Property Tax Oc

Property taxes are a crucial aspect of owning real estate, and understanding the ins and outs of these assessments is essential for homeowners and investors alike. In the context of Oc, a vibrant region known for its diverse landscapes and thriving communities, property taxes play a significant role in the local economy and the overall financial health of property owners.

The Complexity of Property Tax Assessments in Oc

Property tax assessments in Oc are intricate processes that involve various factors, each contributing to the final valuation and subsequent tax amount. From the assessed value of the property to the local tax rates and exemptions, there are numerous elements to consider when understanding the property tax landscape in this region.

One of the primary considerations is the property's location within Oc. The diverse nature of the region means that property values can vary significantly depending on whether the property is situated in a bustling urban center, a picturesque coastal town, or a serene rural setting. These location-specific factors greatly influence the assessed value and, consequently, the property taxes.

Additionally, the type and condition of the property itself play a pivotal role. Whether it's a single-family residence, a multi-unit rental property, a commercial space, or a vacant land parcel, each property category comes with its own set of assessment guidelines and tax implications. For instance, commercial properties often face different tax rates and valuation methods compared to residential properties.

Assessed Value Determination

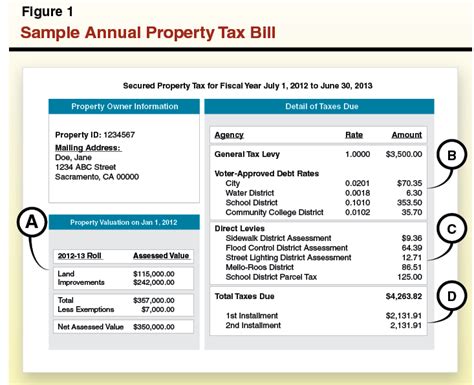

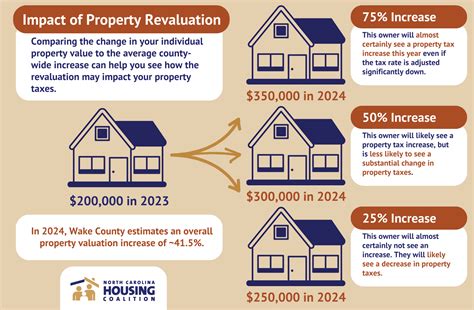

The assessed value of a property is a critical component in the property tax calculation. In Oc, the assessment process typically involves a combination of market value analysis, sales comparison, and income capitalization methods. Assessors carefully examine recent sales data, property features, and market trends to determine a fair and accurate valuation.

| Property Type | Assessment Methodology |

|---|---|

| Residential | Market value analysis, considering recent sales of comparable properties. |

| Commercial | Income capitalization approach, focusing on rental income and potential. |

| Vacant Land | Assessment based on land use, development potential, and comparable land sales. |

It's important to note that assessed values are not always synonymous with the market value of a property. Market fluctuations and individual property characteristics can create discrepancies between the two, leading to potential challenges for property owners when it comes to tax assessments.

Local Tax Rates and Exemptions

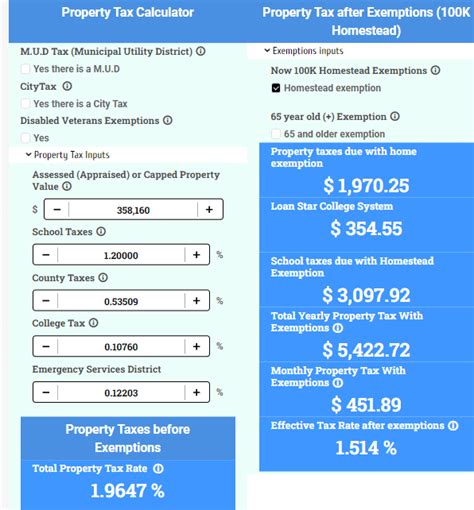

Property taxes in Oc are not a one-size-fits-all affair. Different jurisdictions within the region may have varying tax rates, and these rates can significantly impact the final tax bill. Additionally, various exemptions and deductions are available to property owners, providing opportunities to reduce their tax liabilities.

Some common exemptions include homestead exemptions for primary residences, senior citizen discounts, and exemptions for certain types of agricultural or conservation-oriented properties. Understanding the specific exemptions applicable to one's property is crucial for optimizing tax savings.

Moreover, the timing of property purchases and sales can also influence tax liabilities. For instance, purchasing a property near the end of a tax year may result in prorated taxes, while selling a property can trigger capital gains taxes and impact the assessed value for the following year.

The Impact of Property Taxes on Real Estate Investments in Oc

For real estate investors, property taxes are a critical consideration when evaluating potential investment opportunities in Oc. The tax implications can significantly affect the overall profitability and cash flow of an investment property.

Cash Flow Considerations

Property taxes directly impact the net operating income (NOI) of an investment property. Higher tax liabilities can reduce the cash flow available to the investor, potentially affecting their ability to cover expenses, maintain the property, or even generate a positive return on investment.

When evaluating potential investment properties, investors must carefully consider the tax implications and ensure that the property's income potential can sustain the associated tax burdens. This analysis becomes even more critical when dealing with multi-unit or commercial properties, where the tax liability can be substantial.

Capital Gains and Tax Strategies

Property taxes also come into play when considering capital gains and tax strategies. Selling an investment property triggers capital gains taxes, and the assessed value of the property at the time of sale can significantly impact the tax liability. Understanding the potential tax implications of a sale is crucial for effective tax planning.

Investors may employ various strategies to minimize capital gains taxes, such as utilizing 1031 exchanges to defer taxes or taking advantage of step-up in basis rules for inherited properties. Additionally, understanding the depreciation schedules and tax deductions associated with rental properties can provide opportunities for tax savings.

Tax Incentives and Abatements

Oc may offer tax incentives and abatements to encourage certain types of development or investment. These incentives can significantly reduce the tax burden for qualifying properties, making them more attractive investment opportunities. For instance, tax abatements may be offered for historic property renovations or for properties located in designated economic development zones.

Investors should stay informed about any available tax incentives and ensure they meet the necessary criteria to qualify. Working with tax professionals or real estate advisors familiar with these incentives can help maximize the benefits and ensure compliance with the associated requirements.

Navigating the Property Tax Landscape in Oc: Expert Tips

Understanding and managing property taxes in Oc requires a strategic approach. Here are some expert tips to help property owners and investors navigate the complexities of the local tax landscape:

- Stay Informed: Keep abreast of local tax regulations, rate changes, and assessment methodologies. Subscribing to relevant newsletters or following local tax authority updates can provide valuable insights.

- Engage Professionals: Consider hiring a tax advisor or accountant specializing in real estate taxes. Their expertise can help navigate complex tax scenarios and ensure compliance with local regulations.

- Appeal Assessments: If you believe your property's assessed value is inaccurate, consider appealing the assessment. This process typically involves providing evidence of comparable sales or market conditions to support a lower valuation.

- Optimize Exemptions: Review the available exemptions and deductions annually to ensure you're taking advantage of all applicable tax breaks. This may involve completing necessary paperwork or providing documentation to support your eligibility.

- Plan for Renovations: If you're planning renovations or improvements, understand the potential impact on your property taxes. In some cases, improvements can increase the assessed value, leading to higher taxes. Plan your renovations strategically to minimize tax implications.

- Consider Long-Term Strategies: For investment properties, develop long-term tax strategies. This may involve holding properties for specific periods to qualify for certain tax benefits or considering tax-efficient exit strategies when selling.

The Future of Property Taxes in Oc

The property tax landscape in Oc is subject to ongoing changes and developments. As the region continues to grow and evolve, tax policies may adjust to reflect the changing dynamics of the real estate market and community needs.

One potential future trend is the implementation of more sophisticated assessment methodologies. With advancements in technology and data analytics, assessors may increasingly rely on advanced valuation techniques, ensuring a more accurate and fair assessment process. This could lead to more precise property valuations and potentially reduce assessment-related disputes.

Additionally, as sustainability and environmental considerations become more prominent, there may be a shift towards incentivizing energy-efficient properties or those with green certifications. Tax abatements or reduced tax rates for such properties could encourage more environmentally conscious development and renovation practices.

The future of property taxes in Oc is intertwined with the region's economic growth, community development, and evolving tax policies. Staying informed and adapting to these changes will be crucial for property owners and investors to navigate the complex tax landscape effectively.

How often are property tax assessments conducted in Oc?

+Property tax assessments in Oc are typically conducted annually. However, in some cases, reassessments may occur more frequently, especially if there are significant changes to the property, such as renovations or additions.

Can property owners challenge their assessed value?

+Absolutely! Property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The appeal process typically involves providing evidence and supporting documentation to demonstrate why the assessed value should be adjusted.

What are some common tax exemptions available in Oc?

+Oc offers a range of tax exemptions, including homestead exemptions for primary residences, senior citizen discounts, and exemptions for certain types of agricultural or historic properties. It’s essential to review the specific criteria and requirements for each exemption to determine eligibility.

How do property taxes impact the decision to buy or sell a property in Oc?

+Property taxes are a significant consideration when buying or selling a property in Oc. Buyers should factor in the ongoing tax liabilities, while sellers should be aware of potential capital gains taxes. Understanding the tax implications can influence the timing and strategy of real estate transactions.

Are there any tax incentives for energy-efficient properties in Oc?

+Yes, Oc recognizes the importance of energy efficiency and may offer tax incentives for properties with energy-efficient certifications or upgrades. These incentives can reduce the tax burden and encourage environmentally friendly practices.