Nyc Corporate Tax Rate

When it comes to doing business in New York City, understanding the tax landscape is crucial for any corporation. The corporate tax rate in NYC is a key component that impacts a company's financial strategy and overall profitability. In this comprehensive guide, we will delve into the intricacies of the NYC corporate tax rate, providing you with the knowledge and insights needed to navigate this complex aspect of running a business in the city that never sleeps.

Understanding the NYC Corporate Tax Rate

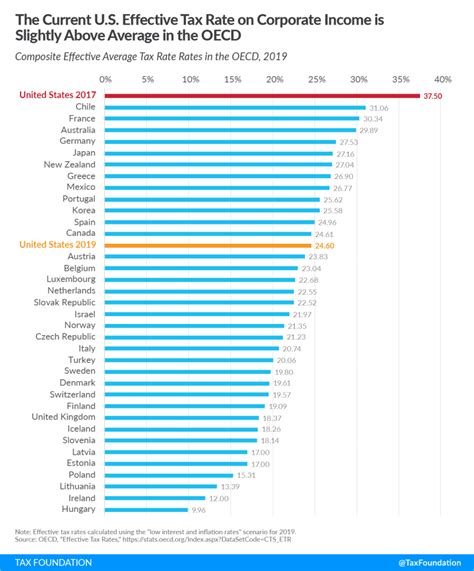

The corporate tax rate in New York City is a combination of state and city taxes, making it a unique and often complex system. While the state of New York imposes a corporate income tax, NYC adds its own surcharges and taxes, resulting in a higher overall tax burden for corporations operating within its boundaries.

Currently, the New York State Corporate Income Tax stands at 6.5%, which applies to all corporations doing business in the state. However, when we specifically consider New York City, the tax rate increases due to the City Corporation Tax and other additional charges.

The City Corporation Tax is a significant component of the NYC corporate tax structure. It is a tax imposed on the net income of corporations that conduct business activities within the five boroughs of New York City. The tax rate for the City Corporation Tax is set at 8.85% as of the most recent updates.

In addition to the City Corporation Tax, corporations in NYC are also subject to the Unincorporated Business Tax (UBT). This tax applies to both sole proprietors and partnerships, as well as certain types of corporations, such as S-Corporations and LLCs. The UBT rate is based on the business's net income and can vary depending on the corporation's specific circumstances.

To provide a clearer picture, let's consider a real-world example. Imagine a corporation with a net income of $1,000,000 operating in NYC. This corporation would be subject to the following tax rates:

- New York State Corporate Income Tax: 6.5% of $1,000,000 = $65,000

- City Corporation Tax: 8.85% of $1,000,000 = $88,500

- Unincorporated Business Tax (UBT): Varies based on business type and income

As you can see, the combined tax burden for this corporation would significantly impact its bottom line. It is essential for businesses to understand these rates and plan their financial strategies accordingly.

Tax Incentives and Benefits in NYC

While the corporate tax rate in NYC may seem daunting, it is important to note that the city also offers various tax incentives and benefits to attract and support businesses. These incentives can help offset the high tax rates and provide opportunities for corporations to thrive in the city.

Tax Abatement Programs

NYC provides several tax abatement programs aimed at encouraging economic growth and development. These programs offer reductions or exemptions on certain taxes, making it more financially viable for corporations to invest in the city.

One notable program is the Industrial and Commercial Abatement Program (ICAP), which offers a partial or full abatement of the City Corporation Tax for eligible businesses. This program is designed to stimulate investment in certain industries and areas of the city, providing a significant tax benefit for qualifying corporations.

Additionally, the Commercial Rent Tax Abatement Program offers a reduction in the commercial rent tax for eligible tenants. This program aims to support small businesses and encourage entrepreneurship by reducing their tax burden.

Economic Development Incentives

NYC is committed to fostering economic growth and has implemented various initiatives to attract and retain businesses. One such initiative is the NYC Economic Development Corporation (NYCEDC), which offers a range of programs and incentives to support business expansion and job creation.

The NYCEDC provides financial assistance, tax incentives, and other resources to help corporations navigate the challenges of doing business in NYC. This includes access to low-interest loans, grants, and tax credits, making it more feasible for businesses to invest in the city's infrastructure and workforce.

Startup and Innovation Support

NYC is known for its vibrant startup culture, and the city actively supports emerging businesses through various initiatives. The NYC Business Solutions program, for example, offers a range of services, including business planning, financing assistance, and tax guidance, to help startups establish a solid foundation.

Additionally, NYC has become a hub for innovation and technology, with programs like TechNYC and NYCx fostering the growth of tech startups and encouraging collaboration between businesses and government entities. These initiatives provide tax benefits and resources to support the development of innovative technologies and businesses.

Tax Filing and Compliance

Navigating the tax filing process in NYC can be complex, but understanding the requirements and deadlines is essential to ensure compliance and avoid penalties.

Filing Deadlines

The filing deadlines for corporate taxes in NYC align with the state’s deadlines. Typically, corporations must file their tax returns and pay their taxes by the 15th day of the third month following the end of their fiscal year. For example, if a corporation’s fiscal year ends on December 31st, the filing deadline would be March 15th.

It is important to note that extensions are available, but they must be requested before the original due date. The extension allows corporations to file their tax returns up to six months after the original due date, providing additional time for tax preparation.

Online Filing and Payment

To streamline the tax filing process, NYC offers an online platform called NYC Open Book. This platform allows corporations to register for accounts, file their tax returns, and make payments electronically. It provides a convenient and secure way to manage tax obligations and access important tax information.

NYC Open Book also offers a range of tools and resources to assist corporations in understanding their tax obligations and ensuring compliance. This includes access to tax forms, guidelines, and frequently asked questions, making it easier for businesses to navigate the complex tax landscape.

The Impact of NYC Corporate Tax Rates

The corporate tax rates in NYC have a significant impact on the financial health and decision-making of corporations operating in the city. The higher tax burden can influence a range of business strategies and operations.

Financial Planning and Strategy

Corporations must carefully consider the tax implications when developing their financial plans and strategies. The high tax rates in NYC can affect profit margins and cash flow, requiring businesses to allocate resources efficiently and make informed decisions regarding investments and expenses.

For example, a corporation may need to reevaluate its pricing strategies to account for the higher tax burden. This could involve adjusting product or service prices to maintain profitability or exploring cost-cutting measures to mitigate the impact of taxes on the bottom line.

Business Expansion and Relocation

The corporate tax rates in NYC can also influence a corporation’s decision to expand its operations or relocate to other areas. While NYC offers a wealth of opportunities and a robust business environment, the tax burden may prompt some businesses to consider alternative locations with potentially lower tax rates.

However, it is important to weigh the benefits of doing business in NYC against the tax implications. NYC provides access to a diverse talent pool, a global marketplace, and a thriving cultural hub, which can outweigh the higher tax rates for many corporations.

Industry-Specific Considerations

The impact of NYC corporate tax rates can vary across different industries. Certain industries may benefit from specific tax incentives or programs that offset the higher tax burden. For example, the film and television industry in NYC enjoys tax credits and incentives that make it an attractive location for production.

On the other hand, industries with lower profit margins may find it more challenging to operate in NYC due to the high tax rates. These businesses may need to explore alternative business models or seek tax relief through government programs to remain competitive.

Future Outlook and Tax Reform

The corporate tax landscape in NYC is subject to change and reform, driven by economic trends, political influences, and the city’s evolving needs. While it is challenging to predict future tax rates with certainty, we can explore some potential scenarios and their implications.

Potential Tax Rate Changes

NYC’s tax rates, including the corporate tax rate, are influenced by various factors, such as the city’s budget, economic conditions, and political agendas. As such, there is always the possibility of rate adjustments, either upwards or downwards, to address fiscal challenges or stimulate economic growth.

For example, during periods of economic downturn, the city may consider raising tax rates to generate additional revenue. Conversely, in times of economic prosperity, the city may opt to reduce tax rates to encourage further investment and business growth.

Tax Reform Initiatives

In recent years, there has been a growing discussion around tax reform in NYC, with various proposals and initiatives aimed at simplifying the tax system and making it more equitable. These reforms often focus on reducing complexity, eliminating loopholes, and ensuring that corporations contribute fairly to the city’s revenue.

One notable initiative is the NYC Tax Fairness and Simplification Commission, established to review the city's tax system and propose reforms. The commission's goal is to create a more transparent and efficient tax structure, benefiting both taxpayers and the city's overall fiscal health.

The Impact of Economic Trends

Economic trends and market fluctuations can also influence the corporate tax rates in NYC. During periods of economic growth, the city may experience increased tax revenue, allowing for potential tax rate reductions or the implementation of tax incentives to maintain the momentum.

Conversely, economic downturns can put pressure on the city's budget, leading to potential tax rate increases or the introduction of temporary taxes to generate additional revenue. Corporations must stay informed about these economic trends to anticipate and adapt to potential changes in the tax landscape.

Conclusion

Understanding the corporate tax rate in NYC is a crucial aspect of doing business in the city. While the tax burden may seem significant, it is essential to consider the broader context, including the wealth of opportunities and resources that NYC offers. Corporations can navigate the complex tax landscape by staying informed, utilizing available tax incentives, and adapting their financial strategies accordingly.

By leveraging the city's support programs, tax abatement initiatives, and economic development incentives, businesses can thrive in NYC while contributing to the city's vibrant economy. The future of NYC's corporate tax rates remains uncertain, but with a proactive approach and a deep understanding of the tax system, corporations can position themselves for long-term success in this dynamic metropolis.

What is the current NYC corporate tax rate, including state and city taxes?

+The current NYC corporate tax rate includes the New York State Corporate Income Tax (6.5%) and the City Corporation Tax (8.85%). Additionally, unincorporated businesses may be subject to the Unincorporated Business Tax (UBT), which varies based on business type and income.

Are there any tax incentives or programs available to corporations in NYC?

+Yes, NYC offers various tax incentives and programs to attract and support businesses. These include tax abatement programs like the Industrial and Commercial Abatement Program (ICAP) and the Commercial Rent Tax Abatement Program. Additionally, the NYC Economic Development Corporation (NYCEDC) provides financial assistance and tax incentives for business expansion and job creation.

How can corporations stay informed about tax filing deadlines and requirements in NYC?

+Corporations can stay informed by utilizing resources provided by the NYC Department of Finance, such as the NYC Open Book platform. This platform offers access to tax forms, guidelines, and important updates. Additionally, consulting with tax professionals or accounting firms can ensure compliance with filing deadlines and tax regulations.

What factors influence potential changes in NYC’s corporate tax rates?

+NYC’s corporate tax rates are influenced by various factors, including economic trends, the city’s budget, and political agendas. Economic downturns may lead to rate increases, while periods of growth can result in tax incentives or rate reductions. Additionally, tax reform initiatives, such as those proposed by the NYC Tax Fairness and Simplification Commission, can impact the tax landscape.