How Are Annuities Taxed

Annuities are financial instruments that offer a steady stream of income over a specified period or for life. They are commonly used as a retirement planning tool, providing a guaranteed income for retirees. However, the taxation of annuities can be a complex topic, and understanding how they are taxed is crucial for individuals planning their retirement finances.

In this comprehensive guide, we will delve into the world of annuity taxation, exploring the various aspects that impact the tax treatment of these financial products. From the different types of annuities to the tax implications during accumulation and payout phases, we will provide a detailed analysis to help you navigate the complexities of annuity taxation effectively.

Understanding Annuities and Their Tax Treatment

Annuities are contracts between an individual and an insurance company, where the insurer agrees to make regular payments to the annuitant in exchange for an initial investment. These payments can be made immediately (immediate annuities) or after a deferred period (deferred annuities). The tax treatment of annuities depends on various factors, including the type of annuity, the tax status of the investor, and the phase of the annuity contract.

Types of Annuities and Their Tax Implications

There are two primary types of annuities: qualified annuities and non-qualified annuities. The tax treatment of these annuities differs significantly.

Qualified Annuities

Qualified annuities, also known as tax-deferred annuities, are funded with pre-tax dollars, often through an employer-sponsored retirement plan like a 401(k) or IRA. These annuities enjoy tax-deferred growth during the accumulation phase, meaning the earnings on the investment are not taxed until they are withdrawn. When withdrawals are made, the entire amount, including the principal and earnings, is taxed as ordinary income.

Non-Qualified Annuities

Non-qualified annuities, on the other hand, are funded with after-tax dollars. This means that the investor has already paid taxes on the money used to purchase the annuity. As a result, the growth on these annuities is tax-free, and only the earnings portion of the withdrawal is taxed as ordinary income.

Taxation During the Accumulation Phase

The accumulation phase refers to the period when the annuity is being funded and grows. During this phase, the tax treatment differs based on the type of annuity.

For qualified annuities, there is no tax liability during the accumulation phase. The contributions and earnings grow tax-free until the annuitant starts receiving payments. This tax deferral allows the annuity to grow more rapidly compared to taxable investments.

Non-qualified annuities, however, are taxed differently. Since the contributions are made with after-tax dollars, the earnings on these annuities are tax-free. The insurer keeps track of the original investment (known as the cost basis) and the earnings. When a withdrawal is made, the portion of the withdrawal that exceeds the cost basis is considered a taxable gain and is subject to ordinary income tax rates.

Taxation During the Payout Phase

The payout phase begins when the annuitant starts receiving regular payments from the annuity. The tax treatment during this phase also depends on the type of annuity.

Qualified annuities: When payments begin, the entire amount received is taxed as ordinary income. This includes both the return of the principal and the earnings. The tax liability can be significant, especially if the annuity has grown substantially over time.

Non-qualified annuities: During the payout phase, only the earnings portion of the withdrawal is taxed as ordinary income. The principal amount is not taxed, as it has already been taxed when the annuity was funded. This tax treatment allows for a more favorable tax outcome compared to qualified annuities.

Tax-Deferred Growth and Annuity Taxation

One of the primary advantages of annuities is their ability to offer tax-deferred growth during the accumulation phase. This means that the earnings on the investment are not taxed until they are withdrawn, allowing the annuity to grow more rapidly compared to taxable investments.

For qualified annuities, the tax-deferred growth is a significant benefit, as it allows individuals to maximize their retirement savings. The tax deferral provides the potential for substantial growth, especially when the annuity is held for an extended period.

However, it's important to note that tax-deferred growth comes with a trade-off. When withdrawals are made from qualified annuities, the entire amount is taxed as ordinary income. This can result in a higher tax liability, especially for individuals in higher tax brackets.

Tax Diversification Strategies

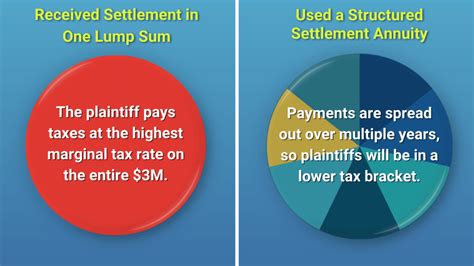

To mitigate the potential tax burden during the payout phase, individuals can employ tax diversification strategies. This involves holding a mix of qualified and non-qualified annuities, as well as other tax-advantaged retirement accounts.

By diversifying their retirement portfolio, individuals can take advantage of the tax-deferred growth of qualified annuities while also benefiting from the tax-free earnings of non-qualified annuities. This approach allows for more control over the tax liability during the payout phase, as individuals can choose which annuity to withdraw from based on their tax situation.

Annuity Taxation and Retirement Planning

Annuities play a crucial role in retirement planning, offering a guaranteed income stream for retirees. However, the tax implications of annuities should be carefully considered when designing a retirement strategy.

For individuals seeking a stable income in retirement, annuities can be an attractive option. The guaranteed payments provide a level of financial security, especially for those concerned about outliving their savings. However, the tax treatment of annuities, particularly during the payout phase, should be taken into account when deciding on the appropriate annuity structure.

Maximizing Tax Efficiency

To maximize tax efficiency, individuals can explore various annuity structures and tax strategies. This may include choosing between immediate and deferred annuities, as well as considering the tax implications of different payout options, such as lifetime income or fixed-term payments.

Additionally, individuals can work with financial advisors to optimize their annuity holdings and retirement portfolio. By carefully managing the tax implications, individuals can ensure that their retirement income is not significantly impacted by taxes, allowing them to enjoy a comfortable retirement.

Annuity Taxation: A Case Study

To illustrate the tax implications of annuities, let’s consider a case study involving two individuals, John and Emily, who are both planning for retirement.

John, a high-income earner, decides to invest in a qualified annuity during his working years. He contributes a significant amount to his annuity, taking advantage of the tax-deferred growth. When he retires, he begins receiving payments from his annuity, which are taxed as ordinary income. Due to his high tax bracket, John faces a substantial tax liability on his annuity withdrawals.

On the other hand, Emily, a moderate-income earner, opts for a mix of qualified and non-qualified annuities. She contributes to her qualified annuity during her working years, but also invests in a non-qualified annuity with after-tax dollars. When she retires, she strategically withdraws from her non-qualified annuity first, taking advantage of the tax-free earnings. This allows her to minimize her tax liability and maximize her retirement income.

Key Takeaways from the Case Study

The case study highlights the importance of considering tax implications when planning for retirement with annuities. John’s decision to solely rely on a qualified annuity resulted in a higher tax liability during his retirement, while Emily’s tax diversification strategy allowed her to manage her tax burden more effectively.

By understanding the tax treatment of different annuity types and employing tax-efficient strategies, individuals can make informed decisions to optimize their retirement income and minimize tax liabilities.

Conclusion

Annuities are powerful financial tools for retirement planning, offering a guaranteed income stream and tax-advantaged growth. However, the taxation of annuities is a complex topic that requires careful consideration. By understanding the tax implications during the accumulation and payout phases, individuals can make informed decisions to maximize their retirement savings and minimize tax liabilities.

As with any financial decision, seeking professional advice is crucial when navigating the world of annuity taxation. Working with a qualified financial advisor can help individuals tailor their annuity holdings to their specific financial goals and tax situation, ensuring a secure and comfortable retirement.

How do taxes affect the value of an annuity?

+The tax treatment of annuities can significantly impact their value. For qualified annuities, the tax deferral during the accumulation phase allows for more rapid growth, but the entire amount, including earnings, is taxed as ordinary income during the payout phase. Non-qualified annuities, on the other hand, offer tax-free earnings during the accumulation phase, resulting in a more favorable tax outcome during the payout phase.

Are there any tax benefits to purchasing an annuity?

+Yes, annuities offer several tax benefits. The tax-deferred growth of qualified annuities allows for more substantial savings during the accumulation phase. Additionally, non-qualified annuities provide tax-free earnings, which can be a significant advantage during the payout phase, especially for individuals with moderate to low incomes.

What are the tax implications of annuitizing an IRA?

+When an IRA is annuitized, it becomes a qualified annuity, and the tax treatment is similar to any other qualified annuity. This means that the entire amount received during the payout phase is taxed as ordinary income, including both the principal and earnings.

Can I minimize taxes on my annuity withdrawals?

+Yes, there are strategies to minimize taxes on annuity withdrawals. By diversifying your retirement portfolio with a mix of qualified and non-qualified annuities, you can control the tax implications. Withdrawing from non-qualified annuities first can help reduce your tax liability, as only the earnings portion is taxed.

Are there any tax penalties for early withdrawals from an annuity?

+Early withdrawals from an annuity may be subject to tax penalties, depending on the type of annuity and the age of the annuitant. Qualified annuities, for example, may have early withdrawal penalties if funds are withdrawn before age 59 ½. It’s important to consult with a tax professional to understand the potential penalties associated with early withdrawals.