Supplemental Tax Bill

Navigating the intricacies of the tax system can be a complex and often daunting task, especially when unexpected bills arrive. In the world of taxes, a Supplemental Tax Bill can catch taxpayers off guard, leading to a multitude of questions and concerns. This comprehensive guide aims to demystify the concept of a Supplemental Tax Bill, providing a detailed analysis of its nature, implications, and strategies for effective management.

Understanding Supplemental Tax Bills

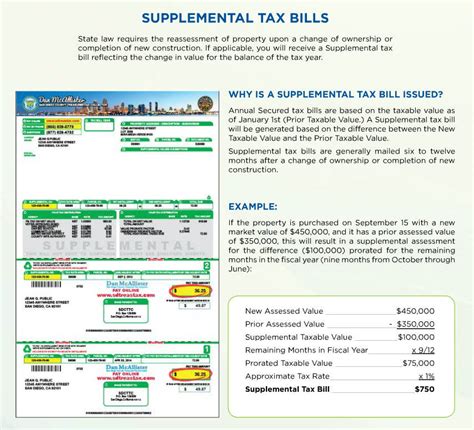

A Supplemental Tax Bill, also known as a supplementary tax assessment, is an additional tax obligation issued by tax authorities when a property's assessed value increases during the tax year. This assessment can occur for various reasons, such as improvements made to the property, changes in market value, or reassessments triggered by specific events. It is important to note that Supplemental Tax Bills are separate from the regular property tax bills and are often issued after the initial tax year has begun.

The primary purpose of Supplemental Tax Bills is to ensure that taxpayers pay their fair share of taxes based on the current value of their property. Tax authorities use various methods, including market analysis, property inspections, and reassessment programs, to determine the increased value and calculate the additional tax owed. These bills are typically issued annually or semi-annually and are calculated based on the specific jurisdiction's tax rates and assessment methodologies.

Common Causes of Supplemental Tax Bills

There are several common scenarios that can lead to the issuance of a Supplemental Tax Bill. These include:

- Property Improvements: Any significant improvements made to a property, such as additions, renovations, or upgrades, can trigger a reassessment. This is because improvements often increase the property's market value, leading to a higher tax assessment.

- Market Value Fluctuations: Even without any physical changes, the value of a property can fluctuate based on the real estate market. If the market value of a property increases significantly, tax authorities may reassess it to align with the current market conditions.

- Reassessment Programs: Many jurisdictions conduct periodic reassessments to ensure that property values are accurately reflected in the tax system. These reassessments can result in Supplemental Tax Bills if the property's value has increased since the last assessment.

- Change of Ownership: In some cases, a Supplemental Tax Bill may be issued when a property changes ownership. This is to ensure that the new owner is taxed based on the property's current value.

Impact and Implications

The arrival of a Supplemental Tax Bill can have several implications for taxpayers. Here are some key considerations:

Financial Impact

The most immediate concern for taxpayers is the financial burden associated with Supplemental Tax Bills. These bills often require immediate payment, adding to the regular property tax obligations. The additional tax amount can vary significantly depending on the jurisdiction, the property's value, and the specific circumstances leading to the reassessment.

| Jurisdiction | Average Supplemental Tax Bill Amount |

|---|---|

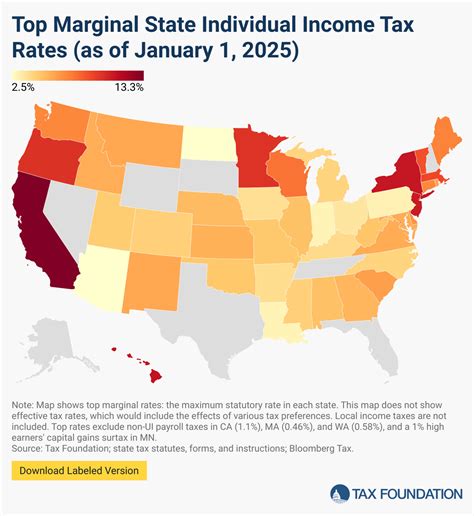

| California | $1,500 - $3,000 |

| New York | $800 - $1,200 |

| Texas | $500 - $1,000 |

It's important to note that these averages are just estimates and the actual amount can vary widely based on individual circumstances.

Legal and Administrative Processes

Supplemental Tax Bills are accompanied by specific legal and administrative processes. Taxpayers have the right to understand the basis of the assessment and may request a review or appeal if they believe the assessment is inaccurate or unfair. This process typically involves providing evidence, such as appraisals or market data, to support their case.

Impact on Property Owners

For property owners, Supplemental Tax Bills can have long-term implications. An increased tax assessment may lead to higher property taxes for subsequent years. Additionally, the reassessment can affect the property's market value, which may impact future sale or refinancing prospects.

Strategies for Management

When faced with a Supplemental Tax Bill, taxpayers have several strategies to consider:

Appeal Process

If a taxpayer believes the Supplemental Tax Bill is incorrect or unfair, they can initiate an appeal process. This typically involves gathering evidence, such as recent appraisals, market data, or expert opinions, to support their case. It's crucial to understand the appeal deadlines and requirements specific to the jurisdiction.

Payment Options

Taxpayers should explore payment options to manage the financial burden of Supplemental Tax Bills. Many jurisdictions offer installment plans or payment arrangements to help taxpayers spread out the payment over a period of time. Additionally, taxpayers can consider using tax savings strategies, such as deducting the additional tax amount from their federal or state income tax returns, to mitigate the financial impact.

Long-Term Planning

To avoid surprises, property owners should stay informed about their property's value and potential reassessment triggers. Regularly monitoring the real estate market and keeping records of any improvements or changes made to the property can help in anticipating potential Supplemental Tax Bills. Additionally, staying informed about local tax laws and assessment practices can empower taxpayers to plan and budget effectively.

Frequently Asked Questions

Can I avoid Supplemental Tax Bills by not making improvements to my property?

+

While avoiding improvements may reduce the likelihood of a Supplemental Tax Bill, it’s important to note that tax authorities can reassess properties based on various factors, including market value fluctuations. However, by keeping records of improvements and understanding local tax laws, you can be better prepared for potential reassessments.

Are Supplemental Tax Bills always issued annually?

+

No, the frequency of Supplemental Tax Bill issuance varies by jurisdiction. Some jurisdictions issue them annually, while others may issue them semi-annually or based on specific triggers. It’s crucial to understand your local tax assessment schedule to anticipate potential Supplemental Tax Bills.

What happens if I don’t pay a Supplemental Tax Bill on time?

+

Failing to pay a Supplemental Tax Bill on time can result in penalties, interest, and potentially legal consequences. It’s important to understand the payment deadlines and explore available payment options to avoid additional financial burdens.

Can I dispute a Supplemental Tax Bill if I disagree with the assessment?

+

Yes, taxpayers have the right to dispute Supplemental Tax Bills if they believe the assessment is inaccurate or unfair. The process typically involves gathering evidence and following the appeal procedures specific to your jurisdiction. It’s essential to understand the appeal deadlines and requirements to ensure a successful dispute.

Are there any tax benefits associated with Supplemental Tax Bills?

+

In some cases, taxpayers may be able to deduct the additional tax amount from their federal or state income tax returns, providing a potential tax benefit. However, the deductibility of Supplemental Tax Bills depends on individual tax situations and applicable tax laws. Consulting a tax professional can help determine any potential tax advantages.