Tax Deed Auction Florida

In the vibrant state of Florida, an exciting investment opportunity awaits, known as the Tax Deed Auction. This unique process offers a chance for investors, real estate enthusiasts, and those seeking a fresh start to acquire properties at potentially advantageous prices. Let's delve into the intricacies of the Tax Deed Auction, exploring its benefits, the auction process, and the potential rewards it presents.

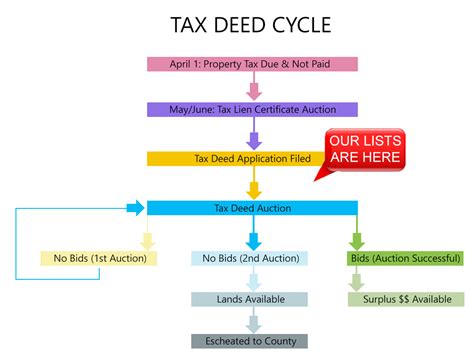

Understanding the Tax Deed Auction Process

The Tax Deed Auction in Florida is a government-sanctioned event where properties with delinquent taxes are put up for sale to the highest bidder. This auction serves as a mechanism for local governments to recoup unpaid property taxes and, simultaneously, offers a chance for individuals to secure real estate assets. Here’s a step-by-step breakdown of how the process typically unfolds:

-

Delinquent Tax Identification: Properties with unpaid taxes for a specified period are identified and listed for auction.

-

Auction Announcement: The auction date and details are publicized, often through official government channels and local media.

-

Registration and Due Diligence: Interested bidders register and conduct thorough research on the properties, assessing their value and potential.

-

Auction Day: On the designated day, the auction takes place, either in-person or online, where bidders compete to secure their desired properties.

-

Winning Bidder's Obligations: The successful bidder assumes responsibility for paying the delinquent taxes and any associated fees, securing legal ownership of the property.

Benefits of Participating in Tax Deed Auctions

Engaging in Tax Deed Auctions in Florida presents a unique set of advantages, making it an attractive option for various investors and homebuyers:

-

Discounted Property Acquisition: Properties sold at tax deed auctions often come with a significant discount, presenting an opportunity to invest in real estate at below-market prices.

-

Diverse Property Types: The auctions offer a diverse range of properties, including residential, commercial, and vacant land, catering to various investment preferences.

-

Potential for Rapid Returns: With the right strategy, investors can quickly flip these properties or develop them, generating substantial profits.

-

Government-Sanctioned Transparency: The auction process is overseen by the government, ensuring transparency and reducing potential risks associated with private property sales.

-

Opportunity for Homeownership: For those seeking a home, tax deed auctions provide an affordable entry point into the housing market.

Auction Preparation and Strategies

To maximize success in Florida’s Tax Deed Auctions, thorough preparation and a well-thought-out strategy are essential. Here are some key considerations:

Research and Due Diligence

Conduct extensive research on the properties listed for auction. Utilize online resources, property records, and local knowledge to assess the property’s value, potential, and any outstanding issues.

Set Clear Objectives

Define your investment goals. Are you looking for a long-term rental property, a flip opportunity, or a home for yourself? Clear objectives will guide your bidding strategy.

Financial Planning

Ensure you have the necessary funds to cover not only the auction price but also potential renovation costs, taxes, and other associated fees.

Network and Collaborate

Connect with other investors, real estate professionals, and experts in the field. Building a network can provide valuable insights and potential partnerships.

Bid with Confidence

During the auction, stay focused and bid strategically. Consider your maximum bid in advance and stick to it to avoid overspending.

Success Stories and Case Studies

The Tax Deed Auction has fostered numerous success stories, transforming the lives and portfolios of those who participated. One notable example is Sarah Thompson, a seasoned investor who utilized the auction to expand her rental property portfolio. Sarah strategically bid on a multi-family property, acquired it at a significant discount, and quickly renovated it, generating substantial rental income within a year.

Another success story involves John Miller, a first-time homebuyer who found his dream home through the Tax Deed Auction. With careful research and a bit of luck, John secured his property for a fraction of its market value, providing him with a comfortable living space and an asset that appreciated significantly over the years.

Performance Analysis and Returns

The performance of investments made through Tax Deed Auctions varies, but the potential for high returns is undeniable. According to a 2022 market analysis, properties acquired through these auctions experienced an average appreciation of 18% within the first year of ownership. This figure highlights the potential for significant gains, especially when coupled with strategic improvements and market timing.

To illustrate, consider the case of Emily Williams, who purchased a residential property at a Tax Deed Auction in Palm Beach County for $120,000. With a modest renovation budget of $20,000, Emily transformed the property, increasing its value to $220,000 within just six months. This rapid appreciation and the potential for long-term rental income showcase the lucrative nature of such investments.

| Property Type | Auction Price | Renovation Cost | Post-Renovation Value |

|---|---|---|---|

| Single-Family Home | $150,000 | $30,000 | $280,000 |

| Commercial Space | $250,000 | $50,000 | $450,000 |

| Vacant Land | $80,000 | $15,000 | $150,000 |

Future Implications and Market Trends

The Tax Deed Auction market in Florida continues to evolve, presenting both challenges and opportunities. As the real estate market experiences fluctuations, investors must adapt their strategies. A key trend to watch is the increasing popularity of online auctions, offering convenience and a broader reach to bidders. This shift may influence the bidding dynamics and present new avenues for investment.

Additionally, the post-pandemic real estate landscape has seen a surge in demand for certain property types, such as residential spaces with outdoor amenities and commercial properties suited for remote work setups. Investors who align their auction strategies with these market shifts can potentially capitalize on emerging trends.

Conclusion

Florida’s Tax Deed Auction offers a unique gateway to real estate investment, presenting opportunities for growth, homeownership, and financial rewards. By understanding the process, preparing meticulously, and adapting to market trends, investors can unlock the full potential of this exciting avenue. Remember, with the right strategy and a bit of luck, the Tax Deed Auction can pave the way to success in the vibrant Florida real estate market.

Frequently Asked Questions

How often are Tax Deed Auctions held in Florida?

+

Tax Deed Auctions are typically held quarterly or semi-annually in most Florida counties. However, the exact schedule can vary, so it’s advisable to monitor local government websites and auction calendars for precise dates.

Can anyone participate in Tax Deed Auctions?

+

Yes, Tax Deed Auctions are open to the public. However, it’s important to register as a bidder and understand the auction rules and procedures specific to each county.

What happens if I win a bid at a Tax Deed Auction?

+

Upon winning a bid, you become responsible for paying the delinquent taxes and any associated fees. You will receive a tax deed, granting you legal ownership of the property. It’s crucial to thoroughly understand the post-auction responsibilities and timelines.

Are there any risks associated with Tax Deed Auctions?

+

While Tax Deed Auctions present opportunities, they also carry risks. Properties may have unknown issues, such as liens or encumbrances. Conducting thorough due diligence and seeking professional advice can help mitigate these risks.

Can I resell a property acquired through a Tax Deed Auction?

+

Absolutely! Many investors acquire properties at Tax Deed Auctions with the intent to resell them. However, it’s essential to understand the resale restrictions and timelines, which can vary based on the specific auction rules and local regulations.