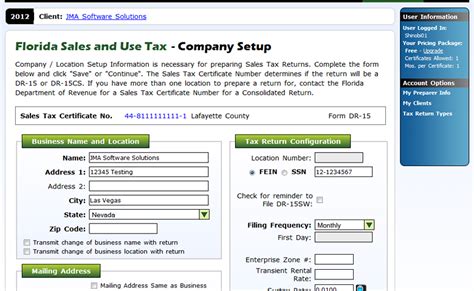

What Is Florida's Sales Tax

Welcome to the sunshine state, Florida, where sunshine and tax considerations go hand in hand. Florida's sales tax is an essential aspect of its economy and a key factor for residents and businesses alike. In this article, we'll delve into the specifics of Florida's sales tax, exploring its rates, exemptions, and unique characteristics.

Unraveling Florida’s Sales Tax Structure

Florida’s sales tax, also known as the Florida State Sales and Use Tax, is a consumption tax imposed on the sale of tangible personal property and certain services within the state. It plays a vital role in funding various state programs and initiatives.

The Basic Rate: A Foundation for Understanding

At its core, Florida’s sales tax rate is set at 6% for most transactions. This base rate applies uniformly across the state, ensuring consistency for businesses and consumers alike. However, it’s important to note that this is just the starting point; additional taxes and surcharges may apply, depending on the specific location and the nature of the transaction.

Digging Deeper: County and Municipal Taxes

Beyond the state’s 6% sales tax, counties and municipalities in Florida have the authority to levy their own taxes. These local option taxes are commonly referred to as discretionary sales surtaxes. The rates for these surtaxes vary from one county to another, adding an extra layer of complexity to the state’s sales tax landscape.

For instance, in Orange County, where the city of Orlando is located, there's an additional 1.5% surtax, bringing the total sales tax rate to 7.5%. In Miami-Dade County, the surtax stands at 1%, resulting in a total sales tax rate of 7%. These variations highlight the diverse tax structures across Florida's counties.

A Table for Clarity: County-Specific Sales Tax Rates

| County | State Sales Tax Rate | Local Surtax Rate | Total Sales Tax Rate |

|---|---|---|---|

| Orange County | 6% | 1.5% | 7.5% |

| Miami-Dade County | 6% | 1% | 7% |

| Hillsborough County | 6% | 1% | 7% |

| Pinellas County | 6% | 1.5% | 7.5% |

| Palm Beach County | 6% | 1.5% | 7.5% |

Exemptions: Understanding What’s Off the Table

While Florida’s sales tax applies to a wide range of goods and services, there are notable exemptions. These exemptions are designed to reduce the tax burden on specific items or sectors. Here are some key exemptions to consider:

- Groceries: Florida offers a partial exemption for groceries, with a maximum tax of 5</strong> on sales over <strong>2,500. This provision aims to make essential food items more affordable for residents.

- Prescription Drugs: Sales of prescription drugs are exempt from sales tax in Florida. This exemption is a welcome relief for those requiring essential medications.

- Residential Rent: Rent for residential properties is generally not taxable in Florida. However, it’s worth noting that commercial rents are subject to sales tax.

- Aircraft and Boats: Sales of aircraft and boats are taxable in Florida, but there are specific exemptions and reduced rates for certain transactions. These exemptions cater to the state’s thriving aviation and marine industries.

Special Considerations: Tourist Development Taxes

Florida’s tourism industry is a significant contributor to its economy, and to support this sector, certain counties levy an additional tax known as the Tourist Development Tax or Resort Tax. This tax is applied to rentals of lodging accommodations, such as hotel rooms, condominiums, and vacation rentals.

The rates for these taxes vary, typically ranging from 1% to 6%, and the proceeds are often used to fund tourism-related initiatives, such as beach restoration, marketing campaigns, and the development of tourist attractions. It's important for travelers to be aware of these additional taxes when planning their visits to Florida.

Online Sales and Florida’s Tax Presence

In the digital age, online sales have become a significant aspect of retail. Florida’s sales tax extends to online transactions as well, with a concept known as tax nexus. This means that online retailers with a physical presence in Florida, such as warehouses or distribution centers, are required to collect and remit sales tax on transactions with Florida customers.

For online retailers without a physical presence in Florida, the rules can be more complex. The state's economic nexus provisions come into play, requiring retailers to collect sales tax if their sales exceed certain thresholds. These thresholds vary based on the type of product and the location of the customer, making it crucial for online businesses to understand their obligations.

Performance Analysis: Florida’s Sales Tax in Action

Florida’s sales tax system has a significant impact on the state’s economy and its residents. Let’s explore some real-world examples to understand its implications.

The Impact on Local Businesses

For local businesses in Florida, the sales tax structure can be a double-edged sword. On one hand, it provides a stable source of revenue for the state and local governments, which can be reinvested into the community through infrastructure development, education, and public services. This benefits businesses by creating a more attractive environment for customers and employees.

However, the varying tax rates across counties can create complexities for businesses operating in multiple locations. They must navigate different tax rates and compliance requirements, which can be time-consuming and resource-intensive. Additionally, businesses may need to adjust their pricing strategies to remain competitive while accounting for the sales tax burden.

Consumer Perspective: Impact on Purchasing Decisions

From a consumer’s perspective, Florida’s sales tax can influence purchasing decisions. While the base rate of 6% may seem relatively low compared to some other states, the addition of local surtaxes can result in a higher overall tax burden. This is especially noticeable in counties with higher surtax rates, such as Orange County (7.5%) and Miami-Dade County (7%).

Consumers often factor in the total cost, including sales tax, when making purchasing decisions. For example, a consumer in Miami-Dade County may opt to shop online or in neighboring counties with lower tax rates to save on their purchases. This behavior can impact local businesses and their bottom line.

Tourism and the Resort Tax

The Tourist Development Tax, often referred to as the Resort Tax, has a unique impact on Florida’s tourism industry. This tax, levied on lodging accommodations, contributes to the state’s tourism infrastructure and marketing efforts. It ensures that visitors help fund the very attractions and amenities that make Florida a desirable destination.

However, it's essential for travelers to be aware of these taxes when planning their trips. While the rates vary, they can add a significant amount to the overall cost of accommodations. Travelers may need to budget accordingly or consider alternative lodging options to manage their expenses.

Future Implications and Potential Changes

Florida’s sales tax landscape is subject to ongoing discussions and potential reforms. As the state’s economy evolves, so too may its tax structure. Here are some key considerations for the future:

Simplification Efforts

One potential area of focus is simplifying the sales tax system. The varying tax rates across counties can create confusion for businesses and consumers alike. Streamlining the tax structure, perhaps by reducing or standardizing local surtaxes, could make compliance and budgeting more manageable.

Tax Reform Initiatives

Florida has a history of tax reform initiatives, and sales tax is often a key component. These initiatives aim to strike a balance between generating sufficient revenue for the state and reducing the tax burden on residents and businesses. Future reforms may explore options like reducing the base rate, adjusting exemptions, or implementing new tax structures.

E-Commerce and Remote Sellers

The rise of e-commerce and remote sellers presents a unique challenge for Florida’s sales tax system. As online shopping continues to grow, ensuring fair tax collection from out-of-state sellers becomes increasingly important. Florida may need to adapt its tax laws to keep pace with the evolving e-commerce landscape.

The Role of Tourism

Florida’s tourism industry is a powerhouse, and the state may explore ways to further support and promote this sector. This could involve adjustments to the Tourist Development Tax or the exploration of new funding mechanisms to enhance the visitor experience and sustain the industry’s growth.

Frequently Asked Questions

What is the current sales tax rate in Florida for most transactions?

+

The base sales tax rate in Florida is 6% for most transactions. However, counties and municipalities may add local surtaxes, resulting in varying total tax rates across the state.

Are there any notable exemptions from Florida’s sales tax?

+

Yes, Florida offers exemptions for groceries, prescription drugs, residential rent, and certain aircraft and boat sales. These exemptions aim to reduce the tax burden on essential items and specific industries.

How does Florida’s sales tax impact online retailers and consumers?

+

Online retailers with a physical presence in Florida must collect and remit sales tax. For those without a physical presence, economic nexus rules apply, requiring tax collection if sales exceed certain thresholds. Consumers should consider the total cost, including sales tax, when making online purchases.

What is the Tourist Development Tax, and how does it affect travelers to Florida?

+

The Tourist Development Tax, or Resort Tax, is an additional tax levied on lodging accommodations in certain counties. It funds tourism-related initiatives. Travelers should be aware of these taxes when budgeting for their trips, as they can add a significant cost to accommodations.

Are there any potential changes or reforms to Florida’s sales tax system on the horizon?

+

Florida may explore sales tax reforms in the future, aiming for simplification, tax burden reduction, and adjustments to support the state’s evolving economy and industries, including tourism and e-commerce.

Florida’s sales tax is a dynamic and evolving component of its economy. As the state continues to thrive and adapt, its tax structure will likely follow suit, ensuring a balanced approach to funding essential services while supporting the growth and prosperity of its residents and businesses.