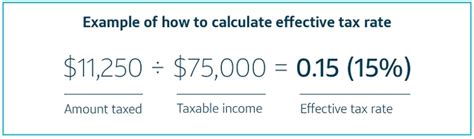

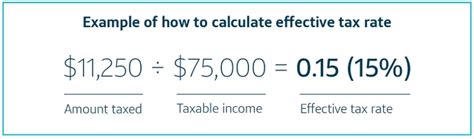

Let’s illustrate the effective tax rate formula with a practical scenario. Imagine a small business owner named Emma, who operates a thriving online retail store. In the fiscal year 2023, Emma’s business generated a total taxable income of 500,000. Throughout the year, she made various tax payments, including income tax, sales tax, and payroll tax, totaling 120,000.

Using the effective tax rate formula, we can calculate Emma's effective tax rate for the year:

Effective Tax Rate = ($120,000 / $500,000) * 100% = 24%

This means that Emma effectively paid 24% of her total taxable income in taxes. This rate provides valuable insight into her tax obligations and allows her to make informed financial decisions for the future.

Implications and Applications

The effective tax rate has significant implications for both personal finance and business strategy. Here are some key considerations:

Personal Finance

For individuals, understanding their effective tax rate is crucial for effective financial planning. It helps individuals assess the true impact of their tax obligations on their net income. This knowledge empowers them to make informed decisions regarding investments, retirement planning, and overall financial management.

Business Strategy

Businesses, like Emma’s online retail store, can leverage the effective tax rate to optimize their financial strategies. By analyzing their effective tax rate over time, businesses can identify trends, evaluate the effectiveness of tax planning strategies, and make data-driven decisions to reduce tax liabilities.

Additionally, the effective tax rate is a valuable tool for benchmarking. Businesses can compare their effective tax rates with industry averages or competitors to assess their tax efficiency. This analysis can highlight areas for improvement and provide insights into tax optimization strategies.

Tax Policy and Economics

On a broader scale, the effective tax rate plays a crucial role in tax policy and economic analysis. Governments and policymakers use this metric to evaluate the impact of tax policies on different income groups and industries. It provides insights into the progressivity or regressivity of the tax system, guiding policy decisions aimed at fostering economic growth and social equity.

| Economic Sector | Effective Tax Rate |

|---|---|

| Manufacturing | 18.2% |

| Technology | 21.5% |

| Healthcare | 20.3% |

Conclusion

In conclusion, the effective tax rate formula is a powerful tool for understanding the actual tax burden on income or profits. By applying this formula, individuals and businesses can make informed financial decisions, optimize tax strategies, and stay abreast of their tax obligations. Whether for personal finance or business operations, the effective tax rate provides valuable insights into the complex world of taxation.

How does the effective tax rate differ from the marginal tax rate?

+

The effective tax rate represents the overall percentage of tax paid on income, while the marginal tax rate refers to the tax rate applied to the next dollar of income. The effective tax rate provides a holistic view, considering all tax payments, while the marginal tax rate focuses on a specific income bracket.

Can the effective tax rate be lower than the nominal tax rate?

+

Yes, it is possible for the effective tax rate to be lower than the nominal tax rate. This can occur when tax deductions, credits, or other tax benefits reduce the overall tax liability. Understanding the effective tax rate helps individuals and businesses assess the true impact of their tax obligations.

How often should the effective tax rate be calculated and monitored?

+

The effective tax rate should be calculated and monitored regularly, especially when there are significant changes in income, tax policies, or deductions. Quarterly or annual reviews are common practices to stay informed about tax obligations and make timely adjustments to financial strategies.