Nm Tax And Rev

The New Mexico Taxation and Revenue Department (NMTRD) is a pivotal agency within the state's government, tasked with managing and overseeing various critical revenue streams. This department's comprehensive role includes administering taxes, collecting revenues, and enforcing compliance, all while offering essential services to both taxpayers and businesses. The NMTRD's responsibilities span across multiple domains, encompassing personal income tax, corporate tax, gross receipts tax, motor vehicle tax, and a range of other specialized taxes. This intricate system plays a fundamental role in funding the state's operations and services, thereby contributing significantly to New Mexico's economic landscape.

Understanding the Role and Impact of NM Tax and Rev

The NMTRD is more than just a tax collection agency; it serves as a critical pillar in the state’s economic structure. The department’s multifaceted responsibilities include implementing tax policies, ensuring compliance, and facilitating the efficient collection of various taxes and fees. This ensures a steady flow of revenue into the state’s coffers, enabling the government to fund essential services and infrastructure projects.

The department's operations are guided by a set of core principles that prioritize integrity, fairness, and efficiency. These principles underpin every aspect of their work, from tax administration to public service delivery. By adhering to these principles, NMTRD aims to foster a climate of trust and transparency with taxpayers and businesses alike.

A significant portion of the department's focus is on personal and corporate tax administration. They provide guidance and support to individuals and businesses, ensuring they understand their tax obligations and can fulfill them efficiently. This includes offering resources and tools to help taxpayers navigate the complex tax landscape, such as online filing systems and tax guides.

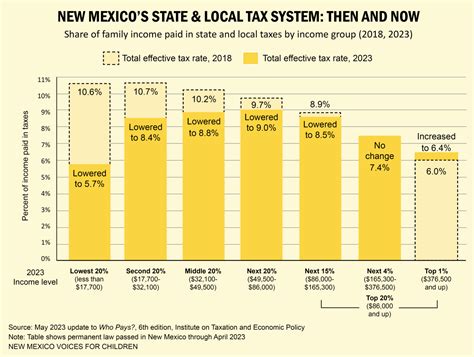

The NMTRD also plays a crucial role in ensuring tax fairness. They implement measures to prevent tax evasion and ensure that everyone pays their fair share. This involves conducting audits, investigating tax fraud, and enforcing penalties for non-compliance. By doing so, they create a level playing field for all taxpayers, fostering a sense of equity and justice.

Tax Administration and Compliance

At the heart of NMTRD’s operations is the administration of the state’s tax system. This involves managing the collection of taxes, ensuring compliance with tax laws, and providing support to taxpayers. The department’s tax administration processes are designed to be efficient, effective, and taxpayer-friendly, aiming to minimize the burden on individuals and businesses while maximizing revenue collection.

The department's compliance division plays a critical role in ensuring that taxpayers adhere to the state's tax laws. They employ a range of strategies, from educational outreach to enforcement actions, to encourage voluntary compliance and deter tax evasion. By promoting a culture of compliance, NMTRD aims to create a fair and sustainable tax system.

One of the key tools in their compliance arsenal is the use of data analytics. By analyzing tax data, the department can identify trends, detect potential non-compliance, and target their enforcement efforts more effectively. This approach not only improves compliance rates but also ensures that the department's resources are used efficiently.

| Tax Type | Collection Methods | Compliance Strategies |

|---|---|---|

| Personal Income Tax | Withholding, estimated payments, direct filing | Educational programs, penalty enforcement, audit initiatives |

| Corporate Tax | Withholding from employees, corporate tax returns | Corporate tax audits, penalty enforcement, voluntary disclosure programs |

| Gross Receipts Tax | Monthly, quarterly, or annual returns | Data analytics, field audits, compliance assistance programs |

Revenue Collection and Allocation

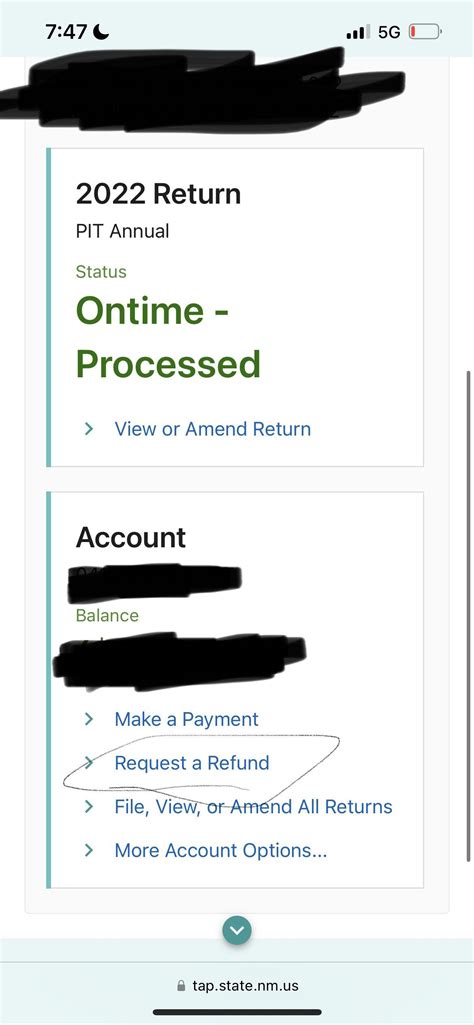

The collection of taxes is a critical function of NMTRD. The department employs a range of methods to ensure timely and accurate revenue collection, including online payment portals, direct debits, and traditional payment methods. They also offer flexible payment plans to assist taxpayers who may be facing financial difficulties.

Once collected, the revenue is carefully allocated to various state funds and programs. This process is guided by state laws and regulations, ensuring that the funds are used efficiently and effectively. The revenue generated by NMTRD supports a wide range of state services and initiatives, including education, healthcare, infrastructure development, and social services.

The department's role in revenue allocation is not merely administrative. They work closely with other state agencies and departments to ensure that the revenue is directed towards the areas of greatest need and highest impact. This collaborative approach ensures that the state's resources are utilized in a manner that benefits the greatest number of New Mexicans.

The Impact of NMTRD’s Services

The services provided by NMTRD have a profound impact on the state’s economy and the lives of its residents. By efficiently administering the tax system and ensuring compliance, the department plays a crucial role in maintaining the state’s financial health and stability. This, in turn, enables the state to provide essential services and invest in infrastructure, thereby fostering economic growth and improving the quality of life for all New Mexicans.

One of the key ways NMTRD impacts the economy is through its tax incentive programs. These programs, which include tax credits, deductions, and exemptions, are designed to encourage economic activity in targeted areas. For instance, the department offers incentives for businesses that create jobs, invest in renewable energy, or locate in economically distressed areas. By providing these incentives, NMTRD stimulates economic growth, creates jobs, and attracts new businesses to the state.

Furthermore, the department's services are not limited to tax administration. They also offer a range of other services, such as assistance with tax preparation, resolution of tax disputes, and information on tax laws and regulations. These services are designed to support taxpayers and businesses, ensuring they have the resources and knowledge to navigate the complex tax landscape. By providing these services, NMTRD helps to foster a culture of compliance and understanding, which is essential for a healthy and sustainable tax system.

Enhancing Taxpayer Experience

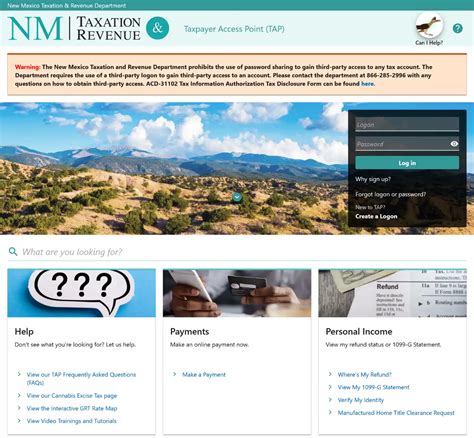

NMTRD recognizes that an efficient and user-friendly tax system is crucial for fostering a positive taxpayer experience. To this end, they have implemented several initiatives aimed at streamlining the tax process and making it more accessible to taxpayers.

One such initiative is the expansion of online services. Taxpayers can now file their tax returns, make payments, and access a wealth of resources and information online. This not only saves time and resources but also reduces the need for in-person interactions, which can be especially beneficial during busy tax seasons or for those in remote areas.

The department has also invested in modernizing its IT infrastructure. This has enabled them to develop more robust and secure systems, ensuring the confidentiality and integrity of taxpayer data. Additionally, these systems enhance the department's ability to process tax returns and payments more efficiently, reducing wait times and potential errors.

Moreover, NMTRD has established dedicated taxpayer assistance centers across the state. These centers provide personalized support and guidance to taxpayers, helping them navigate the tax system and resolve any issues they may encounter. The centers are staffed by experienced professionals who are well-versed in the state's tax laws and regulations, ensuring that taxpayers receive accurate and timely assistance.

| Initiative | Description |

|---|---|

| Online Services Expansion | A wide range of tax-related services, including filing, payment, and information access, are now available online, providing taxpayers with a convenient and efficient alternative to traditional methods. |

| IT Modernization | Upgrading the department's IT infrastructure to enhance security, efficiency, and the overall taxpayer experience, ensuring data protection and streamlining tax processes. |

| Taxpayer Assistance Centers | Establishing physical locations across the state where taxpayers can receive personalized assistance, guidance, and support, ensuring they have the resources to navigate the tax system effectively. |

Collaborative Efforts for Economic Growth

NMTRD understands that economic growth is not solely the responsibility of the tax department. It requires a collaborative effort involving various stakeholders, including businesses, community leaders, and other government agencies. To this end, the department actively engages in partnerships and initiatives aimed at stimulating economic growth and development.

One such initiative is the Small Business Assistance Program. This program provides resources and support to small businesses, helping them navigate the complex tax landscape and understand their tax obligations. By providing this assistance, NMTRD aims to create an environment that fosters the growth and success of small businesses, which are a critical component of the state's economy.

Additionally, the department works closely with local communities to understand their unique needs and challenges. They provide tailored support and resources to help communities develop economic strategies that are aligned with their specific goals and circumstances. This community-centric approach ensures that the department's efforts are not only effective but also sustainable, as they are designed with local input and buy-in.

Furthermore, NMTRD engages in policy discussions and initiatives at the state level. They work with lawmakers and other government agencies to develop tax policies that are fair, efficient, and supportive of economic growth. This collaborative approach ensures that the tax system is not only effective in generating revenue but also in creating an environment that encourages investment and economic activity.

Future Prospects and Innovations

Looking ahead, NMTRD is committed to staying at the forefront of tax administration and revenue collection. They are actively exploring new technologies and innovative strategies to enhance their operations and better serve taxpayers. One area of focus is the implementation of blockchain technology, which has the potential to revolutionize the way taxes are collected and managed.

Blockchain, with its inherent security and transparency, could significantly improve the integrity of tax data and reduce the risk of fraud. It could also streamline tax processes, making them more efficient and cost-effective. NMTRD is closely monitoring the development of blockchain technology and its potential applications in tax administration, with the aim of leveraging its benefits to enhance their operations.

Another area of innovation is the use of artificial intelligence (AI) and machine learning. These technologies can be leveraged to automate certain tax processes, such as data analysis and tax return processing. By using AI, NMTRD can improve the accuracy and efficiency of their operations, freeing up resources that can be redirected towards more complex tasks or taxpayer assistance.

In addition to technological innovations, NMTRD is also focused on improving taxpayer education and engagement. They recognize that a well-informed taxpayer is more likely to comply with tax laws and better understand their rights and responsibilities. To this end, they are developing more comprehensive educational resources and outreach programs, ensuring that taxpayers have the knowledge and tools they need to navigate the tax system confidently.

Adopting Blockchain for Enhanced Security and Transparency

As the world of technology continues to evolve, NMTRD is exploring the potential of blockchain technology to enhance its tax administration processes. Blockchain, a distributed ledger technology, offers a secure and transparent way of recording and verifying transactions. By leveraging blockchain, NMTRD aims to improve the security and integrity of tax data, reduce the risk of fraud, and streamline tax processes.

One of the key advantages of blockchain is its ability to create an immutable record of transactions. This means that once a transaction is recorded on the blockchain, it cannot be altered or deleted without leaving a trace. This feature can significantly enhance the security of tax data, making it more difficult for fraudulent activities to go undetected. It also provides a level of transparency that can build trust between taxpayers and the tax administration.

Furthermore, blockchain's distributed nature can improve the efficiency of tax processes. By removing the need for intermediaries and central authorities, blockchain can simplify and speed up transactions. This can be especially beneficial in tax refund processes, where blockchain can facilitate faster and more secure refunds. Additionally, blockchain's smart contract functionality can automate certain tax processes, reducing the potential for errors and speeding up operations.

| Benefits of Blockchain in Tax Administration |

|---|

| Enhanced Security: Blockchain's immutable record of transactions reduces the risk of fraud and enhances data security. |

| Increased Transparency: The distributed ledger technology provides a transparent view of tax data, fostering trust between taxpayers and the tax administration. |

| Improved Efficiency: By removing intermediaries and central authorities, blockchain can simplify and speed up tax processes, including refunds. |

| Automated Processes: Blockchain's smart contract functionality can automate certain tax processes, reducing errors and streamlining operations. |

Leveraging AI and Machine Learning for Process Automation

In an effort to further streamline its operations and improve efficiency, NMTRD is turning to the power of artificial intelligence (AI) and machine learning. These technologies offer a wealth of opportunities to automate repetitive tasks, improve data analysis, and enhance decision-making processes within the department.

One of the key areas where AI can make a significant impact is in the automation of tax return processing. By leveraging machine learning algorithms, NMTRD can develop systems that can automatically analyze and process tax returns, identifying potential errors or inconsistencies. This not only saves a considerable amount of time and resources but also reduces the risk of human error, leading to more accurate tax assessments.

Furthermore, AI-powered systems can assist in data analysis, helping the department identify trends, anomalies, and potential areas of concern. For instance, AI can be used to detect patterns of tax evasion or non-compliance, allowing the department to focus its resources more effectively. Additionally, AI can be employed to improve taxpayer services, such as providing personalized recommendations or assistance based on individual tax situations.

The potential of AI extends beyond tax administration. It can also be leveraged to enhance revenue collection processes. For example, AI-powered systems can analyze taxpayer behavior and identify potential non-payers, allowing the department to take proactive measures to ensure compliance. Moreover, AI can be used to optimize the department's outreach and communication strategies, ensuring that taxpayers receive the information they need in a timely and effective manner.

| Applications of AI and Machine Learning in NMTRD |

|---|

| Automated Tax Return Processing: Leveraging machine learning to analyze and process tax returns, reducing errors and streamlining operations. |

| Enhanced Data Analysis: Using AI to identify trends, anomalies, and potential areas of concern, improving decision-making processes. |

| Taxpayer Services: Developing AI-powered systems to provide personalized recommendations and assistance, enhancing the taxpayer experience. |

| Optimized Revenue Collection: Employing AI to analyze taxpayer behavior and identify non-payers, improving compliance and revenue collection. |

Conclusion: A Vision for the Future

The New Mexico Taxation and Revenue Department is committed to continuous improvement and innovation. By embracing technological advancements and collaborative efforts, they aim to enhance their services, improve taxpayer experiences, and foster economic growth. Their focus on efficiency, fairness, and transparency ensures that they remain a trusted partner in the state’s economic journey.

As they look to the future, NMTRD is dedicated to staying at the forefront of tax administration. They will continue to explore new technologies, such as blockchain and AI, to enhance their operations and better serve taxpayers. By leveraging these innovations, they aim to create a more efficient, secure, and transparent tax system that benefits all New Mexicans.

Moreover, the department's commitment to collaboration and community engagement ensures that their efforts are aligned with the state's economic goals and the needs of its residents. By working together with businesses, communities, and other government agencies, NMTRD is well-positioned to drive economic growth, create jobs, and improve the quality of life for all New Mexicans.

In conclusion, the NMTRD is not just a tax collection agency; it is a vital partner in the state's economic development. Through their dedication to fairness, efficiency, and innovation, they play a pivotal role in shaping New Mexico's future. With their eyes firmly on the horizon, they are committed to building a brighter, more prosperous future for all New Mexicans.

FAQ

What is the role of the NMTRD in tax administration?

+

The NMTRD is responsible for administering and enforcing the state’s tax laws. This includes collecting taxes, ensuring compliance, and providing support and