How Long Should You Keep Tax Returns

Tax season is a crucial time for individuals and businesses, and proper record-keeping is essential for compliance and financial planning. One common question that arises is, "How long should I retain my tax returns and related documents?" This article aims to provide an in-depth analysis, offering expert guidance and insights on the topic, along with practical tips and strategies for effective tax record management.

Understanding the Importance of Tax Record Retention

Tax returns and associated documents serve as a detailed financial snapshot of a particular period. They provide a historical record of income, expenses, deductions, and tax liabilities. Retaining these records is crucial for several reasons, including:

- Compliance and Audits: Tax authorities may request documentation to verify the accuracy of filed returns. In the event of an audit, having well-organized and readily accessible records can significantly ease the process and help resolve any discrepancies.

- Amendments and Refunds: Tax laws and regulations can change over time, and keeping records allows individuals to identify potential errors or overlooked deductions. This can lead to amended returns and potential refunds.

- Financial Planning: Tax returns offer valuable insights into income trends, expenses, and tax obligations. By analyzing past returns, individuals and businesses can make informed financial decisions, budget effectively, and plan for future tax liabilities.

- Legal and Business Transactions: Tax records may be required for various legal proceedings, such as divorce settlements, business mergers, or estate planning. They also play a role in securing loans or attracting investors, as they provide a transparent view of financial health.

The Legal Requirements for Tax Return Retention

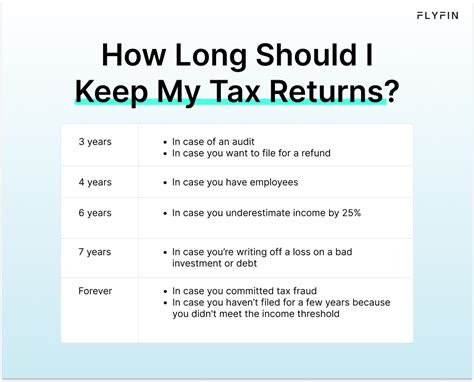

The duration for which tax returns and related documents should be retained varies depending on jurisdiction and the type of taxpayer. While specific laws may differ, here are some general guidelines:

Individual Taxpayers

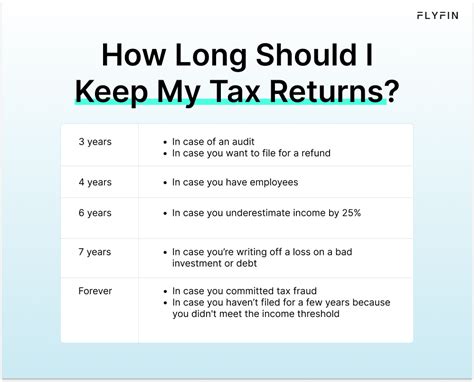

For most individual taxpayers, the Internal Revenue Service (IRS) recommends retaining records for a minimum of three years after the date the return was filed or the due date, whichever is later. This applies to federal tax returns and includes supporting documents such as W-2 forms, 1099s, receipts, and other income and expense records.

However, certain circumstances may require a longer retention period. For instance, if you claim a loss from worthless securities or a bad debt deduction, the IRS suggests keeping records for seven years. Additionally, if you fail to file a tax return or file a fraudulent return, the IRS has no time limit to audit and assess taxes.

| Tax Form | Recommended Retention Period |

|---|---|

| Form 1040 (Individual Tax Return) | 3 years |

| Form W-2 (Wage and Tax Statement) | 3 years |

| Form 1099 (Various Income Types) | 3 years |

| Other Income/Expense Records | 3 years |

| Worthless Securities/Bad Debt | 7 years |

Businesses and Corporations

Businesses, including corporations, partnerships, and sole proprietorships, generally have a longer retention period due to the complexity of their financial operations and the potential for more extensive audits. The IRS recommends keeping records for a minimum of three to seven years, depending on the type of tax return and the nature of the business.

| Business Tax Form | Recommended Retention Period |

|---|---|

| Form 1120 (Corporate Tax Return) | 3–7 years |

| Form 1065 (Partnership Tax Return) | 3–7 years |

| Form 1040 Schedule C (Sole Proprietorship) | 3–7 years |

| Business Income/Expense Records | 3–7 years |

Strategies for Effective Tax Record Management

Organizing and managing tax records can be a daunting task, especially for individuals with multiple income streams or businesses with complex operations. Here are some strategies to streamline the process:

Digital vs. Physical Storage

With the advancement of technology, many taxpayers opt for digital storage solutions. Scanning and organizing documents into a secure cloud-based system or a well-organized digital filing system on a computer can provide easy access and backup options. However, it’s crucial to ensure the security and integrity of digital records.

For those who prefer physical storage, investing in a secure filing cabinet or storage box can help keep records organized and protected. Labeling folders and using a consistent naming system can make retrieval efficient.

Secure Backup and Disaster Recovery

Whether using digital or physical storage, backup is essential. For digital records, regular backups to external hard drives or secure cloud storage can prevent data loss due to hardware failures or cyber attacks. For physical records, consider storing duplicates in a safe deposit box or with a trusted third party.

Document Organization and Labeling

Implement a logical filing system that makes sense for your specific needs. For example, you can organize records by tax year, type of document, or category (income, expenses, deductions). Ensure each document is clearly labeled with the tax year, form number, and a brief description of its contents.

Regular Review and Pruning

Periodically review your tax records to ensure they are up-to-date and relevant. As records reach their retention limit, carefully assess their continued need. Shredding or securely destroying outdated records can help prevent identity theft and reduce clutter.

Future Considerations and Digital Innovations

As technology continues to evolve, the landscape of tax record retention is likely to change. Here are some future considerations:

Blockchain and Digital Ledger Technology

Blockchain technology offers a secure and transparent way to store and verify financial data. While still in its early stages, blockchain-based tax record systems could provide an immutable audit trail, reducing the need for extensive record retention. However, widespread adoption and regulatory acceptance are necessary before this becomes a mainstream solution.

Artificial Intelligence and Automation

AI-powered tax preparation and record-keeping tools are becoming more sophisticated. These tools can automatically organize and analyze tax records, identify potential deductions, and provide real-time insights. While they do not eliminate the need for record retention, they can streamline the process and reduce the burden on taxpayers.

Government Digital Initiatives

Many governments are embracing digital transformation, and this extends to tax administration. Some countries are exploring the idea of a “digital tax file,” where taxpayers can securely store and manage their tax records online, potentially reducing the need for extensive physical record retention. However, privacy and security concerns must be addressed before such initiatives can be widely adopted.

Conclusion

Understanding the appropriate duration for retaining tax returns and related documents is crucial for effective financial management and compliance. By following the recommended guidelines and implementing efficient record-keeping strategies, individuals and businesses can stay organized and prepared for any tax-related contingencies. As technology continues to advance, the future of tax record retention may involve innovative solutions, but for now, a combination of digital and physical storage, along with secure backup and organization, remains the best practice.

What happens if I can’t find my tax records during an audit?

+If you are unable to locate your tax records during an audit, the IRS may estimate your tax liability based on available information. This can result in additional taxes, penalties, and interest. It’s crucial to maintain organized records to avoid such situations.

Can I destroy my tax records after the recommended retention period?

+While the IRS recommends specific retention periods, it’s ultimately your decision when to destroy records. However, it’s advisable to retain records longer if there is a possibility of future audits or if you anticipate changes in tax laws that may affect past returns.

Are there any tax records that should be kept indefinitely?

+Certain records, such as real estate deeds, stock certificates, and legal documents related to business transactions, may need to be retained indefinitely. It’s best to consult with a tax professional or legal advisor to determine the specific retention requirements for these documents.