Auto Sales Tax

The auto sales tax is a crucial aspect of the automotive industry, influencing both dealers and consumers. It is an essential component of the overall vehicle pricing structure, impacting the final cost of a car or truck and, consequently, the purchasing decisions of buyers. Understanding the intricacies of auto sales tax is key to making informed choices when it comes to vehicle purchases and managing dealership finances.

Understanding Auto Sales Tax

Auto sales tax, often referred to as vehicle excise duty or motor vehicle tax, is a government-imposed levy on the sale of motor vehicles. It is typically calculated as a percentage of the purchase price, varying depending on the jurisdiction and the type of vehicle being sold. This tax is a significant source of revenue for many governments, helping to fund infrastructure, education, and other public services.

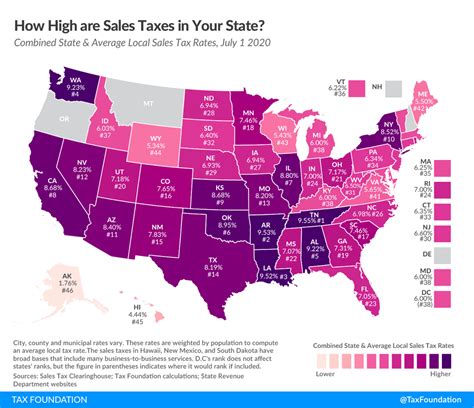

The auto sales tax can significantly affect the overall cost of a vehicle, especially for high-end models or those with substantial add-ons and upgrades. For instance, in the United States, the average sales tax rate on vehicles ranges from 4% to 10%, depending on the state, which can add thousands of dollars to the total cost of a new car.

Factors Influencing Auto Sales Tax

Several factors come into play when determining the auto sales tax. These include:

- Location: Sales tax rates can vary widely between different regions and countries. For example, while some states in the US have relatively low sales tax rates, others can impose a much higher percentage.

- Vehicle Type: Governments often levy different tax rates based on the type of vehicle. For instance, hybrid and electric cars might be subject to lower tax rates to encourage their adoption, while luxury vehicles or those with high emissions could face higher taxes.

- Vehicle Price: In some jurisdictions, the sales tax is calculated based on a tiered system, where different tax rates apply to different price brackets. This means that a more expensive vehicle could face a higher overall tax burden.

- Vehicle Use: The purpose for which a vehicle is intended can also impact the sales tax. For example, vehicles used for business purposes might have different tax considerations than those used for personal use.

| Region | Average Sales Tax Rate |

|---|---|

| United States | 6.5% |

| Canada | 5% |

| United Kingdom | 20% |

| Australia | 10% |

The table above provides a simplified overview of average sales tax rates in various regions. It's important to note that these rates can vary significantly within each country, depending on local regulations and policies.

Impact on Dealers and Consumers

Auto sales tax has a significant impact on both dealerships and consumers. For dealerships, the tax affects their pricing strategies and profit margins. Dealers must carefully calculate the sales tax to ensure they are compliant with local regulations and can provide accurate quotes to customers.

Dealer Perspective

From a dealer’s standpoint, auto sales tax can be a complex and critical consideration. They must stay updated with the latest tax rates and regulations to avoid legal issues and maintain a positive reputation. Additionally, dealerships often have to absorb a portion of the sales tax to remain competitive, which can eat into their profit margins.

For instance, consider a dealership in a state with an 8% sales tax rate. If they want to offer a competitive price on a vehicle with a $30,000 sticker price, they might need to reduce their profit margin to account for the sales tax. This means they might only make a profit of $1,000 on the sale, instead of the usual $2,000 they might make in a state with a lower tax rate.

Consumer Perspective

For consumers, understanding auto sales tax is crucial to making informed purchasing decisions. The tax can significantly increase the overall cost of a vehicle, potentially affecting a buyer’s ability to afford a certain model or add-ons.

Let's take the example of a consumer who is considering a $40,000 vehicle in a state with a 10% sales tax. The sales tax alone would amount to $4,000, bringing the total cost of the vehicle to $44,000. This might influence the buyer's decision to opt for a less expensive model or consider a different state for the purchase.

Strategies for Managing Auto Sales Tax

Both dealers and consumers can employ various strategies to navigate the complexities of auto sales tax.

Dealer Strategies

Dealers can employ the following strategies to manage auto sales tax effectively:

- Stay Informed: Dealers should regularly update their knowledge of local tax laws and regulations. This ensures they are compliant and can provide accurate information to customers.

- Pricing Strategies: Dealers can incorporate sales tax into their pricing strategies to make their offerings more competitive. This might involve absorbing a portion of the tax or offering incentives to offset the tax burden for customers.

- Financing Options: Dealers can work with financial institutions to offer financing options that help customers manage the tax burden. This could include zero-interest loans or deferred payment plans.

Consumer Strategies

Consumers can consider the following strategies when dealing with auto sales tax:

- Research: Consumers should research the sales tax rates in their area and compare them with other regions. This can help them understand the overall cost of the vehicle and make informed decisions about where to purchase.

- Negotiation: Consumers can negotiate with dealerships to include the sales tax in the overall price of the vehicle. This might involve requesting a lower price on the vehicle or negotiating a trade-in value that accounts for the tax.

- Financing Options: Consumers can explore various financing options to manage the sales tax burden. This could include personal loans, auto loans, or lease agreements that offer favorable terms.

Future Implications and Innovations

The landscape of auto sales tax is likely to evolve in the coming years, driven by technological advancements and changing consumer preferences. One notable trend is the increasing focus on sustainability and environmental responsibility.

As more countries and regions introduce policies to reduce carbon emissions and promote sustainable transportation, auto sales tax might play a pivotal role in influencing consumer behavior. Governments could implement tax incentives or rebates for electric vehicles or hybrid cars, encouraging consumers to make more environmentally friendly choices.

Additionally, the rise of online car-buying platforms and subscription models is expected to bring about changes in how auto sales tax is handled. These platforms often provide transparent pricing, including sales tax, which could simplify the purchasing process for consumers. Subscription models, which bundle vehicle ownership with maintenance and insurance, might also incorporate sales tax into their monthly fees, providing a more predictable cost structure for consumers.

Case Study: Impact of Auto Sales Tax on Electric Vehicle Adoption

A real-world example of the impact of auto sales tax can be seen in the adoption of electric vehicles (EVs). Many governments around the world have introduced tax incentives and rebates to encourage the transition to electric mobility. For instance, the US federal government offers a tax credit of up to $7,500 for the purchase of a new EV, while some states provide additional incentives.

These tax incentives have significantly influenced consumer behavior, making EVs a more affordable and attractive option. A study by the International Council on Clean Transportation (ICCT) found that these tax credits have been instrumental in boosting EV sales, especially in states with additional incentives. The study also highlighted the importance of tax policy in shaping the EV market and accelerating the transition to sustainable transportation.

Conclusion

Auto sales tax is a critical component of the automotive industry, impacting both dealers and consumers. Understanding the intricacies of this tax is essential for making informed decisions, whether it’s a dealership looking to optimize its pricing strategies or a consumer aiming to minimize their total cost of ownership. As the industry evolves, so too will the role and structure of auto sales tax, offering new opportunities and challenges for all stakeholders involved.

How is auto sales tax calculated?

+Auto sales tax is typically calculated as a percentage of the vehicle’s purchase price. The exact rate varies depending on the jurisdiction, with some places having a flat rate and others using a tiered system based on vehicle price brackets.

Are there any tax incentives for purchasing certain types of vehicles?

+Yes, many governments offer tax incentives or rebates for the purchase of certain types of vehicles, particularly those that are more environmentally friendly, such as electric or hybrid cars. These incentives can significantly reduce the overall cost of ownership for these vehicles.

How can dealerships help consumers manage auto sales tax?

+Dealerships can assist consumers by providing transparent pricing that includes sales tax, offering financing options that help manage the tax burden, and negotiating trade-in values that account for the tax. They can also stay informed about local tax laws and regulations to provide accurate information to customers.