Fairfax County Tax Records

Welcome to an in-depth exploration of the Fairfax County Tax Records, a comprehensive guide designed to offer a detailed understanding of this critical aspect of property ownership and management within the vibrant community of Fairfax County, Virginia.

Fairfax County, renowned for its diverse neighborhoods, robust economy, and exceptional quality of life, stands as a prominent destination for homeowners, investors, and businesses alike. The county's tax records play a pivotal role in shaping the local real estate market and overall economic landscape.

Understanding Fairfax County Tax Records

Fairfax County Tax Records serve as a detailed documentation of property ownership, value, and associated tax obligations within the county. These records are integral to the functioning of the local government, providing a foundation for revenue generation and enabling the provision of essential services to residents.

The tax records encompass a wealth of information, including property assessments, tax rates, and payment histories. They are a vital resource for homeowners, offering transparency and accountability in the tax assessment process. Additionally, these records are indispensable for investors and real estate professionals, providing insights into property values, trends, and potential investment opportunities.

Key Components of Fairfax County Tax Records

Fairfax County Tax Records consist of several crucial elements, each offering unique insights into property ownership and taxation:

- Property Assessments: These records detail the estimated value of each property within the county, determined through a comprehensive assessment process conducted by the Fairfax County Department of Taxation. The assessments take into account various factors, including property type, size, location, and recent sales data.

- Tax Rates: The tax rates applied to properties are established by the county government and are subject to annual adjustments. These rates, expressed as a percentage, determine the tax obligations for property owners.

- Tax Payment Histories: Tax records also maintain a detailed history of tax payments made by property owners. This information is vital for ensuring compliance and identifying any outstanding tax liabilities.

- Exemptions and Deductions: Fairfax County offers various tax exemptions and deductions to eligible property owners, such as homestead exemptions and tax credits. These provisions can significantly reduce tax obligations and are an essential aspect of the county's tax system.

The transparency and accessibility of Fairfax County Tax Records contribute to the county's reputation as a desirable place to live and invest. By providing comprehensive and up-to-date information, these records empower property owners and prospective buyers to make informed decisions, fostering a stable and prosperous community.

The Role of Technology in Fairfax County Tax Records

Fairfax County has embraced technological advancements to streamline the management and accessibility of tax records. The Fairfax County Online Tax Records Portal is a user-friendly platform that enables residents and professionals to access tax information quickly and conveniently.

Through this portal, users can retrieve detailed property assessments, view tax payment histories, and even estimate future tax obligations. The platform's advanced search functionality allows for precise queries, making it easier to research specific properties or compare tax data across the county.

The integration of technology into the tax records system has not only improved efficiency but has also enhanced transparency. Residents can now access their tax information securely and instantly, fostering trust and confidence in the county's tax processes.

Benefits of the Online Tax Records Portal

- Convenience and Accessibility: The portal provides 24/7 access to tax records, allowing users to retrieve information at their convenience without the need for physical visits to government offices.

- Real-Time Updates: Tax records are updated in real-time, ensuring that users have access to the most current and accurate information.

- Enhanced Transparency: The portal's transparent interface allows users to track changes in tax assessments, rates, and payments, promoting accountability and trust in the tax system.

- Efficient Research and Analysis: Advanced search features enable users to conduct in-depth research, compare properties, and analyze tax trends, benefiting real estate professionals, investors, and homeowners alike.

The adoption of digital technology for tax records management showcases Fairfax County's commitment to innovation and citizen-centric governance. By leveraging technology, the county has created a modern and efficient system that meets the needs of its diverse population.

Impact on Real Estate Market

Fairfax County Tax Records play a significant role in shaping the local real estate market. The transparency and accessibility of tax information contribute to a stable and competitive market environment, benefiting both buyers and sellers.

For buyers, access to detailed tax records provides valuable insights into property values and tax obligations. This information aids in making informed purchase decisions, ensuring that buyers are aware of the financial responsibilities associated with property ownership.

Sellers, on the other hand, benefit from the market's transparency, which encourages fair pricing and reduces the risk of overvaluation. The availability of tax records helps establish a level playing field, fostering trust and confidence among buyers and sellers.

Real Estate Investment Strategies

Fairfax County's tax records are a valuable resource for real estate investors. By analyzing historical tax data and trends, investors can identify high-growth areas, assess the financial viability of investment properties, and make strategic decisions.

The online tax records portal further enhances investment opportunities by providing real-time data and advanced analytical tools. Investors can track property values, tax rates, and payment histories, enabling them to identify undervalued properties and make timely investment moves.

The integration of tax records into investment strategies showcases the importance of data-driven decision-making in today's real estate market. Fairfax County's commitment to transparency and accessibility positions it as a prime destination for investors seeking a stable and prosperous environment.

Community Engagement and Transparency

Fairfax County's approach to tax records management reflects its commitment to community engagement and transparency. The county understands that an informed citizenry is crucial for a thriving and harmonious community.

By making tax records easily accessible, the county empowers residents to actively participate in the governance process. Citizens can review tax assessments, understand the allocation of tax revenues, and engage in meaningful conversations about the county's financial health.

Building Trust through Transparency

- Open Data Policy: Fairfax County adopts an open data policy, ensuring that a wide range of government data, including tax records, is accessible to the public.

- Educational Initiatives: The county organizes educational programs and workshops to help residents understand tax records, assessments, and their rights and responsibilities as property owners.

- Community Feedback: The county actively seeks feedback from residents on its tax records and assessment processes, incorporating their insights to improve transparency and fairness.

The emphasis on transparency and community engagement not only fosters trust but also encourages civic participation. Residents feel empowered to voice their concerns and contribute to the decision-making process, leading to a more responsive and accountable government.

Future Outlook and Innovations

Fairfax County continues to explore innovative ways to enhance its tax records management system. The county recognizes the potential of emerging technologies to further improve efficiency, accessibility, and transparency.

Potential future developments include the integration of artificial intelligence and machine learning algorithms to automate certain tax assessment processes, enhancing accuracy and reducing human error. Additionally, the county may explore blockchain technology to create an immutable and secure record-keeping system, further boosting trust and accountability.

Emerging Technologies and Their Impact

- Artificial Intelligence: AI-powered systems can analyze vast amounts of data, including property characteristics, market trends, and historical tax records, to provide more accurate assessments and predictions.

- Blockchain Technology: Implementing blockchain can create a decentralized and tamper-proof ledger for tax records, enhancing security and transparency while reducing the risk of fraud.

- Mobile Apps: Fairfax County could develop mobile applications to provide residents with on-the-go access to tax records, payment histories, and other relevant information.

As Fairfax County embraces these technological advancements, it positions itself at the forefront of modern governance, ensuring that its tax records system remains efficient, secure, and accessible to all.

Conclusion

Fairfax County Tax Records are a cornerstone of the county's robust and transparent governance system. Through a combination of comprehensive data, technological innovation, and community engagement, Fairfax County has created a model for effective tax management that benefits residents, investors, and the local economy.

As the county continues to evolve and adapt to technological advancements, its tax records system will remain a vital resource, shaping the community's future and contributing to its continued prosperity.

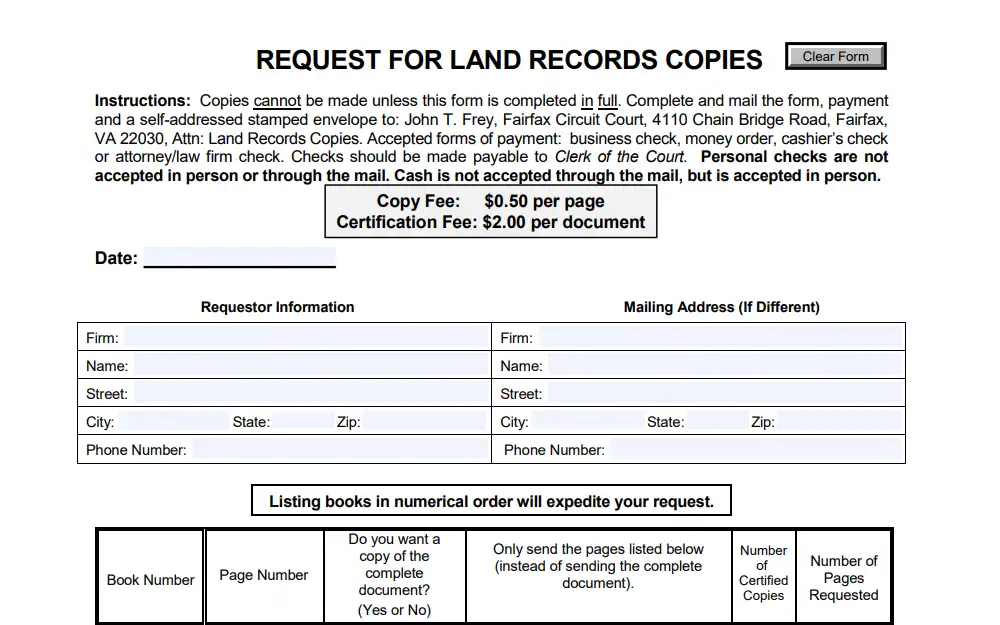

How can I access Fairfax County Tax Records online?

+

You can access Fairfax County Tax Records through the official Fairfax County Online Tax Records Portal. The portal provides a user-friendly interface for searching and retrieving tax information. You’ll need to provide the property’s address or parcel number to access specific records.

Are there any exemptions or deductions available for Fairfax County property owners?

+

Yes, Fairfax County offers several tax exemptions and deductions to eligible property owners. These include the Homestead Exemption, which reduces the assessed value of your primary residence, and Tax Credits for senior citizens and disabled individuals. You can find detailed information about these exemptions and their eligibility criteria on the county’s official website.

How often are property assessments conducted in Fairfax County?

+

Property assessments in Fairfax County are conducted annually. The Fairfax County Department of Taxation evaluates properties based on various factors to determine their assessed value. This process ensures that tax obligations are fair and aligned with the current market conditions.

Can I appeal my property assessment if I believe it is inaccurate?

+

Yes, Fairfax County provides a process for property owners to appeal their assessments if they believe the assessed value is incorrect. You can find detailed information about the appeal process, including deadlines and required documentation, on the Fairfax County Department of Taxation website.

How does Fairfax County use tax revenue, and what services does it provide to residents?

+

Fairfax County uses tax revenue to fund a wide range of essential services and infrastructure projects. These include public education, public safety, road maintenance, recreational facilities, and social services. The county’s comprehensive budget outlines how tax dollars are allocated to ensure the well-being and prosperity of its residents.