Tax Refund Usa Tourist

Tax refunds are an intriguing aspect of the US tax system, offering a unique opportunity for tourists and visitors to reclaim some of the taxes they pay during their stay. The process, however, can be complex and often requires a thorough understanding of the tax laws and regulations. In this comprehensive guide, we will delve into the intricacies of tax refunds for tourists in the USA, covering everything from eligibility to the practical steps involved.

Understanding Tax Refunds for Tourists in the USA

Tax refunds for tourists, also known as VAT refunds or sales tax refunds, are a mechanism through which non-residents can reclaim the taxes they pay on goods and services purchased in the United States. This refund system is designed to ensure that tourists do not face an additional financial burden due to the taxes imposed on retail purchases. The process involves several key steps, from eligibility assessment to the actual refund claim, and it is essential to understand these steps to maximize the benefits.

Eligibility Criteria for Tax Refunds

Not all tourists are eligible for tax refunds in the USA. The eligibility criteria primarily depend on the individual’s residence status, the duration of their stay, and the nature of their purchases. Here are the key eligibility requirements:

- Non-Resident Status: Individuals must be non-residents of the USA to qualify for tax refunds. This typically means that the person is not a US citizen, a permanent resident (Green Card holder), or an individual who has lived in the USA for a substantial period, such as 183 days or more in a given year.

- Minimum Purchase Requirements: There is usually a minimum purchase amount required to qualify for a tax refund. This threshold can vary by state and by retailer. For instance, in some states, purchases must exceed $100, while in others, the threshold could be higher or lower.

- Purchase Type: Tax refunds are typically available for tangible personal property, such as clothing, electronics, souvenirs, and other goods. Services, like hotel stays or restaurant meals, are generally not eligible for tax refunds.

- Timeframe: Tax refunds are often only available for purchases made within a specific timeframe before departure. This period can vary, but it is typically within the last 60 to 90 days before leaving the USA.

It's crucial to note that eligibility rules can differ significantly based on the state in which the purchase is made. Some states, like California and Texas, have well-established tax refund programs for tourists, while others may have more limited or no refund options. Therefore, it's essential to research the specific state's regulations before making purchases with the intention of claiming a refund.

Tax Refund Process: Step-by-Step Guide

Claiming a tax refund as a tourist in the USA involves a series of steps, which can be summarized as follows:

- Purchase with Tax Exemption: When making a purchase, tourists should inform the retailer that they intend to claim a tax refund. The retailer will then process the transaction without charging the applicable sales tax. This step is crucial as it sets the foundation for the refund process.

- Obtain a Tax Refund Form: Retailers typically provide tourists with a tax refund form or receipt that outlines the purchase details, including the amount of tax paid. This form is essential for the refund claim and should be carefully retained.

- Complete the Refund Application: Tourists must complete a tax refund application, which may be provided by the retailer or obtained from a tax refund service provider. This application requires detailed information about the purchase, including the date, location, and amount.

- Submit the Application: The completed application, along with the necessary supporting documents (such as the tax refund form or receipt), should be submitted to the appropriate tax authority or a tax refund service provider. The submission process can vary, and tourists should ensure they understand the specific requirements.

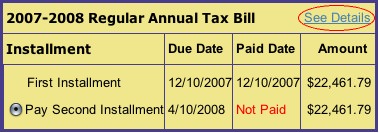

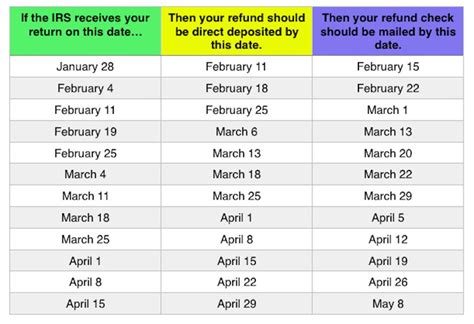

- Processing and Receipt of Refund: Once the application is submitted, it undergoes a processing period, which can take several weeks or even months. If the application is approved, the refund will be issued, typically through a bank transfer or a check.

It's important to note that the tax refund process can be more complex for certain purchases, such as those made online or via mail order. In such cases, tourists may need to provide additional documentation or follow specific procedures to qualify for a refund. Therefore, it is always advisable to consult with a tax professional or a tax refund service provider for accurate guidance.

Maximizing Tax Refunds: Strategies and Tips

Maximizing tax refunds requires a strategic approach and a good understanding of the tax system. Here are some tips to help tourists make the most of their tax refund opportunities:

- Plan Your Purchases: Tourists should plan their purchases strategically to maximize tax refunds. This includes understanding the eligibility criteria, minimum purchase requirements, and state-specific regulations. By doing so, they can ensure they are making eligible purchases and optimizing their refund potential.

- Research Retailers: Not all retailers participate in the tax refund program. Tourists should research which retailers offer tax-free shopping or tax refund services. This information can often be found on the retailer’s website or by contacting their customer service.

- Keep Detailed Records: Maintaining detailed records of purchases is crucial for a successful tax refund claim. This includes keeping all receipts, tax refund forms, and any other supporting documents. These records will be essential when completing the refund application.

- Consider Tax Refund Service Providers: Tourists can also engage tax refund service providers, who can guide them through the process and often offer additional benefits, such as expedited refund processing or assistance with complex cases.

- Understand Exchange Rates: Tax refunds are typically issued in the local currency, which means the refund amount can fluctuate based on exchange rates. Tourists should be aware of these fluctuations and consider the timing of their purchases and refund applications to maximize the value of their refund.

Conclusion: Making the Most of Your Tax Refund Opportunities

Tax refunds for tourists in the USA can be a valuable benefit, offering a chance to reclaim some of the taxes paid during a visit. However, the process is not without its complexities, and it requires a good understanding of the eligibility criteria, the refund process, and the strategies to maximize refunds. By following the guidelines outlined in this guide and staying informed about the latest regulations, tourists can make the most of their tax refund opportunities and potentially save a significant amount on their purchases.

How long does it typically take to receive a tax refund after submitting the application?

+

The processing time for tax refunds can vary, typically ranging from a few weeks to several months. Factors such as the volume of refund applications, the complexity of the case, and the efficiency of the tax authority can all impact the processing time. It is advisable to plan accordingly and allow for sufficient time before departing the USA.

Are there any restrictions on the use of tax refund funds?

+

In most cases, there are no specific restrictions on how tax refund funds can be used. Tourists are free to utilize the refunded amount as they wish, whether it’s for additional purchases, travel expenses, or simply as a savings boost. However, it’s important to note that the refund amount may be subject to foreign exchange rates and any associated fees.

Can I claim a tax refund on purchases made online or via mail order?

+

Claiming tax refunds on online or mail-order purchases can be more complex. It often requires additional documentation, such as proof of export, and may involve specific procedures. Tourists should carefully review the refund policies and procedures for online or mail-order purchases to ensure they meet the necessary requirements.

Are there any additional fees associated with tax refund claims?

+

Yes, there may be additional fees associated with tax refund claims. These fees can vary depending on the method of refund, the service provider, and the location of the purchase. Some retailers may charge a processing fee, while tax refund service providers may have their own fee structures. It’s essential to understand these fees and consider them when planning your purchases and refund claims.

What should I do if my tax refund application is denied?

+

If your tax refund application is denied, it’s important to carefully review the denial notice to understand the reasons for the rejection. You may be able to appeal the decision, but this process can be complex and time-consuming. Consulting with a tax professional or a tax refund service provider can help you navigate the appeal process and increase your chances of a successful outcome.