Business Tax Certificate

The Business Tax Certificate, often referred to as a Business License or Business Permit, is a crucial document that every business owner needs to understand and obtain. This certificate serves as an official recognition of a business's legitimacy and compliance with local, state, and federal regulations. It is a vital step in the process of starting and operating a business, ensuring that entrepreneurs meet the necessary requirements and can conduct their operations legally. In this comprehensive guide, we will delve into the world of Business Tax Certificates, exploring their purpose, the application process, the various types available, and the critical role they play in the business ecosystem.

Understanding the Purpose of a Business Tax Certificate

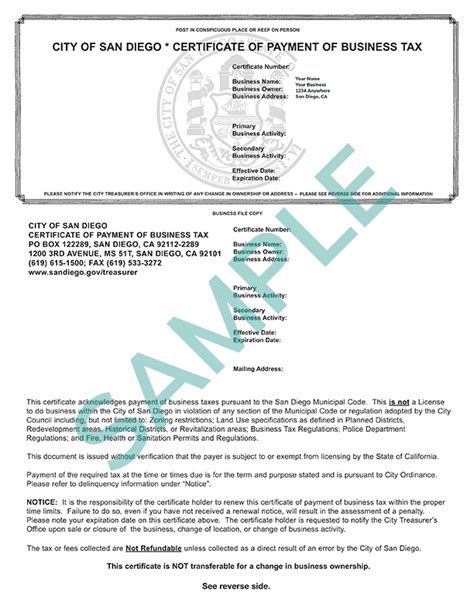

A Business Tax Certificate is a permit issued by a government authority, typically at the local or state level, authorizing a business to operate within a specific jurisdiction. It acts as a form of identification for the business and signifies that the enterprise has met the necessary legal and regulatory standards. Obtaining this certificate is an essential step for any business, as it ensures compliance with laws and regulations, helps prevent legal issues, and provides a foundation for the business to grow and thrive.

The purpose of a Business Tax Certificate extends beyond mere legality. It also serves as a tool for local governments to manage and regulate business activities within their communities. By requiring businesses to obtain these certificates, authorities can monitor and control the number and types of businesses operating in their area. This, in turn, helps to ensure fair competition, maintain order, and protect consumers.

Key Functions of a Business Tax Certificate

- Legal Compliance: Ensures the business adheres to local, state, and federal laws and regulations.

- Revenue Generation: Provides a means for local governments to collect taxes and fees from businesses.

- Community Management: Allows authorities to control and monitor business activities, promoting a healthy business environment.

- Consumer Protection: Helps safeguard consumers by ensuring businesses meet certain standards and requirements.

The Application Process: A Step-by-Step Guide

Applying for a Business Tax Certificate involves a series of steps, each crucial to the successful registration of your business. The process may vary slightly depending on the location and type of business, but the general procedure remains consistent. Here's a detailed breakdown of what you can expect:

Step 1: Research and Planning

Before initiating the application process, it's essential to conduct thorough research on the specific requirements for your business type and location. This step involves understanding the local laws, regulations, and any additional permits or licenses you might need. Engage with local business associations, consult with legal professionals, and review government websites to gather all the necessary information.

During this phase, it's also beneficial to create a detailed business plan. A well-structured plan will not only guide your application process but also serve as a roadmap for the growth and success of your business. Consider factors like your target market, financial projections, marketing strategies, and operational plans.

Step 2: Choose the Right Business Structure

The choice of business structure is a critical decision that will impact various aspects of your business, including tax obligations, personal liability, and operational flexibility. Common business structures include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each structure has its own advantages and disadvantages, so it's essential to carefully evaluate which option aligns best with your business goals and personal preferences.

Step 3: Register Your Business Name

Registering your business name is a vital step in establishing your business's identity. This process typically involves checking the availability of your desired business name and then officially registering it with the appropriate government agency. It's important to choose a unique and memorable name that accurately reflects your business's brand and mission.

In some cases, you may also need to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). An EIN is a unique nine-digit number assigned to businesses for tax purposes. It serves as your business's social security number, allowing you to hire employees, open business bank accounts, and file business tax returns.

Step 4: Obtain Necessary Permits and Licenses

Depending on your business type and location, you may need to obtain specific permits and licenses to operate legally. These can include industry-specific licenses, health and safety permits, zoning permits, and more. Research the requirements for your business and reach out to the relevant government agencies to ensure you meet all the necessary criteria.

During this step, it's crucial to stay organized and keep track of all the required documents and deadlines. Some permits may have specific application processes or renewal periods, so staying on top of these details is essential to avoid any legal complications.

Step 5: Apply for Your Business Tax Certificate

Once you've completed the preliminary steps and gathered all the necessary documentation, you can proceed with applying for your Business Tax Certificate. The application process typically involves filling out an online or paper form, providing detailed information about your business, and paying the associated fees. Ensure that you carefully review and complete all sections of the application to avoid any delays or rejections.

After submitting your application, you may need to wait for a period of time while the relevant authorities process your request. This timeframe can vary depending on the workload of the issuing agency and the complexity of your application. It's important to remain patient and proactive during this stage, following up with the agency if necessary to check on the status of your application.

Types of Business Tax Certificates: Exploring the Options

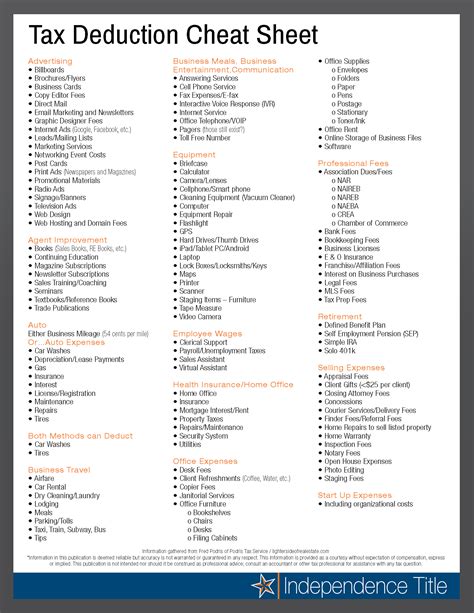

Business Tax Certificates come in various forms, each tailored to specific business types and jurisdictions. Understanding the different types available is crucial to ensuring you obtain the correct certificate for your business. Here's an overview of some common types of Business Tax Certificates:

General Business License

A General Business License is a broad permit that covers a wide range of business activities. It is often the primary license required for most businesses and serves as a foundation for other specific permits and licenses. This license typically covers basic operations, such as selling goods or services, and may have additional requirements depending on the nature of the business.

Industry-Specific Licenses

Certain industries, such as healthcare, construction, or transportation, often require specific licenses and permits. These industry-specific licenses ensure that businesses operating in these sectors meet the necessary standards and regulations. Examples include medical licenses for healthcare providers, contractor licenses for construction businesses, and transportation permits for delivery or logistics companies.

Professional Licenses

Professional licenses are required for businesses that offer specific professional services, such as law, accounting, engineering, or architecture. These licenses ensure that professionals meet the necessary qualifications and adhere to ethical standards in their respective fields. Obtaining a professional license often involves passing exams, meeting educational requirements, and maintaining ongoing professional development.

Home-Based Business License

If you plan to operate your business from home, you may need to obtain a Home-Based Business License. This license ensures that your business activities comply with local zoning regulations and any specific requirements for home-based businesses. It's important to note that the rules and restrictions for home-based businesses can vary significantly between jurisdictions, so thorough research is essential.

Special Event Permits

Special Event Permits are temporary licenses required for businesses or individuals hosting events, such as festivals, concerts, or fundraising activities. These permits ensure that the event meets safety and regulatory standards and often involve coordination with local authorities, emergency services, and other relevant stakeholders.

| Business Type | Relevant Business Tax Certificate |

|---|---|

| Retail Store | General Business License, Sales Tax Permit |

| Construction Company | General Business License, Contractor License |

| Law Firm | General Business License, Professional License (Law) |

| Catering Service | General Business License, Health and Safety Permit |

| Online E-commerce Business | General Business License, Sales Tax Permit |

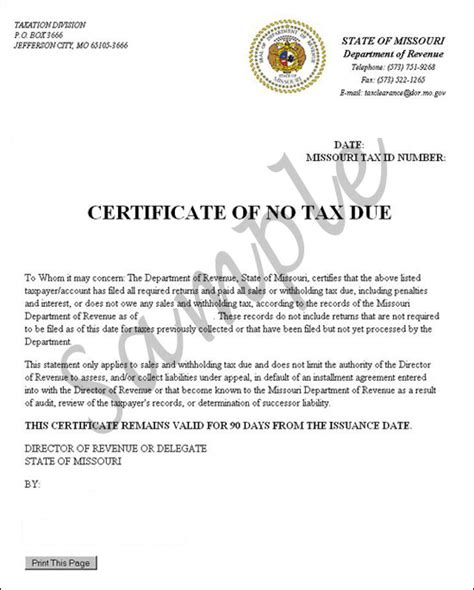

The Importance of Compliance: Avoiding Penalties and Legal Issues

Obtaining a Business Tax Certificate is not just a bureaucratic formality; it's a critical step in ensuring your business operates within the bounds of the law. Compliance with local, state, and federal regulations is essential to avoid legal issues, penalties, and potential business shutdowns. Here's a closer look at the importance of compliance and the potential consequences of non-compliance.

Benefits of Compliance

- Legal Protection: Compliance with regulations helps protect your business from legal action and penalties.

- Credibility: Operating with a valid Business Tax Certificate enhances your business's credibility and trustworthiness.

- Consumer Confidence: Compliance demonstrates your commitment to ethical and responsible business practices, building consumer confidence.

- Access to Resources: Many government programs and support initiatives are only available to compliant businesses.

Consequences of Non-Compliance

- Legal Action: Non-compliance can lead to lawsuits, fines, and even criminal charges in severe cases.

- Business Shutdown: Authorities may revoke your Business Tax Certificate and shut down your operations until compliance is achieved.

- Reputational Damage: Non-compliance can tarnish your business's reputation, leading to loss of customers and business opportunities.

- Limited Growth: Non-compliant businesses may face restrictions on growth and expansion, limiting their potential.

Renewal and Updates: Keeping Your Business Certificate Current

Obtaining a Business Tax Certificate is just the beginning of your business's journey. To maintain compliance and avoid legal issues, it's essential to stay up-to-date with any renewal requirements and keep your certificate current. Here's a guide to help you navigate the renewal process and ensure your business remains in good standing.

Understanding Renewal Requirements

Business Tax Certificates typically have an expiration date, after which they need to be renewed. The renewal process may involve submitting updated information, paying renewal fees, and possibly undergoing additional inspections or reviews. It's crucial to understand the specific renewal requirements for your certificate to avoid any lapses in compliance.

Renewal requirements can vary depending on the type of Business Tax Certificate and the jurisdiction in which your business operates. Some certificates may have annual renewal periods, while others may require renewal every few years. It's essential to keep track of these deadlines and ensure you initiate the renewal process well in advance to avoid any disruptions to your business operations.

The Renewal Process

The renewal process for a Business Tax Certificate typically involves the following steps:

- Check the Expiration Date: Begin by reviewing your current Business Tax Certificate to determine when it expires.

- Gather Necessary Documentation: Gather any updated information or documents required for the renewal process, such as financial statements or proof of insurance.

- Submit Renewal Application: Complete and submit the renewal application, either online or through the appropriate government agency.

- Pay Renewal Fees: Pay the applicable renewal fees, which may vary based on the type of certificate and the jurisdiction.

- Wait for Approval: Once your renewal application is submitted, you may need to wait for the issuing authority to process your request. This timeframe can vary, so it's essential to stay informed about the status of your renewal.

- Receive Updated Certificate: Upon approval, you should receive an updated Business Tax Certificate, which will be valid for the next renewal period.

It's important to note that the renewal process may differ slightly depending on the specific certificate and jurisdiction. Some jurisdictions may have additional requirements, such as mandatory inspections or business plan updates. It's crucial to research and understand these requirements to ensure a smooth renewal process.

Frequently Asked Questions

How long does it take to obtain a Business Tax Certificate?

+The processing time for a Business Tax Certificate can vary depending on several factors, including the complexity of your business, the volume of applications received by the issuing authority, and the specific requirements of your jurisdiction. In general, it can take anywhere from a few days to several weeks to obtain a Business Tax Certificate. It's important to start the application process early to ensure you have your certificate in hand before commencing business operations.

Are there any fees associated with obtaining a Business Tax Certificate?

+Yes, there are typically fees involved in obtaining a Business Tax Certificate. These fees can vary depending on the type of certificate, the jurisdiction, and the size of your business. It's important to research and understand the specific fees applicable to your business to ensure you budget accordingly. Some jurisdictions may also offer reduced fees for certain types of businesses or for those who meet certain eligibility criteria.

What happens if I operate my business without a valid Business Tax Certificate?

+Operating a business without a valid Business Tax Certificate can have serious legal consequences. Depending on the jurisdiction, you may face fines, penalties, or even criminal charges. Additionally, you may be required to shut down your business operations until you obtain the necessary certificate. It's crucial to prioritize obtaining a Business Tax Certificate to avoid these potential legal issues and ensure the long-term success of your business.

Can I apply for a Business Tax Certificate online?

+Yes, many jurisdictions now offer online application processes for Business Tax Certificates. This can streamline the application process and make it more convenient for business owners. However, it's important to verify whether your specific jurisdiction provides an online application option and to ensure that you meet all the necessary requirements before initiating the online application.

What information do I need to provide when applying for a Business Tax Certificate?

+The specific information required when applying for a Business Tax Certificate can vary depending on the jurisdiction and the type of business. However, in general, you will need to provide details such as your business name, address, type of business, ownership structure, and contact information. You may also need to provide financial information, such as projected revenue or expenses, and any additional permits or licenses you hold. It's important to carefully review the application requirements to ensure you provide all the necessary information.

In conclusion, the Business Tax Certificate is a fundamental aspect of starting and operating a business. It ensures legal compliance, protects your business’s reputation, and provides a foundation for growth and success. By understanding the application process, the various types of certificates available, and the importance of compliance, you can navigate the world of business regulations with confidence. Remember, obtaining and maintaining your Business Tax Certificate is an ongoing responsibility that contributes to the health and stability of your business and the broader business ecosystem.