Mobile County Tax Appraisal

Welcome to our comprehensive guide on the Mobile County Tax Appraisal process, where we delve into the intricacies of property valuation and its implications for residents and business owners. In this article, we will explore the methods, challenges, and opportunities presented by the tax appraisal system in Mobile County, offering an in-depth analysis that will benefit property owners and anyone interested in understanding the local real estate landscape.

Understanding the Mobile County Tax Appraisal System

The Mobile County Tax Appraisal system is a crucial component of the county’s fiscal infrastructure, impacting both the local economy and individual taxpayers. It is a complex process that involves the systematic evaluation of all taxable properties within the county, including residential, commercial, and industrial properties.

The primary goal of this appraisal system is to ensure that property taxes are levied fairly and equitably across the county. It serves as the foundation for the calculation of property taxes, which are a significant source of revenue for local government operations and services.

Key Objectives of Mobile County Tax Appraisal

- Ensuring equitable tax distribution among property owners.

- Accurately reflecting market values to maintain a stable and competitive real estate market.

- Providing transparency and predictability in the tax assessment process.

- Supporting local economic development and infrastructure projects through tax revenue.

The Appraisal Process: A Step-by-Step Guide

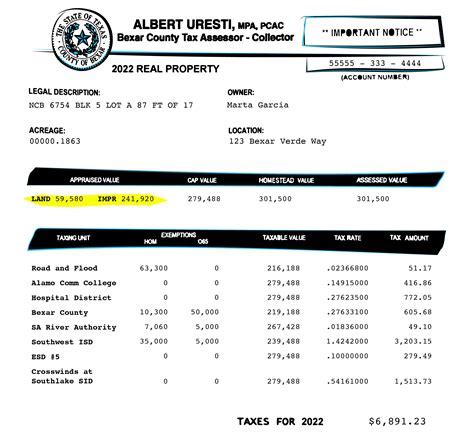

- Data Collection: Appraisers gather comprehensive information on each property, including physical characteristics, location, and recent sales data.

- Property Inspection: Trained appraisers conduct on-site visits to verify the collected data and assess the property’s condition.

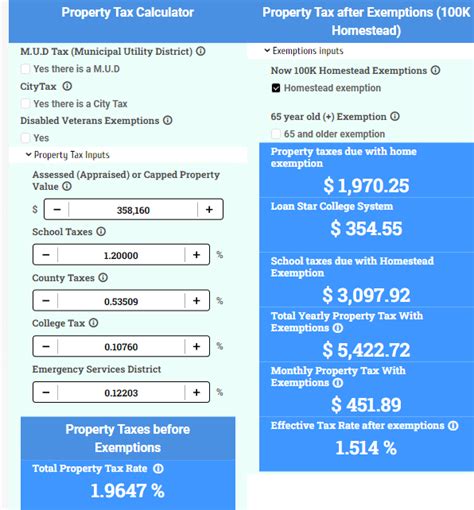

- Market Analysis: Using advanced valuation models, appraisers compare the property with recent sales of similar properties in the area to determine its fair market value.

- Adjustment and Valuation: Appraisers adjust the property’s value based on unique features and market trends, ensuring an accurate and up-to-date assessment.

- Review and Appeal: Property owners have the opportunity to review their appraised value and, if necessary, file an appeal to challenge the assessment.

This meticulous process ensures that the tax appraisal system is fair, accurate, and in line with market realities. It allows property owners to understand the value of their assets and make informed decisions regarding ownership, investment, and tax planning.

The Impact of Mobile County Tax Appraisals

The tax appraisal system in Mobile County has far-reaching effects on various aspects of the community’s life and economy.

Residential Property Owners

For homeowners, the tax appraisal process determines the value of their most significant asset. It directly impacts their property taxes, affecting their annual financial obligations. Accurate appraisals ensure that homeowners are not overburdened with excessive tax liabilities, while also contributing to the overall stability of the local housing market.

Additionally, the tax appraisal system provides homeowners with a valuable tool for financial planning. It offers a clear understanding of their property's worth, which is essential for decisions related to refinancing, home equity loans, or even selling the property.

Commercial and Industrial Entities

Businesses, large and small, also rely on the tax appraisal system to determine their property tax obligations. Accurate appraisals are crucial for commercial entities, as they directly impact the cost of doing business in Mobile County. A well-managed appraisal system can encourage business growth and investment by providing a stable and predictable tax environment.

Furthermore, the tax appraisal process can influence a company's strategic decisions. For instance, a favorable appraisal may encourage businesses to expand their operations or consider new investment opportunities within the county.

Community Development and Infrastructure

The revenue generated from property taxes plays a vital role in funding local government initiatives and community development projects. These funds are often used to improve infrastructure, enhance public services, and support local schools and public safety initiatives.

An efficient tax appraisal system ensures that the revenue generated is proportional to the value of the properties, allowing the county to invest in its future growth and development. It creates a positive cycle where accurate appraisals lead to fair tax assessments, which, in turn, support essential community projects.

Challenges and Innovations in Mobile County Tax Appraisals

While the Mobile County Tax Appraisal system is designed to be fair and accurate, it faces certain challenges that require innovative solutions.

Addressing Market Fluctuations

Real estate markets are dynamic, and rapid changes in property values can present a challenge for appraisers. Mobile County’s appraisal system employs advanced valuation techniques and continuous market monitoring to ensure that appraisals reflect the current market realities.

Appraisers collaborate with local real estate professionals and analysts to stay abreast of market trends, allowing them to adjust appraisals as needed and maintain fairness for property owners.

Technological Advancements

The integration of technology has revolutionized the tax appraisal process. Mobile County has embraced digital tools and platforms to enhance efficiency and accuracy. Advanced software systems enable appraisers to manage vast amounts of data, streamline inspections, and produce more precise valuations.

Additionally, the use of geographic information systems (GIS) has improved the accuracy of property mapping and location-based appraisals, ensuring that each property is assessed based on its unique characteristics and surroundings.

Community Engagement and Transparency

Mobile County recognizes the importance of community involvement and transparency in the tax appraisal process. The county has implemented various initiatives to educate property owners about the appraisal process, their rights, and the appeal process.

By fostering an environment of open communication and transparency, the county aims to build trust and understanding among taxpayers, leading to a more collaborative and effective tax appraisal system.

The Future of Mobile County Tax Appraisals

As Mobile County continues to evolve and grow, its tax appraisal system will play a pivotal role in shaping the local economy and community. The county is committed to staying at the forefront of appraisal practices, adapting to changing market dynamics, and leveraging technology to enhance efficiency and accuracy.

In the coming years, Mobile County aims to further refine its appraisal processes, incorporating advanced analytics and machine learning techniques to improve the accuracy and speed of valuations. Additionally, the county plans to explore innovative approaches to community engagement, ensuring that taxpayers are well-informed and actively involved in the appraisal process.

Potential Future Developments

- Implementing predictive modeling to forecast property values and identify potential market trends.

- Utilizing drone technology for more efficient and detailed property inspections.

- Developing an online portal for property owners to access appraisal information and initiate the appeal process seamlessly.

- Expanding community outreach programs to educate taxpayers about the benefits of accurate appraisals.

Frequently Asked Questions

How often are properties appraised in Mobile County?

+Properties in Mobile County are typically appraised every four years, though this may vary based on market conditions and individual property characteristics.

Can property owners appeal their appraised value?

+Absolutely! Property owners have the right to appeal their appraised value if they believe it is inaccurate or unfair. The appeal process is designed to ensure a fair and transparent resolution.

How does the tax appraisal system benefit the local economy?

+An efficient tax appraisal system promotes economic growth by providing a stable and predictable tax environment for businesses. It also ensures that property taxes are fairly distributed, supporting essential community initiatives and infrastructure development.

What role does technology play in the tax appraisal process?

+Technology has revolutionized the tax appraisal process, enhancing accuracy and efficiency. Advanced software, GIS systems, and data analytics tools enable appraisers to manage vast amounts of data and produce precise valuations.