Attorney Tax

In the complex world of legal practice, understanding the intricate relationship between law and taxes is essential for attorneys to navigate successfully. Attorney tax, a specialized field, involves unique challenges and considerations that directly impact the financial health of law firms and legal professionals. This comprehensive guide delves into the intricacies of attorney tax, exploring the specific tax obligations, strategies, and best practices that every legal professional should be aware of to ensure compliance and optimize their financial position.

Understanding the Unique Tax Landscape for Attorneys

The tax landscape for attorneys is distinct, marked by a combination of general tax principles and specific regulations tailored to the legal profession. This section aims to provide an overview of the key considerations and challenges that attorneys face when managing their tax obligations.

The Complexity of Attorney Tax Obligations

Attorney tax obligations extend beyond the standard income tax calculations. Legal professionals must navigate a range of tax-related issues, including but not limited to:

- Business income taxation: Attorneys, whether solo practitioners or part of a firm, are subject to business income tax on their legal services. This involves understanding how to calculate and report business income accurately.

- Self-employment taxes: Self-employed attorneys must deal with the complexities of self-employment taxes, including Social Security and Medicare taxes, which are typically covered by employers for traditional employees.

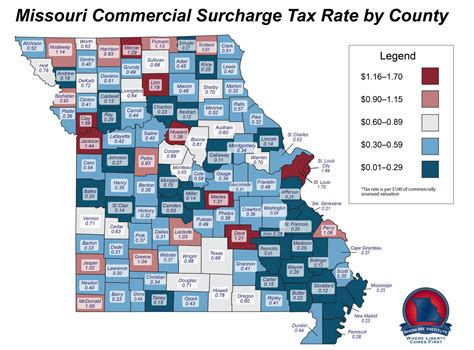

- State and local taxes: In addition to federal taxes, attorneys must comply with state and local tax regulations, which can vary significantly across jurisdictions.

- Trust account management: Attorneys often manage client trust accounts, which come with unique tax considerations, such as accurately reporting and remitting taxes on interest earned in these accounts.

- Pass-through entity taxation: Many law firms are structured as pass-through entities, which means the firm’s income is taxed at the owner’s individual tax rate. This introduces complexities in tax planning and compliance.

Challenges and Pitfalls to Avoid

Navigating the attorney tax landscape is not without its challenges. Common pitfalls that attorneys should be aware of include:

- Inadequate record-keeping: Precise record-keeping is essential for accurate tax reporting. Attorneys must maintain detailed records of income, expenses, and client trust account activity to avoid penalties and ensure compliance.

- Overlooking tax deductions: Legal professionals may overlook legitimate tax deductions, such as those related to continuing education, office expenses, and technology investments. Maximizing deductions can significantly reduce tax liabilities.

- Late filing or payment penalties: Attorneys, like any business owners, are subject to penalties for late tax filing or payment. Staying on top of deadlines is crucial to avoid unnecessary fines.

- Non-compliance with state regulations: The varying tax regulations across states can be challenging. Attorneys practicing in multiple states must ensure compliance with each state’s specific requirements to avoid penalties and legal issues.

The Role of Tax Planning for Attorneys

Effective tax planning is a strategic tool for attorneys to manage their tax obligations and optimize their financial outcomes. By implementing thoughtful tax planning strategies, legal professionals can:

- Minimize tax liabilities: Through strategic tax planning, attorneys can identify opportunities to reduce their tax burden, such as by maximizing deductions, utilizing tax credits, and structuring their business to take advantage of favorable tax treatments.

- Improve cash flow: By understanding and managing tax obligations, attorneys can better forecast and manage their cash flow, ensuring they have sufficient funds to meet tax liabilities and maintain the financial health of their practice.

- Enhance financial stability: Effective tax planning contributes to the long-term financial stability of a law practice. It allows attorneys to make informed financial decisions and plan for the future, including retirement and business succession.

Key Tax Strategies for Attorneys

Implementing effective tax strategies is crucial for attorneys to manage their tax obligations efficiently and optimize their financial position. This section explores some of the key tax strategies that legal professionals can employ to achieve these objectives.

Maximizing Deductions and Credits

One of the primary strategies for attorneys to reduce their tax liabilities is to maximize deductions and credits. This involves carefully tracking and documenting eligible expenses and taking advantage of tax credits designed for small businesses and professionals.

Eligible deductions for attorneys may include:

- Office rent and utilities

- Legal research expenses

- Technology costs, including software subscriptions and hardware

- Continuing education expenses

- Business travel and entertainment costs

- Health insurance premiums

Additionally, attorneys should explore tax credits such as the Small Business Health Care Tax Credit, which provides a credit for a portion of the cost of providing health insurance to employees, and the General Business Credit, which can include tax credits for research and development, investment in certain energy-efficient properties, and more.

Utilizing Tax-Advantaged Retirement Plans

Attorneys can benefit significantly from tax-advantaged retirement plans, which offer opportunities to save for the future while reducing current tax liabilities. Some popular options include:

- Solo 401(k): This plan allows self-employed individuals and small business owners to contribute a significant amount of their income into a tax-deferred retirement account. The contribution limits are higher than traditional 401(k) plans, making it an attractive option for attorneys.

- SEP IRA (Simplified Employee Pension): SEP IRAs allow attorneys to contribute a percentage of their income as an employer contribution on behalf of themselves and their employees. Contributions are tax-deductible, providing an immediate tax benefit.

- Defined Benefit Plan: While more complex to set up and administer, defined benefit plans can provide significant tax advantages for high-income earners like attorneys. These plans have higher contribution limits compared to other retirement plans.

Structuring Business Entities for Tax Efficiency

The choice of business entity can have significant tax implications for attorneys. Common business structures for legal practices include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each structure offers different tax treatments and benefits.

For instance, an LLC can offer pass-through taxation, where business profits are reported on the owners' personal tax returns, avoiding the double taxation that corporations face. However, corporations may be advantageous in certain situations, such as when the business expects to have a high level of profits and wants to retain some earnings within the company for future growth and expansion.

Implementing Tax-Efficient Billing and Payment Practices

The way attorneys bill their clients and manage payments can also impact their tax obligations. Here are some strategies to consider:

- Time-based billing: Billing clients based on the time spent on a case or project can provide a more accurate reflection of the work performed and may be more tax-efficient than flat fees.

- Invoice timing: Attorneys should aim to invoice clients promptly after completing work to ensure timely payment. This can help with cash flow management and tax planning.

- Accepting digital payments: Encouraging clients to pay electronically can simplify record-keeping and make it easier to track income for tax purposes.

Compliance and Reporting Requirements

Compliance with tax laws and accurate reporting are critical aspects of managing attorney tax obligations. This section provides an overview of the key compliance and reporting requirements that attorneys must adhere to.

Income Tax Compliance

Attorneys, like any other business owners, are subject to federal, state, and local income tax laws. Compliance with these laws involves accurately reporting business income, deductions, and credits on tax returns.

For federal income taxes, attorneys typically use Form 1040, along with Schedule C (Profit or Loss From Business) for sole proprietorships or Schedule E (Supplemental Income and Loss) for partnerships or LLCs taxed as partnerships. These forms detail the income, expenses, and deductions related to the legal practice.

Self-Employment Tax Compliance

Self-employed attorneys are responsible for paying self-employment taxes, which include Social Security and Medicare taxes. These taxes are typically covered by employers for traditional employees. Attorneys must calculate and pay these taxes on their net earnings from self-employment, which are reported on Schedule SE (Self-Employment Tax) and filed with Form 1040.

State and Local Tax Compliance

Attorneys must also comply with state and local tax regulations, which can vary significantly. These may include state income taxes, sales taxes, and other local business taxes. It’s crucial for attorneys to understand the specific tax requirements in the jurisdictions where they practice and file the appropriate tax returns.

Client Trust Account Compliance

Attorneys who manage client trust accounts must comply with specific tax regulations regarding these accounts. This includes accurately reporting and remitting taxes on interest earned in these accounts. The specific requirements can vary by state, so attorneys should consult local regulations and best practices.

Record-Keeping and Documentation

Maintaining accurate and detailed records is essential for tax compliance and audit preparedness. Attorneys should keep records of income, expenses, client trust account activity, and any other relevant financial information. This documentation should be organized and easily accessible to support tax reporting and potential audits.

Future Implications and Evolving Tax Landscape

The tax landscape for attorneys is dynamic, and staying informed about potential changes and future implications is essential for effective tax planning and compliance. This section explores some of the key trends and considerations that may impact the tax obligations of attorneys in the coming years.

The Impact of Technological Advancements

Technological advancements are transforming the legal industry, and their influence extends to tax obligations as well. Here’s how technology is shaping the tax landscape for attorneys:

- Tax Software and Automation: Advanced tax software and automation tools are making it easier for attorneys to manage their tax obligations. These tools can streamline record-keeping, tax calculation, and compliance, reducing the risk of errors and increasing efficiency.

- Blockchain and Cryptocurrency: With the increasing use of blockchain technology and cryptocurrencies, attorneys may need to navigate the tax implications of these new assets. Understanding the tax treatment of cryptocurrency transactions and investments will become more relevant.

- Data Security and Privacy: As attorneys increasingly rely on digital tools and cloud-based solutions for tax management, data security and privacy become critical concerns. Ensuring the security of sensitive tax information is essential to protect clients and avoid potential liabilities.

Potential Tax Law Changes

Tax laws are subject to change, and attorneys should stay informed about potential modifications that may impact their tax obligations. Here are some key areas to watch:

- Tax Reform: Periodic tax reforms can significantly alter the tax landscape. Attorneys should monitor proposed changes to tax rates, deductions, and credits, as these can impact their financial planning and compliance strategies.

- State and Local Tax Changes: State and local governments may introduce new taxes or modify existing ones. Attorneys practicing in multiple jurisdictions should stay informed about these changes to ensure compliance.

- International Tax Considerations: For attorneys with international clients or who practice in an international context, staying updated on global tax regulations is crucial. Changes in international tax treaties or policies can have direct implications for their tax obligations.

Embracing Tax Education and Professional Development

In a dynamic tax landscape, continuing education and professional development are essential for attorneys to stay ahead of the curve. Here are some recommendations for attorneys to enhance their tax knowledge and skills:

- Attend Tax Workshops and Seminars: Participate in workshops and seminars focused on tax issues relevant to the legal profession. These events provide an opportunity to learn about the latest tax strategies and compliance requirements.

- Engage with Tax Professionals: Collaborate with tax professionals, such as CPAs and tax attorneys, to stay informed about tax law changes and best practices. Consider forming strategic alliances or partnerships to enhance your tax expertise.

- Online Resources and Communities: Utilize online resources and join professional communities focused on tax issues. These platforms can provide valuable insights, updates, and opportunities to connect with peers facing similar tax challenges.

Conclusion

Managing attorney tax obligations is a complex but critical aspect of legal practice. By understanding the unique tax landscape, implementing effective tax strategies, and staying compliant with tax laws, attorneys can optimize their financial position and ensure the long-term success of their legal practice. As the tax landscape continues to evolve, staying informed and adaptable is key to navigating the challenges and opportunities that arise.

What are the key tax obligations for attorneys?

+Attorneys must comply with federal, state, and local income tax laws, self-employment taxes, and state and local regulations. They also have unique obligations related to client trust accounts and business entity taxes.

How can attorneys reduce their tax liabilities?

+Attorneys can reduce tax liabilities by maximizing deductions and credits, utilizing tax-advantaged retirement plans, and structuring their business entities for tax efficiency. Effective tax planning and billing practices also play a role in minimizing tax obligations.

What are some common tax mistakes attorneys should avoid?

+Common mistakes include inadequate record-keeping, overlooking tax deductions, late filing or payment penalties, and non-compliance with state regulations. Attorneys should prioritize accurate record-keeping and seek professional advice to avoid these pitfalls.

How can attorneys stay informed about tax law changes?

+Attorneys can stay informed by attending tax workshops and seminars, engaging with tax professionals, and utilizing online resources and communities focused on tax issues. Regularly reviewing relevant publications and staying connected with industry peers is also beneficial.