Is A New Roof Tax Deductible

When it comes to home improvements and tax deductions, the question of whether a new roof is tax-deductible is a common concern for homeowners. The answer, however, is not a straightforward yes or no. The tax-deductibility of a new roof depends on various factors, including the nature of the roof replacement, the purpose of the improvement, and the taxpayer's individual circumstances. In this comprehensive guide, we will delve into the intricacies of this topic, providing an in-depth analysis to help you understand the tax implications of a new roof.

Understanding Tax Deductions for Home Improvements

Before we dive into the specifics of roof replacements, it’s essential to grasp the concept of tax deductions for home improvements. Tax deductions can reduce your taxable income, potentially resulting in a lower tax liability. The Internal Revenue Service (IRS) recognizes certain home improvement expenses as deductible, but the rules and regulations can be complex.

The IRS categorizes home improvements into two main types: repairs and improvements. Repairs are generally immediate and necessary fixes to maintain or restore the functionality of your home. On the other hand, improvements are enhancements that add value, prolong the life of your property, or adapt it to new uses.

Repairs vs. Improvements: A Crucial Distinction

Understanding the distinction between repairs and improvements is crucial when it comes to tax deductions. Repairs are typically deductible in the year they are incurred, provided they are ordinary and necessary. Ordinary repairs are those that are common and accepted in the trade, while necessary repairs are those that are appropriate to maintain or restore the property to a sound condition.

For example, fixing a leaky roof to prevent further damage is considered an ordinary and necessary repair. The cost of such a repair is generally deductible in the year it is incurred, as long as it meets the IRS criteria.

Improvements and Their Tax Treatment

Improvements, on the other hand, are not immediately deductible. The IRS considers improvements as capital expenditures, which means they are investments in your property that increase its value or useful life. The cost of improvements is typically recovered over time through depreciation or added to the basis of your property.

Depreciation is a method of allocating the cost of the improvement over the expected useful life of the asset. For residential rental properties, the Modified Accelerated Cost Recovery System (MACRS) is often used to calculate depreciation. However, for a primary residence, depreciation is not allowed, so the cost of improvements is added to the basis of the property.

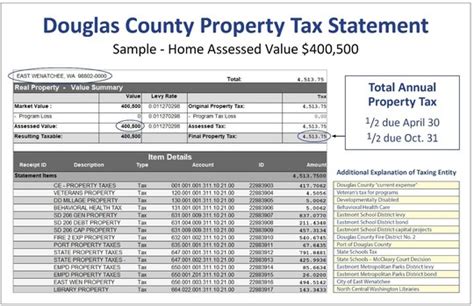

| Improvement Type | Tax Treatment |

|---|---|

| Repairs | Generally deductible in the year incurred |

| Improvements | Capitalized and recovered through depreciation or added to property basis |

Is a New Roof Considered a Repair or an Improvement?

Now, let’s address the central question: is a new roof a repair or an improvement? The answer lies in the circumstances surrounding the roof replacement.

Roof Replacement as a Repair

In some cases, a new roof can be considered a repair. This typically applies when the existing roof is damaged beyond repair due to natural causes, such as a severe storm or a fallen tree. If the roof’s condition is a result of sudden and unexpected damage, the replacement can be treated as a repair and potentially deducted in the year it is incurred.

For instance, if a hailstorm causes extensive damage to your roof, and you need to replace it to prevent further damage to your home, the IRS may allow you to deduct the cost of the new roof as a repair expense.

Roof Replacement as an Improvement

On the other hand, if the new roof is installed as an upgrade or to extend the life of the existing roof, it is more likely to be considered an improvement. This is especially true if the new roof is significantly better in quality or durability than the original roof.

For example, if you replace your old asphalt shingle roof with a metal roof that has a much longer lifespan, the IRS may view this as an improvement. In such cases, the cost of the new roof would not be deductible as a repair but could be recovered through depreciation or added to the basis of your property.

Tax Deductions for Energy-Efficient Roofs

One specific aspect to consider is the potential tax benefits of energy-efficient roof replacements. The IRS offers tax incentives for certain energy-efficient home improvements, including roofs.

Residential Energy Efficient Property Credit

The Residential Energy Efficient Property Credit (Section 25D of the IRS code) provides a tax credit for various energy-efficient improvements, including qualified roofing materials. This credit allows taxpayers to claim a portion of the cost of the improvement as a credit against their tax liability.

To qualify for this credit, the roofing materials must meet specific energy efficiency standards set by the IRS. These standards typically involve the use of reflective materials that reduce heat absorption, resulting in lower cooling costs during hot summer months.

| Roofing Material | Energy Efficiency Standard |

|---|---|

| Metal Roof | Minimum solar reflectance of 0.65 |

| Asphalt Shingles | Minimum solar reflectance of 0.25 and thermal emittance of 0.90 |

Claiming Tax Deductions for a New Roof

If you believe that your new roof qualifies as a repair or an energy-efficient improvement, you’ll need to properly document and claim the deduction on your tax return.

Documentation Requirements

To support your claim for a tax deduction, you should gather the following documentation:

- Receipts or invoices for the roof replacement, including the date of installation and the total cost.

- Photographic evidence of the damaged roof (if applicable) to demonstrate the necessity of the repair.

- Contractor’s license and insurance information.

- Manufacturer’s specifications and warranty information for energy-efficient roofing materials.

Claiming on Your Tax Return

When it comes to claiming the deduction, the process can vary depending on whether you’re claiming a repair or an improvement.

For a repair, you would typically claim the expense on Schedule A (Form 1040) as a miscellaneous itemized deduction, subject to the 2% of Adjusted Gross Income (AGI) floor. However, due to the Tax Cuts and Jobs Act of 2017, many miscellaneous itemized deductions are no longer deductible for tax years 2018 through 2025.

For an improvement, the cost would be added to the basis of your property. This increase in basis can impact the amount of gain or loss when you eventually sell your home. Consult with a tax professional to ensure you correctly calculate and report the adjusted basis.

Conclusion

Determining whether a new roof is tax-deductible is a nuanced process that depends on various factors. Understanding the distinction between repairs and improvements, as well as the tax treatment of each, is crucial. Additionally, exploring the potential tax benefits of energy-efficient roof replacements can further enhance your tax savings.

As with any tax-related matter, it's essential to consult with a qualified tax professional or accountant who can provide personalized advice based on your specific circumstances. They can guide you through the complexities of tax deductions and ensure you maximize your savings while remaining compliant with IRS regulations.

Frequently Asked Questions

Can I deduct the cost of a new roof if it was damaged by a natural disaster?

+Yes, if your roof was damaged by a natural disaster, such as a hurricane or tornado, and the replacement is necessary to restore your home to its pre-disaster condition, the cost of the new roof can be treated as a repair and potentially deducted in the year it is incurred.

What if I replace my old roof with a higher-quality roof to improve my home’s value?

+In this case, the IRS is likely to view the new roof as an improvement rather than a repair. Improvements are not immediately deductible, but the cost can be recovered through depreciation or added to the basis of your property.

Are there any tax incentives for installing energy-efficient roofs?

+Yes, the IRS offers tax credits for energy-efficient home improvements, including qualified roofing materials. The Residential Energy Efficient Property Credit allows taxpayers to claim a portion of the cost as a credit against their tax liability. Ensure your roofing materials meet the necessary energy efficiency standards.

How do I claim the tax deduction for a new roof on my tax return?

+The process depends on whether the new roof is considered a repair or an improvement. For a repair, you would typically claim it on Schedule A as a miscellaneous itemized deduction. For an improvement, the cost is added to the basis of your property. Consult a tax professional for specific guidance.