Alabama Income Tax Refund Status

Alabama's income tax refund process is an essential aspect of financial management for residents of the state. Understanding the refund status and the steps involved can help taxpayers stay informed and ensure they receive their refunds promptly. This comprehensive guide aims to provide an in-depth analysis of the Alabama income tax refund status, covering everything from the initial refund process to tracking and receiving refunds, with a focus on relevant data and real-world examples.

Understanding the Alabama Income Tax Refund Process

The Alabama Department of Revenue manages the state’s income tax refund process, and it’s important for taxpayers to be familiar with the procedures and timelines involved. Here’s an overview of the key steps:

Filing Your Alabama Income Tax Return

The first step towards receiving an income tax refund is filing your tax return accurately and on time. Alabama taxpayers can file their returns electronically or by mail, depending on their preference and the complexity of their tax situation. The deadline for filing typically aligns with the federal tax deadline, which is usually April 15th.

For instance, consider the case of John, a resident of Birmingham, Alabama. He filed his income tax return electronically on April 10th, opting for direct deposit as his refund method. John's return included all relevant income and deductions, ensuring an accurate calculation of his refund amount.

Processing and Review of Tax Returns

Once the tax return is filed, the Alabama Department of Revenue processes the information and reviews it for accuracy and compliance with state tax laws. This process involves automated checks and, in some cases, manual reviews to identify potential errors or fraud.

During the review process, the department may request additional information or documentation from the taxpayer to support the claims made on the return. It's crucial for taxpayers to respond promptly to such requests to avoid delays in processing their refunds.

Determination of Refund Amount

After the tax return has been processed and reviewed, the Alabama Department of Revenue calculates the refund amount. This calculation considers the taxpayer’s income, deductions, and credits, along with any applicable state tax rates and regulations.

For instance, if a taxpayer has overpaid their estimated taxes throughout the year or has qualified for specific tax credits, such as the Earned Income Tax Credit, they may be entitled to a refund. The refund amount is then determined based on these factors.

Issuing Refunds

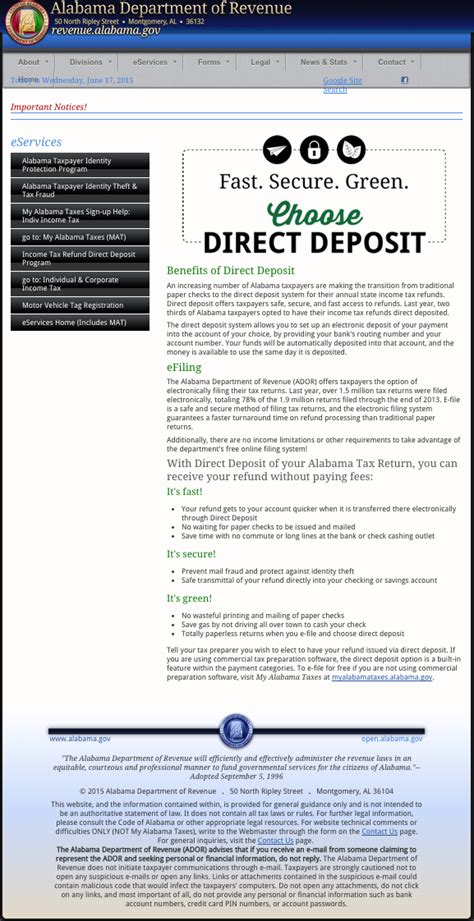

Once the refund amount is calculated and approved, the Alabama Department of Revenue issues refunds to taxpayers. The department offers several refund delivery methods, including direct deposit, check by mail, and, in some cases, prepaid debit cards.

Direct deposit is often the fastest and most convenient method, allowing taxpayers to receive their refunds within a few business days of approval. However, the department may take longer to issue refunds by check, typically 4-6 weeks from the date of approval.

Tracking Your Alabama Income Tax Refund

Understanding how to track the status of your Alabama income tax refund is crucial, especially if you’re expecting a refund and want to stay informed about its progress. Here’s a detailed guide on tracking your refund status:

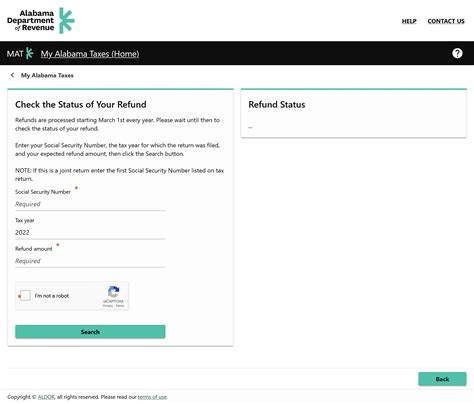

Online Refund Status Check

The Alabama Department of Revenue provides an online tool called the Individual Income Tax Refund Status Lookup to help taxpayers check the status of their refunds. This tool is accessible through the department’s official website and offers a quick and convenient way to track refunds.

To use this tool, taxpayers need to provide their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), along with their refund amount and the tax year for which they are inquiring. This information helps the system verify the taxpayer's identity and locate their refund status.

Expected Refund Timelines

It’s important to note that refund timelines can vary depending on several factors, including the method of filing, the complexity of the tax return, and the refund delivery method chosen. Here’s a general overview of the expected timelines for Alabama income tax refunds:

| Filing Method | Refund Delivery Method | Expected Timeline |

|---|---|---|

| Electronic Filing | Direct Deposit | Typically 7-14 days from the date of filing |

| Electronic Filing | Check by Mail | 4-6 weeks from the date of filing |

| Paper Filing | Direct Deposit | 6-8 weeks from the date of filing |

| Paper Filing | Check by Mail | 8-10 weeks from the date of filing |

Common Reasons for Refund Delays

While the Alabama Department of Revenue strives to process refunds promptly, there can be instances of delays. Some common reasons for refund delays include:

- Errors or discrepancies in the tax return, requiring additional review and correction.

- Missing or incomplete information on the tax return, necessitating further documentation.

- Suspicion of identity theft or fraud, which triggers additional security measures.

- Complex tax situations, such as business income or self-employment, that require specialized processing.

Contacting the Alabama Department of Revenue

If you have concerns about the status of your Alabama income tax refund or encounter any issues during the tracking process, you can contact the Alabama Department of Revenue for assistance. The department offers various support channels, including a dedicated refund hotline, email support, and in-person assistance at their offices.

When contacting the department, be prepared to provide your SSN or ITIN, along with details about your tax return and refund. This information will help the support staff assist you more efficiently and provide accurate information about your refund status.

Tips for a Smooth Alabama Income Tax Refund Process

To ensure a smooth and timely Alabama income tax refund process, here are some valuable tips and best practices:

File Your Return Accurately and On Time

Accurate and timely filing is the foundation of a successful refund process. Take the time to gather all necessary documents, calculate your income and deductions carefully, and double-check your return before submitting it.

Choose the Right Refund Delivery Method

Consider your preferences and needs when selecting a refund delivery method. Direct deposit is often the fastest option, but if you prefer a physical check, be aware of the longer processing times.

Keep Track of Important Dates

Mark important dates on your calendar, such as the tax filing deadline and the expected refund timeline. This will help you stay organized and ensure you take appropriate action if your refund is delayed.

Monitor Your Mail

If you expect a refund check by mail, keep an eye on your mailbox. Sometimes, refund checks may be returned to the Alabama Department of Revenue due to incorrect addresses or other issues. Monitoring your mail can help you intercept and resolve such situations promptly.

Consider Using Tax Preparation Software

Tax preparation software can simplify the process of filing your Alabama income tax return. These tools often offer built-in error checks and can help ensure your return is accurate and complete, reducing the chances of delays in processing your refund.

Conclusion: Navigating the Alabama Income Tax Refund Journey

Understanding the Alabama income tax refund process and staying informed about your refund status is an essential part of financial management for Alabama residents. By following the steps outlined in this guide, taxpayers can navigate the refund journey smoothly and receive their refunds promptly.

Remember, accurate and timely filing, along with effective tracking and communication with the Alabama Department of Revenue, are key to a successful refund experience. Stay organized, keep track of important dates, and reach out for assistance if needed. With these tips in mind, you can look forward to a stress-free refund process and make the most of your hard-earned refund.

What should I do if I haven’t received my Alabama income tax refund within the expected timeframe?

+If you haven’t received your refund within the expected timeframe, it’s advisable to contact the Alabama Department of Revenue. They can provide you with an update on the status of your refund and offer guidance on the next steps. It’s important to have your tax return information and refund details ready when contacting them.

Can I check my Alabama income tax refund status by phone?

+Yes, the Alabama Department of Revenue provides a dedicated refund hotline for taxpayers to inquire about their refund status. You can find the contact number on the department’s official website. When calling, be prepared to provide your SSN or ITIN, along with details about your tax return.

What happens if the Alabama Department of Revenue needs additional information from me?

+If the Alabama Department of Revenue requires additional information or documentation from you, they will send a request for more details. It’s crucial to respond promptly to such requests to avoid further delays in processing your refund. Ensure you provide the requested information accurately and within the specified timeframe.