Free Tax Usa Reviews

Welcome to our in-depth review of Free Tax USA, a popular online tax preparation platform that has gained traction among taxpayers seeking a cost-effective and user-friendly solution for filing their taxes. In today's digital age, the demand for efficient and accessible tax filing services is on the rise, and Free Tax USA aims to cater to this need by offering a straightforward and affordable approach. This review will explore the features, functionality, and overall user experience of Free Tax USA, providing valuable insights to help you decide if it's the right choice for your tax filing needs.

Understanding Free Tax USA

Free Tax USA is an online tax preparation service that was launched with the mission of making tax filing simple, fast, and, most importantly, free for eligible taxpayers. The platform is designed to guide users through the tax filing process step by step, ensuring accuracy and providing a seamless experience. It caters to a wide range of users, from those with simple tax situations to more complex returns, offering a variety of features to accommodate different needs.

The platform's user-friendly interface and intuitive design make it accessible to taxpayers of all ages and technical backgrounds. Free Tax USA understands that tax filing can be a daunting task, so they aim to simplify the process, offering clear instructions and helpful tools to make the journey as stress-free as possible. Whether you're a first-time filer or a seasoned taxpayer, Free Tax USA strives to provide a reliable and efficient service.

Key Features and Functionality

Free Tax USA boasts an array of features that set it apart from traditional tax preparation methods. Here’s an overview of some of its key offerings:

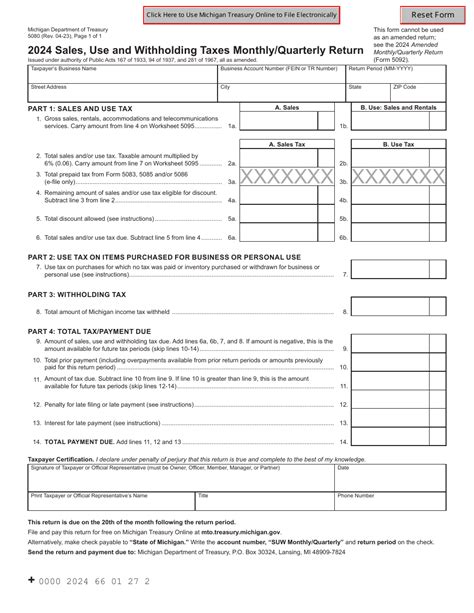

1. Free Federal and State Filing

One of the standout features of Free Tax USA is its commitment to offering free federal and state tax filing for eligible taxpayers. This means that if your tax situation is relatively straightforward, you can file your taxes without incurring any costs. The platform’s algorithm assesses your tax profile to determine your eligibility for free filing, ensuring that you receive the most accurate and cost-effective solution.

Eligible taxpayers can expect a seamless and transparent filing process, with no hidden fees or surprises. Free Tax USA understands that every dollar counts, especially during tax season, so they prioritize providing a genuinely free service to those who qualify.

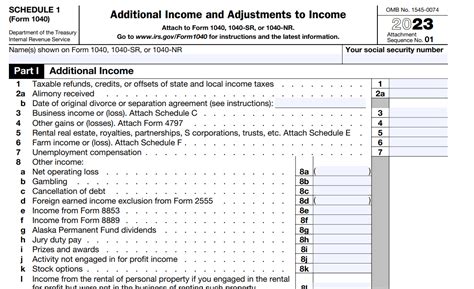

2. Comprehensive Tax Preparation Tools

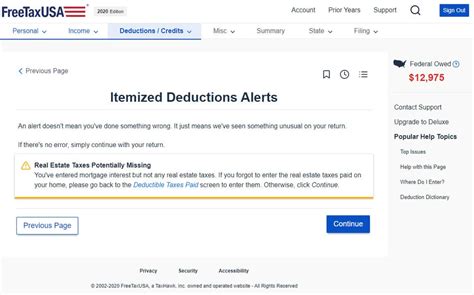

Free Tax USA provides a suite of powerful tax preparation tools to assist users in accurately calculating their tax liabilities and maximizing their refunds. These tools include calculators for deductions, credits, and exemptions, helping taxpayers identify every possible opportunity to reduce their tax burden. The platform’s intuitive design ensures that even users with complex tax situations can navigate these tools with ease.

Additionally, Free Tax USA offers a tax optimization feature that analyzes your financial data and provides personalized recommendations to optimize your tax return. This feature takes into account various factors, such as charitable contributions, education expenses, and retirement savings, to ensure you receive the highest possible refund or minimize your tax liability.

3. Secure and Encrypted Data Protection

Taxpayers’ data security is of utmost importance to Free Tax USA. The platform employs state-of-the-art encryption technologies to protect users’ personal and financial information throughout the filing process. All data transmitted between your device and the Free Tax USA servers is encrypted, ensuring that your sensitive information remains confidential and secure.

Furthermore, Free Tax USA adheres to strict data privacy standards, ensuring that your data is only used for the purpose of tax filing and not shared with any third parties without your explicit consent. This commitment to data protection gives users peace of mind, knowing that their information is handled with the utmost care and discretion.

4. Easy Import and Data Transfer

Free Tax USA understands that tax filing can be time-consuming, especially when it comes to manually entering financial data. To streamline the process, the platform offers easy import features that allow users to seamlessly transfer their tax data from previous years or other tax preparation software. This feature saves valuable time and reduces the risk of errors associated with manual data entry.

Additionally, Free Tax USA provides integration with popular financial institutions, enabling users to import their banking and investment information directly into the platform. This seamless data transfer ensures accuracy and efficiency, making the tax filing process faster and more convenient.

Performance and User Experience

Free Tax USA prides itself on delivering a smooth and efficient user experience, ensuring that taxpayers can navigate the platform with ease and complete their tax filings promptly. The platform’s performance is backed by robust infrastructure, ensuring that users can access their accounts and files without delays or technical issues.

The user interface is designed with simplicity in mind, making it easy for taxpayers to find the tools and features they need. Clear and concise instructions guide users through each step of the filing process, providing a stress-free experience. Whether you're filing your taxes for the first time or are a seasoned filer, Free Tax USA's intuitive design ensures a seamless journey.

Furthermore, Free Tax USA offers 24/7 customer support to assist users with any questions or concerns they may have. The support team is highly responsive and knowledgeable, providing timely assistance to ensure a positive user experience. This commitment to customer service sets Free Tax USA apart, ensuring that taxpayers receive the support they need throughout the filing process.

Real-World Performance and Customer Feedback

Free Tax USA has gained popularity among taxpayers, and its success can be attributed to its excellent performance and positive user feedback. Here’s a glimpse into how the platform has fared in real-world scenarios:

1. Efficiency and Speed

Users have praised Free Tax USA for its efficient and speedy tax filing process. The platform’s streamlined approach allows taxpayers to complete their returns in a fraction of the time it would take using traditional methods. This efficiency is particularly beneficial for busy individuals who value their time and appreciate the convenience of a quick and straightforward filing process.

With Free Tax USA, users can expect to spend less time on tax-related tasks, leaving them with more time to focus on their personal and professional commitments. The platform's user-friendly design and intuitive navigation contribute to this efficiency, making tax filing a breeze.

2. Accuracy and Precision

Free Tax USA places a strong emphasis on accuracy, ensuring that users receive the most precise calculations and tax estimates. The platform’s advanced algorithms and tax expertise ensure that every deduction, credit, and exemption is accounted for, maximizing users’ refunds or minimizing their tax liabilities.

Users have expressed satisfaction with the platform's accuracy, noting that Free Tax USA has helped them identify additional deductions and credits they may have otherwise missed. This attention to detail sets Free Tax USA apart, giving users the confidence that their tax returns are completed with the utmost precision.

3. Customer Satisfaction and Trust

Free Tax USA has built a strong reputation for delivering a satisfying and trustworthy user experience. The platform’s commitment to data security and privacy has earned the trust of its users, who appreciate the platform’s discretion and respect for their personal information. This trust is further reinforced by the platform’s transparent pricing structure, ensuring that users are not hit with unexpected fees.

Users have also highlighted the platform's excellent customer support, praising the team's responsiveness and expertise. The ability to quickly resolve queries and provide timely assistance has contributed to Free Tax USA's positive reputation and overall user satisfaction.

Future Outlook and Potential Improvements

As Free Tax USA continues to gain traction and establish itself as a leading online tax preparation platform, there are several areas where further development and innovation could enhance the user experience even more.

1. Mobile App Integration

While Free Tax USA offers a web-based platform, developing a dedicated mobile app could further improve accessibility and convenience for users. A mobile app would allow taxpayers to access their accounts and complete their tax filings on the go, providing an added layer of flexibility and ease.

With the increasing reliance on mobile devices, a mobile app would cater to users who prefer a more portable and intuitive tax filing experience. This development would align with the platform's mission of making tax filing as convenient and accessible as possible.

2. Enhanced Tax Optimization Features

Free Tax USA’s tax optimization feature is already a valuable tool for taxpayers, but further enhancements could make it even more powerful. By integrating advanced algorithms and machine learning technologies, the platform could offer more sophisticated tax planning and optimization strategies.

These enhancements could include dynamic tax planning tools that adapt to users' financial goals and life events, providing personalized recommendations to optimize their tax positions throughout the year. By staying ahead of tax-related changes and opportunities, Free Tax USA could empower users to make informed financial decisions.

3. Expanded Eligibility Criteria for Free Filing

While Free Tax USA already offers free federal and state filing for eligible taxpayers, expanding the eligibility criteria could further increase accessibility and attract a broader user base. By adjusting the criteria to accommodate more taxpayers, the platform could help even more individuals save on tax preparation costs.

This expansion could involve increasing the income threshold for free filing or introducing additional criteria based on factors such as military service, student status, or other specific circumstances. By making tax filing more inclusive, Free Tax USA could become a go-to resource for a wider range of taxpayers.

Conclusion: Is Free Tax USA Right for You?

Free Tax USA stands out as a reliable and efficient online tax preparation platform, offering a range of features and benefits to taxpayers seeking a cost-effective and user-friendly solution. With its commitment to accuracy, data security, and customer support, the platform has earned a positive reputation among users.

Whether you're a first-time filer or a seasoned taxpayer, Free Tax USA provides a straightforward and intuitive filing experience. The platform's focus on efficiency, precision, and accessibility makes it an excellent choice for those looking to simplify their tax filing journey. With its ongoing commitment to innovation and user satisfaction, Free Tax USA continues to be a leading option for taxpayers seeking a seamless and stress-free tax filing experience.

Can I really file my taxes for free with Free Tax USA?

+Yes, Free Tax USA offers free federal and state filing for eligible taxpayers. The platform’s algorithm assesses your tax situation to determine if you qualify for free filing. If you have a simple tax profile, you can file your taxes without any costs.

Is my data secure on Free Tax USA?

+Absolutely! Free Tax USA prioritizes data security and employs advanced encryption technologies to protect your personal and financial information. Your data is only used for tax filing purposes and is not shared with any third parties without your consent.

How does Free Tax USA’s tax optimization feature work?

+The tax optimization feature analyzes your financial data and provides personalized recommendations to maximize your tax benefits. It considers various factors, such as deductions, credits, and exemptions, to help you optimize your tax return and potentially increase your refund.

Can I import my tax data from previous years or other software?

+Yes, Free Tax USA offers easy import features that allow you to seamlessly transfer your tax data from previous years or other tax preparation software. This saves time and reduces the risk of errors associated with manual data entry.

What if I have questions or need assistance during the filing process?

+Free Tax USA provides 24⁄7 customer support to assist you with any queries or concerns. The support team is highly responsive and knowledgeable, ensuring that you receive timely assistance throughout your tax filing journey.