Nc Estimated Tax Payment

The North Carolina (NC) Estimated Tax Payment system is an essential aspect of the state's tax collection process, designed to ensure that individuals and businesses with income not subject to withholding, or with income in excess of certain thresholds, make regular payments throughout the year to cover their expected tax liabilities. This system is particularly crucial for independent contractors, freelancers, and small business owners, who may not have taxes automatically deducted from their income.

Understanding NC Estimated Tax Payments

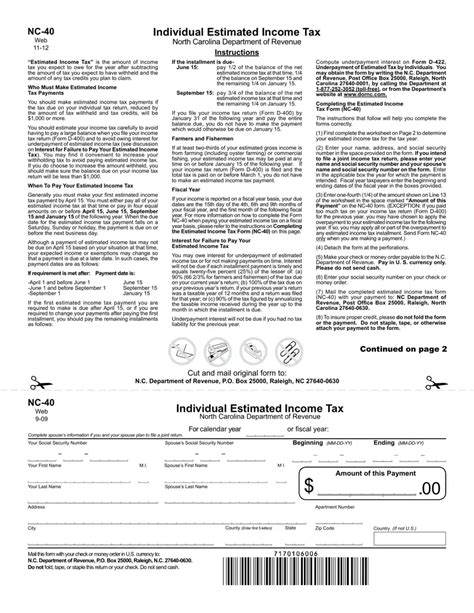

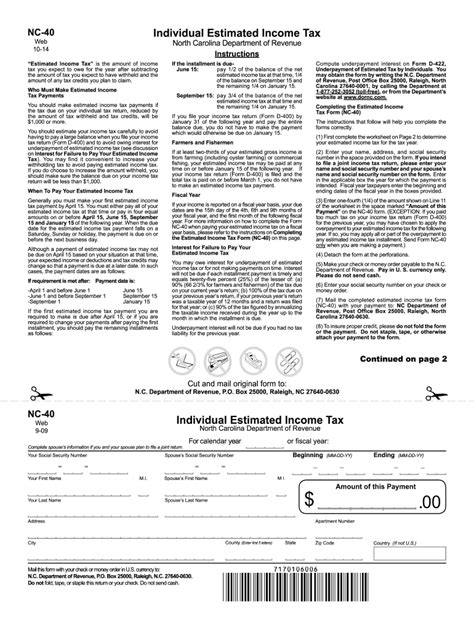

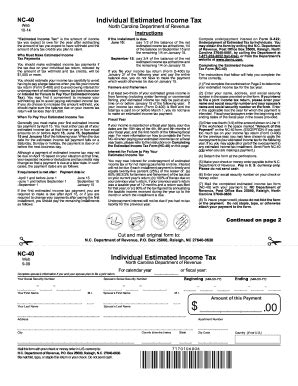

Estimated tax payments in North Carolina are quarterly payments made by individuals and businesses to cover their anticipated income tax, self-employment tax, and other taxes. These payments are typically due on the 15th of April, June, September, and January, aligning with the federal estimated tax payment schedule. The primary purpose of this system is to prevent taxpayers from facing large tax bills at the end of the year and to ensure a more consistent cash flow for the state government.

The estimated tax payment system is based on the taxpayer's expected adjusted gross income, taxable income, taxes, credits, and deductions for the year. Taxpayers must calculate their estimated tax liability for the year and make payments accordingly. The North Carolina Department of Revenue provides a detailed guide to help taxpayers estimate their tax liability and make accurate payments.

Who Needs to Make Estimated Tax Payments in NC

Individuals and businesses who meet certain criteria are required to make estimated tax payments in North Carolina. These include:

- Individuals whose expected tax liability for the year, after subtracting their withholding and refundable credits, is $1,000 or more.

- Businesses, including sole proprietorships, partnerships, S corporations, and trusts, with expected tax liabilities of $500 or more.

- Individuals who had a tax liability of $1,000 or more in the previous year but whose withholding and refundable credits for the current year will not cover that amount.

- Individuals who receive income from sources that do not have tax withheld, such as dividends, interest, and alimony.

How to Calculate and Pay NC Estimated Taxes

To calculate your estimated tax payments in North Carolina, you can use the estimated tax worksheet provided by the NC Department of Revenue in their estimated tax payment guide. This worksheet helps you estimate your adjusted gross income, taxable income, taxes, credits, and deductions for the year, and then calculates the quarterly payments you should make.

Once you've determined your estimated tax payments, you can make these payments online through the NC Department of Revenue's eServices portal, by phone using the Pay-By-Phone system, or by mailing a check or money order to the address provided in the instructions. It's important to note that payments must be received by the due date to avoid penalties.

Penalty for Underpayment of Estimated Taxes

If you underestimate your tax liability and underpay your estimated taxes, you may face a penalty from the North Carolina Department of Revenue. The penalty is generally 5% of the amount of tax not paid by the due date of each estimated tax payment period. However, if you make your estimated tax payments based on the prior year’s tax liability and that liability was not less than 100% of the tax for the prior year, you may not be subject to the underpayment penalty.

To avoid penalties, it's recommended to pay at least as much as you paid in estimated tax payments for the previous year, or 90% of your expected tax liability for the current year, whichever is smaller. You can also make use of the Safe Harbor Rule, which provides an alternative method to calculate your estimated tax payments and avoid the underpayment penalty.

Tax Relief Programs in North Carolina

North Carolina offers several tax relief programs to assist taxpayers who may be facing financial hardship or other challenges. These programs aim to provide flexibility and support to individuals and businesses, ensuring they can meet their tax obligations while navigating difficult circumstances.

North Carolina’s Installment Payment Agreements

For taxpayers who are unable to pay their full tax liability in one payment, the North Carolina Department of Revenue offers an Installment Payment Agreement program. This program allows taxpayers to pay their taxes in smaller, more manageable installments over a specified period. To qualify, taxpayers must demonstrate a genuine inability to pay the full amount due and agree to certain terms and conditions, such as timely payment of each installment and the potential for penalties and interest on the unpaid balance.

The North Carolina Department of Revenue provides an online application for taxpayers to request an installment payment agreement. This application requires detailed financial information and a clear explanation of the taxpayer's financial situation. Once approved, taxpayers are provided with a payment schedule and terms, which they must adhere to in order to maintain the agreement.

| Benefits of Installment Payment Agreements |

|---|

| Provides flexibility for taxpayers who cannot pay their full tax liability in one payment. |

| Avoids the need for aggressive tax collection measures, such as levies or liens. |

| Allows taxpayers to maintain compliance with tax laws while managing their financial obligations. |

Offer in Compromise Program

The Offer in Compromise program is another tax relief option offered by the North Carolina Department of Revenue. This program allows taxpayers to settle their tax liabilities for less than the full amount owed, typically when it is in the best interest of the state and the taxpayer. To qualify, taxpayers must demonstrate a genuine inability to pay the full amount due and must have filed all required tax returns.

The Offer in Compromise program is often a last resort for taxpayers who are unable to pay their full tax liability and do not qualify for an Installment Payment Agreement. It requires a thorough evaluation of the taxpayer's financial situation, including their income, expenses, assets, and ability to pay. The Department of Revenue considers each case individually and makes a decision based on the taxpayer's unique circumstances.

Tax Relief Due to Disaster or Emergency

In cases of disaster or emergency, such as hurricanes, floods, or other natural disasters, the North Carolina Department of Revenue may offer tax relief to affected taxpayers. This relief can include extended deadlines for filing tax returns and paying taxes, as well as reduced or waived penalties and interest. The specific relief measures vary depending on the nature and severity of the disaster.

To receive tax relief due to a disaster or emergency, taxpayers should contact the North Carolina Department of Revenue as soon as possible. The Department will provide guidance on the specific relief measures available and the steps needed to take advantage of them. It's important to note that taxpayers must still meet their tax obligations, but the Department of Revenue recognizes that in times of crisis, these obligations may need to be adjusted.

Resources for Taxpayers

The North Carolina Department of Revenue provides a wealth of resources to assist taxpayers in understanding and meeting their tax obligations. These resources include:

- Estimated Tax Payment Guide: A comprehensive guide to help taxpayers understand their estimated tax obligations and calculate their payments.

- Installment Payment Agreement Application: An online application for taxpayers to request an installment payment agreement.

- Offer in Compromise Program Information: Details about the program and how to apply, including eligibility requirements and the application process.

- Disaster Relief Information: Up-to-date information on tax relief measures available for taxpayers affected by a disaster or emergency.

- Contact Information: Various ways to contact the Department of Revenue for assistance, including phone numbers, email addresses, and physical addresses.

Conclusion

Understanding and complying with North Carolina’s estimated tax payment system is crucial for individuals and businesses to maintain their financial obligations and avoid penalties. The system ensures a steady cash flow for the state government and helps taxpayers manage their tax liabilities throughout the year. Additionally, the tax relief programs and resources provided by the North Carolina Department of Revenue offer valuable support to taxpayers facing various financial challenges, ensuring that they can navigate their tax obligations in a fair and flexible manner.

Frequently Asked Questions

How do I know if I need to make estimated tax payments in North Carolina?

+

You need to make estimated tax payments in North Carolina if your expected tax liability for the year, after subtracting your withholding and refundable credits, is 1,000 or more for individuals or 500 or more for businesses. You may also need to make estimated tax payments if your previous year’s tax liability was $1,000 or more and your withholding and refundable credits for the current year will not cover that amount.

What happens if I don’t make estimated tax payments or underpay them?

+

If you do not make estimated tax payments or underpay them, you may face a penalty from the North Carolina Department of Revenue. The penalty is generally 5% of the amount of tax not paid by the due date of each estimated tax payment period. However, there are safe harbor rules and other provisions that may apply to certain taxpayers.

Can I make estimated tax payments online in North Carolina?

+

Yes, you can make estimated tax payments online through the NC Department of Revenue’s eServices portal. You can also make payments by phone using the Pay-By-Phone system or by mailing a check or money order to the address provided in the instructions.

What are the due dates for estimated tax payments in North Carolina?

+

Estimated tax payments in North Carolina are typically due on the 15th of April, June, September, and January, aligning with the federal estimated tax payment schedule. These dates may be subject to change in certain circumstances, so it’s advisable to check the official North Carolina Department of Revenue website for the most up-to-date information.

How do I calculate my estimated tax payments in North Carolina?

+

To calculate your estimated tax payments in North Carolina, you can use the estimated tax worksheet provided by the NC Department of Revenue. This worksheet helps you estimate your adjusted gross income, taxable income, taxes, credits, and deductions for the year, and then calculates the quarterly payments you should make.