How Long To Keep Taxes

Tax records are an essential part of personal and business financial management. They serve as a crucial tool for maintaining compliance with tax authorities, providing historical financial data, and facilitating accurate tax filing. However, the question of how long to retain these records is a critical one, and the answer depends on various factors and regulations.

Understanding Tax Record Retention: A Comprehensive Guide

Tax record retention is a fundamental aspect of tax compliance and financial management. It involves maintaining records of financial transactions, receipts, invoices, and other documents related to tax obligations. These records are essential for several reasons, including:

- Compliance with tax laws: Tax authorities, such as the Internal Revenue Service (IRS) in the United States, require individuals and businesses to keep accurate records to support their tax filings.

- Historical financial data: Tax records provide a comprehensive view of financial activities over time, enabling businesses and individuals to track their financial health, identify trends, and make informed decisions.

- Audit preparation: In the event of an audit, tax records are vital for substantiating income, expenses, and deductions claimed on tax returns. Proper record retention can significantly ease the audit process.

- Accurate tax filing: Tax records ensure that tax returns are accurate and complete, reducing the risk of errors, penalties, and legal issues.

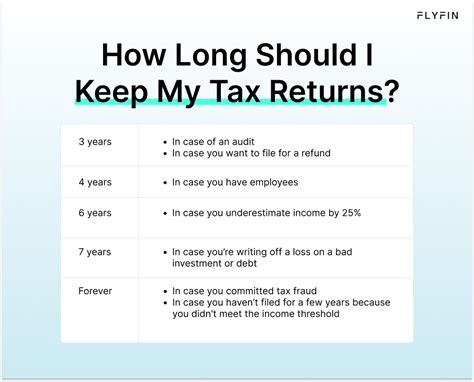

The duration for which tax records should be kept varies based on the type of record, the taxpayer's status (individual or business), and the specific tax jurisdiction. Understanding these variations is crucial for effective tax record management.

Tax Record Retention Periods for Individuals

For individuals, the retention period for tax records generally depends on the type of tax return filed and the nature of the income and expenses reported. Here are some key guidelines:

| Tax Record Type | Recommended Retention Period |

|---|---|

| Tax Returns (1040, etc.) | Generally, individuals should keep federal income tax returns and supporting documents for at least 3 years after the tax return due date or the date of filing, whichever is later. |

| W-2 Forms (Income Statements) | W-2 forms should be retained for at least 3 years. However, it's recommended to keep them indefinitely as they provide a record of employment history and income. |

| 1099 Forms (Income from Self-Employment, Interest, Dividends, etc.) | Similar to W-2 forms, 1099s should be retained for at least 3 years, but keeping them indefinitely is beneficial for tracking income sources. |

| Expense Records (Receipts, Invoices) | Expense records should be kept for at least 3 years to support deductions claimed on tax returns. However, it's advisable to retain them longer, especially if there's a chance of an audit. |

| Property Records (Real Estate, Vehicles) | Records of property ownership and transactions should be retained indefinitely. These records are essential for calculating capital gains or losses and providing proof of ownership. |

It's important to note that the 3-year retention period is a general guideline. In certain cases, such as if there is a substantial underreporting of income, the IRS can assess taxes for up to 6 years. Additionally, if an individual fails to file a tax return or files a fraudulent return, there is no time limit for the IRS to assess taxes.

Tax Record Retention for Businesses

Businesses, whether sole proprietorships, partnerships, or corporations, have more complex tax record retention requirements. These requirements vary based on the type of business, the nature of its operations, and the tax jurisdictions it operates within. Here are some key considerations:

Federal Tax Record Retention for Businesses

For federal tax purposes in the United States, businesses are generally required to keep records for at least 3 years from the date the tax return was due or the date it was filed, whichever is later. This applies to most business tax records, including:

- Income statements (Forms 1065, 1120, etc.)

- Expense records (invoices, receipts)

- Asset records (purchase and sale documentation)

- Payroll records

- Financial statements

However, there are certain exceptions and extended retention periods for specific records. For example, records related to bad debts, securities, options, and certain capital gains may need to be retained for up to 7 years.

State and Local Tax Record Retention

State and local tax jurisdictions also have their own record retention requirements. These can vary significantly, and businesses must ensure compliance with the regulations in each state they operate in. For instance, some states may require businesses to retain records for 4 years or more.

Business Tax Records for Audits

In the event of an audit, businesses must be prepared to provide tax records dating back several years. The IRS has the authority to assess taxes for up to 6 years if there is substantial underreporting of income, and there is no time limit for assessing taxes in cases of fraud or failure to file.

Digital vs. Physical Record Retention

With the increasing use of digital records, businesses must also consider the storage and security of electronic tax records. The IRS accepts digital records as long as they are accurate, complete, and accessible. Businesses should ensure that their digital record-keeping systems are reliable and secure.

Best Practices for Tax Record Retention

To ensure effective tax record retention, individuals and businesses can follow these best practices:

- Organize Records: Keep tax records organized and easily accessible. Consider using digital tools or cloud storage for efficient organization.

- Scan and Digitize: For physical records, scan and digitize them to create a backup and improve accessibility. This is especially useful for long-term retention.

- Secure Storage: Store tax records in a secure location, whether physically or digitally. Ensure that digital records are protected with strong passwords and encryption.

- Regular Review: Periodically review tax records to ensure accuracy and completeness. This practice helps identify any missing or incorrect information.

- Retain Beyond Minimums: While the minimum retention periods are a guideline, it's often beneficial to retain records longer, especially for complex transactions or potential audit scenarios.

The Impact of Technology on Tax Record Retention

Advancements in technology have significantly influenced the way tax records are managed and retained. The shift from physical to digital records has brought about several advantages and considerations:

Advantages of Digital Tax Record Management

Digital tax record management offers several benefits, including:

- Enhanced Accessibility: Digital records can be accessed from anywhere with an internet connection, making it easier for taxpayers and tax professionals to collaborate and review records.

- Improved Organization: Digital tools and cloud storage solutions provide robust organization systems, making it simpler to categorize and retrieve specific records.

- Space Efficiency: Physical storage space for tax records is no longer a constraint. Digital records require minimal physical space, reducing storage costs.

- Enhanced Security: While digital records can be vulnerable to cyber threats, proper security measures such as encryption and secure storage can mitigate these risks.

- Automatic Backup: Many digital storage solutions offer automatic backup features, ensuring that records are protected against data loss.

Considerations for Digital Tax Record Retention

Despite the advantages, there are also considerations to keep in mind when transitioning to digital tax record retention:

- Data Security: Tax records contain sensitive financial information, making them a prime target for cybercriminals. Businesses and individuals must invest in robust security measures to protect digital records.

- Record Retention Policies: With digital records, it's crucial to have clear policies in place for record retention, deletion, and access control. These policies should align with legal and regulatory requirements.

- Technology Obsolescence: Digital records can become inaccessible if the technology used to create or store them becomes obsolete. Businesses should plan for technology upgrades and ensure data migration when necessary.

- Legal and Regulatory Compliance: Digital tax record retention must comply with legal and regulatory requirements, including data privacy laws and tax record retention guidelines.

The Future of Tax Record Retention

As technology continues to advance, the future of tax record retention is likely to be shaped by further digitalization and automation. Here are some potential trends and developments:

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) technologies are already being used to automate various aspects of tax record management, such as data extraction and categorization. In the future, these technologies could play a more significant role in tax record retention, offering advanced search and retrieval capabilities and even predictive analytics to identify potential issues or anomalies in tax records.

Blockchain Technology

Blockchain, a distributed ledger technology, has the potential to revolutionize tax record retention by providing a secure and transparent way to store and share financial data. Blockchain-based solutions could enhance data security, reduce the risk of fraud, and streamline the audit process by providing an immutable record of financial transactions.

Cloud-Based Solutions

Cloud-based tax record management systems are expected to become even more prevalent, offering scalable and secure storage solutions. These systems can provide real-time collaboration, advanced search capabilities, and seamless integration with tax preparation software, making tax record management more efficient and accessible.

Increased Automation

Automation technologies, such as robotic process automation (RPA) and optical character recognition (OCR), are likely to play a more significant role in tax record retention. These technologies can automate the extraction and digitization of tax records, reducing manual effort and minimizing errors.

Data Privacy and Security

With the increasing focus on data privacy and security, tax record retention solutions will need to prioritize these aspects. This includes implementing robust encryption protocols, access controls, and data protection measures to safeguard sensitive financial information.

Conclusion

Tax record retention is a critical aspect of financial management, and understanding the recommended retention periods and best practices is essential for individuals and businesses. With the rapid pace of technological advancement, the future of tax record retention is likely to be shaped by digital transformation, automation, and enhanced security measures. By staying informed and adopting these advancements, taxpayers can ensure compliance, ease the tax filing process, and mitigate the risks associated with tax record management.

FAQ

How long should I keep my tax records as an individual?

+

As an individual, you should generally keep your tax records for at least 3 years from the due date or filing date of your tax return, whichever is later. However, it’s recommended to keep certain records, such as W-2 and 1099 forms, indefinitely for a comprehensive financial history.

What happens if I don’t keep my tax records for the recommended period?

+

If you fail to keep your tax records for the recommended period, you may face challenges in case of an audit. The IRS or tax authorities can assess additional taxes or penalties if they find discrepancies in your records. It’s essential to maintain accurate and complete tax records to avoid such issues.

Can I destroy my tax records after the recommended retention period?

+

While you can destroy tax records after the recommended retention period, it’s advisable to keep certain records indefinitely. This includes records related to property ownership, significant financial transactions, and long-term investments. These records can provide valuable historical data and support your financial planning.