Waukesha Tax Listing

Welcome to this in-depth exploration of the Waukesha Tax Listing, a comprehensive guide to understanding the tax landscape within the vibrant city of Waukesha. As an expert in the field, I aim to provide a detailed and insightful analysis, offering a unique perspective on this essential aspect of local governance and its implications for residents and businesses alike.

Understanding the Waukesha Tax Listing

The Waukesha Tax Listing is an annual record of property assessments and corresponding tax liabilities for residents and property owners within the city limits of Waukesha. This listing plays a pivotal role in the city’s fiscal management, serving as a foundation for the determination of property taxes, which are a significant source of revenue for the municipality.

The process of creating the Waukesha Tax Listing involves meticulous evaluation of each property's value, taking into account factors such as location, size, improvements, and market trends. This assessment process ensures fairness and accuracy in tax distribution, allowing the city to allocate resources effectively and maintain essential services for its residents.

Key Components of the Tax Listing

The Waukesha Tax Listing is a detailed document, providing an array of information that is crucial for both property owners and the city’s financial planning.

- Property Assessments: The listing provides an assessment of each property's value, offering a transparent view of the city's property market.

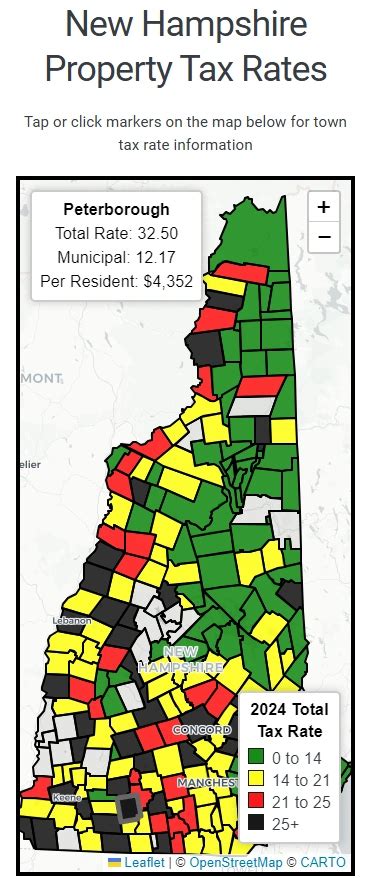

- Tax Rates: It includes the current tax rates, which are determined by the city's financial needs and budgetary requirements.

- Tax Due Dates: Property owners can find the deadlines for tax payments, ensuring they stay compliant with the city's regulations.

- Exemptions and Credits: The listing also outlines any applicable exemptions or credits, such as those for senior citizens or veterans, offering financial relief to eligible property owners.

| Assessment Category | Description |

|---|---|

| Residential Properties | Includes single-family homes, apartments, and condominiums. |

| Commercial Properties | Encompasses offices, retail spaces, and industrial facilities. |

| Agricultural Lands | Covers farmlands and rural properties. |

| Vacant Lots | Includes unimproved land parcels. |

The Impact of Waukesha’s Tax Structure

The Waukesha Tax Listing has a profound influence on the city’s economic health and the well-being of its residents. It directly affects property values, investment opportunities, and the overall fiscal stability of the city.

Economic Growth and Development

A well-structured tax system, as exemplified by the Waukesha Tax Listing, can stimulate economic growth. By encouraging investment through fair and competitive tax rates, the city attracts businesses and developers, leading to job creation and an improved standard of living for residents.

For instance, the city's tax policies have facilitated the development of Waukesha's vibrant downtown area, with new commercial spaces and residential units attracting both visitors and long-term residents. This growth has been a direct result of the city's commitment to a balanced tax approach.

Equitable Tax Distribution

The Waukesha Tax Listing ensures that the tax burden is distributed fairly among property owners. This equity is critical for maintaining social cohesion and preventing the over-taxation of certain segments of the population. The city’s assessment process considers various factors, ensuring that each property’s value is accurately reflected in its tax liability.

Financial Planning for Residents

For individual property owners, the Waukesha Tax Listing provides a clear roadmap for financial planning. Knowing their tax obligations in advance allows residents to budget effectively, plan for necessary improvements, and take advantage of any available tax credits or exemptions.

Additionally, the listing offers transparency, empowering residents to understand how their tax dollars are being utilized by the city. This transparency fosters trust and engagement between the municipality and its citizens, leading to a more collaborative approach to local governance.

Navigating the Waukesha Tax Listing: A Step-by-Step Guide

Understanding and utilizing the Waukesha Tax Listing can be a valuable tool for property owners and prospective buyers. Here’s a step-by-step guide to help you navigate this essential document.

Step 1: Accessing the Tax Listing

The Waukesha Tax Listing is typically available online through the city’s official website. It is often organized by street address or property ID, making it easy to locate your specific property’s information.

Alternatively, physical copies of the listing are available at the Waukesha City Hall, where staff can assist you in finding the relevant details. This option is particularly useful for those who prefer a more hands-on approach or need assistance understanding the data.

Step 2: Understanding Your Property’s Assessment

Once you’ve located your property on the listing, focus on the assessment section. This will provide you with the following crucial information:

- Assessed Value: The estimated value of your property as determined by the city's assessors.

- Taxable Value: The value upon which your property taxes are calculated. This may differ from the assessed value due to various factors, including tax exemptions or limits.

- Tax Rate: The current tax rate applicable to your property. This rate is applied to the taxable value to determine your annual tax liability.

Step 3: Calculating Your Tax Liability

With the assessed and taxable values, as well as the tax rate, you can calculate your estimated tax liability for the year. This calculation is a straightforward multiplication of the taxable value by the tax rate.

For example, if your taxable value is $200,000 and the tax rate is 1.5%, your estimated tax liability would be $3,000 for the year. This calculation provides a clear understanding of your financial obligation to the city.

Step 4: Exploring Tax Relief Options

The Waukesha Tax Listing also outlines any tax relief programs or exemptions you may be eligible for. These can include:

- Homestead Credit: A credit available to homeowners who use their property as their primary residence.

- Senior Citizen Exemption: An exemption for property owners aged 65 or older, reducing their taxable value.

- Veteran's Exemption: An exemption offered to honorably discharged veterans, reducing their property tax liability.

By understanding these options, you can take advantage of any applicable benefits, reducing your tax burden and improving your financial position.

Conclusion: Waukesha’s Commitment to Transparency

The Waukesha Tax Listing stands as a testament to the city’s commitment to transparency and fiscal responsibility. By providing residents and businesses with clear and accessible information about their tax obligations, the city fosters trust and engagement with its citizens.

As we've explored, the tax listing is more than just a record of assessments and tax rates. It is a tool for economic growth, equitable tax distribution, and financial planning. Understanding and utilizing this resource empowers residents to make informed decisions about their properties and their role in the city's financial landscape.

For further insights into Waukesha's tax structure and its impact on the community, stay tuned for future articles. We will continue to delve into the complexities of local governance and its implications for the vibrant city of Waukesha.

How often is the Waukesha Tax Listing updated?

+The Waukesha Tax Listing is typically updated annually, reflecting the city’s current fiscal year. This ensures that property owners have access to the most up-to-date information regarding their tax obligations.

Can I dispute my property’s assessment in the Waukesha Tax Listing?

+Yes, if you believe your property’s assessment is inaccurate, you have the right to appeal. The process typically involves submitting documentation and attending a hearing to present your case. It’s advisable to consult with a tax professional or the city’s assessment office for guidance.

What happens if I don’t pay my property taxes as listed in the Waukesha Tax Listing?

+Unpaid property taxes can lead to significant penalties and interest charges. In extreme cases, the city may place a lien on your property or even initiate foreclosure proceedings. It’s crucial to stay current with your tax payments to avoid these consequences.