Fresno County Property Taxes

Welcome to an in-depth exploration of property taxes in Fresno County, California. As one of the largest agricultural counties in the nation, Fresno's diverse landscape, ranging from fertile farmlands to bustling urban centers, presents a unique dynamic for property owners and investors. This guide aims to unravel the complexities of property taxation in this region, offering a comprehensive understanding of the process, rates, and potential benefits.

Understanding Property Tax Essentials in Fresno County

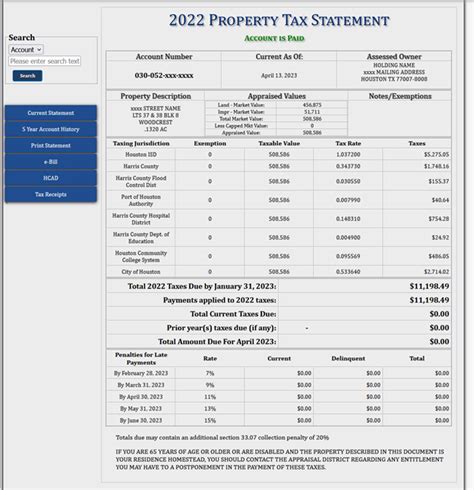

Property taxes are a vital source of revenue for local governments, including Fresno County, funding essential services like schools, emergency services, and infrastructure development. The tax rate is determined by a combination of factors, including the property’s assessed value and the applicable tax rate within the specific district or city.

In Fresno County, property owners are subject to an annual tax, typically due in two installments. The tax year follows a fiscal calendar, with assessments made based on the property's value as of January 1st. This value is then multiplied by the applicable tax rate to determine the owner's liability for the year.

Property Tax Rates in Fresno County

The tax rate in Fresno County varies depending on the specific city or district. For instance, the City of Fresno itself has a slightly higher rate compared to unincorporated areas of the county. Additionally, special assessment districts, such as those for mosquito abatement or fire protection, can further impact the overall tax rate.

| Area | Tax Rate |

|---|---|

| City of Fresno | 1.2285% |

| Unincorporated Fresno County | 1.1485% |

| Clovis | 1.1475% |

| Sanger | 1.2485% |

Property Assessment and Valuation

The assessment process in Fresno County is conducted by the Fresno County Assessor’s Office. This office is responsible for determining the fair market value of each property, which forms the basis for tax calculations. The assessed value can change due to various factors, including property improvements, market fluctuations, or reassessments triggered by specific events like a change of ownership.

For instance, let's consider a residential property in Clovis, which has seen a recent boom in real estate values. The owner, Ms. Johnson, purchased her home in 2018 for $300,000. In 2023, due to the thriving market, the Assessor's Office reassessed the property, increasing its value to $420,000. This new value will impact Ms. Johnson's tax liability for the upcoming year.

Property Tax Benefits and Exemptions in Fresno County

Fresno County offers a range of property tax benefits and exemptions designed to support specific groups of property owners and promote certain types of development. These incentives can significantly reduce the tax burden for eligible individuals and entities.

Homeowner’s Property Tax Exemption

The Homeowner’s Property Tax Exemption is a key benefit for owner-occupants in Fresno County. This exemption reduces the assessed value of a primary residence by up to $7,000, directly lowering the property tax liability. To qualify, the property must be the owner’s principal dwelling, and they must apply with the Assessor’s Office.

Mr. Lee, a homeowner in the City of Fresno, successfully applied for this exemption. His property, assessed at $250,000, now has a reduced assessed value of $243,000 ($250,000 - $7,000), leading to a substantial tax savings of approximately $700 per year.

Senior Citizen’s Property Tax Postponement

For senior citizens aged 62 or older, Fresno County provides a Property Tax Postponement program. This program allows eligible seniors to defer the payment of their property taxes until a later date, typically when they sell the property or pass away. This benefit can provide significant financial relief for seniors on fixed incomes.

Veteran’s Property Tax Exemption

Fresno County honors its veterans with a Veteran’s Property Tax Exemption. Qualified veterans can receive a property tax exemption of up to $400,000 on their primary residence. This exemption is a testament to the county’s gratitude for the service and sacrifice of its veterans.

Lt. Col. Davis, a retired veteran living in Sanger, has benefited from this exemption. His property, valued at $600,000, now has an assessed value of $200,000 for tax purposes, resulting in substantial annual savings on his property taxes.

Property Tax Appeals in Fresno County

Property owners in Fresno County have the right to appeal their assessed value if they believe it is inaccurate or unfair. The appeal process is managed by the Fresno County Assessment Appeals Board, an independent body that reviews and decides on these matters.

Common Reasons for Appeals

- Disagreement with the property’s assessed value

- Inaccurate property characteristics recorded by the Assessor’s Office

- Significant changes in the property’s condition or use

- Inequities compared to similar properties in the area

The Appeal Process

- File an Appeal: Property owners must submit a formal appeal application within specific deadlines, typically between July 2nd and November 30th of the assessment year.

- Provide Evidence: Supporting documentation, such as recent sales data of comparable properties or expert appraisals, is essential to substantiate the appeal.

- Hearing: If the appeal is accepted, a hearing will be scheduled. The owner or their representative can present their case before the Assessment Appeals Board.

- Decision: The Board will render a decision, which can either uphold the original assessment or adjust it based on the evidence provided.

Conclusion: Navigating Fresno County’s Property Tax Landscape

Understanding the intricacies of property taxes in Fresno County is crucial for property owners and investors. From the initial assessment to potential appeals and exemptions, each step in the process can significantly impact a property’s financial liability. By staying informed and engaged, property owners can ensure they are paying their fair share and taking advantage of the benefits and exemptions they are entitled to.

What is the deadline for paying property taxes in Fresno County?

+

The first installment is due on November 1st, while the second installment is due on February 1st of the following year. Late payments incur penalties and additional fees.

How often are property assessments conducted in Fresno County?

+

Fresno County conducts annual assessments. However, certain events, like a change of ownership or new construction, can trigger a reassessment outside of the annual cycle.

Are there any online resources to estimate property taxes in Fresno County?

+

Yes, the Fresno County Tax Collector’s Office provides an online tax estimator tool. This tool allows property owners to input their property’s assessed value and view an estimate of their annual tax liability.

Can I appeal my property taxes if I disagree with the assessment?

+

Absolutely. Fresno County offers a formal appeals process managed by the Assessment Appeals Board. Property owners can file an appeal if they believe their assessment is inaccurate or unfair.

Are there any exemptions or reductions available for low-income homeowners in Fresno County?

+

Yes, Fresno County offers the Homeowner’s Property Tax Exemption and the Senior Citizen’s Property Tax Postponement program, which can provide significant tax relief for eligible homeowners.