Optima Tax Relief Portal

Welcome to the comprehensive guide to the Optima Tax Relief Portal, a cutting-edge platform designed to revolutionize the way taxpayers manage their tax relief processes. In an era where technology is transforming every aspect of our lives, the Optima Tax Relief Portal stands out as a beacon of efficiency and accessibility in the complex world of tax resolution.

With an ever-increasing number of taxpayers seeking assistance with their tax debts, the need for a streamlined, user-friendly solution has never been more apparent. The Optima Tax Relief Portal steps up to this challenge, offering a digital haven where taxpayers can navigate the intricate path to tax relief with ease and confidence.

The Evolution of Tax Relief: Introducing Optima’s Portal

In the landscape of tax relief, where traditional methods often involve lengthy paperwork, endless phone calls, and complicated processes, Optima Tax Relief has emerged as a trailblazer. Recognizing the power of technology to simplify and enhance, they developed a portal that redefines the tax relief journey.

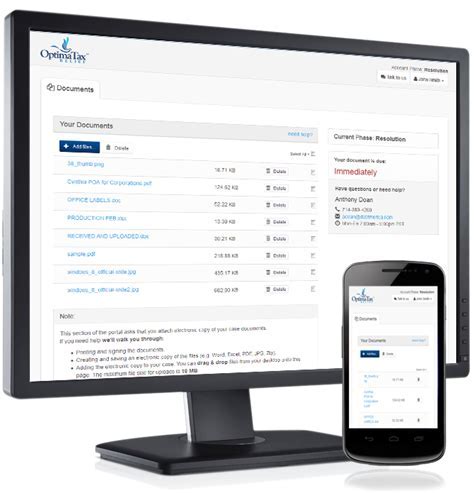

The Optima Tax Relief Portal is more than just a website; it's a comprehensive digital platform that empowers taxpayers to take control of their tax situations. With a user-friendly interface and a host of innovative features, the portal offers a seamless experience, making the often-daunting task of tax relief accessible and manageable.

Key Features of the Optima Tax Relief Portal

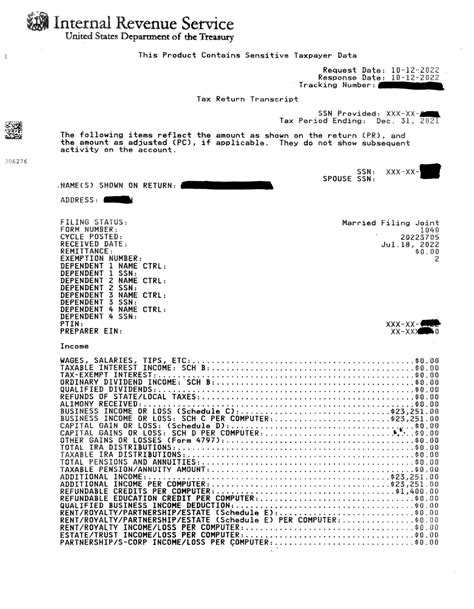

- Secure Online Account Management: Taxpayers can create a secure online account, providing a personalized space to manage their tax relief journey. Here, they can access their tax documents, track the progress of their case, and communicate directly with their dedicated tax professionals.

- Real-Time Case Updates: The portal provides real-time updates, ensuring taxpayers are always in the loop. They can view the latest developments, upcoming deadlines, and any changes to their case status, giving them peace of mind and a sense of control.

- Intuitive Document Upload: One of the most significant challenges in tax relief is managing the voluminous paperwork. Optima’s portal simplifies this with an intuitive document upload feature. Taxpayers can easily upload and organize their documents, ensuring a smooth and efficient process for their tax professionals.

- Interactive Tax Calculators: Understanding one’s tax liability is crucial. The portal offers interactive tax calculators, allowing taxpayers to estimate their potential tax savings and better understand the financial impact of different tax relief options.

- Secure Payment Gateway: For those ready to proceed with their tax relief plan, the portal provides a secure payment gateway. This feature ensures a seamless and safe transaction, giving taxpayers peace of mind when making financial commitments.

The Benefits of Optima’s Digital Approach

The Optima Tax Relief Portal offers a myriad of benefits, enhancing the overall tax relief experience:

- Efficiency: By digitizing the tax relief process, Optima ensures a faster, more streamlined journey. Taxpayers can avoid the delays often associated with traditional methods, saving valuable time and effort.

- Accessibility: The portal is accessible 24⁄7, allowing taxpayers to manage their cases from the comfort of their homes. This convenience is especially beneficial for those with busy schedules or limited mobility.

- Transparency: With real-time updates and direct communication, taxpayers enjoy unparalleled transparency. They can track every step of the process, fostering trust and confidence in Optima’s services.

- Empowerment: By providing a platform that puts taxpayers in the driver’s seat, Optima empowers individuals to take an active role in their tax relief journey. This sense of control can be empowering, especially during a stressful financial situation.

A Look at the Technical Specifications

Behind the scenes, the Optima Tax Relief Portal is powered by state-of-the-art technology, ensuring a secure and reliable experience. Here’s a glimpse at some of the technical aspects:

| Security | The portal employs advanced encryption protocols, ensuring data privacy and security. Taxpayers’ sensitive information is protected at all times. |

|---|---|

| Scalability | Designed to handle a large volume of users, the platform is highly scalable. It can accommodate growing demand without compromising performance. |

| Integration | The portal integrates seamlessly with Optima’s internal systems, allowing for efficient data flow and a cohesive user experience. |

| Performance | With optimized server architecture, the portal delivers fast loading times and a smooth user interface, even during peak usage. |

Performance Analysis and User Feedback

Since its launch, the Optima Tax Relief Portal has received widespread acclaim from both taxpayers and industry experts. Its user-friendly design and intuitive navigation have been praised, making it accessible to a broad range of users.

The portal's real-time case updates feature has been particularly well-received, providing taxpayers with the peace of mind that comes with transparency. Additionally, the secure document upload and storage system has streamlined the often-cumbersome process of gathering and submitting tax documents.

Optima's commitment to security is evident in the portal's design, with advanced encryption protocols and multi-factor authentication ensuring the safety of user data. This attention to detail has fostered trust among users, who appreciate the added layer of protection for their sensitive financial information.

Furthermore, the portal's interactive tax calculators have proven to be a valuable tool, empowering taxpayers to make informed decisions about their tax relief strategies. The ability to estimate potential savings and understand the financial implications of different options has been instrumental in helping individuals take control of their tax situations.

In terms of performance, the Optima Tax Relief Portal has consistently delivered exceptional uptime and fast response times. This reliability is crucial, as taxpayers often require immediate access to their accounts and real-time updates during critical periods of their tax relief journey.

Future Implications and Continuous Improvement

At Optima, we understand that technology is ever-evolving, and so are the needs of our taxpayers. As such, we are committed to continuous improvement and innovation to ensure our portal remains at the forefront of tax relief technology.

Our development roadmap includes integrating AI-powered features to further enhance the user experience. This includes intelligent document processing, which can automatically categorize and tag documents, making it even easier for taxpayers to manage their paperwork. Additionally, we aim to incorporate predictive analytics to provide personalized recommendations and insights, guiding taxpayers towards the most suitable tax relief options based on their unique circumstances.

Furthermore, we recognize the importance of staying ahead of emerging trends and technologies. As blockchain and cryptocurrency gain traction in the financial landscape, we are exploring ways to integrate these technologies into our portal, offering secure and innovative solutions for taxpayers dealing with digital assets.

Our vision extends beyond the current capabilities of the Optima Tax Relief Portal. We aim to establish it as a comprehensive financial management platform, providing taxpayers with tools not just for tax relief but also for budgeting, savings, and investment strategies. By expanding our scope, we hope to empower individuals to achieve long-term financial wellness and security.

Conclusion

The Optima Tax Relief Portal is more than just a digital platform; it’s a transformative force in the world of tax relief. By leveraging technology, Optima has created a gateway to financial freedom, making the complex process of tax resolution accessible, efficient, and empowering for taxpayers.

As we continue to innovate and adapt, we remain dedicated to our mission: providing taxpayers with the tools and support they need to overcome their tax challenges and achieve financial peace of mind. With the Optima Tax Relief Portal, we're not just simplifying tax relief; we're revolutionizing it.

How do I create an account on the Optima Tax Relief Portal?

+Creating an account is straightforward. Simply visit the Optima Tax Relief Portal’s homepage and click on the “Sign Up” or “Create Account” button. You’ll be guided through a secure registration process, where you’ll provide your personal details and create a unique username and password. Once your account is set up, you can log in anytime to manage your tax relief journey.

Is my data secure on the Optima Tax Relief Portal?

+Absolutely! Optima takes data security extremely seriously. The portal utilizes advanced encryption technologies to protect your personal and financial information. Additionally, we employ robust security measures, including multi-factor authentication, to ensure that only authorized users can access your account. Your data is safe with us.

Can I access the portal on my mobile device?

+Yes, the Optima Tax Relief Portal is designed to be mobile-friendly. You can access it seamlessly on your smartphone or tablet, allowing you to manage your tax relief journey on the go. Whether you’re commuting or on the road, you’ll have access to your account and real-time updates.