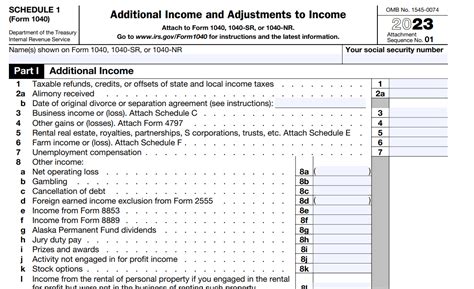

What Is Schedule 1 Tax Form

The Schedule 1 tax form, officially known as the "Form 1040-Schedule 1: Additional Income and Adjustments to Income," is an important component of the U.S. federal tax system. It serves as a critical tool for taxpayers to report various sources of income and adjustments to their taxable income, ensuring a comprehensive and accurate tax filing process. This article aims to provide an in-depth exploration of Schedule 1, shedding light on its purpose, contents, and implications for individual taxpayers.

Understanding the Purpose of Schedule 1

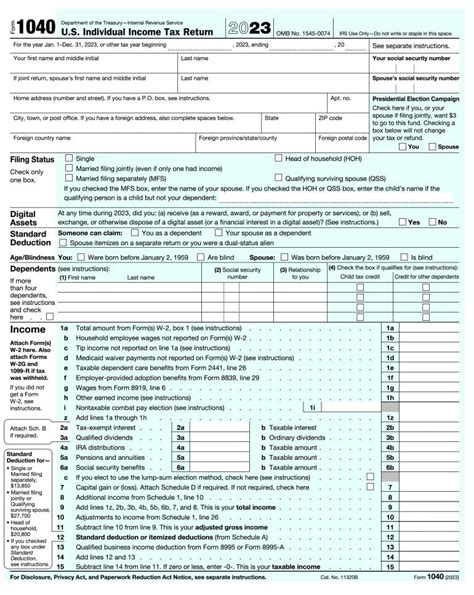

Schedule 1 is an integral part of the IRS Form 1040, which is the standard tax return form used by most U.S. individual taxpayers. It was introduced as part of the Tax Cuts and Jobs Act (TCJA) in 2017, and its primary function is to provide a dedicated space for taxpayers to disclose additional sources of income and certain deductions that do not fit within the main Form 1040.

The need for Schedule 1 arises from the complexity of modern tax laws, which encompass a wide range of income types and tax adjustments. By separating these additional income sources and adjustments, taxpayers can ensure a more organized and transparent tax filing process. This separation also allows the IRS to better understand and assess the financial situations of individual taxpayers, promoting fairness and accuracy in the tax system.

Key Components of Schedule 1

Schedule 1 consists of several sections, each designed to capture specific types of income and adjustments. Here’s a breakdown of its key components:

Additional Income

This section of Schedule 1 is dedicated to reporting various forms of income that are not typically included in the main Form 1040. These may include:

- Alimony Received: If you received alimony payments, they are generally taxable and must be reported here.

- Capital Gains: Capital gains from the sale of assets, such as stocks or real estate, are often subject to taxation and should be disclosed.

- Gambling Winnings: Any gambling winnings exceeding $600 or a smaller amount from a single gaming establishment must be reported as additional income.

- Other Income: This includes miscellaneous sources of income, such as rental income, royalties, or income from a side business.

Adjustments to Income

Adjustments to income are deductions that reduce your taxable income. Schedule 1 provides a space to report these adjustments, which can significantly impact your overall tax liability. Some common adjustments include:

- Student Loan Interest Deduction: If you paid interest on a qualifying student loan, you may be eligible for this deduction, which can reduce your taxable income.

- Tuition and Fees Deduction: Taxpayers can deduct qualified education expenses, including tuition and certain fees, up to a certain limit.

- IRA Contributions: Contributions to an Individual Retirement Account (IRA) can be deducted from your taxable income, encouraging savings for retirement.

- Self-Employment Tax: If you are self-employed, you must pay self-employment tax, which is reported as an adjustment to income.

Other Adjustments and Deductions

Schedule 1 also includes space for various other adjustments and deductions, such as:

- Moving Expenses: Taxpayers who relocate for work-related reasons may be able to deduct certain moving expenses.

- Health Savings Account (HSA) Deductions: Contributions to a Health Savings Account can be deducted from taxable income, encouraging health-related savings.

- Self-Employed Health Insurance: Self-employed individuals can deduct health insurance premiums paid for themselves and their families.

Completing Schedule 1: A Step-by-Step Guide

Completing Schedule 1 accurately is crucial to ensure you pay the correct amount of tax and avoid potential penalties. Here’s a simplified step-by-step guide to help you navigate the process:

- Gather Necessary Documents: Collect all relevant documents related to your additional income and adjustments, such as W-2 forms, 1099 forms, and receipts for eligible expenses.

- Determine Additional Income: Calculate and record all sources of additional income as outlined earlier. Be sure to include all applicable forms and amounts.

- Calculate Adjustments: Compute the adjustments to your income. This may involve referring to IRS guidelines and publications for specific instructions on calculating deductions.

- Transfer to Form 1040: Once you've completed Schedule 1, transfer the total additional income and adjustments to the appropriate lines on your Form 1040. This ensures that your additional income and adjustments are correctly factored into your overall tax calculation.

- Review and Sign: Carefully review your completed Schedule 1 and Form 1040 to ensure accuracy. Sign and date your tax return before submitting it to the IRS.

Schedule 1 and Tax Strategy

Schedule 1 can be a powerful tool in your tax planning strategy. By understanding the types of income and adjustments that fall under Schedule 1, you can make informed decisions to optimize your tax position. For instance, if you’re considering investing in a side business or real estate, understanding the tax implications on Schedule 1 can help you make more strategic financial decisions.

Additionally, keeping thorough records of your additional income and adjustments can be advantageous. These records can provide a clear picture of your financial activities and may be useful in supporting your tax filings or addressing any IRS inquiries.

Conclusion: Schedule 1’s Impact on Taxpayers

Schedule 1 plays a vital role in the U.S. tax system, ensuring that taxpayers accurately report all sources of income and eligible adjustments. Its introduction as part of the TCJA has streamlined the tax filing process, making it easier for taxpayers to disclose additional income and deductions. By providing a dedicated space for these items, Schedule 1 enhances transparency and fairness in the tax system.

As a taxpayer, understanding the intricacies of Schedule 1 is essential for accurate tax reporting and effective financial planning. By staying informed about the types of income and adjustments that require disclosure on Schedule 1, you can navigate the tax system with confidence and ensure compliance with IRS regulations.

How often do I need to use Schedule 1?

+You should use Schedule 1 whenever you have additional sources of income or adjustments to your taxable income that don’t fit within the main Form 1040. This may vary from year to year, depending on your financial activities and circumstances.

Can I file taxes without using Schedule 1?

+If you have no additional income or adjustments that require disclosure on Schedule 1, you may not need to use it. However, it’s important to review your financial situation carefully to ensure you’re not overlooking any relevant income or deductions.

What happens if I make a mistake on Schedule 1?

+Mistakes on Schedule 1 can lead to inaccurate tax calculations and potential penalties. It’s crucial to review your Schedule 1 carefully before filing. If you discover a mistake after filing, you can amend your tax return using Form 1040X.

Is Schedule 1 the only form I need to file taxes?

+No, Schedule 1 is just one part of the tax filing process. You will typically need to complete Form 1040 and potentially other schedules or forms depending on your specific financial situation and tax obligations.