Nd Property Tax

In the realm of real estate and financial planning, understanding the intricacies of property taxes is crucial. Nd Property Tax is a specific type of tax levied on real estate properties, and it plays a significant role in the overall financial management of property ownership. This comprehensive guide aims to unravel the complexities surrounding Nd Property Tax, offering an in-depth analysis of its definitions, calculations, implications, and strategies for effective management.

Understanding Nd Property Tax

Nd Property Tax, an acronym that stands for Nondurable Property Tax, is a unique tax assessment imposed on certain types of real estate properties. Unlike standard property taxes that are applicable to all property owners, Nd Property Tax targets specific categories of properties, often based on their usage, location, or unique characteristics.

This specialized tax is designed to account for the varying values and benefits associated with different types of properties. It considers factors such as the property's potential for economic development, its impact on the local community, and its contribution to the overall tax base. By implementing Nd Property Tax, governing bodies can tailor tax assessments to align with the unique features and benefits provided by each property.

Legal and Jurisdictional Framework

The imposition of Nd Property Tax is governed by specific legal frameworks and jurisdictional regulations. Each region or locality may have its own set of guidelines outlining the criteria for Nd Property Tax assessments. These regulations are typically developed in collaboration with local government bodies, tax authorities, and legal experts to ensure fairness and transparency in the tax collection process.

The legal framework for Nd Property Tax often includes detailed definitions of the properties that fall under its purview. These definitions may be based on the property's usage, such as commercial, industrial, or agricultural purposes, or they may be tied to specific features like the presence of natural resources or unique architectural designs.

| Property Type | Nd Property Tax Assessment |

|---|---|

| Commercial Properties | Assessed based on the potential for economic growth and job creation. |

| Industrial Zones | Taxed according to the impact on local infrastructure and environmental considerations. |

| Agricultural Lands | Evaluated for their contribution to food production and rural development. |

By understanding the legal and jurisdictional aspects of Nd Property Tax, property owners can gain insight into the specific criteria that influence their tax assessments. This knowledge empowers them to make informed decisions regarding property management, investment strategies, and potential tax planning measures.

Calculating Nd Property Tax

The calculation of Nd Property Tax involves a complex process that considers various factors, ensuring that the tax burden is distributed equitably among property owners. The assessment process is typically handled by specialized tax authorities or assessment boards, which employ sophisticated methodologies to determine the value of each property subject to Nd Property Tax.

Property Valuation Methods

Property valuation is a critical component of Nd Property Tax calculation. Assessors utilize a range of techniques to determine the fair market value of properties, taking into account factors such as location, size, condition, and potential uses. Here are some common valuation methods employed in the assessment process:

- Market Comparison Approach: This method involves comparing the subject property to similar properties that have recently been sold in the same market. By analyzing these sales, assessors can estimate the value of the property based on its potential for similar transactions.

- Income Approach: For income-generating properties like rental apartments or commercial spaces, the income approach is used. It considers the property's potential rental income, operating expenses, and capitalization rates to determine its value.

- Cost Approach: The cost approach estimates the value of the property by calculating the cost of replacing the property, including the cost of land, construction, and any improvements. This method is often used for unique or specialized properties where market data is limited.

Assessors may employ a combination of these methods to arrive at a comprehensive valuation, ensuring that the assessed value accurately reflects the property's true worth.

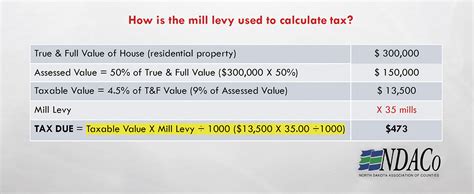

Assessment Ratios and Tax Rates

Once the property’s value is determined, the assessor applies an assessment ratio to calculate the taxable value. The assessment ratio is a predetermined percentage set by the local government, representing the portion of the property’s value that is subject to taxation. For example, if the assessment ratio is 20%, the taxable value of a property valued at 500,000 would be 100,000.

The taxable value is then multiplied by the tax rate, which is established by the local taxing authority. The tax rate is expressed as a percentage and is typically determined based on the jurisdiction's budgetary needs and revenue requirements. By multiplying the taxable value by the tax rate, the assessor calculates the Nd Property Tax owed by the property owner.

For instance, if the tax rate is 2%, the Nd Property Tax for a property with a taxable value of $100,000 would be $2,000. This calculation provides a clear understanding of the tax liability associated with the property, allowing property owners to plan their finances accordingly.

Implications of Nd Property Tax

Nd Property Tax has far-reaching implications for both property owners and local communities. Understanding these implications is essential for effective financial planning and community development.

Financial Considerations for Property Owners

For property owners, Nd Property Tax represents a significant financial obligation. It is an annual cost that must be budgeted for and paid to maintain compliance with local tax regulations. The amount of Nd Property Tax owed can vary significantly based on the property’s valuation, assessment ratio, and tax rate.

Property owners must carefully consider their tax liabilities when making financial plans. They may need to set aside funds specifically for Nd Property Tax payments, ensuring that they have sufficient resources to meet these obligations. Additionally, property owners should stay informed about any changes in tax rates or assessment procedures that could impact their financial responsibilities.

Community Development and Infrastructure

Nd Property Tax plays a crucial role in funding local community development and infrastructure projects. The revenue generated from these taxes contributes to the overall tax base, enabling local governments to invest in essential services and improvements.

The funds collected through Nd Property Tax can be utilized for a wide range of purposes, including:

- Building and maintaining schools, hospitals, and other public facilities.

- Improving roads, bridges, and transportation networks.

- Developing recreational spaces and parks.

- Funding social services and community programs.

- Supporting local economic development initiatives.

By contributing to Nd Property Tax, property owners become integral to the financial backbone of their communities, ensuring the continuous development and enhancement of the local area.

Strategies for Effective Nd Property Tax Management

Managing Nd Property Tax efficiently requires a strategic approach. Property owners can employ various tactics to ensure they are well-prepared for their tax obligations and potentially minimize their tax liabilities.

Tax Planning and Consultation

Engaging in proactive tax planning is essential for property owners. This involves seeking professional advice from tax consultants or accountants who specialize in real estate taxation. These experts can provide valuable insights into the specific tax laws and regulations applicable to Nd Property Tax, helping property owners understand their rights and obligations.

Tax consultants can guide property owners through the process of maximizing tax benefits and identifying potential deductions or exemptions. They can also assist in developing long-term tax strategies that align with the property's financial goals and objectives.

Appealing Assessments

In some cases, property owners may disagree with the assessed value of their property or feel that it is not accurately reflective of its true worth. In such situations, property owners have the right to appeal the assessment. The appeal process typically involves providing evidence and supporting documentation to demonstrate that the assessed value is incorrect.

Property owners should gather relevant information, such as recent sales data of similar properties, expert appraisals, or evidence of unique circumstances affecting the property's value. By presenting a strong case, property owners can potentially reduce their Nd Property Tax liability through a successful appeal.

Property Improvement and Maintenance

Investing in property improvements and maintenance can have a positive impact on Nd Property Tax assessments. Well-maintained properties often receive more favorable valuations, which can result in lower tax liabilities. Property owners should consider regular maintenance, upgrades, and improvements to ensure their property remains in good condition and aligns with market standards.

Additionally, certain improvements, such as energy-efficient upgrades or environmentally friendly modifications, may qualify for tax incentives or deductions. By staying informed about these incentives, property owners can make strategic decisions that not only enhance their property but also potentially reduce their tax burden.

Conclusion

Nd Property Tax is a complex yet essential aspect of property ownership. By understanding the legal frameworks, calculation methodologies, and implications associated with this specialized tax, property owners can effectively manage their financial obligations and contribute to the development of their local communities. Proactive tax planning, strategic improvements, and staying informed about tax regulations are key strategies for navigating the world of Nd Property Tax successfully.

How often are Nd Property Tax assessments conducted?

+The frequency of Nd Property Tax assessments can vary depending on the jurisdiction. In some areas, assessments are conducted annually, while in others, they may occur every few years. It is essential for property owners to be aware of the assessment schedule in their region.

Can property owners deduct Nd Property Tax from their income taxes?

+The deductibility of Nd Property Tax depends on the tax laws of the specific jurisdiction and the taxpayer’s circumstances. In many cases, Nd Property Tax is deductible, but it is crucial to consult with a tax professional to understand the applicable rules and regulations.

Are there any exemptions or reductions available for Nd Property Tax?

+Yes, certain properties or property owners may be eligible for exemptions or reductions in Nd Property Tax. These can include senior citizen discounts, veteran benefits, or exemptions for specific types of properties, such as historical landmarks or environmentally sensitive areas. It is advisable to research and inquire about potential exemptions applicable to your property.