Dallas County Real Estate Taxes

Understanding the intricacies of real estate taxes is essential for homeowners and property investors, especially in dynamic markets like Dallas County. This comprehensive guide will delve into the specifics of Dallas County real estate taxes, providing valuable insights for those navigating the local property landscape.

The Fundamentals of Dallas County Real Estate Taxes

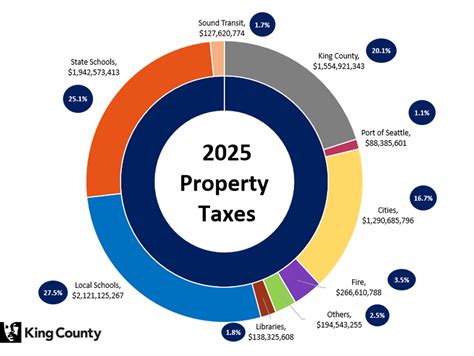

Dallas County, located in the heart of Texas, boasts a vibrant real estate market characterized by diverse property types and a robust economy. The county’s real estate tax system plays a pivotal role in funding essential public services and infrastructure, making it a crucial aspect for both residents and businesses.

Real estate taxes, often referred to as property taxes, are a significant source of revenue for local governments, including counties like Dallas. These taxes are levied on the assessed value of properties, which can include residential homes, commercial buildings, and land. The revenue generated from these taxes is used to support a wide range of public services, from schools and emergency services to road maintenance and public transportation.

In Dallas County, the real estate tax system is designed to ensure fair and equitable taxation. The county employs a team of professional assessors who are responsible for determining the value of each property within its boundaries. This value, known as the assessed value, forms the basis for calculating the real estate taxes owed by property owners.

Assessed Value and Tax Rates

The assessed value of a property is determined through a meticulous process that takes into account various factors, including:

- Market Value: The current market value of the property is a key consideration. Assessors analyze recent sales of similar properties in the area to establish a fair market value for each individual property.

- Property Characteristics: The physical attributes of the property, such as its size, age, condition, and any improvements made, are also assessed. These factors can significantly impact the property's value.

- Location: The property's location within the county is crucial. Different areas may have varying property values due to factors like proximity to schools, amenities, and economic opportunities.

Once the assessed value is determined, it is subjected to a tax rate to calculate the actual tax liability. The tax rate is set annually by the Dallas County Commissioners Court and is expressed as a percentage of the assessed value. This rate is applied uniformly across all properties within the county, ensuring fairness and consistency.

| Tax Rate Components | Description |

|---|---|

| Maintenance and Operations Tax Rate | This rate funds the general operations of the county government and is used to maintain essential services. |

| Interest and Sinking (I&S) Tax Rate | This rate is dedicated to paying off the county's bonded indebtedness, such as bonds issued for infrastructure projects. |

| Additional Rates (if applicable) | Some counties may have additional tax rates for specific purposes, such as supporting local school districts or funding transportation improvements. |

The Tax Bill

Property owners in Dallas County receive an annual tax bill, which outlines the assessed value of their property, the applicable tax rates, and the resulting tax liability. This bill provides a detailed breakdown of how the taxes are calculated and allocated.

The tax bill is typically due by a specific deadline, and property owners have the option to pay in full or choose an installment plan. Late payments may incur penalties and interest, so it's important for homeowners to stay informed about payment deadlines and options.

Exemptions and Discounts

Dallas County offers various exemptions and discounts to eligible property owners, helping to reduce their tax liability. These exemptions are designed to provide relief to specific groups and encourage certain behaviors that benefit the community.

Residential Homestead Exemption

One of the most significant exemptions available is the Residential Homestead Exemption. This exemption is granted to homeowners who use their property as their primary residence. By qualifying for this exemption, homeowners can reduce the taxable value of their property, resulting in lower real estate taxes.

To qualify for the Residential Homestead Exemption, property owners must meet certain criteria, including:

- Ownership: The property must be owned by the applicant and used as their principal residence.

- Occupancy: The applicant must reside in the property for at least six months out of the year.

- Application: Homeowners must submit an application to the Dallas County Appraisal District (DCAD) by a specified deadline.

The amount of exemption varies depending on the county and the homeowner's qualifications. In Dallas County, the exemption can significantly reduce the taxable value of a property, providing substantial savings on real estate taxes.

Other Exemptions and Discounts

In addition to the Residential Homestead Exemption, Dallas County offers several other exemptions and discounts to eligible property owners, including:

- Over-65 Exemption: Property owners who are 65 years or older and meet certain income requirements may qualify for this exemption, which can further reduce their taxable value.

- Disabled Veteran Exemption: Disabled veterans may be eligible for an exemption on a portion of their property's value, helping to ease their tax burden.

- Early Payment Discount: Property owners who pay their taxes early may be eligible for a discount, encouraging prompt payment and providing a financial incentive.

Appealing Property Assessments

In some cases, property owners may disagree with the assessed value of their property, believing it to be inaccurate or unfair. Dallas County provides a process for property owners to challenge their property assessments and seek a reduction in their taxable value.

The Protest Process

To initiate a protest, property owners must submit a written notice to the Dallas County Appraisal Review Board (ARB) within a specified timeframe. This notice should outline the reasons for the protest, providing evidence to support the claim that the assessed value is incorrect.

The ARB is an independent board responsible for hearing and deciding protests. It consists of local citizens who are appointed by the Dallas County Commissioners Court. The board's primary function is to ensure that property assessments are fair and accurate, resolving disputes between property owners and the appraisal district.

Evidence and Hearing

During the protest process, property owners have the opportunity to present evidence supporting their claim. This may include recent sales data of similar properties, professional appraisals, or other relevant information. The ARB carefully considers all evidence presented and may request additional information or conduct a physical inspection of the property.

Once the evidence has been reviewed, the ARB schedules a hearing where property owners can present their case. This hearing provides an opportunity for property owners to explain their concerns and answer any questions the board may have. It's essential for property owners to prepare thoroughly for the hearing, ensuring they have a strong case and all necessary documentation.

ARB Decision

After carefully considering the evidence and hearing the property owner’s case, the ARB makes a decision on the protest. The board can:

- Approve the protest and reduce the assessed value.

- Deny the protest, leaving the original assessed value unchanged.

- Approve a partial protest, reducing the assessed value by a certain amount.

The ARB's decision is final and binding, unless further appeal is pursued through the courts. Property owners who are dissatisfied with the ARB's decision have the right to appeal to the District Court, where they can present their case before a judge.

Real Estate Tax Payment Options and Deadlines

Dallas County offers various payment options and deadlines for property owners to settle their real estate tax liabilities. Understanding these options and staying informed about payment deadlines is crucial to avoid penalties and ensure timely payment.

Payment Options

Property owners in Dallas County have several convenient payment options to choose from:

- Online Payment: The Dallas County Tax Office provides an online payment portal, allowing property owners to pay their taxes securely using a credit card, debit card, or electronic check. This option is available 24/7 and provides a quick and convenient way to settle tax liabilities.

- Mail-in Payment: Property owners can also pay their taxes by mailing a check or money order to the Dallas County Tax Office. It's important to include the correct tax statement and ensure the payment is received before the deadline to avoid late fees.

- In-Person Payment: For those who prefer a more traditional method, in-person payments can be made at the Dallas County Tax Office during regular business hours. This option allows property owners to pay their taxes using cash, check, or money order.

Payment Deadlines

Dallas County has established specific deadlines for real estate tax payments to ensure a smooth and efficient tax collection process. Missing these deadlines can result in penalties and interest charges, so it’s crucial for property owners to stay informed and plan their payments accordingly.

The tax year in Dallas County runs from January 1 to December 31. Property owners receive their tax bills by mail, typically in late October or early November. The tax bill outlines the total amount due, the payment deadline, and any applicable penalties for late payments.

The standard deadline for real estate tax payments in Dallas County is January 31 of the following year. However, to encourage early payment and provide some flexibility, the county offers a discount period during which property owners can pay their taxes at a reduced rate. The discount period usually runs from October 1 to January 31, with the exact discount varying depending on the payment date.

For example, if a property owner pays their taxes during the early discount period (typically from October 1 to November 30), they may be eligible for a 5% discount on the total tax liability. Paying during the regular discount period (December 1 to January 31) may result in a slightly lower discount, typically around 3%.

After the discount period ends, property owners who have not paid their taxes in full may incur a penalty. The penalty is calculated as a percentage of the unpaid tax amount and is applied on February 1 of the following year. It's important to note that the penalty is in addition to any interest that may accrue on the unpaid balance.

Penalty and Interest Charges

Late payments of real estate taxes in Dallas County can result in penalty and interest charges. These charges are designed to discourage late payments and ensure timely revenue collection for the county.

The penalty for late payments is typically calculated as a percentage of the unpaid tax amount. For example, a common penalty rate is 5% of the unpaid balance for each month the payment is overdue. However, it's important to note that the penalty rate can vary depending on local regulations and the specific circumstances.

In addition to the penalty, interest may also accrue on the unpaid balance. The interest rate is usually set by the Dallas County Commissioners Court and is applied on a monthly basis. Interest charges can quickly add up, so it's crucial for property owners to pay their taxes on time to avoid these additional expenses.

Installment Payment Plans

Recognizing that some property owners may face financial challenges, Dallas County offers installment payment plans to help manage real estate tax liabilities. These plans allow property owners to spread their tax payments over multiple installments, making it more manageable to settle their tax obligations.

To enroll in an installment payment plan, property owners typically need to meet certain criteria, such as having a valid tax bill and being current with any previous tax obligations. The Dallas County Tax Office may require a down payment and set specific terms and conditions for the plan, including the number of installments and any associated fees.

It's important for property owners to carefully review the terms of the installment payment plan and ensure they can meet the agreed-upon payments. Failing to make timely payments under the plan can result in penalties and interest, similar to late payments of the full tax amount.

Dallas County Real Estate Tax Calculator

To assist property owners in estimating their real estate tax liabilities, Dallas County provides a real estate tax calculator. This user-friendly tool allows homeowners and investors to input key information about their property, such as the assessed value and applicable tax rates, to calculate an estimated tax amount.

The tax calculator is a valuable resource for property owners who want to budget effectively and plan their finances. It provides a quick and convenient way to estimate tax liabilities, helping individuals understand the financial implications of owning property in Dallas County.

While the tax calculator offers a useful estimate, it's important to note that the actual tax liability may vary based on individual circumstances and any applicable exemptions or discounts. Property owners should always refer to their official tax bill for the most accurate and up-to-date information regarding their real estate taxes.

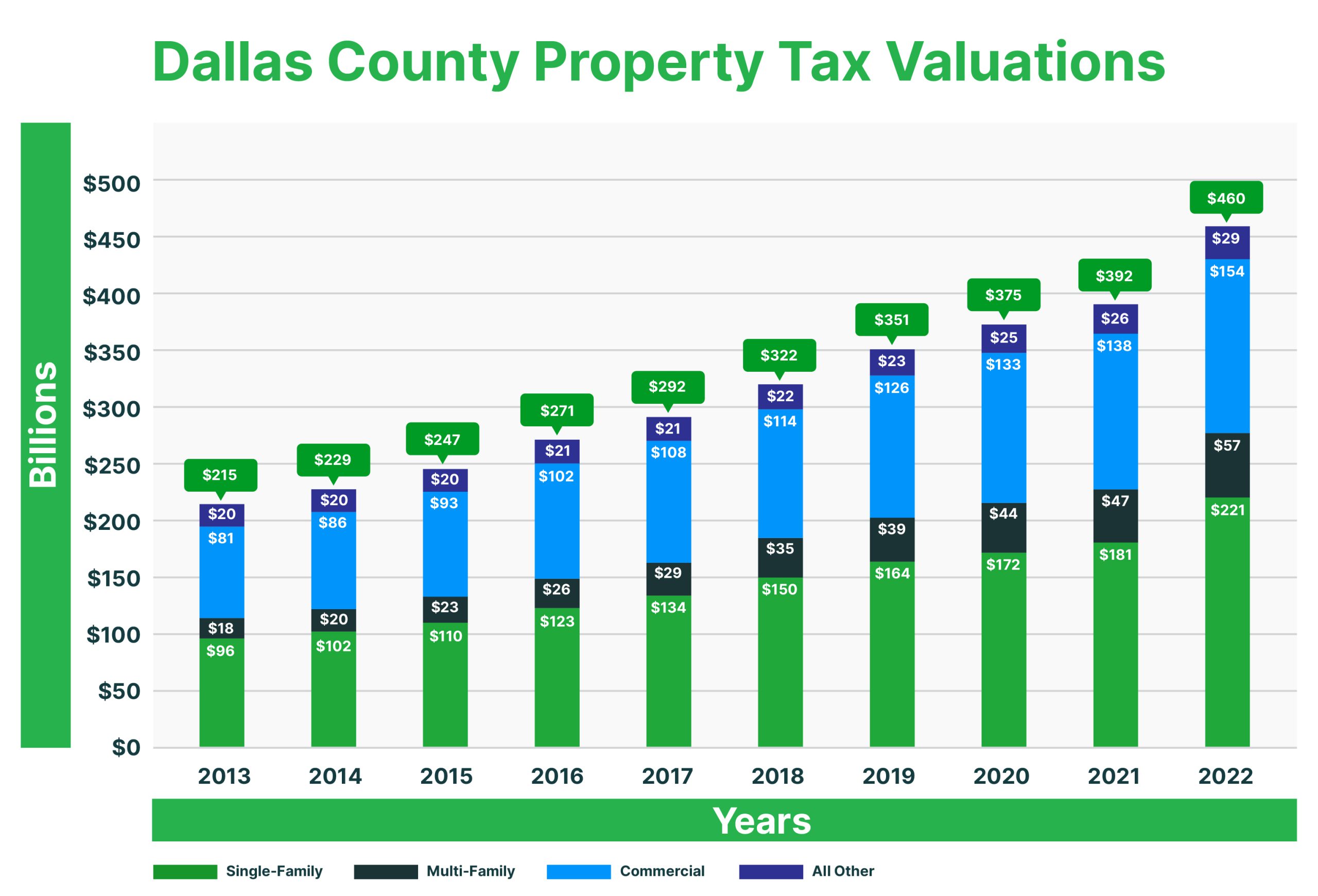

Understanding the Impact of Real Estate Taxes on Property Values

Real estate taxes play a significant role in shaping the overall property landscape in Dallas County. These taxes not only fund essential public services but also have a direct impact on property values and market trends.

Property Value and Tax Burden

In a market like Dallas County, where real estate is in high demand, property values can fluctuate based on various factors, including the tax burden. Higher tax rates can make properties less attractive to buyers, potentially impacting their resale value.

On the other hand, lower tax rates can stimulate the real estate market, making properties more affordable and desirable. This can lead to increased demand and potentially higher property values over time. Property owners should carefully consider the tax implications when making investment decisions and planning their financial strategies.

Market Trends and Tax Policy

Dallas County’s real estate market is influenced by a range of factors, including economic conditions, population growth, and tax policies. Changes in tax rates or the introduction of new exemptions can have a direct impact on market trends and investor behavior.

For example, if the county decides to implement a tax incentive program to attract new businesses or encourage homeownership, it can stimulate the real estate market. Conversely, increases in tax rates or the removal of certain exemptions may lead to a slowdown in the market as buyers and investors reassess their financial commitments.

Property owners and investors should stay informed about local tax policies and market trends to make informed decisions. Understanding the interplay between real estate taxes and property values is crucial for long-term financial planning and investment strategies.

Navigating the Dallas County Real Estate Market

The Dallas County real estate market offers a diverse range of opportunities for homeowners and investors. From vibrant urban neighborhoods to suburban enclaves and rural retreats, the county caters to various lifestyles and preferences.

Residential Real Estate

Dallas County boasts a thriving residential real estate market, with a wide array of housing options. Whether you’re a first-time homebuyer, a growing family, or a retiree, the county has something to offer. From cozy apartments in the city center to spacious single-family homes in suburban communities, the options are vast.

The residential real estate market in Dallas County is characterized by its dynamism and resilience. Despite occasional market fluctuations, the demand for housing remains strong, driven by a growing population, a robust job market, and a thriving economy. This makes Dallas County an attractive destination for homebuyers seeking stability and opportunity.

Commercial Real Estate

In addition to its vibrant residential market, Dallas County is also a hub for commercial real estate. The county is home to a diverse range of businesses, from small startups to multinational corporations. This diverse business landscape creates a strong demand for commercial properties, including office spaces, retail outlets, and industrial facilities.

The commercial real estate market in Dallas County is influenced by factors such as economic growth, industry trends, and population dynamics. As the county's economy continues to thrive, with a focus on sectors like technology, healthcare, and finance, the demand for commercial spaces is expected to remain robust. This makes Dallas County an attractive investment destination for commercial real estate investors.

Land and Development Opportunities

Dallas County offers a wealth of opportunities for land development and investment. The county’s strategic location, strong infrastructure, and favorable business environment make it an ideal place for businesses and developers to establish a presence.

Whether you're interested in developing residential communities, commercial hubs, or industrial parks, Dallas County provides the necessary resources and support. The county's comprehensive land use plans and zoning regulations ensure a balanced approach to development, promoting sustainable growth while preserving the natural environment.

Real Estate Investment Strategies

For investors looking to enter the Dallas County real estate market, a strategic approach is key. Here are some investment strategies to consider:

- Buy-and-Hold: This strategy involves purchasing properties with the intention of holding them for the long term, often as rental properties. It can provide a steady stream of income and potential capital appreciation over time.

- Fix-and-Flip: This strategy focuses on acquiring properties at a discounted price, making necessary renovations, and