New Jersey State Tax Refund Status

For New Jersey residents, understanding the state tax refund process and how to check the status of your refund is essential. The New Jersey Division of Taxation aims to process refunds promptly, and providing taxpayers with a convenient way to track their refund status is a priority. In this comprehensive guide, we'll explore the ins and outs of the New Jersey state tax refund process, offering valuable insights and tips to ensure a smooth and efficient experience.

Navigating the New Jersey State Tax Refund Journey

Filing your state taxes and awaiting the refund can be a stressful time. The good news is that New Jersey’s tax system is designed to be taxpayer-friendly, with a well-organized process for refund management. Let’s delve into the key steps and considerations to help you navigate this journey with ease.

Understanding the New Jersey Tax Calendar

New Jersey operates on a fiscal year that runs from July 1st to June 30th. The tax year is divided into various filing periods, each with its own deadlines. Here’s a simplified breakdown of the key dates:

- January 1st to April 15th: This is the primary tax filing period for most individuals and businesses. Taxpayers have until April 15th to file their returns for the previous fiscal year.

- April 16th to June 15th: This period is dedicated to late filers. While it’s always best to file on time, this window provides a chance for those who missed the initial deadline to catch up.

- July 1st to December 31st: The beginning of a new fiscal year. During this period, taxpayers can expect to receive their refunds or be notified of any additional payments required.

It’s crucial to note that the New Jersey Division of Taxation may introduce changes to these deadlines from time to time. Always refer to their official website or consult a tax professional for the most up-to-date information.

The Filing Process: A Step-by-Step Guide

Filing your state taxes in New Jersey is a straightforward process, thanks to the state’s user-friendly online platform. Here’s a step-by-step guide to ensure a smooth filing experience:

- Gather Your Documents: Before you begin, ensure you have all the necessary paperwork. This includes your federal tax return, W-2 forms, 1099 forms, and any other relevant financial documents.

- Access the Online Filing System: Visit the official New Jersey Division of Taxation website and navigate to the “File Your Taxes” section. Here, you’ll find the necessary forms and instructions.

- Choose Your Filing Method: New Jersey offers two primary filing methods: online filing and paper filing. Online filing is the preferred method as it’s faster and more secure. If you opt for paper filing, make sure to mail your return to the correct address.

- Enter Your Information: Carefully enter all the required details, including your personal information, income, deductions, and credits. Double-check your entries to avoid errors.

- Review and Submit: Once you’ve completed the form, review it thoroughly. Ensure all the information is accurate and complete. Then, submit your return electronically or mail it, depending on your chosen method.

- Payment or Refund: If you owe taxes, you’ll need to make a payment along with your return. Conversely, if you’re due a refund, the state will process it once your return is accepted.

Tracking Your Refund: A Simple Process

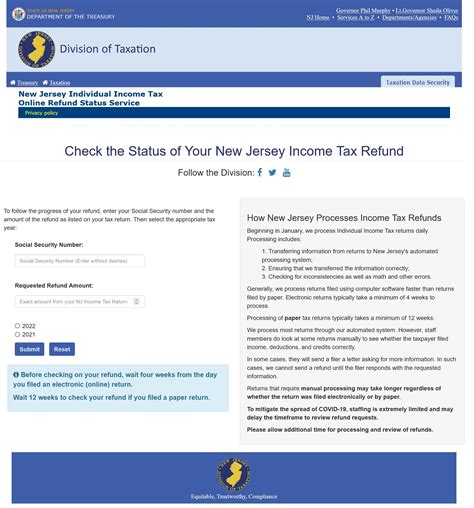

Once you’ve filed your state tax return, the wait for your refund can seem endless. Fortunately, New Jersey provides a convenient online tool to check the status of your refund. Here’s how to do it:

- Visit the Refund Status Page: Go to the New Jersey Division of Taxation website and locate the “Where’s My Refund?” section. This is where you’ll input your personal information to track your refund.

- Enter Your Details: You’ll need to provide your Social Security Number, your filing status (single, married filing jointly, etc.), and the exact amount of your expected refund. This information must match what you entered on your tax return.

- Check Your Status: After submitting your details, you’ll receive an update on the status of your refund. The system will provide you with a clear indication of whether your refund has been processed, is in progress, or if there are any issues that require attention.

It’s important to note that refund processing times can vary. New Jersey aims to issue refunds within 45 days of receiving a complete and accurate return. However, certain factors, such as errors on your return or additional reviews, may delay the process.

Maximizing Your New Jersey State Tax Refund

Now that you understand the refund process, let’s explore some strategies to ensure you receive the maximum refund you’re entitled to. These tips can help you optimize your tax return and make the most of your hard-earned money.

Common Tax Deductions and Credits

New Jersey offers various deductions and credits that can reduce your taxable income or provide a direct refund. Here are some of the most common ones to consider:

- Property Tax Deduction: New Jersey allows taxpayers to deduct a portion of their property taxes from their taxable income. This deduction can be particularly beneficial for homeowners.

- Dependent Deduction: If you have eligible dependents, such as children or elderly relatives, you can claim a deduction for their support. This can lower your taxable income and potentially increase your refund.

- Education Credits: New Jersey provides tax credits for eligible educational expenses. This includes credits for tuition, books, and other qualified education-related costs. These credits can directly reduce your tax liability.

- Energy Credits: The state offers tax credits for energy-efficient home improvements. If you’ve invested in solar panels, energy-efficient appliances, or other qualifying improvements, you may be eligible for this credit.

Strategies for a Bigger Refund

Maximizing your refund involves more than just claiming deductions and credits. Here are some additional strategies to consider:

- Review Your Withholdings: Ensure that your withholdings from your paycheck are set at the correct rate. If you’re consistently owed a refund, you may want to adjust your withholdings to have more money in your paycheck throughout the year.

- File Electronically: Online filing is not only convenient but also more secure. It reduces the risk of errors and ensures a faster processing time for your refund.

- Keep Accurate Records: Maintain organized records of your income, expenses, and deductions. This will make it easier to file your taxes accurately and support any claims you make.

- Consider Professional Help: If you have a complex tax situation or are unsure about certain deductions or credits, consider seeking the advice of a tax professional. They can help you maximize your refund and ensure compliance with state tax laws.

Avoiding Common Mistakes

While the New Jersey tax system is designed to be user-friendly, errors can still occur. Here are some common mistakes to avoid when filing your state taxes:

- Incorrect Personal Information: Double-check your name, address, and Social Security Number to ensure they match your official records. Errors in this information can delay your refund or lead to processing issues.

- Math Errors: Double-check your calculations to avoid simple math mistakes. Even small errors can affect your refund amount.

- Missing Signatures: If you’re filing a joint return, ensure both spouses sign the return. Missing signatures can lead to processing delays.

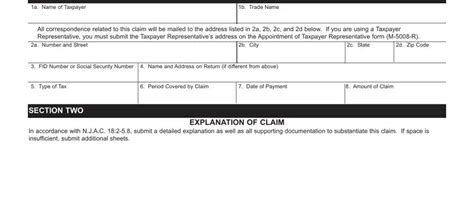

- Forgetting to Attach Documents: If you’re claiming certain deductions or credits, ensure you attach the necessary supporting documents. Failing to do so may result in your claim being denied.

The Future of New Jersey’s Tax System

As technology advances and taxpayer expectations evolve, New Jersey’s tax system is also undergoing transformations. The state is investing in modernizing its infrastructure to enhance the tax filing and refund process. Here’s a glimpse into the future of New Jersey’s tax landscape:

Digital Transformation

New Jersey is embracing digital solutions to streamline the tax process. The state is working towards a fully digital tax system, where taxpayers can file their returns, pay taxes, and track refunds entirely online. This shift aims to improve efficiency, reduce errors, and provide a more convenient experience for taxpayers.

Enhanced Security Measures

With the rise of cyber threats, New Jersey is prioritizing the security of taxpayer data. The state is implementing advanced encryption technologies and two-factor authentication to protect personal and financial information. These measures ensure that taxpayers can file their returns and check their refund status without compromising their privacy and security.

Tax Reform and Policy Changes

New Jersey’s tax system is subject to ongoing reforms and policy changes. The state regularly evaluates its tax laws to ensure fairness and competitiveness. Recent reforms have focused on simplifying the tax code, reducing burdens on taxpayers, and promoting economic growth. As a taxpayer, staying informed about these changes is crucial to understanding your rights and obligations.

Conclusion

Navigating the New Jersey state tax refund process can be simplified with the right knowledge and tools. By understanding the tax calendar, following the proper filing procedures, and maximizing your deductions and credits, you can ensure a smooth and rewarding experience. Remember to stay informed about tax reforms and policy changes, and don’t hesitate to seek professional help when needed.

For more information and updates on New Jersey's tax system, visit the official New Jersey Division of Taxation website. Stay informed, stay compliant, and maximize your refund potential!

What happens if my refund status shows an error or issue?

+If your refund status indicates an error or issue, it’s essential to take prompt action. The New Jersey Division of Taxation will provide specific instructions on how to resolve the issue. This may involve correcting errors on your return, providing additional documentation, or contacting the tax office for further assistance. It’s crucial to address these issues promptly to avoid delays in receiving your refund.

Can I check my refund status over the phone or by mail?

+While the online tracking system is the most efficient way to check your refund status, New Jersey also offers phone and mail options. You can call the tax office’s dedicated refund hotline or send a written request to the tax office. However, these methods may take longer and provide less detailed information compared to the online tracking system.

How long does it typically take to receive my refund after filing my return?

+New Jersey aims to process refunds within 45 days of receiving a complete and accurate return. However, factors like errors, additional reviews, or high volume during peak filing seasons can cause delays. It’s always best to file your return as early as possible to increase the chances of a prompt refund.