Miami Sales Tax

Sales tax is an essential aspect of doing business in any location, and understanding the intricacies of these taxes is crucial for both businesses and consumers. In Miami, Florida, the sales tax landscape is unique and worth exploring in detail. This comprehensive guide will delve into the specifics of Miami's sales tax, offering an in-depth analysis of rates, applicability, and the impact it has on the local economy.

Understanding Miami’s Sales Tax Structure

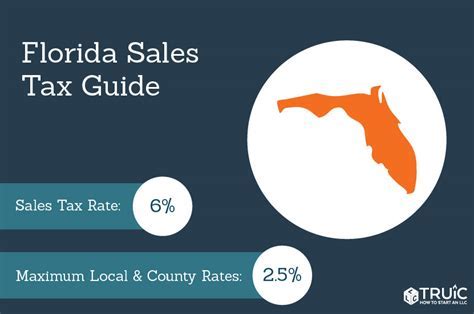

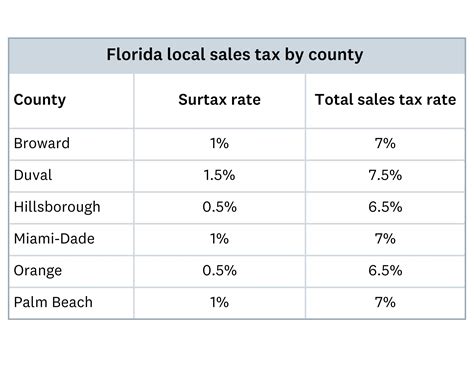

Miami’s sales tax system is a combination of state, county, and local taxes, each with its own rate and regulations. The state of Florida imposes a sales tax rate of 6%, which is applied uniformly across the state. However, Miami-Dade County, where Miami is located, adds an additional 1% sales surtax, bringing the total county tax to 7%. This means that any purchase made within the county is subject to this combined rate.

Furthermore, certain jurisdictions within Miami-Dade County have the authority to levy their own discretionary sales surtaxes. These surtaxes are typically used to fund specific local initiatives or projects. For instance, the City of Miami has a 0.5% surtax, which means that within the city limits, the total sales tax rate is 7.5%. Other municipalities within the county may have different surtax rates, making the sales tax rate vary across different parts of Miami-Dade.

It's worth noting that Miami's sales tax structure is not limited to just these rates. Certain types of goods and services are exempt from sales tax, while others are subject to additional taxes. For example, prepared foods and certain professional services may have a different tax rate or may be exempt altogether.

| Taxing Authority | Sales Tax Rate |

|---|---|

| State of Florida | 6% |

| Miami-Dade County | 7% |

| City of Miami | 7.5% |

Impact on Local Businesses and Consumers

The sales tax structure in Miami has a significant influence on both local businesses and consumers. For businesses, particularly those selling tangible goods, the sales tax can impact their pricing strategies and overall profitability. The additional surtaxes can make it challenging to compete with businesses in areas with lower tax rates.

On the consumer side, the higher sales tax rates in Miami can affect purchasing decisions and overall spending habits. Consumers may choose to shop online or in neighboring counties with lower tax rates, impacting the local economy. However, for certain essential goods and services, consumers may have little choice but to pay the higher tax rates, as they are necessary for day-to-day life.

Strategies for Businesses

To mitigate the impact of high sales taxes, businesses in Miami often employ a variety of strategies. One common approach is to bundle services or offer discounts to make the overall price more competitive, despite the tax. Another strategy is to highlight the additional value or benefits that come with purchasing from local businesses, emphasizing the support for the local economy.

Additionally, some businesses choose to diversify their offerings, providing a mix of taxable and non-taxable goods or services. This approach can help balance the impact of sales tax on their bottom line.

Consumer Behavior and Choices

Consumers in Miami are often savvy when it comes to sales tax. They may compare prices across different retailers or consider online shopping options to find the best deals. Some may also plan their purchases strategically, timing them to take advantage of tax-free holidays or promotional periods.

However, it's important to note that the convenience of local shopping and the desire to support local businesses often outweigh the tax differences for many consumers. This is particularly true for unique or specialized goods that may not be readily available elsewhere.

Sales Tax Compliance and Enforcement

Ensuring compliance with Miami’s sales tax regulations is crucial for businesses to avoid penalties and maintain a good standing with the Florida Department of Revenue. Businesses are required to collect the appropriate sales tax from customers and remit it to the state regularly.

The Florida Department of Revenue has a comprehensive set of guidelines and resources available to help businesses understand their sales tax obligations. These include registration requirements, tax calculation methods, and reporting procedures. Failure to comply with these regulations can result in audits, fines, and even criminal charges in severe cases.

Common Compliance Challenges

One of the biggest challenges for businesses is keeping up with the ever-changing sales tax regulations. With different rates and rules for various jurisdictions and product types, staying compliant can be complex. This is especially true for businesses with multiple locations or those that sell both taxable and exempt goods.

To address these challenges, many businesses invest in robust accounting and tax management systems. These systems can automate tax calculations, ensuring accuracy and reducing the risk of errors. Additionally, businesses often seek professional guidance from tax advisors or consultants to ensure they are meeting all their sales tax obligations.

Future Outlook and Potential Changes

The sales tax landscape in Miami, like in many other regions, is subject to change. Proposed legislative reforms, economic shifts, and changing consumer behaviors can all impact the future of sales tax rates and regulations.

Currently, there is a growing trend towards simplifying sales tax structures and harmonizing rates across jurisdictions. This could potentially reduce the complexity of the current system in Miami, making it easier for businesses and consumers to understand and navigate.

However, any changes to the sales tax system will likely be influenced by a variety of factors, including the need to fund public services and infrastructure, the impact on local businesses, and the overall economic health of the region. As such, while future reforms are possible, they are unlikely to happen overnight, and businesses and consumers should expect a certain degree of continuity in the near term.

Conclusion

Miami’s sales tax structure is a complex but crucial aspect of the local economy. It impacts the pricing strategies of businesses, the purchasing decisions of consumers, and the overall economic health of the region. By understanding the intricacies of this tax system, businesses and consumers can make more informed choices and navigate the local market more effectively.

As the sales tax landscape continues to evolve, staying informed and adaptable will be key for all stakeholders involved in Miami's business and consumer ecosystem.

Are there any tax-free holidays in Miami?

+Yes, Miami, along with the rest of Florida, observes certain tax-free holidays. These are specific periods when sales tax is not applied to certain categories of goods, often including school supplies, clothing, and books. These holidays are typically announced by the state government and can provide significant savings for consumers.

How often do sales tax rates change in Miami-Dade County?

+Sales tax rates in Miami-Dade County can change infrequently, usually as a result of legislative action or local ballot initiatives. While the base state sales tax rate has remained stable for some time, local surtax rates may change more frequently, often to fund specific projects or initiatives.

What happens if a business fails to collect or remit sales tax correctly?

+Failure to collect or remit sales tax correctly can result in a range of penalties, including fines, interest charges, and even suspension of business licenses. In severe cases, it can also lead to criminal charges. It is crucial for businesses to understand their sales tax obligations and seek professional advice if needed.